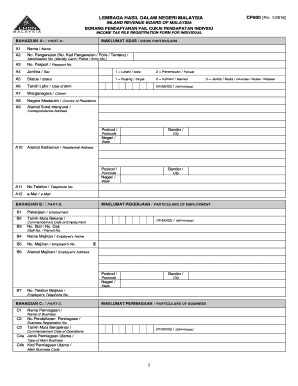

Income Tax Borang B

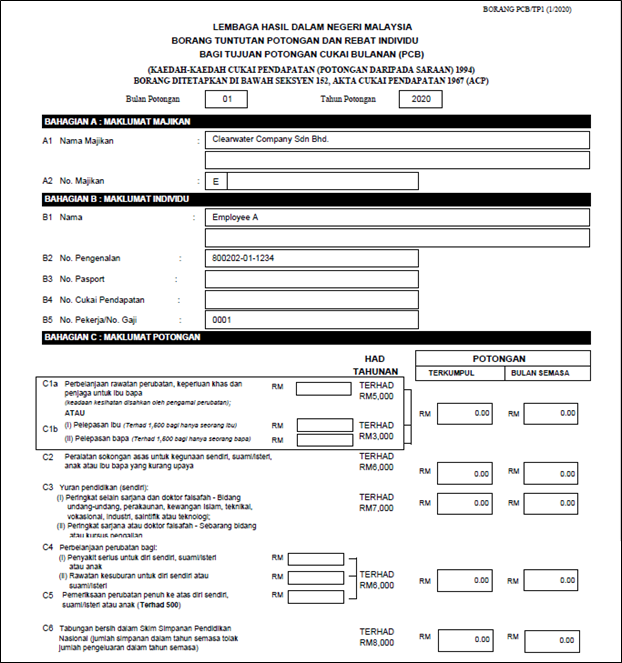

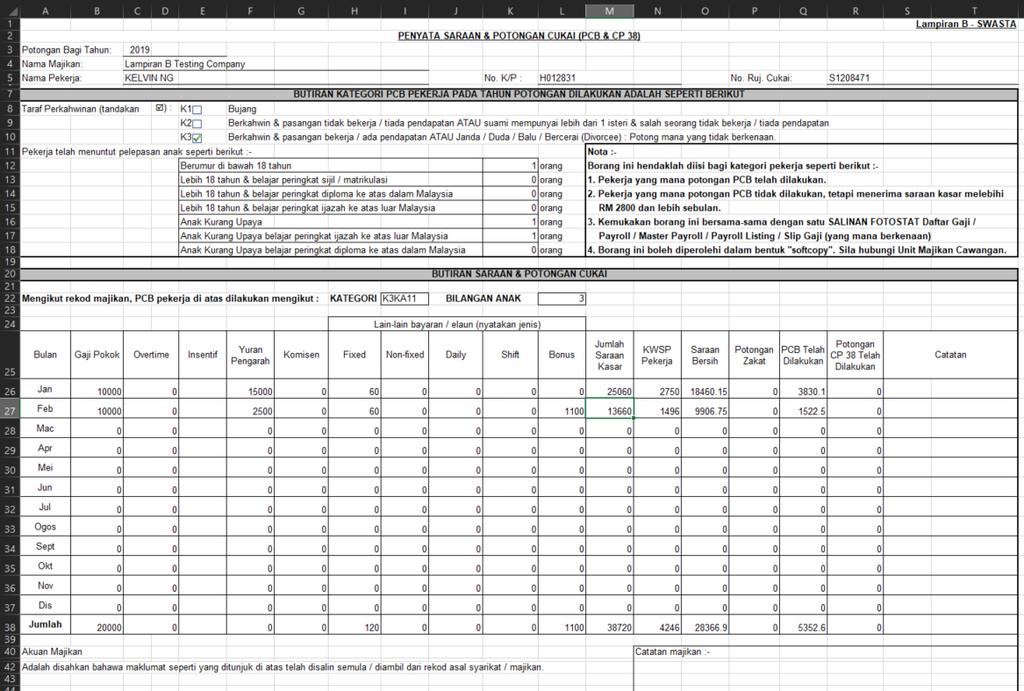

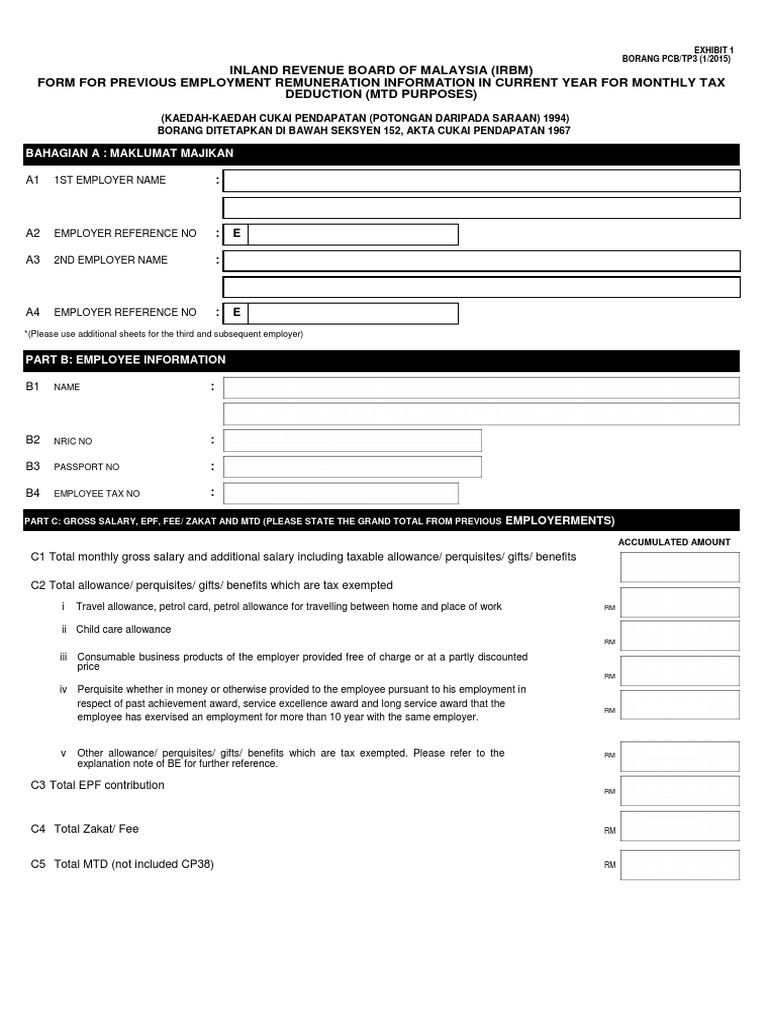

Refer to the working sheet hk 2 3 and appendix b2 as well as public ruling no.

Income tax borang b. So how to file income tax. Apa beza borang be dan borang b. 00 b2 statutory income from rents b2.

