Income Tax Number Malaysia Example

Please quote your application number problems complaints comments.

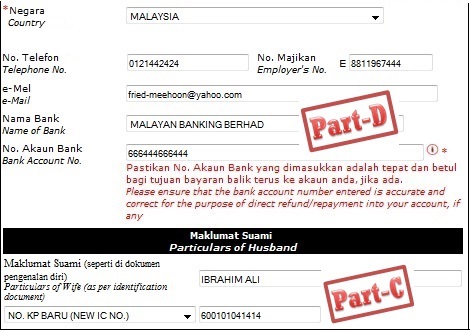

Income tax number malaysia example. Your income tax number consists of a tax reference type of 1 or 2 letter code followed by a 10 or 11 digit tax reference number. When will you get the income tax reference no. Sg 12345678901 tax reference types. The wives will have a different file number from the husbands plus code 0 at the end of their new file number.

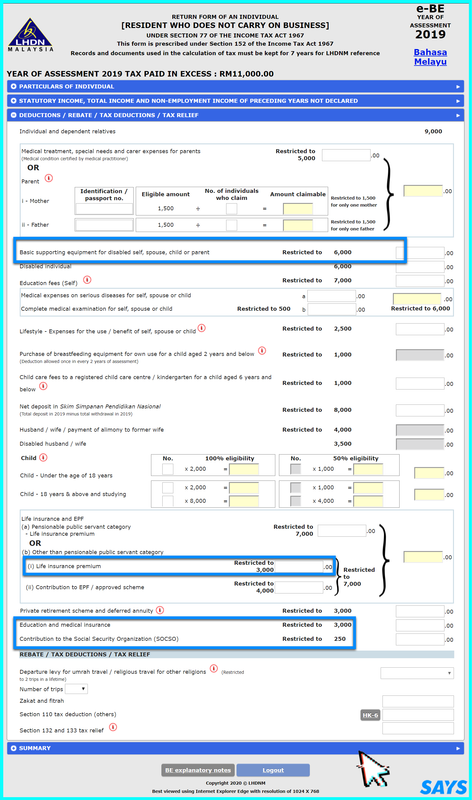

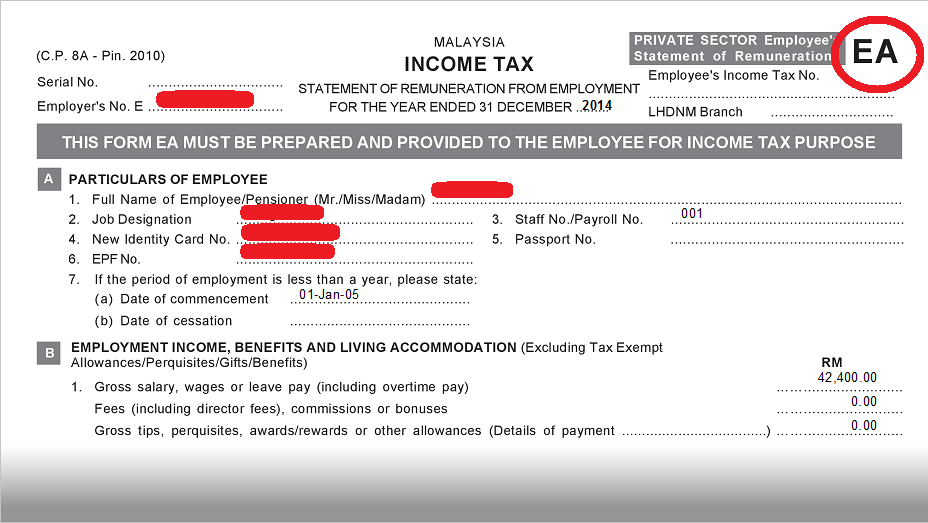

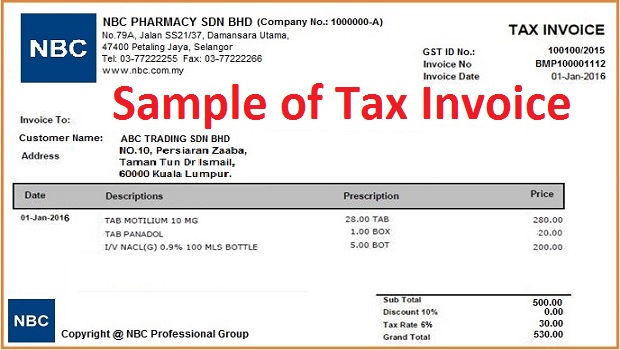

A first timer s easy guide to filing taxes 2019. All tax returns must be completed and returned before april 30 of the following year. The government is looking to introduce the use of tax identification numbers for those aged 18 and above by 2021. Check your application status.

Chargeable income gross income tax deductible expenses tax exemptions tax reliefs applying this formula on an actual figure for an example you will get this equation. The most common tax reference types are sg og d and c. Rm55 000 gross income rm9 000 taxable deductible expenses rm2 000 tax exemption rm4 400 tax relief rm39 600 chargeable income. For employees who have an income tax number fill in the number in this item.

Type of file number maximum 2 alphabets characters space income tax number maximum 10 numeric characters example. Lembaga hasil dalam negeri malaysia classifies each tax number by tax type. Contact 03 8913 3800. Example for non individual file number.

Experts say the government s plan to introduce tax. Click link to e daftar. Kad pengenalan baru tanpa simbol seperti format berikut. Register at the nearest irbm inland revenue board of malaysia lhdn lembaga hasil dalam negeri branch or register online at hasil gov my.

To file income tax an expatriate needs to obtain an income tax number from the inland revenue board of malaysia irb. The inland revenue board of malaysia malay. In malaysia the tax year runs in accordance with the calendar year beginning on january 1 and ending on december 31. Within 3 working days after completing an online application.

For example let s say your annual taxable income is rm48 000. Semakan nombor cukai pendapatan individu lembaga hasil dalam negeri malaysia. Based on this amount the income tax to pay the government is rm1 640 at a rate of 8. Here are the income tax rates for personal income tax in malaysia for ya 2019.

Tf 1023456709 or c 2584563202. Bernama pic petaling jaya. Employer can attach form cp22 or form in lieu of cp39 together with form cp39 when make mtd payment. If you are newly taxable you must register an income tax reference number.

Please used the given application number to check your application status.