Income Tax E Filing

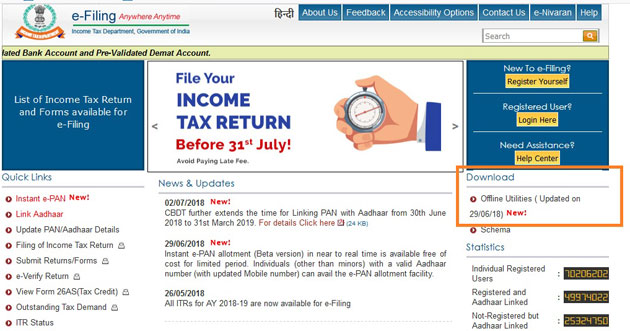

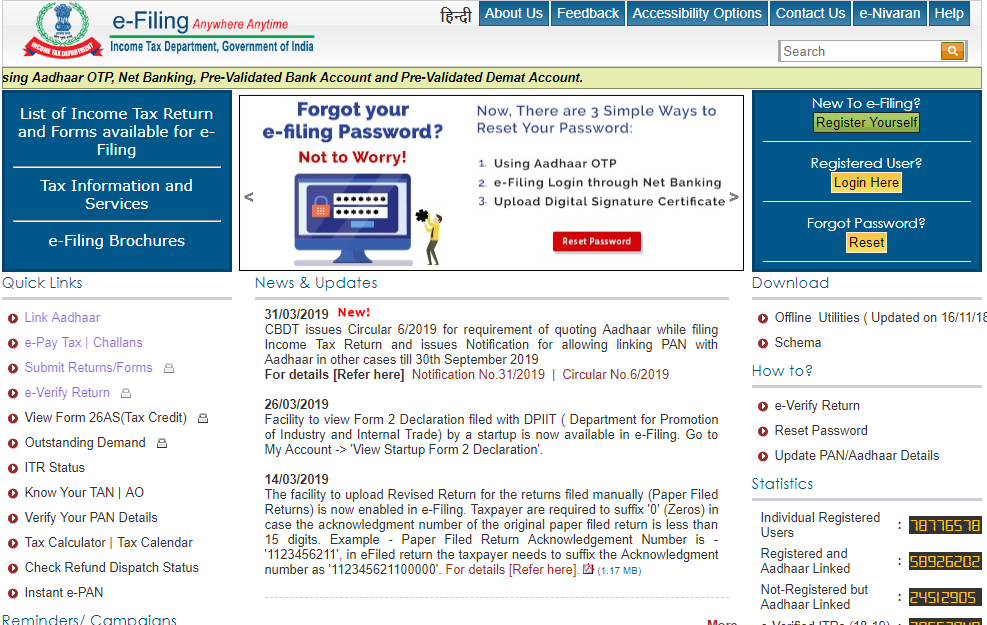

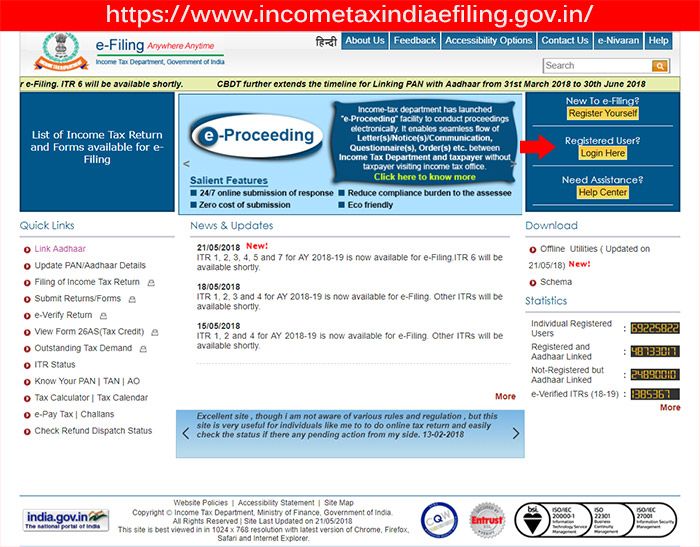

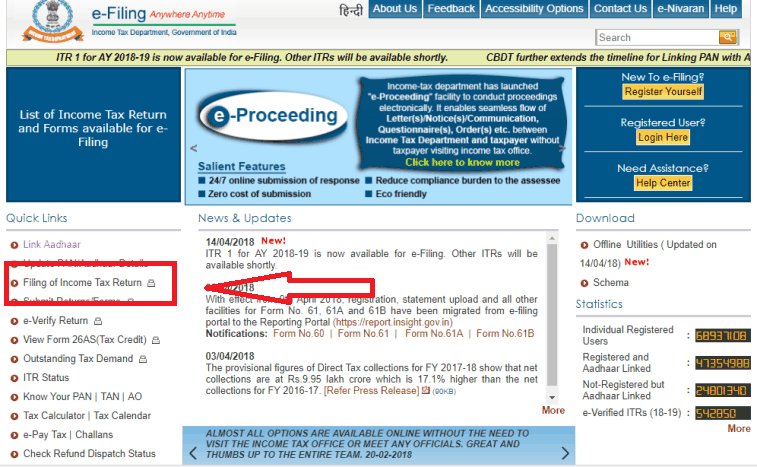

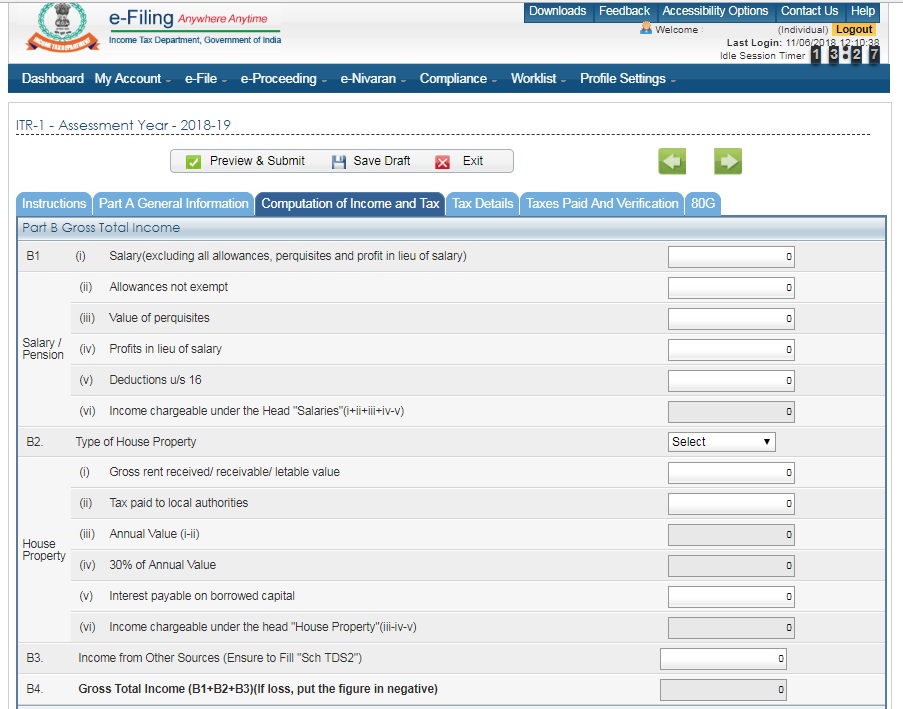

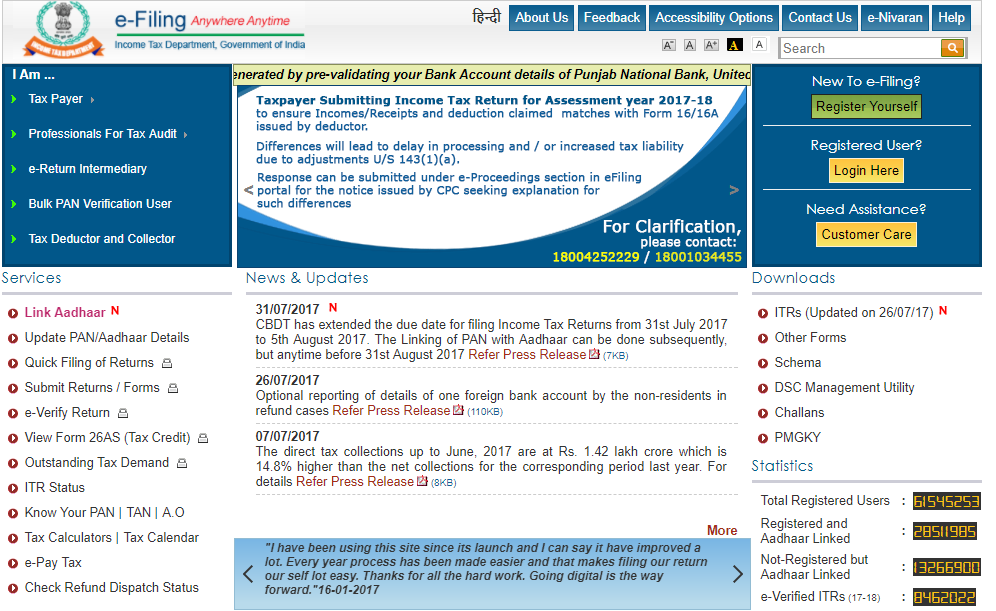

Navigate to the e file tab click response to outstanding tax demand to view the tax demand or click e pay tax to generate the pre filled challan for payment login to e filing account.

Income tax e filing. Do not file a second tax return or call. Pemberhentian pengeluaran sijil taraf orang kena cukai stokc mulai 18 mac 2019 lembaga hasil dalam negeri malaysia lhdnm tidak lagi menerima permohonan untuk sijil taraf orang kena cukai stokc. Irs free file or e file get your tax record and view your account. H r block will explain the position taken by the irs or other taxing authority and assist you in preparing an audit response.

