Income Tax Brackets Malaysia

His ba is conducted twice every five years and dosm is currently conducting the 2019 survey nationwide.

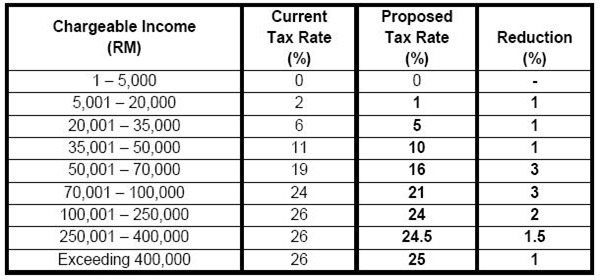

Income tax brackets malaysia. How to pay income. Personal income tax rates. Based on this amount the income tax to pay the government is rm1 640 at a rate of 8. The personal income tax rates for 2018 2019 have been restructured and are different from previous year s rates.

What is income tax return. On the first 5 000 next 15 000. Non resident individuals pay tax at a flat rate of 30 with effect from ya 2020. Malaysia income tax e filing guide.

For example let s say your annual taxable income is rm48 000. Tax rates for year of assessment 2019 tax filed in 2020 chapter 6. 1 2018 retained seven tax brackets but lowered some of the tax rates and raised some of the income thresholds for those rates. Malaysia taxpayer s responsibilities.

What is tax rebate. Top 20 t20 middle 40 m40 and bottom 40 b40. The tax cuts and jobs act that went into effect on jan. How does monthly tax deduction mtd pcb work in malaysia.

With effect from ya 2020 a non resident individual is taxed at a flat rate of 30 on total taxable income. These proposals will not become law until their enactment and may be amended in the course of their passage through. Below are the individual personal income tax rates for the year of assessment 2019 provided by the the inland revenue board irb lembaga hasil dalam negeri lhdn malaysia. Malaysians are categorised into three different income groups.

Home income tax rates. Green technology educational services healthcare. What is income tax return. How to pay income tax in malaysia.

On the first 5 000. Income tax rates 2020 malaysia. This booklet also incorporates in coloured italics the 2020 malaysian budget proposals announced on 11 october 2019 and the finance bill 2019. This is based on the department of statistics dosm household income and basic amenities his ba survey of 2016.

Malaysia personal income tax rate a graduated scale of rates of tax is applied to chargeable income of resident individual taxpayers starting from 0 on the first rm5 000 to a maximum of 30 on chargeable income exceeding rm2 000 000 with effect from ya 2020. Inland revenue board of malaysia shall not be liable for any loss or damage caused by the usage of any information obtained from this website. What is tax rebate. How does monthly tax deduction mtd pcb work in malaysia.

This publication is a quick reference guide outlining malaysian tax information which is based on taxation laws and current practices. Here are the income tax rates for personal income tax in malaysia for ya 2019. However if you claimed rm13 500 in tax deductions and tax reliefs your chargeable income would reduce to rm34 500. Tax relief for year of assessment 2019 tax filed in 2020 chapter 5.

Malaysia income tax e filing guide. Calculations rm rate tax rm 0 5 000.