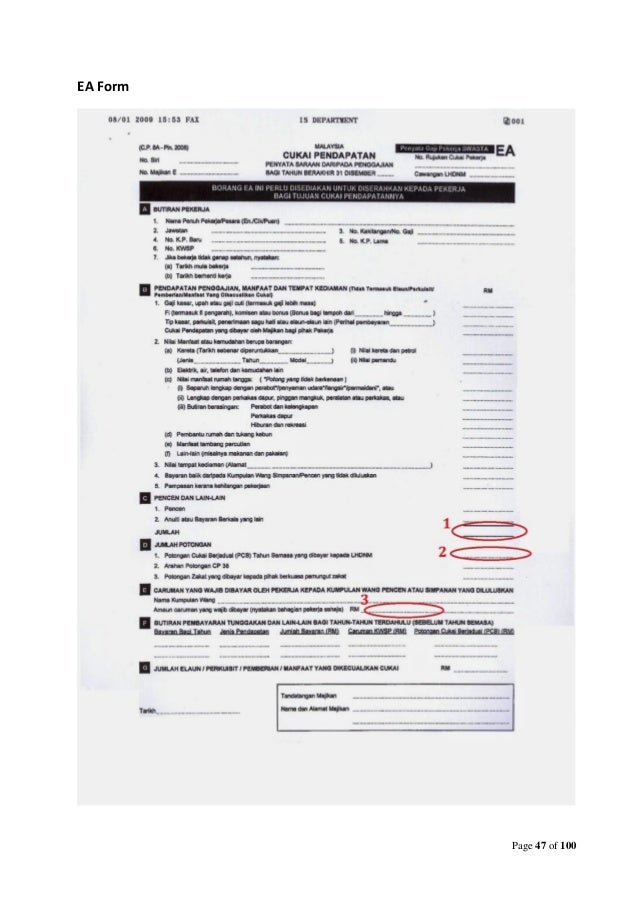

How To Fill Up Ea Form

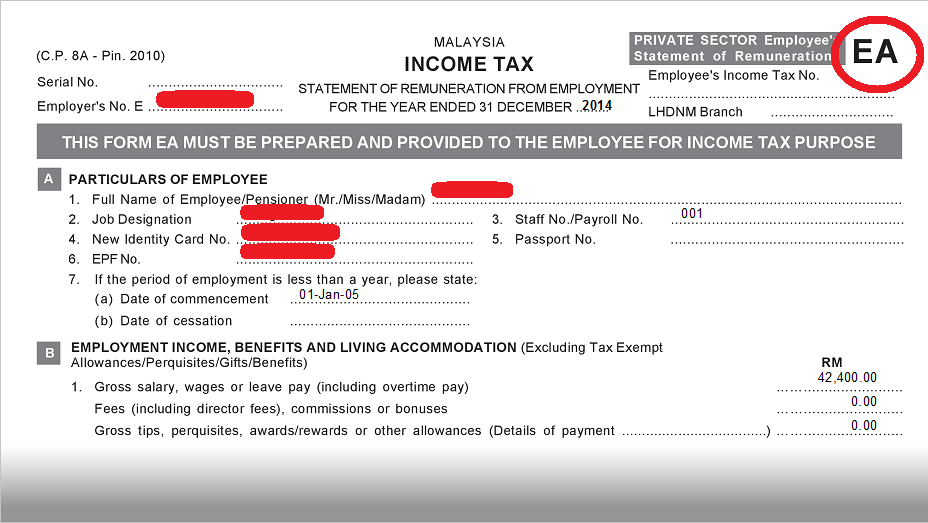

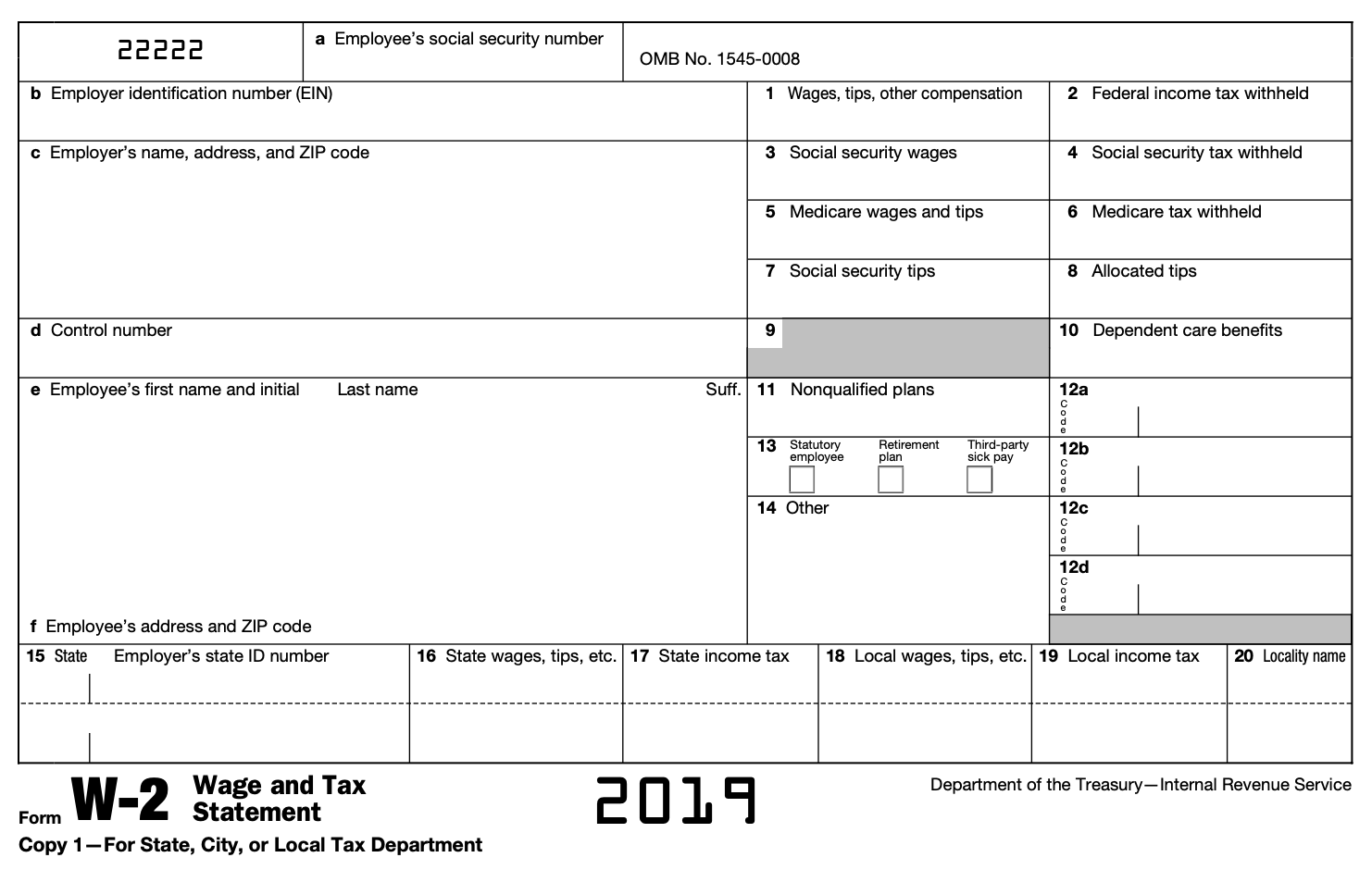

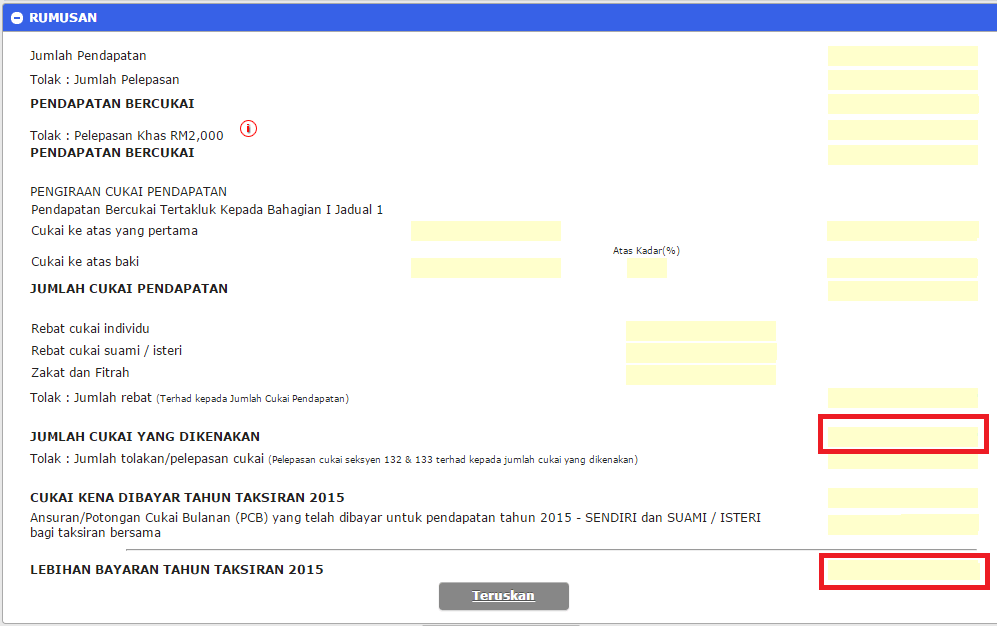

Refer to your 2019 ea form s and fill in your statutory income.

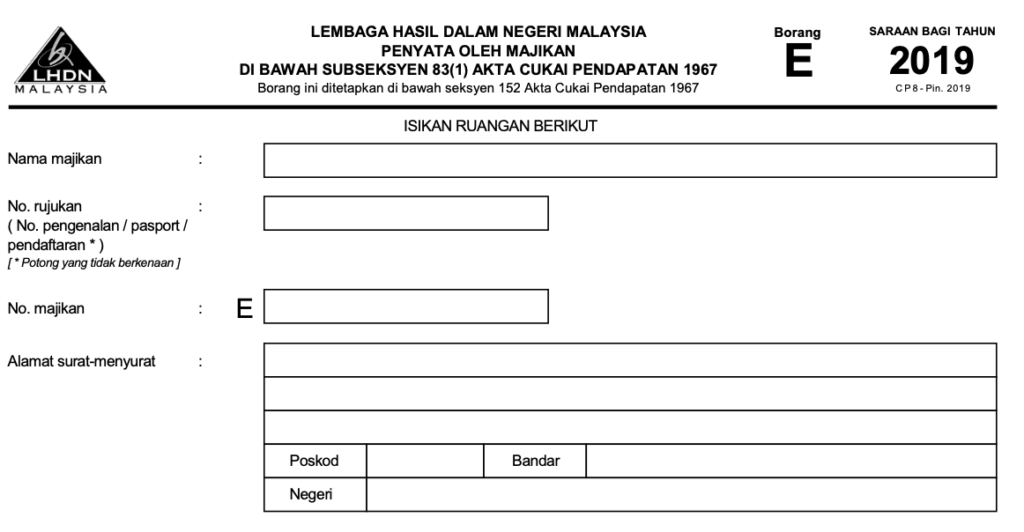

How to fill up ea form. However you do not have to file the total amount stated in the ea form s. Although there is a new ea form for year 2016 lhdn has announced that the the old versions of form ea form ec and c p. 8d can still be used for submitting 2016 income. At the various options available on the.

The old version of the forms format allowed to be used for the year of. There is an option that allows you to share the exported ea form with you employees easily if you don t want your employees to have access to the exported ea forms just remember to uncheck it. Now here s how to actually do it. Firstly the payroll summary you confirm every month.

You can download the detailed information registration form for this by clicking on the link below or right click and choose save as. Fill up the registration form. Perquisite benefits in kind income includes. Once you sign the form and hand it in you should receive a piece of paper with your lhdn e filing pin 16 numbers in 4 sets of 4 printed on it.

