Income Tax Calculator 2019 Federal

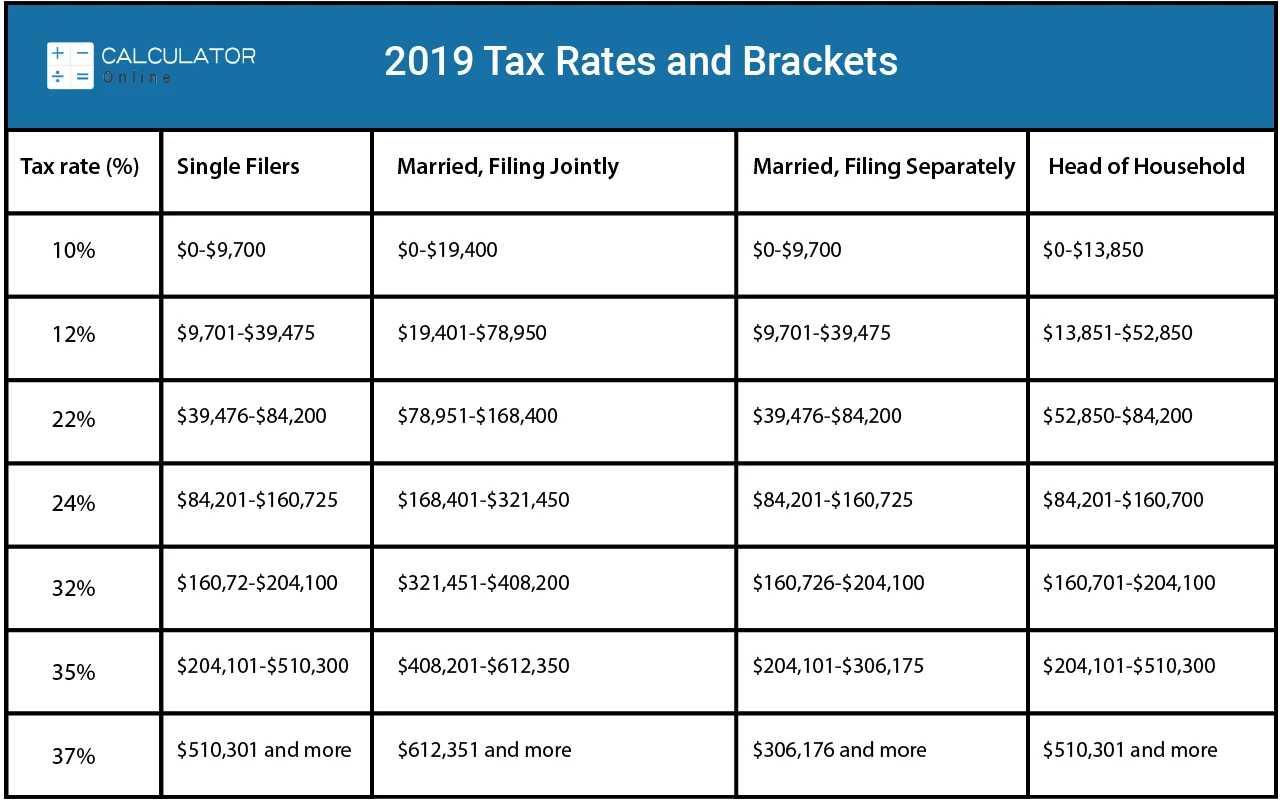

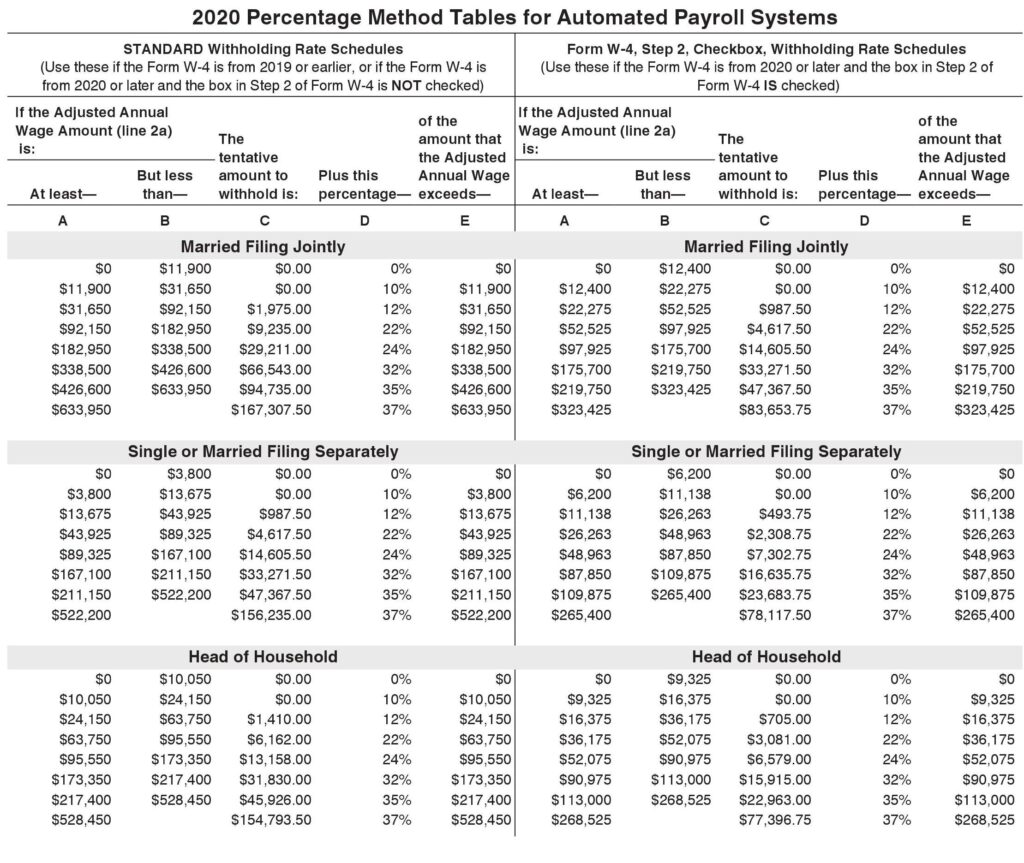

And is based on the tax brackets of 2019 and 2020.

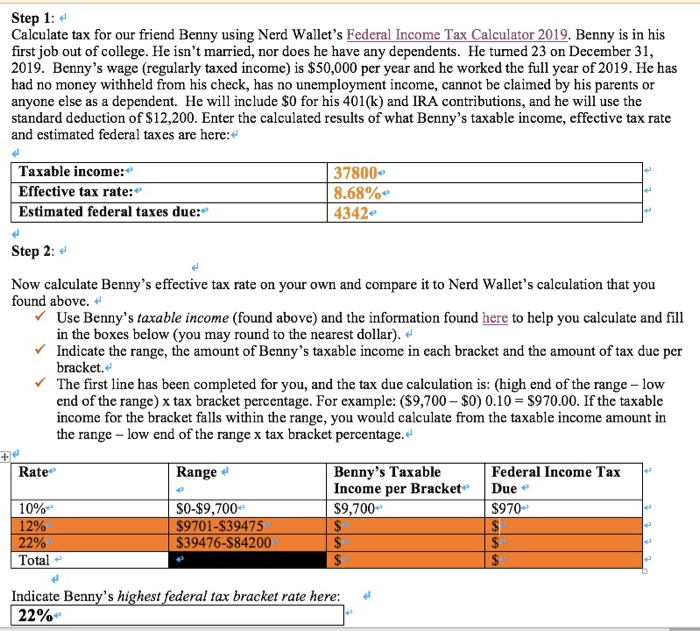

Income tax calculator 2019 federal. At the same time you may prefer to have less tax withheld up front so you receive more in your paychecks and get a smaller refund at tax time. Answer a few simple questions about your life income and expenses and our free tax refund estimator will give you an idea of how much you ll get as a refund or owe the irs when you file in 2020. Taxes are unavoidable and without planning the annual tax liability can be very uncertain. Click here for a 2020 federal tax refund estimator.

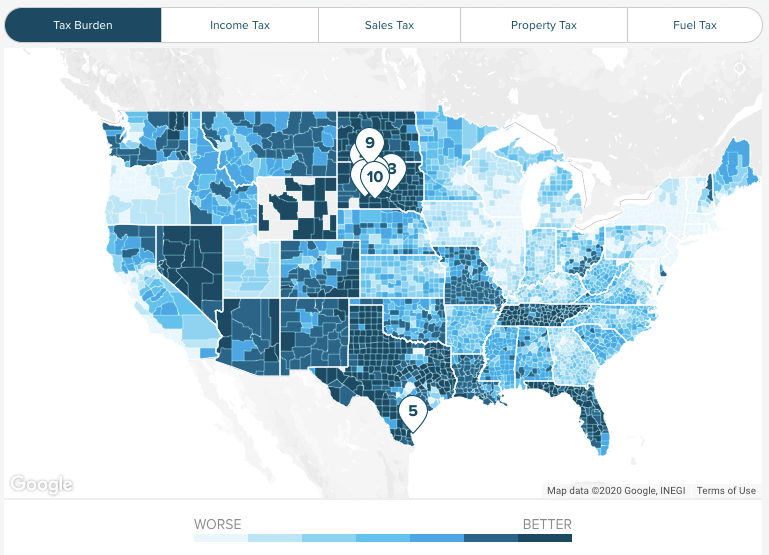

Use this free tax return calculator to estimate how much you ll owe in federal taxes on your 2019 return using your income deductions and credits in just a few steps. Federal income tax calculator 2020 federal income tax calculator. Also we separately calculate the federal income taxes you will owe in the 2019 2020 filing season based on the trump tax plan. Use the following calculator to help determine your estimated tax liability along with your average and marginal tax rates.

Your 2019 federal income tax liability would be 900 according to irs tax tables. When should you use the estimator if you changed your withholding for 2019 the irs reminds you to be sure to recheck your withholding at the start of 2020. This calculator computes federal income taxes state income taxes social security taxes medicare taxes self employment tax capital gains tax and the net investment tax. The income tax calculator estimates the refund or potential owed amount on a federal tax return.

Our income tax calculator calculates your federal state and local taxes based on several key inputs. The 2020 tax values can be used for 1040 es estimation planning ahead or comparison. Estimate your 2019 tax refund. The irs offers an online tool to help you determine if you may or may not need to file.

The provided information does not constitute financial tax or legal advice. Your household income location filing status and number of personal exemptions. Get started filing status. It is mainly intended for residents of the u s.

Your estimated federal refund 0.