How To File Tax For Sole Proprietorship In Malaysia

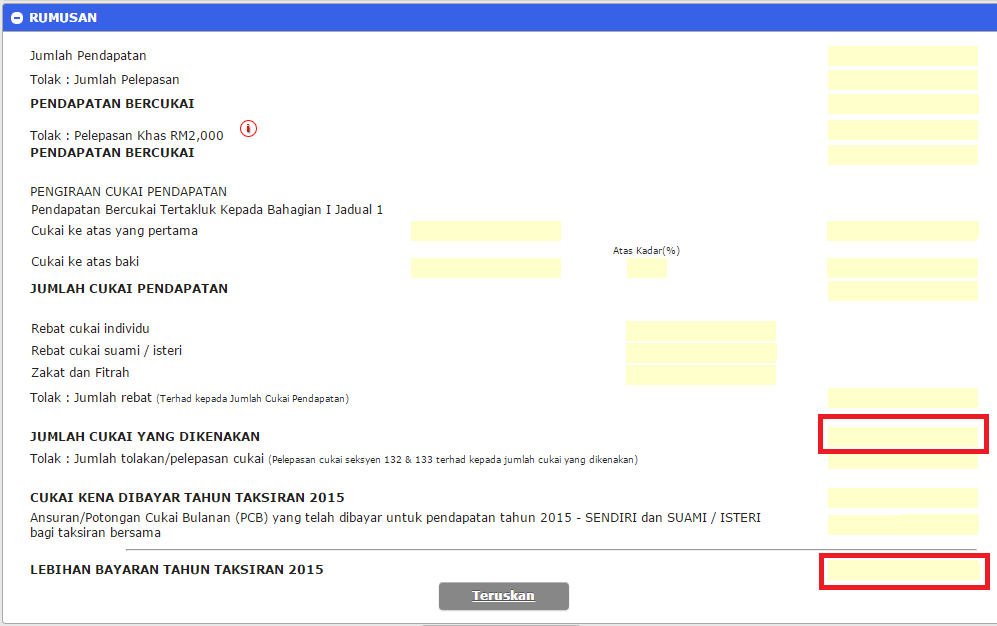

Use form cp 600pt.

