How To Invest In Unit Trust

Before deciding to invest in unit investment trust fund evaluate your goals.

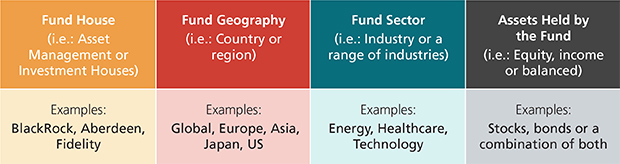

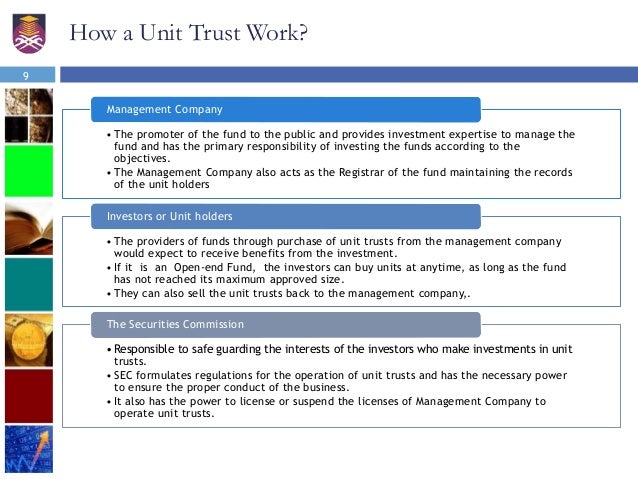

How to invest in unit trust. Not all unit trusts are created equal each fund is complemented with different assets. Charges erode returns so the less you pay to access an investment the more cash will be left to grow for you. All the relevant risk factors are set out in the relevant prospectus for the fund. Investors are advised to read carefully and understand the contents of prospectus and consider the general risk factors associated with investing in unit trusts in addition to other specific risks uniquely associated with the fund.

Ensure that the fund s investment strategies are in line with your own objectives. Their initial decisions are crucial to the success of the unit investment trust. Unit trust prices may fluctuate. However before you go to the nearest bank you need to think this decision through.

A charge of 1 or more may not sound like much but these tiny percentages add up to a huge amount in time. To be clear unit trust is just an investment structure it is not an investment strategy itself. The best way to invest in unit trusts is directly through a low cost unit trust provider. So it s best you understand the common types of unit trust funds available and how they complement your financial goals to know which to put your money in.

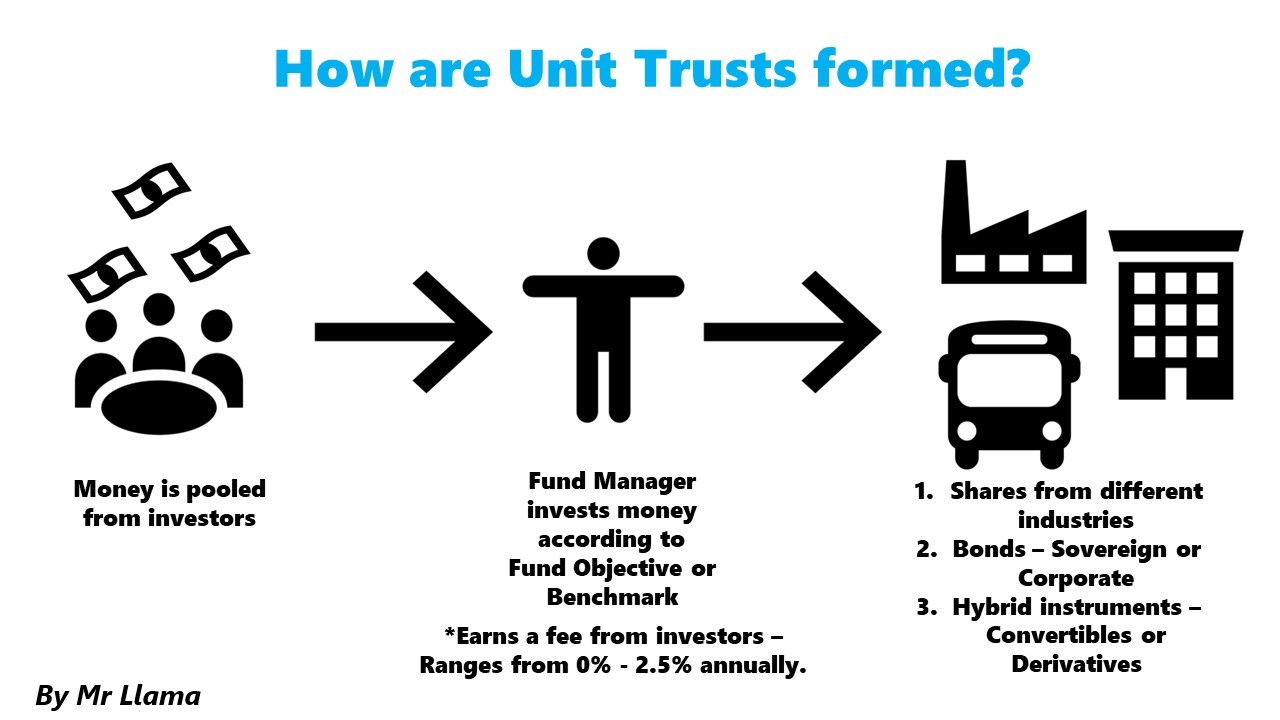

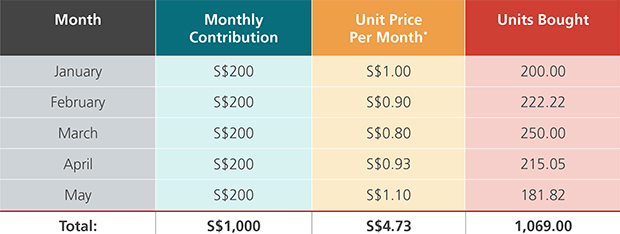

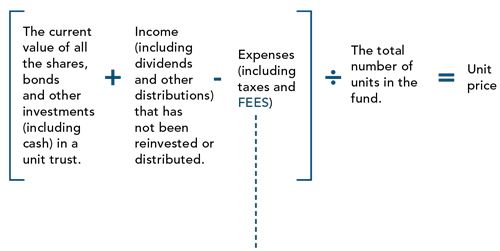

The fund is divided into units of equal value. The minimum investment in a unit trust is usually a lump sum of 250 500 or 1 000. Therefore know and trust the principals who are purchasing the funds on your behalf. Unit investment trust fund is just one of the many ways you can invest your hard earned money and make passive income.

Ensure that the fund you are investing in fits in with your portfolio s over risk return profile and does not. Ways to invest in unit trusts. Here are some of the factors you should consider. There will be an online sales charge of 0 82 per transaction on any investment amount.

Find out how much you should invest now to reach your investment goal here. Cpf ordinary account or special account savings. Three ways of funding your unit trusts investment. When you invest you will buy a number of units at a set price.

Unit trust etf or reits are all under the trust structure. When investing in a unit trust there are strict rules limiting the sale of assets due to declining investment possibilities and in the case of bonds early redemption. There are also different types of unit trust funds you can invest in.