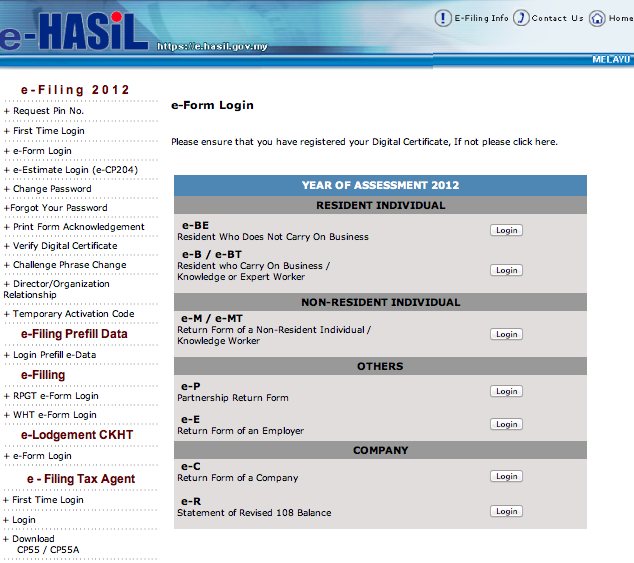

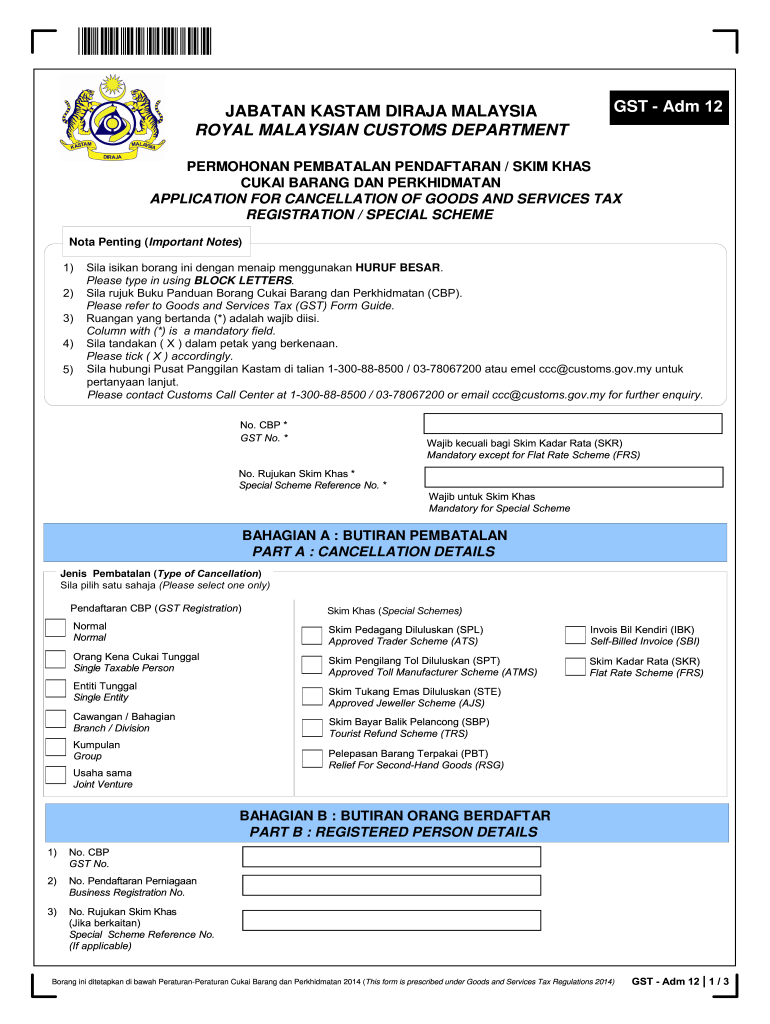

Form b income assessed under section 4 a 4 f of the ita 1967 and be completed by individual residents who have business income sole proprietorship or partnership. Can i declare my business income if i receive a form be. Income tax deadline extended until 30 june 2020 in lieu with the movement control order period from 18 to 31 march 2020 due to covid 19 pandemic irb has extended the income tax deadline for this year. 00 b3 statutory income from interest discounts royalties premiums pensions annuities other periodical payments and other gains or profits b3.

