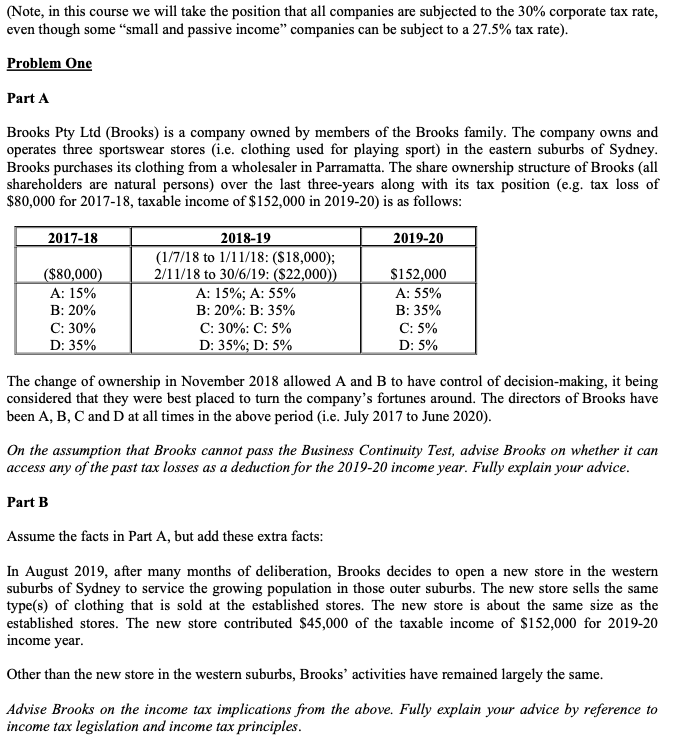

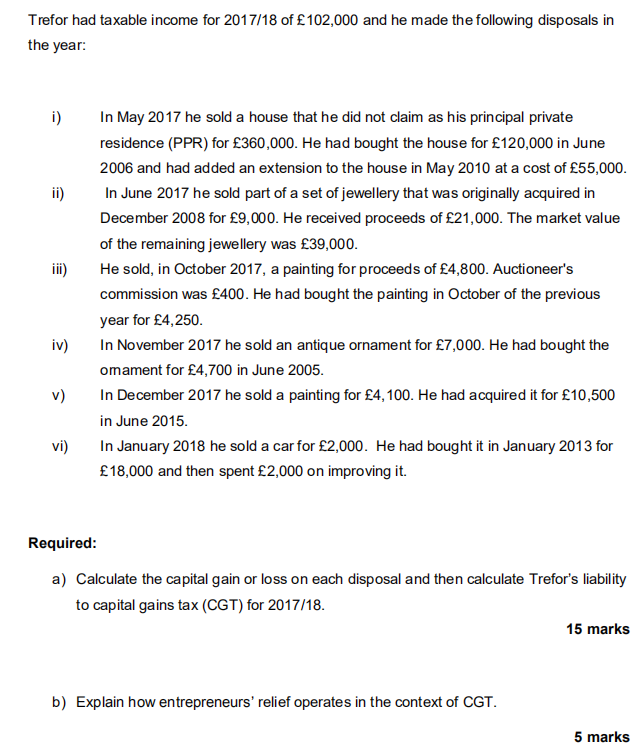

Income Tax Rate 2017 18

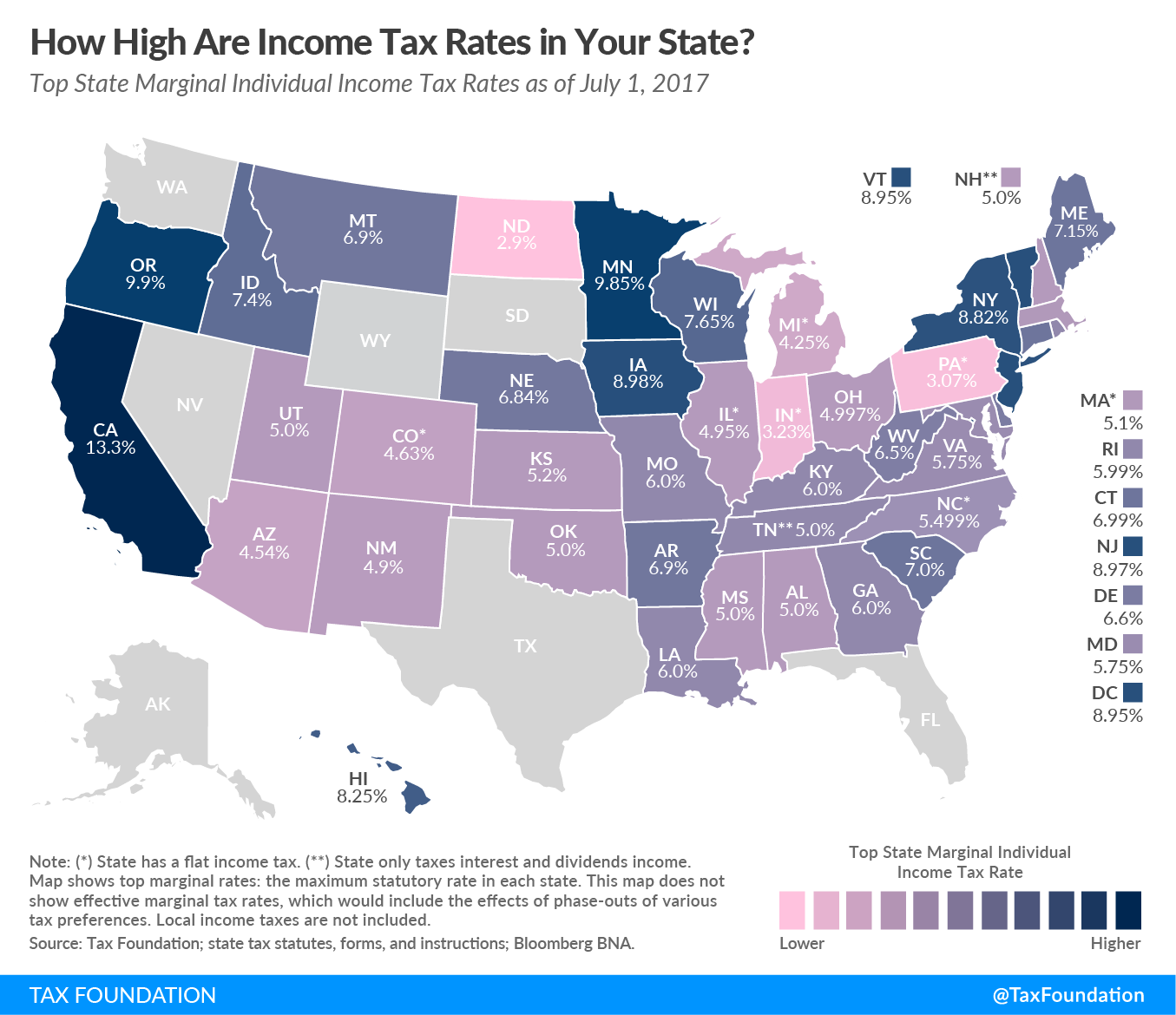

For 2017 18 the scottish parliament set the rates of income tax and the limits at which these rates apply for scottish residents.

Income tax rate 2017 18. Click here to save tax with hdfc life s various online insurance products. 5 00 000 5 5 rs. The starting rate band is only applicable to savings income. Standard rate on first 1 000 of income which would otherwise be taxable at the special rates for trustees.