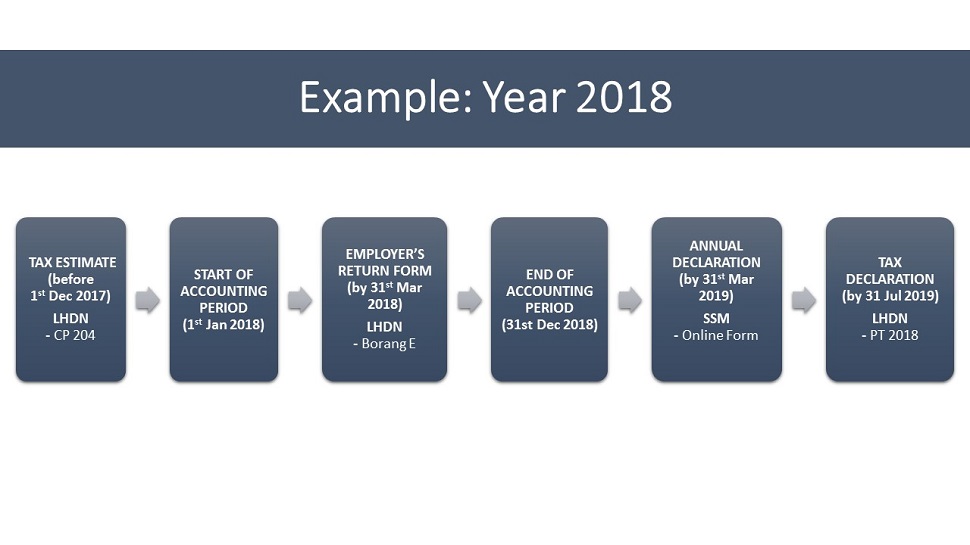

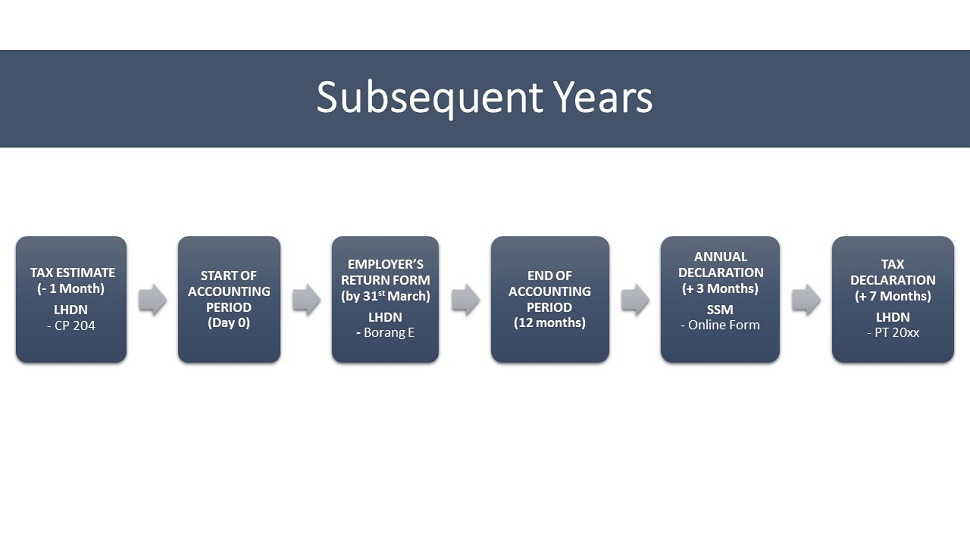

How to file tax for sole proprietorship in malaysia. It costs rm 10 and takes just a few minutes. Sole proprietorship is governed by companies commission of malaysia suruhanjaya syarikat malaysia and registration of businesses act 1956. All profits and losses go directly to the business owner. Tax file register your llp for a tax file at a nearby lhdn branch.

