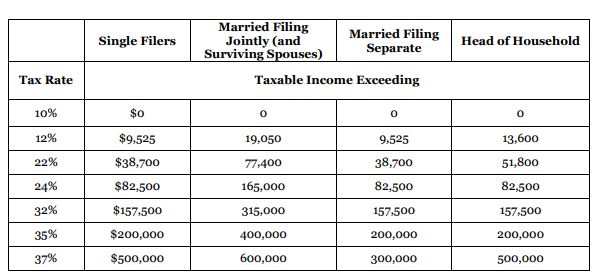

Income Tax Rate 2018

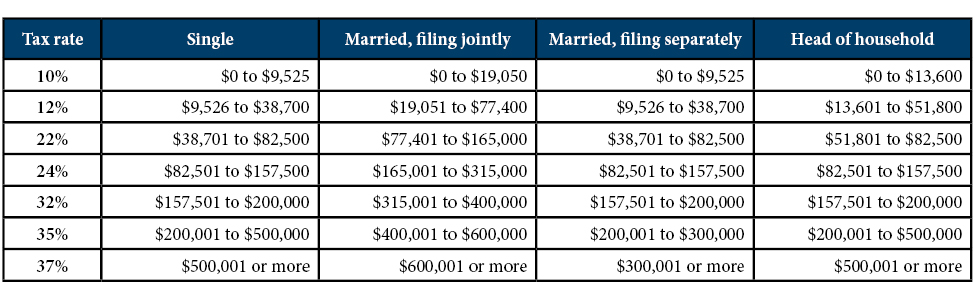

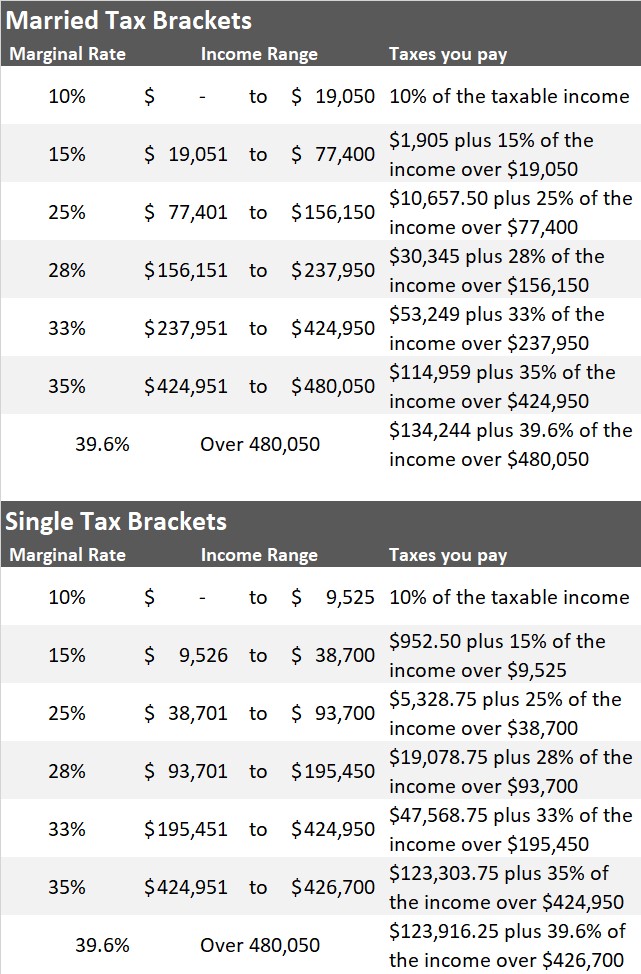

Your bracket depends on your taxable income and filing status.

Income tax rate 2018. The top rate will fall from 39 6 to 37. The 2017 budget made no changes to the personal income tax scale for. To determine the tax due for tax years ending on or after july 1 2017 refer to informational bulletin fy 2018 02. The standard deduction for single filers will increase by 5 500 and by.

Iit prior year. These tax rates are new and come from the tax jobs and cuts act of 2017 which was signed into law by president trump on december 22 2017. The amount of tax you owe depends on your income level and filing status. 10 12 22 24 32 35 and 37.