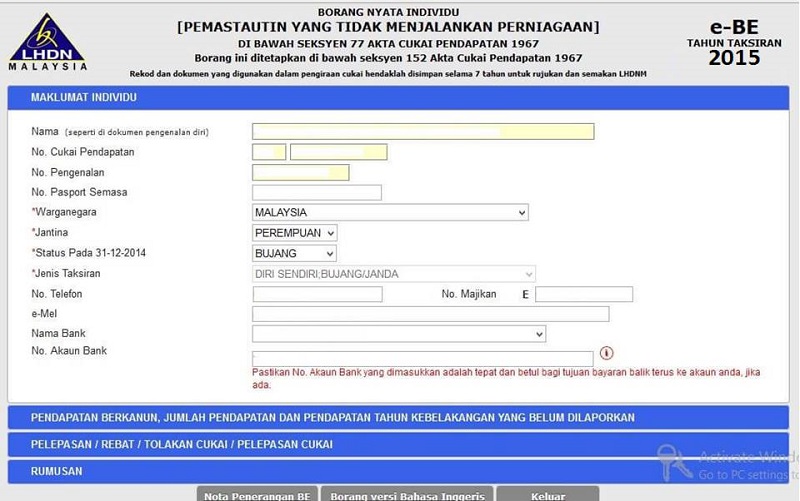

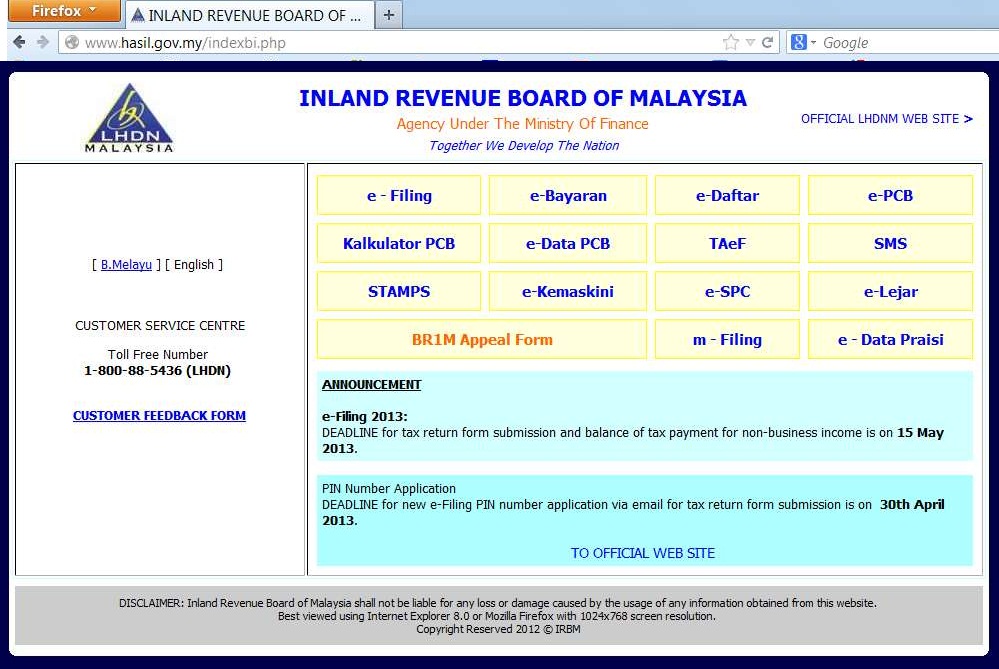

Income other than business. Taxpayers who use the conventional non e filing method of filing taxes have to wait up to 90 days to be refunded. Borang be untuk. Cukai pendapatan kesejahteraan cukai anda bermula di sini.

