Income Tax Refund Malaysia

Calculations rm rate tax rm 0 5 000.

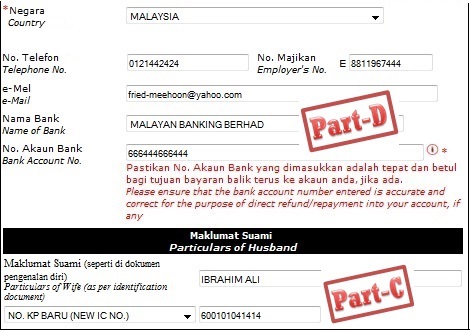

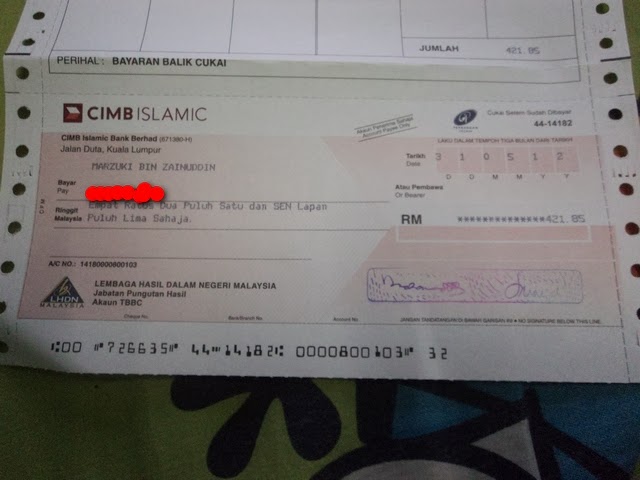

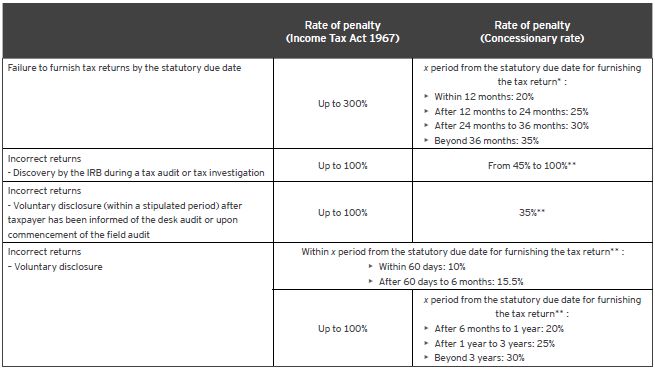

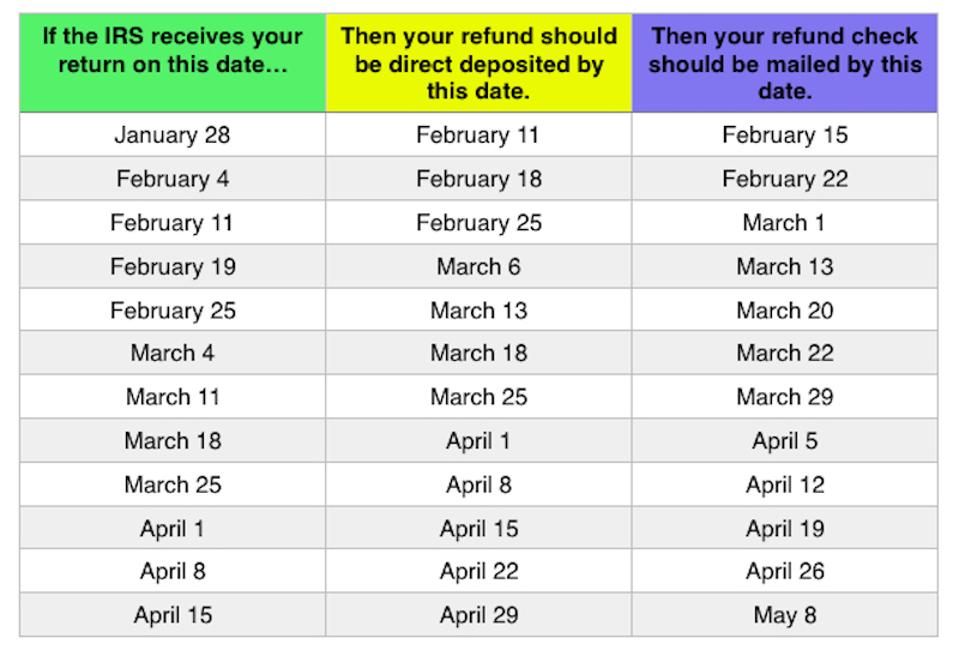

Income tax refund malaysia. If you do find yourself overpaying your taxes when you file it don t worry you can get back the additional taxes you ve paid in the form of tax return or tax refund. Lanjutan daripada itu pengeluaran stokc juga akan diberhentikan. Tax rebate for. Tax payment has been made mora than the tax imposed reduce assesssment has been approved which resulted a tax credit in the ladger whcih can be refunded or tax deducted from dividend at source is greater that tax payable in a year of assessment.

After feb 2017 my status will be resident and i can get tax back i mean refund my tax from the tax that i paid rm1900 first 6 months is it correct. Zakat and fitrah can be claimed as a tax rebate for the actual amount expended up until the total tax amount. A tax refund exist where. This would bring your chargeable income down to rm35 000 and the amount of tax you have to pay is rm600.

Tax rebate for self. So if your amount taxed after taking all your claimed tax reliefs into account is rm402 you can claim a tax rebate for zakat up to the actual amount expended or the maximum of tax charged. Tax rebates are not deducted from your chargeable income like a tax relief is but from your final tax amount at the end. Tax return is the amount you have overpaid your taxes on and this commonly occurs when the taxpayer is subjected to mtd and the monthly deduction does not include additional tax reliefs such as purchase of approved items like books or personal computer or unplanned expenses like medical expenses for serious illness.

If i can get my tax back how much can i refund. On the first 2 500. For example say your employment income is rm50 000 a year and you have claimed rm15 000 in tax reliefs. Currently my salary is 7200 i have paid income tax since aug 2016 until now around rm1900 month.

Lembaga hasil dalam negeri malaysia inland revenue board of malaysia. Mulai 18 mac 2019 lembaga hasil dalam negeri malaysia lhdnm tidak lagi menerima permohonan untuk sijil taraf orang kena cukai stokc. If your chargeable income after tax reliefs and deductions does not exceed rm35 000 you will be granted a rebate of rm400 from your tax charged. On the first 5 000 next 15 000.

A tax rebate directly reduced your amount of tax charged and there are currently four types of tax rebates for income tax malaysia ya 2019.