Income Tax Return Format Pdf

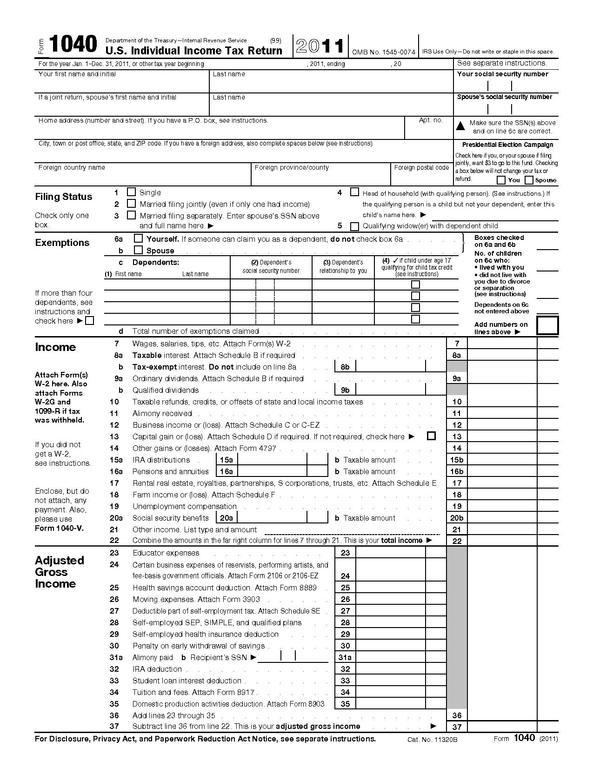

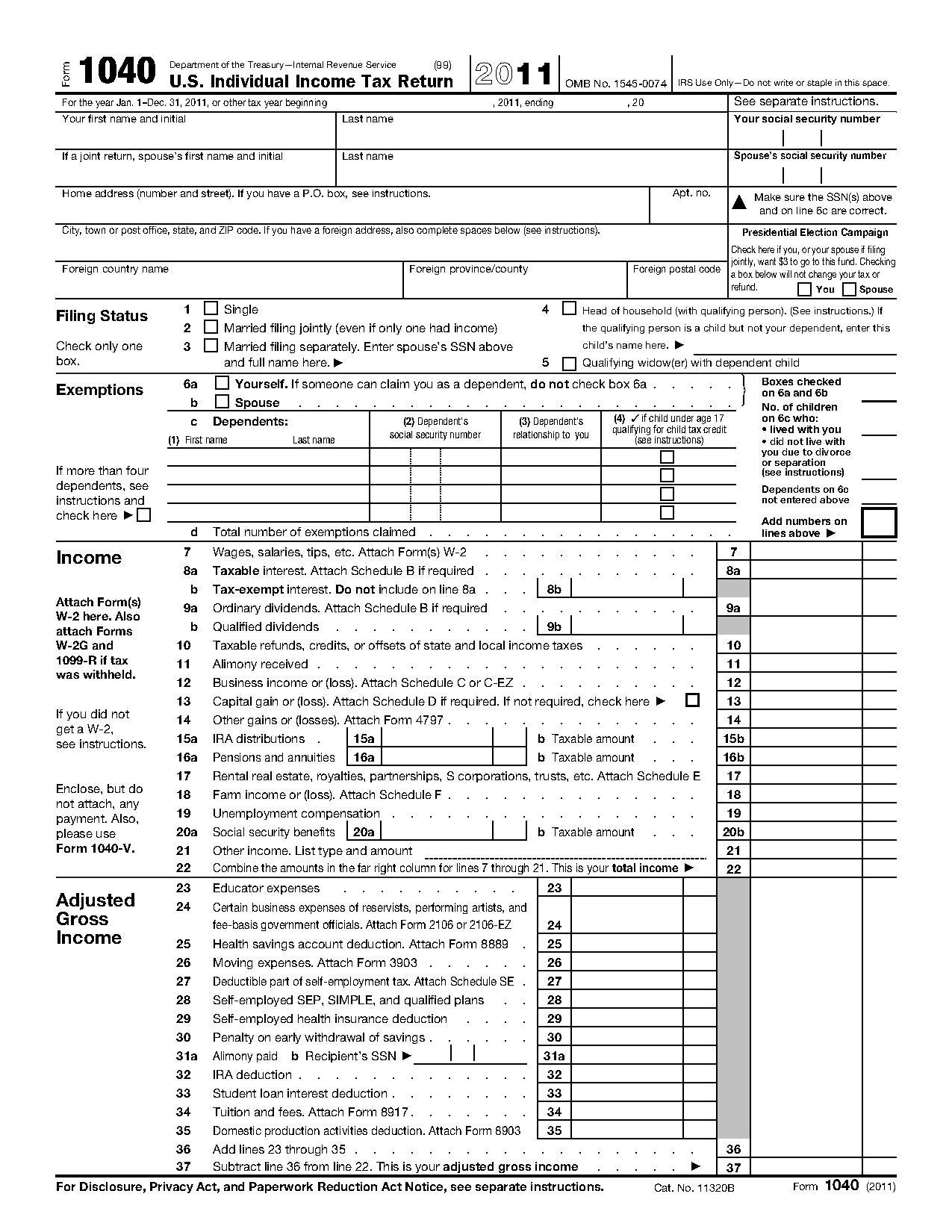