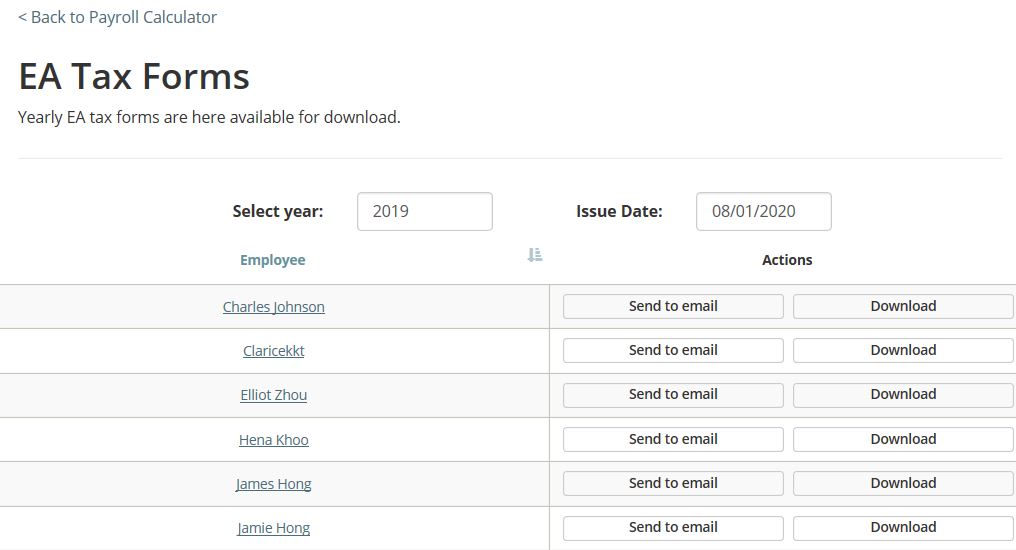

To export employee ea form you may go to payroll annual salary statement then click at the export ea form button. Login to e filing website. Go to the official registration page and click on borang pendapatan online. Go to e filing website.

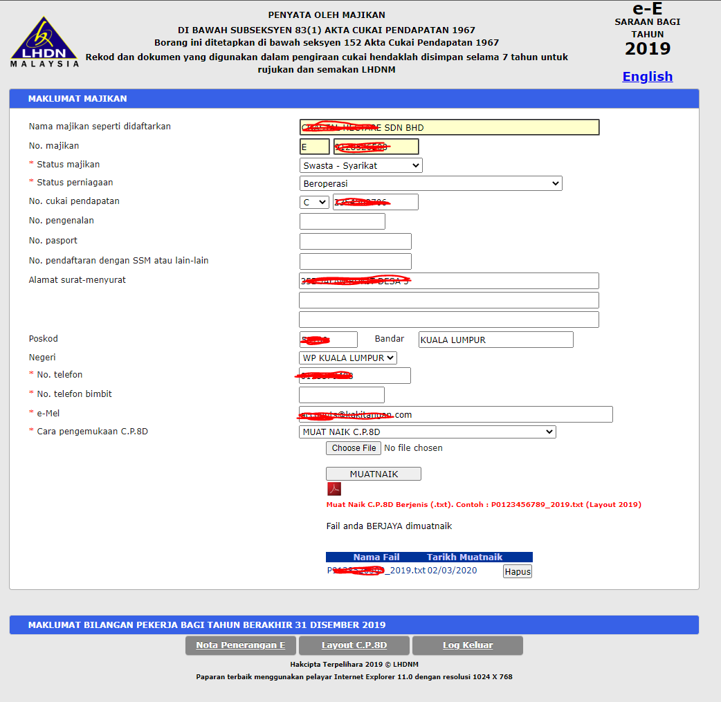

For everyone who has no idea what ea forms are let us break it down for you. Scroll down until you see muat naik disini. Step by step income tax e filing guide. Click this link to see how easy it is to do ea form and e form in actpay.

