Income Tax Malaysia 2016

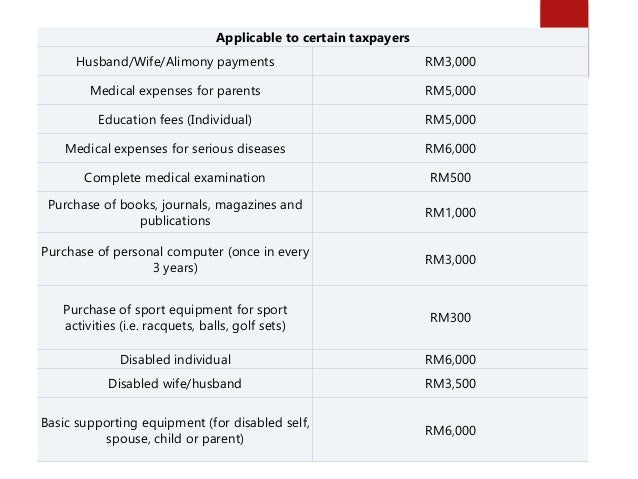

Tax relief and deductions.

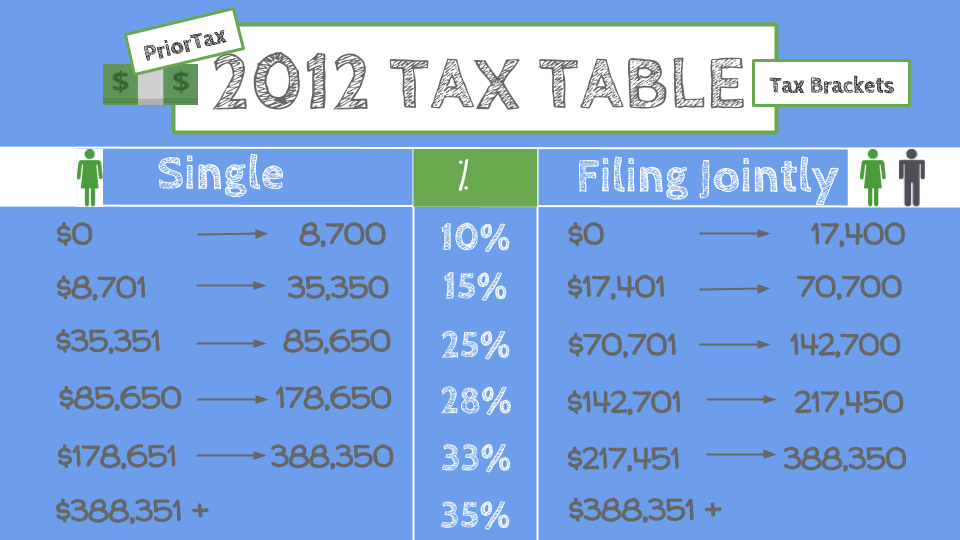

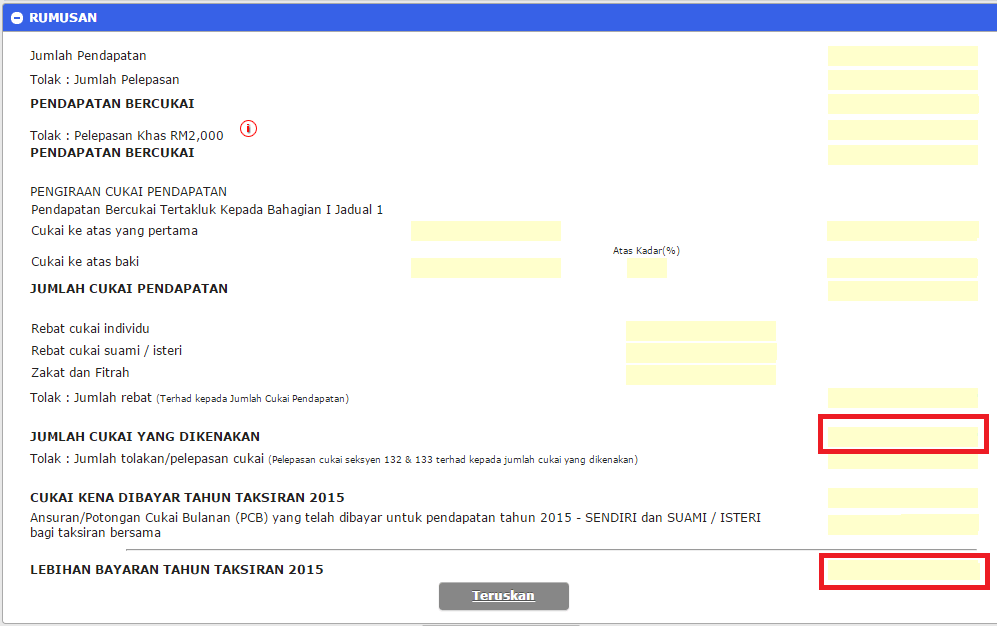

Income tax malaysia 2016. However there are some exceptions to the matter. Tax rm 0 5 000. Calculations rm rate. However if you claimed rm13 500 in tax deductions and tax reliefs your chargeable income would reduce to rm34 500.

12 malaysia taxation and investment 2016 updated november 2016 10 penalty. Most malaysians are unaware of the differences between tax exemptions tax reliefs tax rebates and tax deductibles. Underestimation of tax payable also may result in a 10 penalty if the actual tax payable exceeds the estimate by more than 30. Assessment year 2016 2017.

1 for non residents of malaysia people who have been living in the country for less than 182 days per year the tax rate has been set at 25 on all the income that has been earned in malaysia regardless of your citizenship or nationality. Companies are taxed on their earnings with the exception of resident companies in the banking insurance air transport and shipping sectors which are assessed on a world income scope. The applicable tax rates are the following. Based on this amount the income tax to pay the government is rm1 640 at a rate of 8.