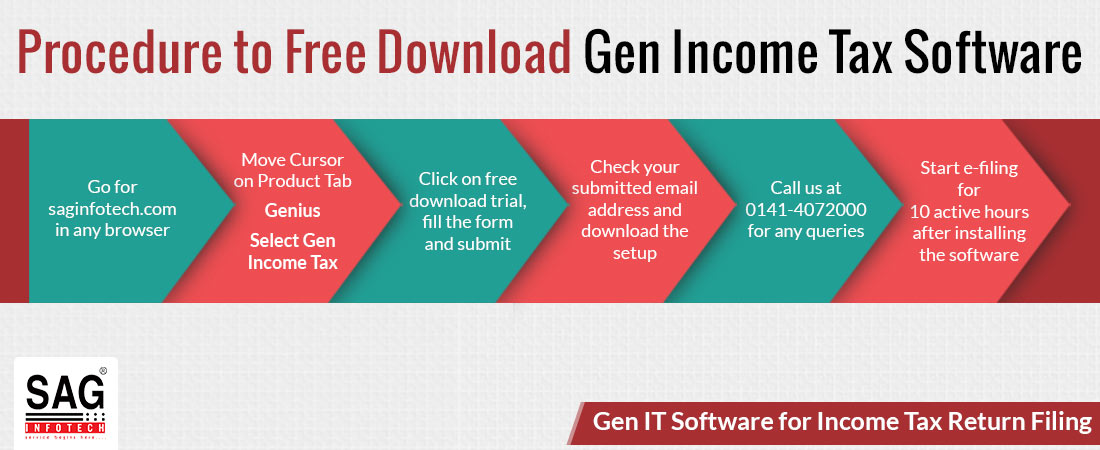

Options to pay taxes. E filing individual tax return year of assessment 2020 2021. You can file online with irs free file until october 15 at midnight et. Required information and documents.

Does not include audit representation. We continue to process electronic and paper tax returns issue refunds and accept payments. Use irs free file or fillable forms. For businesses and other taxpayer audiences see the links to the left.

Sepanjang sesi penyenggaraan ini semua aplikasi e filing m filing taef e bas e kemaskini e spc dan e lejar tidak dapat dicapai. Click the login to e filing account button to pay any due tax intimated by the ao or cpc. Enter your info here tool to register for an economic impact payment or stimulus check. You must provide a copy of your forms w 2 to the authorized irs e file provider before the provider sends the electronic return to the irs.

We re experiencing delays in processing paper tax returns due to limited staffing. You don t need to send your forms w 2 to the irs and should keep them in a safe place with a copy of your tax return. Use irs free file if your adjusted gross income is 69 000 or less. You can print your returns until october 20.

Register for a stimulus payment. Businesses and self employed get your employer id number ein find form 941 prepare to file make estimated payments and more. If you already filed a paper return we will process it in the order we received it. If you did not file a 2018 or 2019 federal tax return because your income was too low use the non filers.

If you are comfortable doing your own taxes try free file fillable forms. Mra e services is a secured online platform offering taxpayers the facility to file tax returns electronically.