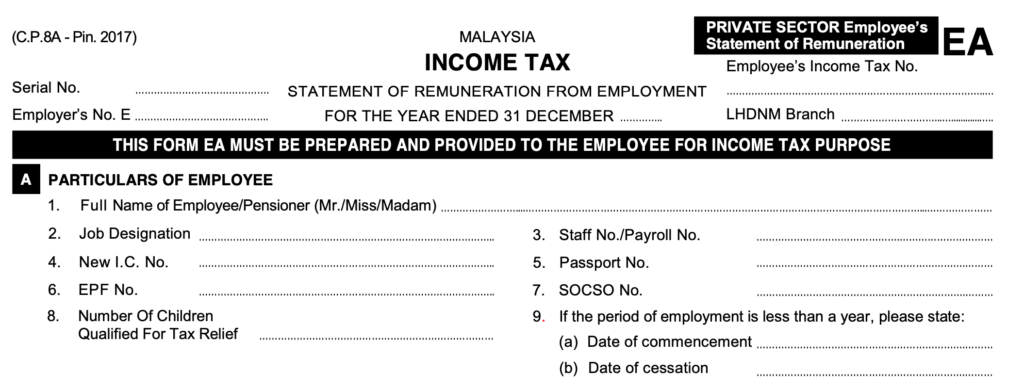

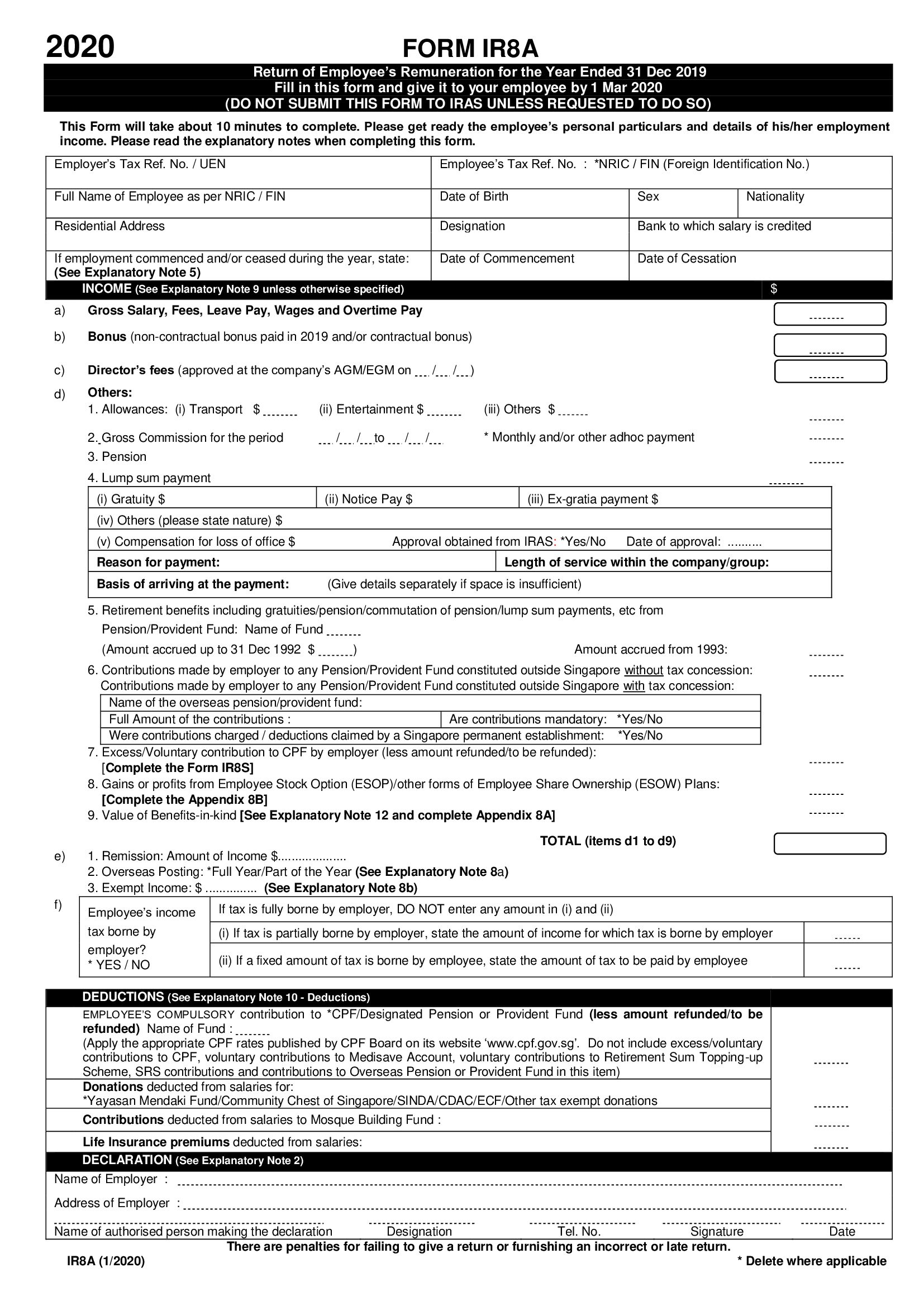

When you arrive at irb s official website look for ezhasil and click on it. According to the inland revenue board of malaysia an ea form is a yearly remuneration statement that includes your salary for the past year. Firstly the payroll summary you confirm every month. Keep this number for future reference.