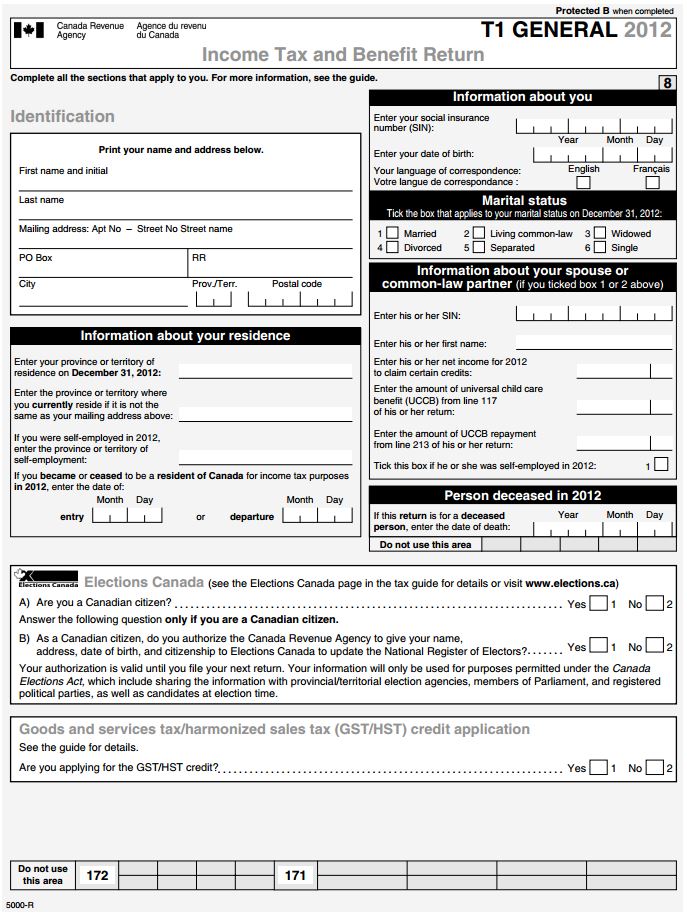

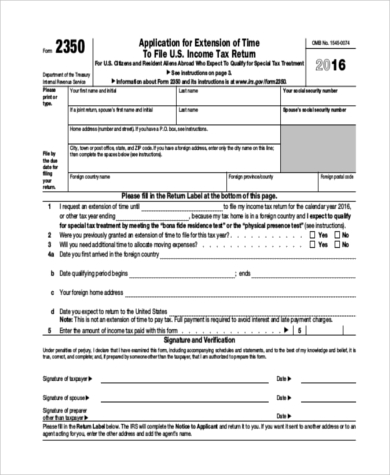

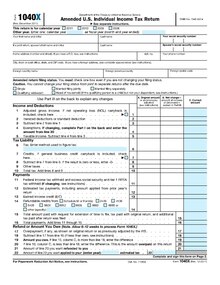

Form 1040 is used by u s.