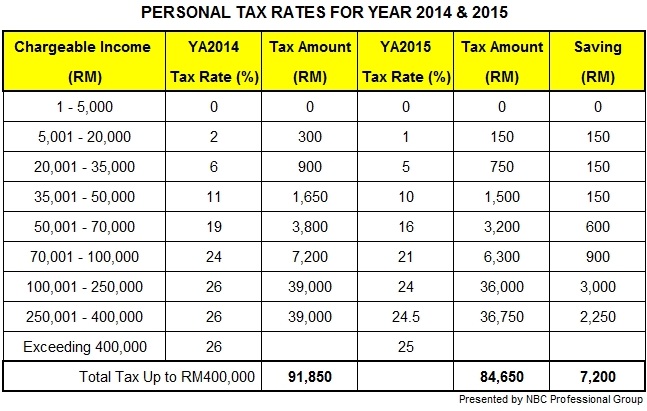

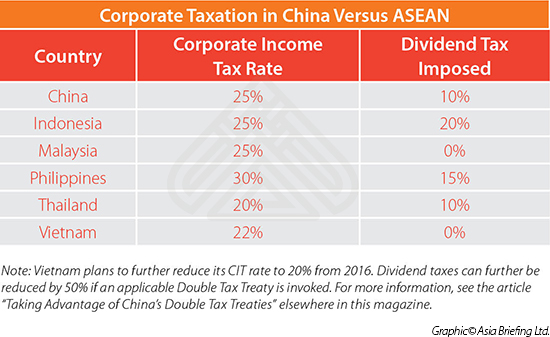

Income tax rates resident companies are taxed at the rate of 25 reduced to 24 w e f ya 2016 while those with paid up capital of rm2 5 million or less are taxed at the following scale rates. With imoney s the definitive guide to personal income tax in malaysia for 2016 you can be worry free this income tax season as you go through their simple and easy to understand guide. Mulai 18 mac 2019 lembaga hasil dalam negeri malaysia lhdnm tidak lagi menerima permohonan untuk sijil taraf orang kena cukai stokc. For expatriates that qualify for tax residency malaysia has a progressive personal income tax system in which the tax rate increases as an individual s income increases starting at 0 percent and capped at 30 percent.

Lanjutan daripada itu pengeluaran stokc juga akan diberhentikan. Reduced corporate tax for resident companies. 16 may 2016 tax treatment on interest income received by a person carrying on a business public ruling no. Kuala lumpur 30 march 2016 preparing and filing your income tax in malaysia can be a challenging and anxiety inducing experience every year for most people.

The standard corporate tax rate in malaysia is 24 from 2016 reduced from 25 in 2015. For example let s say your annual taxable income is rm48 000.