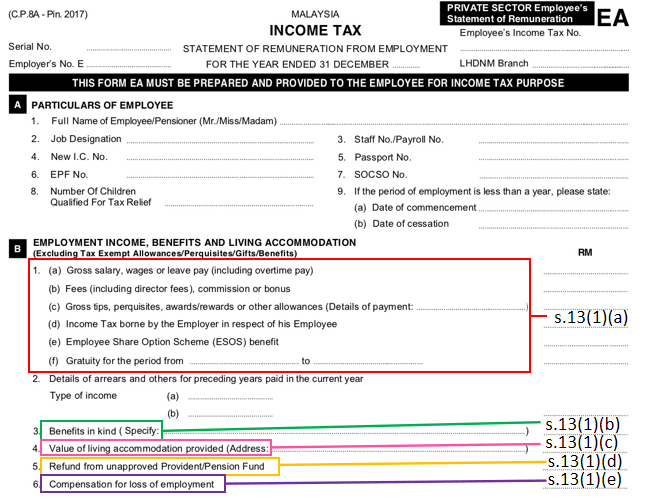

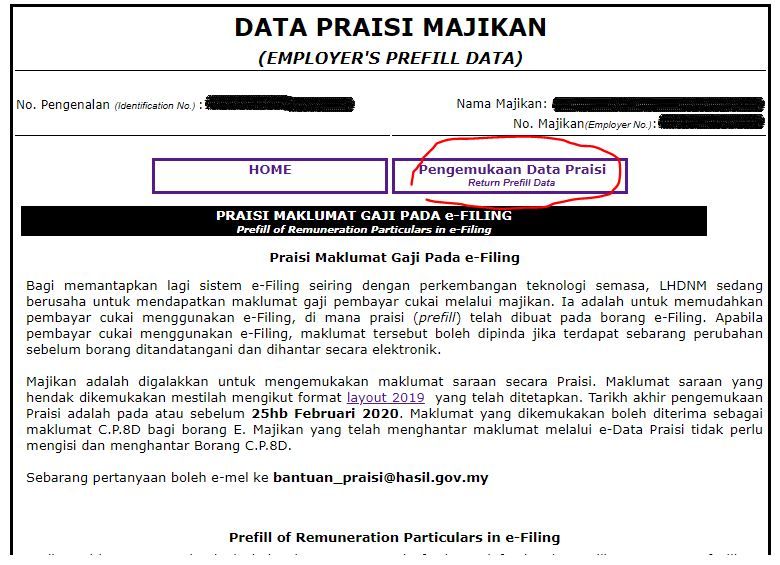

Registration form borang e ea open house return from form e page to home page. From lhdn announcement. You will usually use this form to file personal taxes during tax season. For example if you received perquisites and benefits in kind during your employment the money you get is exempted from income tax.