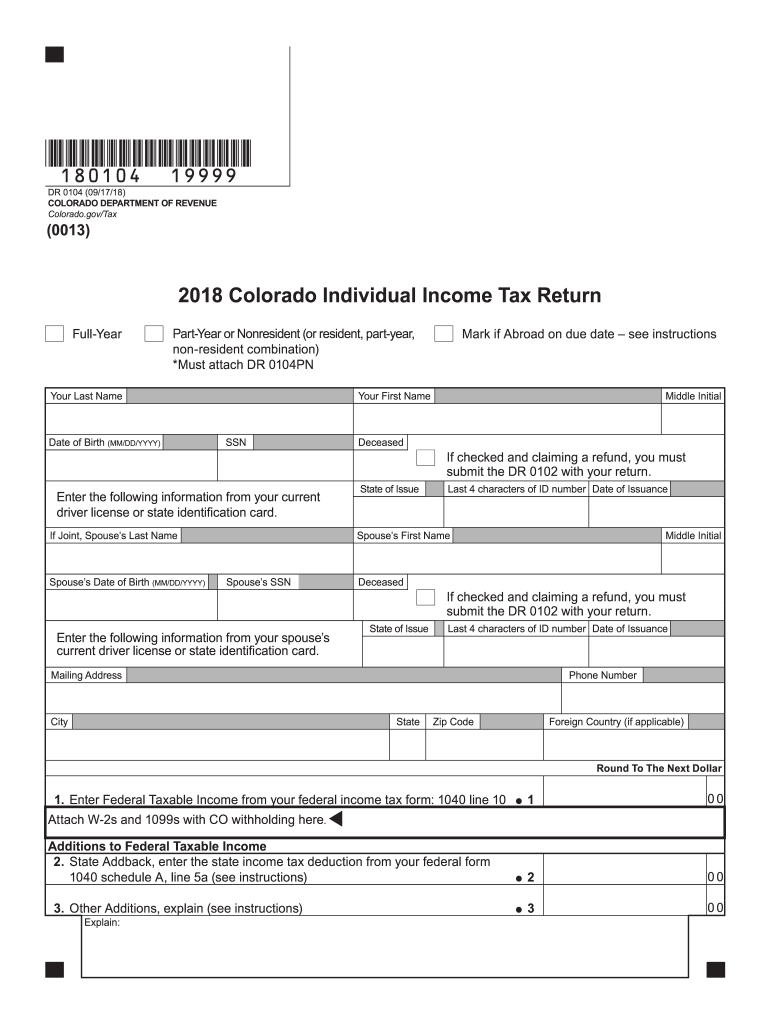

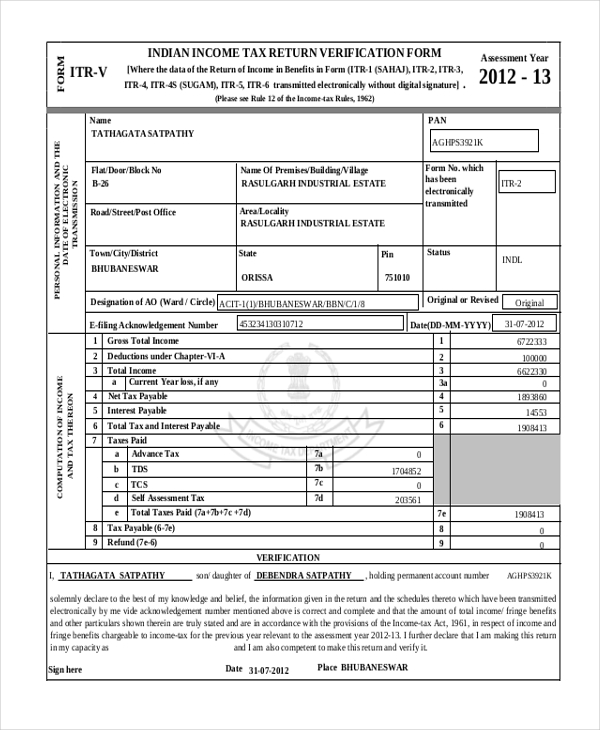

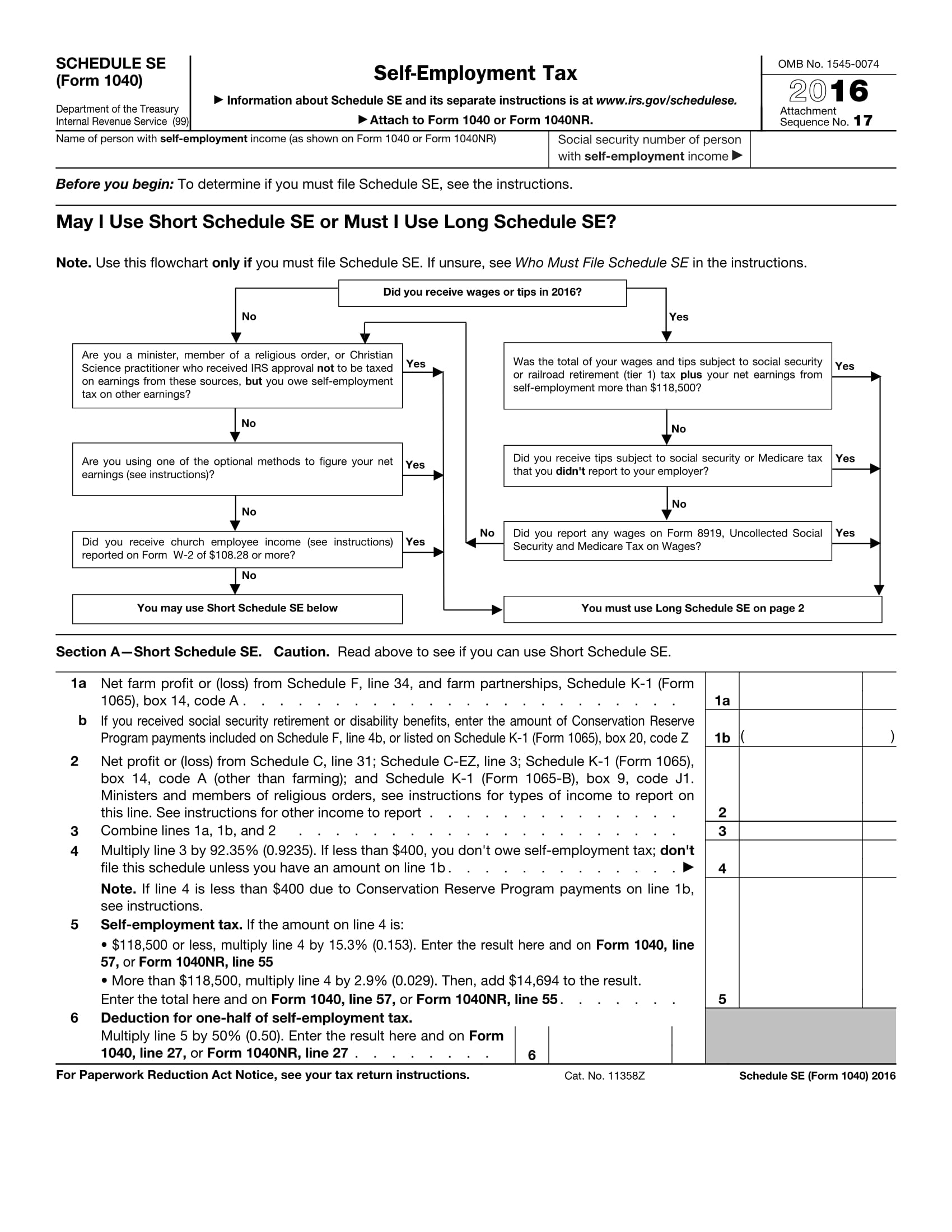

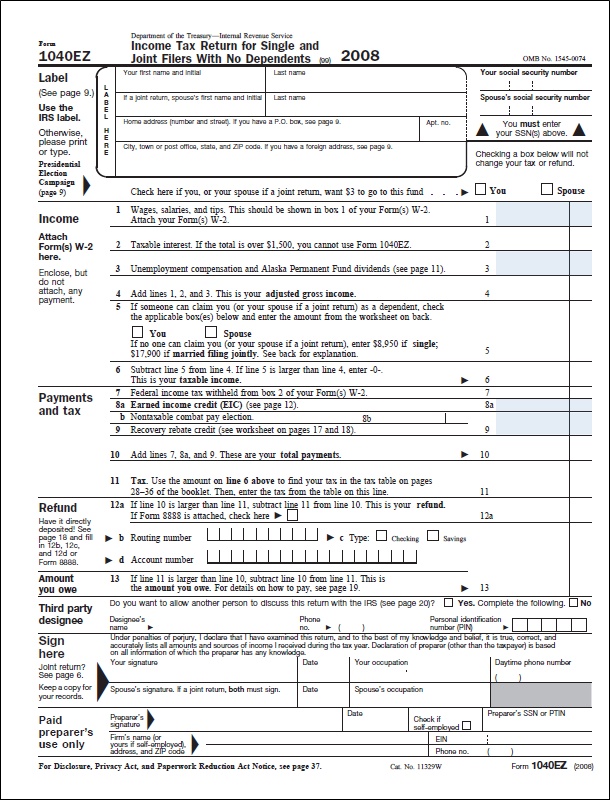

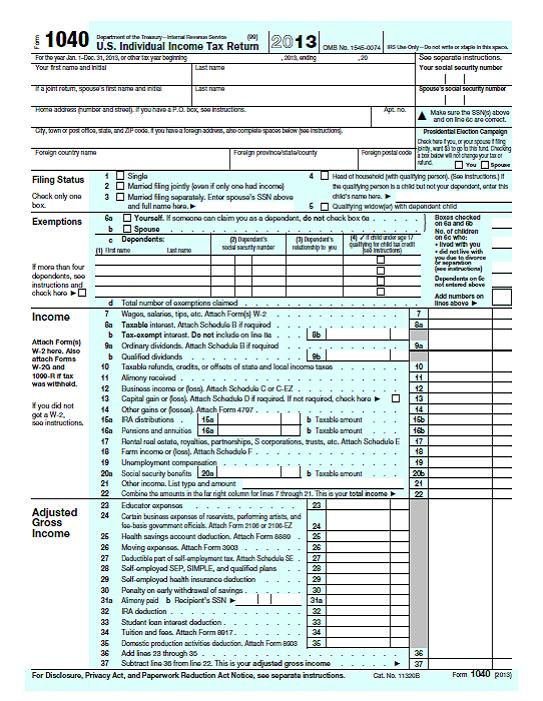

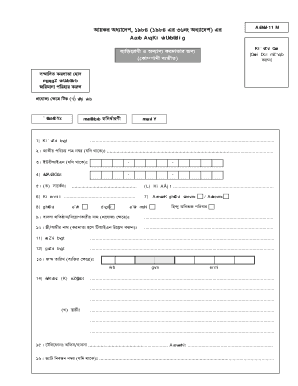

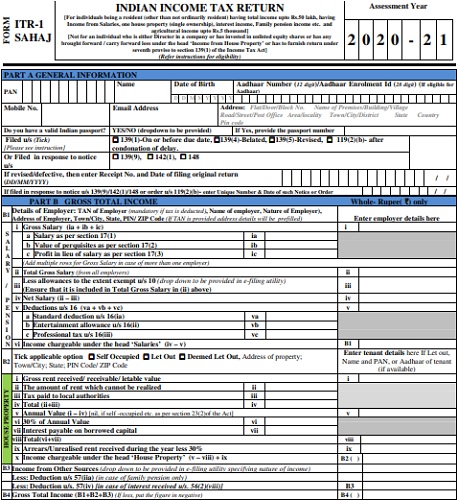

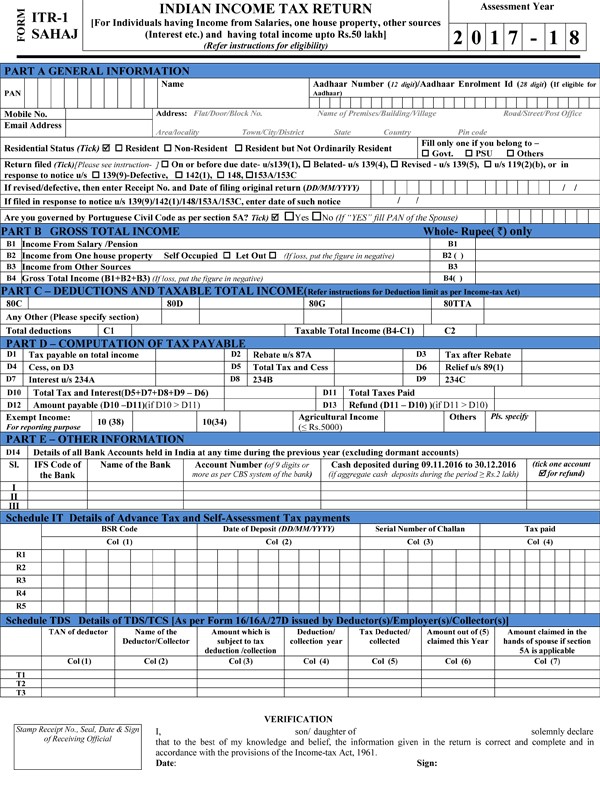

Income tax return format pdf. Irs use only do not write or staple in this space. Individual income tax return including recent updates related forms and instructions on how to file. Information about form 1040 u s. The indian government has recently notified the pdf format of all the income tax return itr forms for ay 2020 2021 under the tax regime.