Bit prior year rates. 1 2018 retained seven tax brackets but lowered some of the tax rates and raised some of the income thresholds for those rates. 2018 individual income tax brackets the federal income tax has 7 rates. There are seven federal tax brackets for the 2020 tax year.

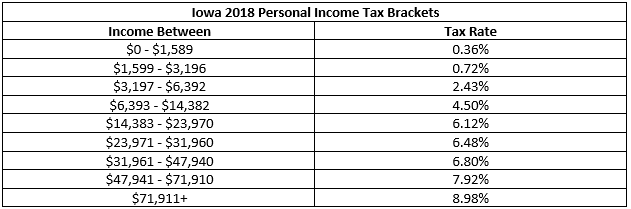

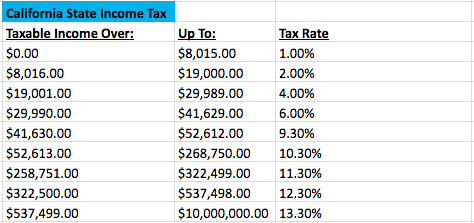

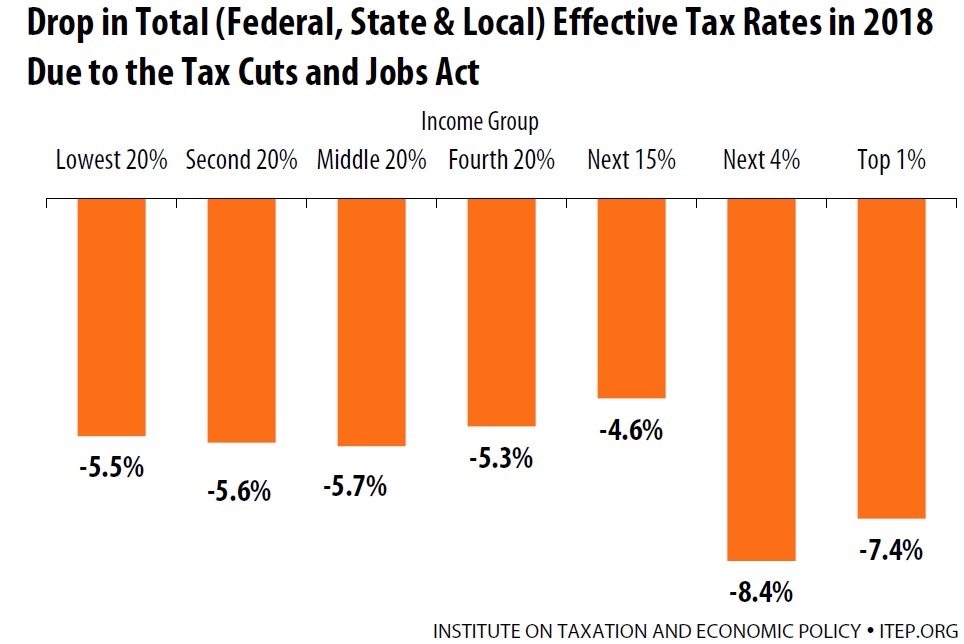

Effective july 1 2017. 2018 standard deduction and exemptions. The average individual income tax rate for all taxpayers fell slightly from 14 3 percent to 14 2 percent and the average tax rate fell for all groups. 2019 individual income tax rates pdf 121 kb 2018 individual income tax rates pdf 87 kb 2017 individual income tax rates pdf 86 kb 2016 individual income tax rates pdf 87 kb 2015 individual income tax rates pdf 10 kb 2014 individual income tax rates pdf 100 kb 2013 individual income tax rates pdf 11 kb.

Standard deduction and personal exemption. To determine the tax due for tax years ending on or after july 1 2017 refer to informational bulletin fy 2018 02. Tax rates 2017 2018 year residents the 2018 financial year starts on 1 july 2017 and ends on 30 june 2018. The financial year for tax purposes for individuals starts on 1st july and ends on 30 june of the following year.

Arkansas income tax rate and tax brackets shown in the table below are based on income earned between. In 2018 the income limits for all tax brackets and all filers will be adjusted for. 10 12 22 24 32 35 and 37. 2018 tax brackets income tax brackets and rates.

Arkansas income tax rate 2019 2020. 4 95 percent of net income.