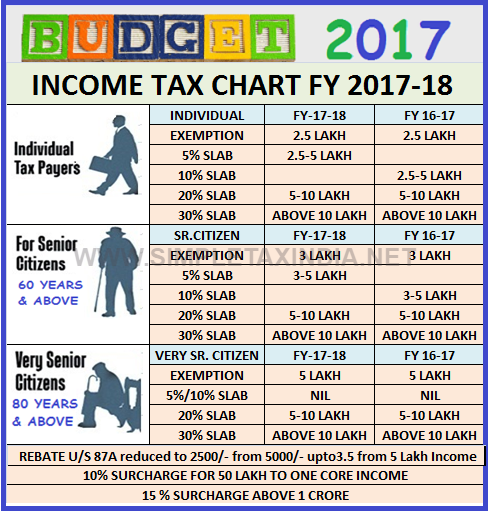

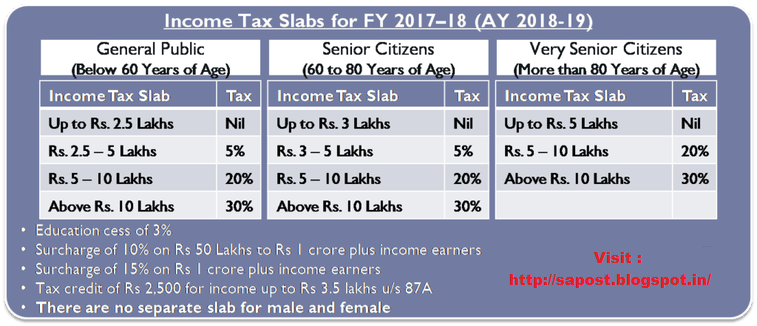

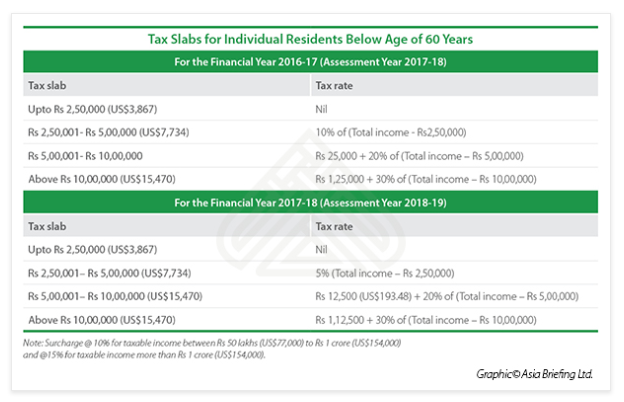

Single taxpayers 2018 tax rates standard deduction 12 000 2017 tax rates standard deduction 6 350 10 0 to 9 525 10 0 to 9 325 12 9 525 to 38 700 15 9 325 to 37 950 22 38 700 to 82 500 25 37 950 to 91 900 24 82 500 to 157 500 28 91 900 to 191 650 32 157 500 to 200 000 33 191 650 to continue reading 2017 vs. Up to 20 depends on the. 1 1 individual resident or non resident who is of the age of less than 60 years on the last day of the relevant previous year. Tax on this income.