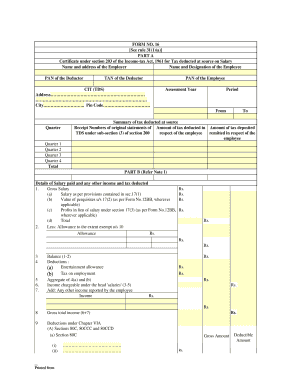

And all attachments as originally submitted to the irs including form s w 2 schedules or amended returns. 30 and those exempted in sec. 27 c and other special laws with no other taxable income. Insertion of form no.

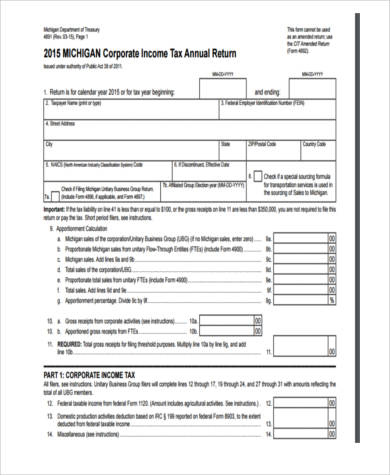

Income tax sixth amendment rules 2010 substitution of rules 30 31 31a 31aa 37ca and 37d. It is mandatory for all the taxpayers in india to file their returns on time as per the government rules and guidelines. Corporation income tax return for calendar year 2019 or tax year beginning 2019 ending 20. Taxpayers to file an annual income tax return.

Copies of forms 1040 1040a and 1040ez are generally available for 7 years from filing before they are destroyed by law. Form 1120 department of the treasury internal revenue service u s. Description of the form notification circular. Form 1040 1120 941 etc.

6 tax return requested. 1702 ex download annual income tax return for corporation partnership and other non individual taxpayer exempt under the tax code as amended sec. Form 1040 ez is a short version tax form for annual income tax returns filed by single filers with no dependents. 41 2010 dated 31 05 2010 view.

16 16a and 27d. For individuals and hufs not having income from profits and gains of business or profession भ ग ii खण ड 3 i भ रत क र जपत र अस ध रण 275 form itr 2 indian income tax return for individuals and hufs not having income from profits and gains of business or profession. Income tax return itr forms for ay 2020 21 cbdt notified new itr 1 2 2a 3 4 itr 4s 5 for ay 2020 21 download itr form 2020 21 in pdf format itr forms in fillable format or excel format download itr forms instruction for 2020 21. Individual income tax return.

24g and omission of rule 37a notification no.

/w2-9ca13523f4d74e958b821aab63af2e60.png)