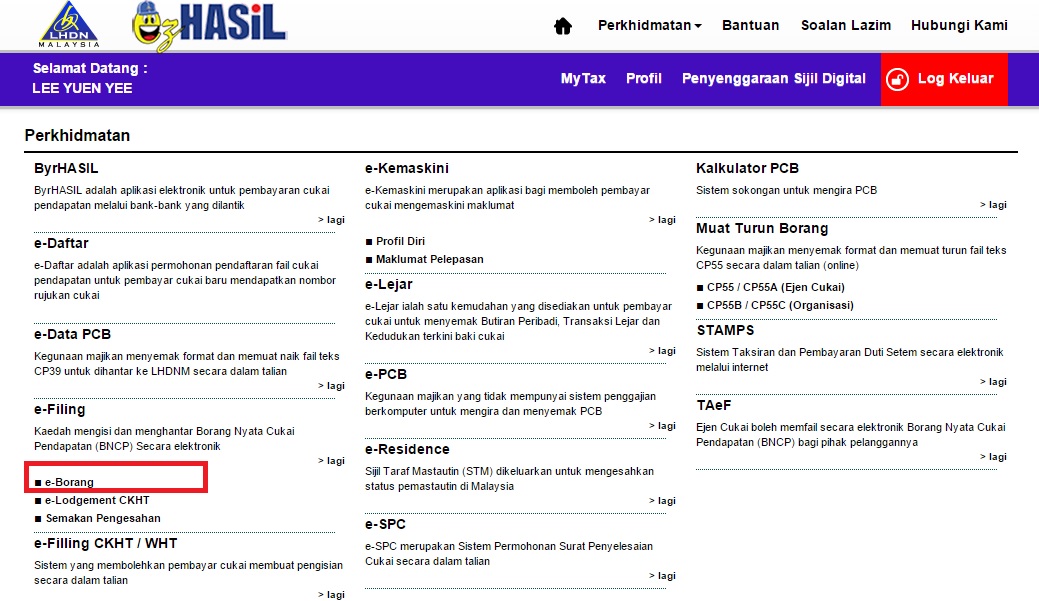

Sebenarnya borang be b 2019 akan dimuat naik pada 1 mac. Business income should be declared in the form b. For the be form resident individuals who do not carry on business the deadline for filing income tax in malaysia is 30 april 2020 for manual filing and 15 may 2020 via e filing. Program memfail borang nyata bn bagi tahun 2020 pindaan 1 2020 program memfail borang nyata bn bagi tahun 2020 pindaan 2 2020.

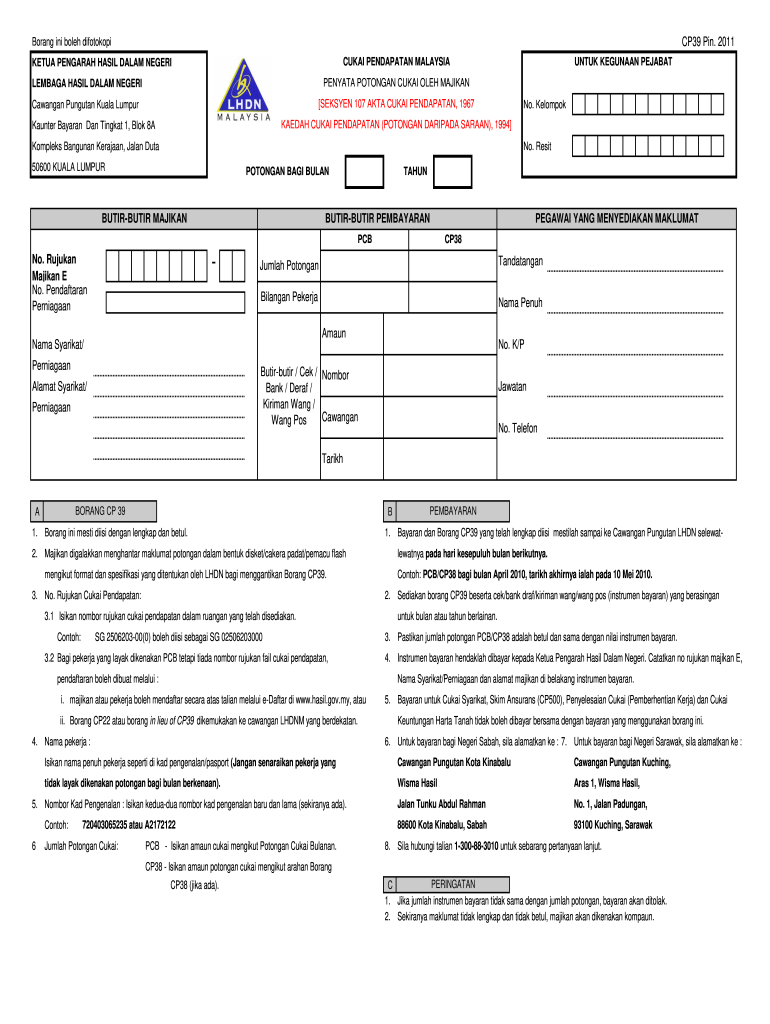

Anda nak tengok borang be b 2019. If you ve paid income tax in excess via monthly tax deductions the excess amount will be reimbursed to you via the bank account details you provided. Program memfail borang nyata bn bagi tahun 2020. The income tax of an employee borne by his employer is tax allowance which is chargeable to tax under the provision paragraph 13 1 a of ita 1967.