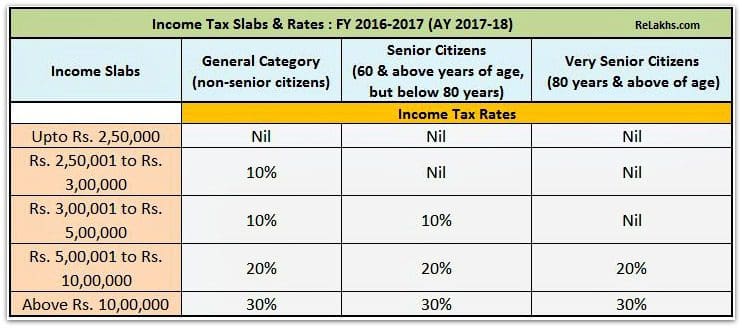

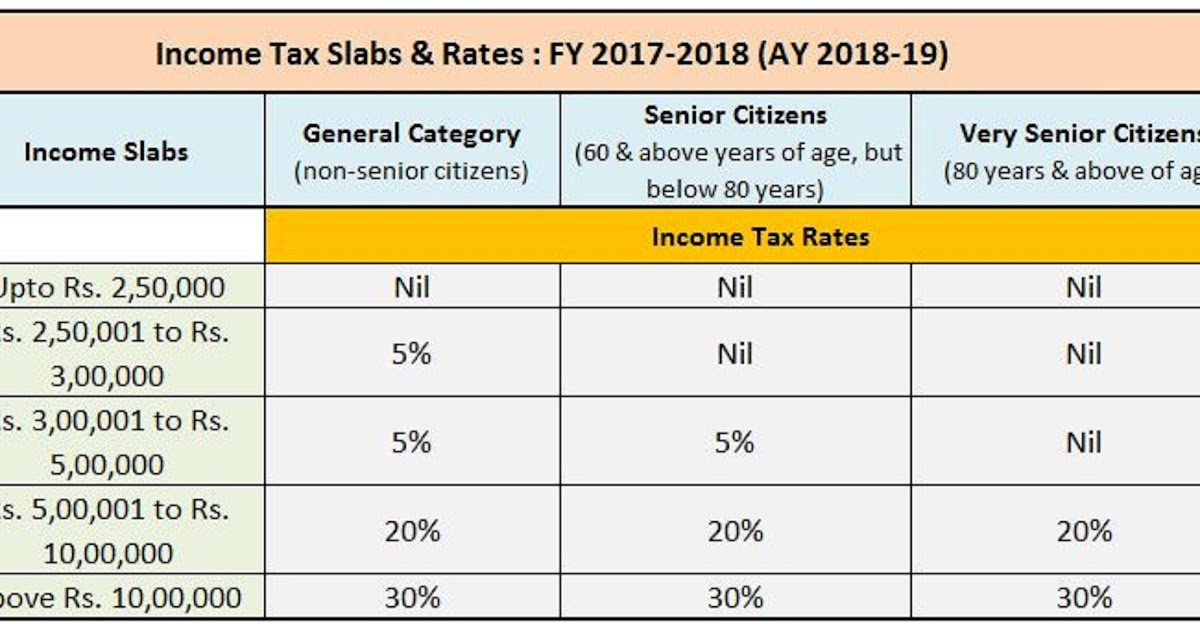

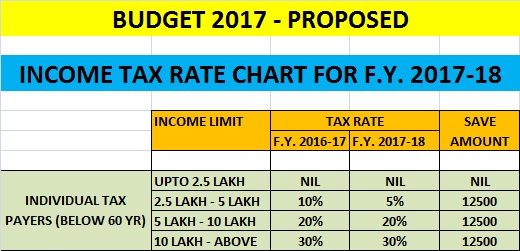

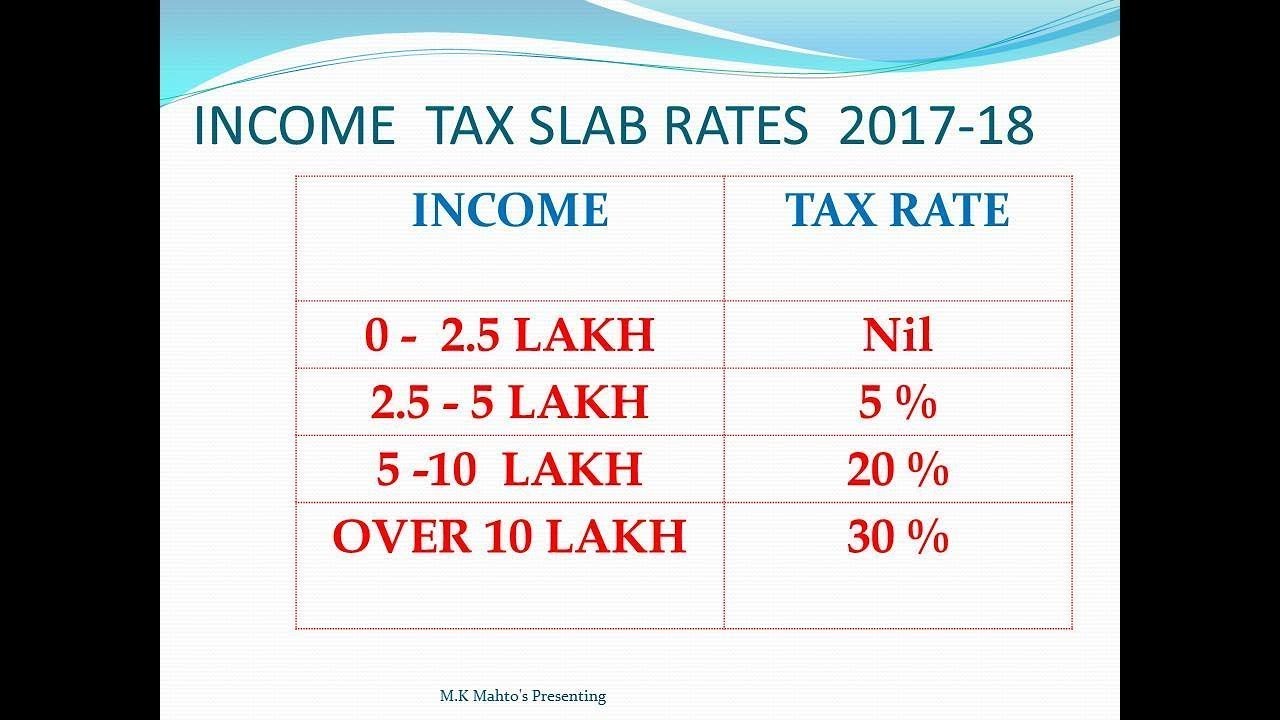

Up to 20 depends on the type of income. The new income tax slab for the f y 2017 18 for first category upto rs. Income tax rates income tax slab for ay 2017 18 1 income tax slab for individual. 2018 federal income tax brackets.

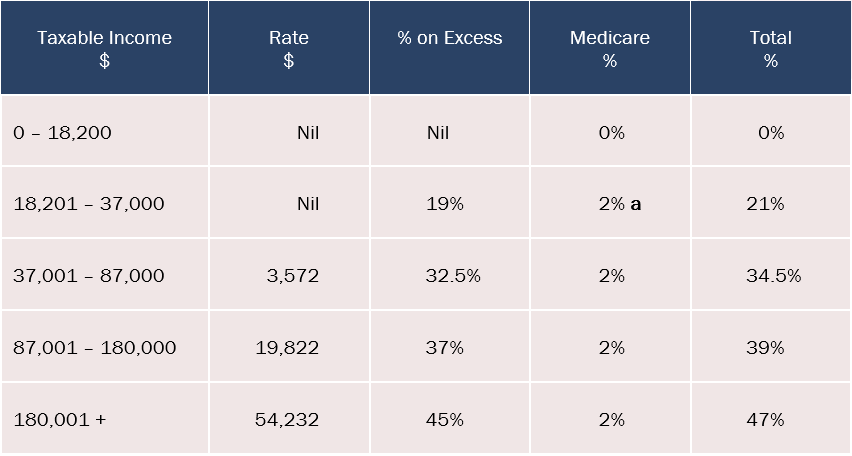

Surcharge is levied on the amount of income tax at following rates if total income of. 19c for each 1 over 18 200. Check the latest guidance on tax reliefs and brackets here with quickrebates. All of the necessary uk income tax and national insurance rates and allowances for the income tax year 2017 18 fiscal year ending 5th april 2018.

10 00 000 20 20 above rs. The 0 rate is not available if the taxable amount of non savings income exceeds the starting rate band. You could be paying too much tax or nic. Band taxable income tax rate.

Hmrc change and update the tax brackets every year. 10 00 000 30 30 surcharge. 2 50 000 rs. 20 797 plus 37c for each 1 over 90 000.

3 572 plus 32 5c for each 1 over 37 000.

/cdn.vox-cdn.com/uploads/chorus_asset/file/9892289/tpc3.png)