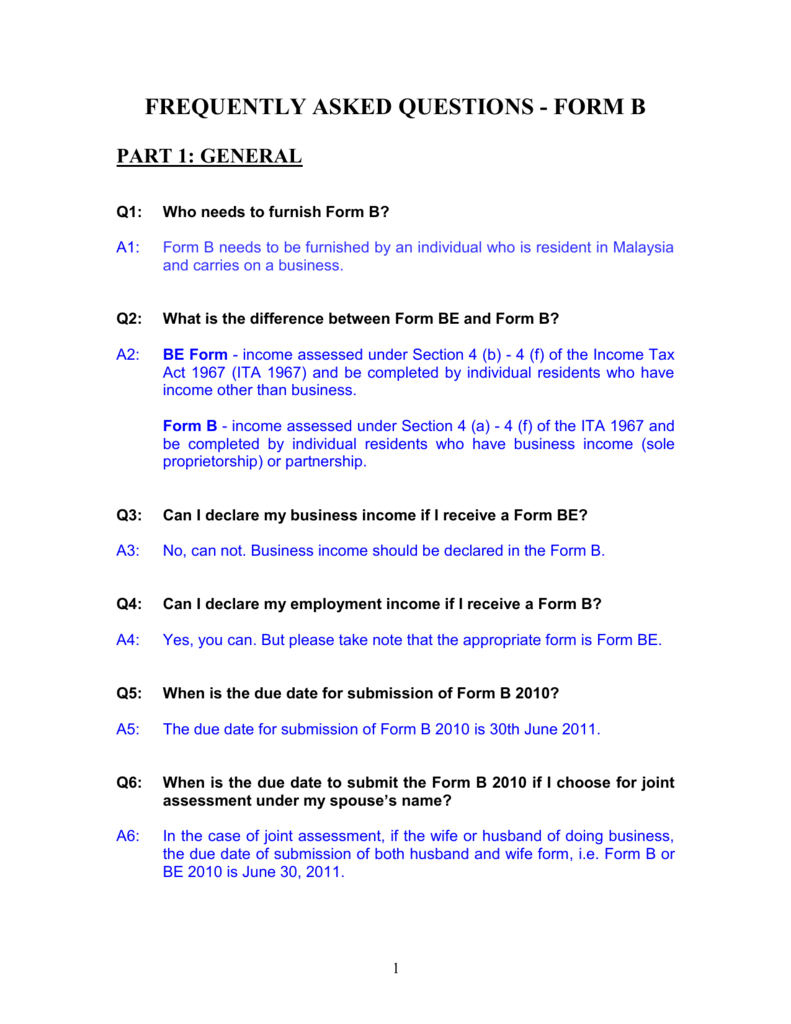

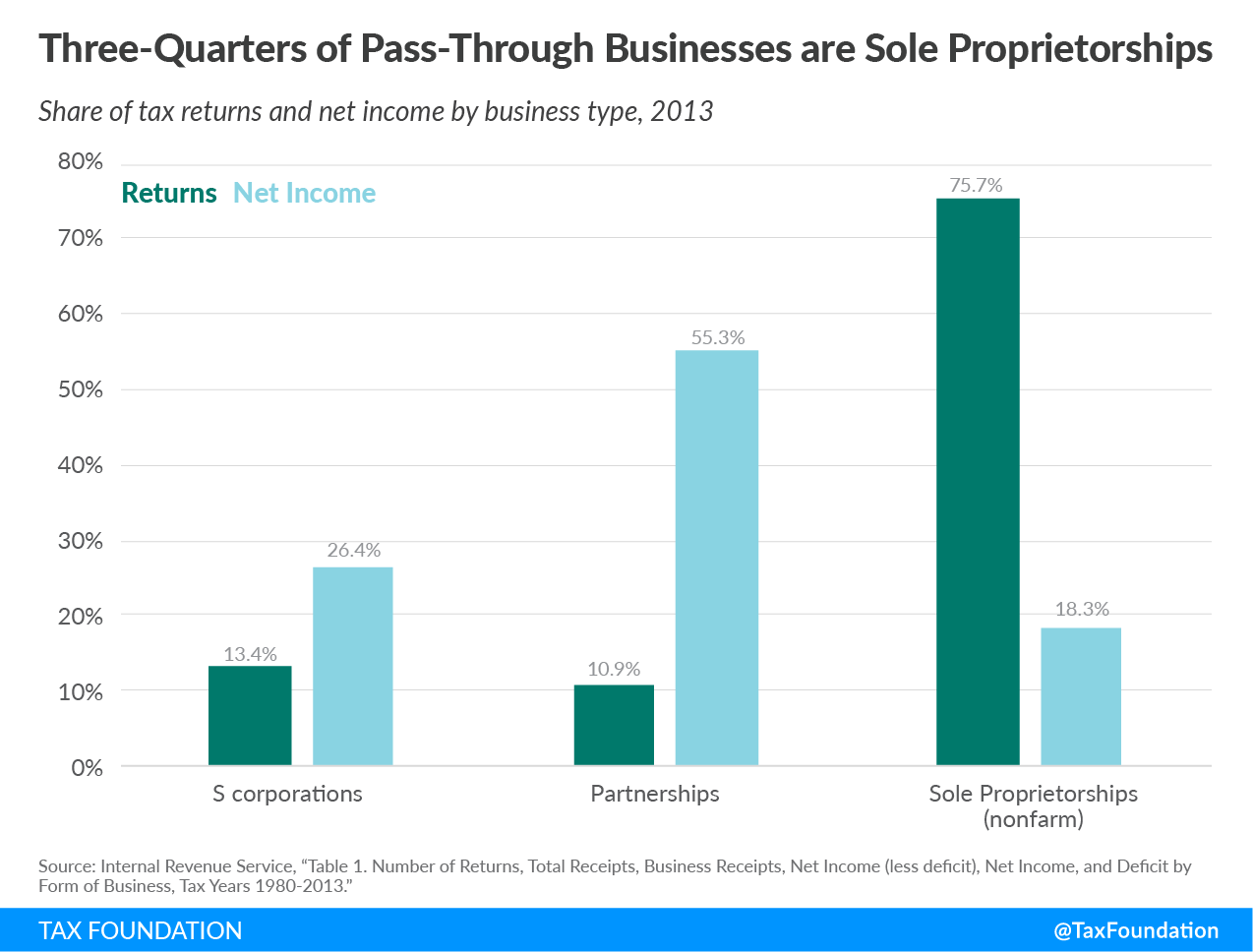

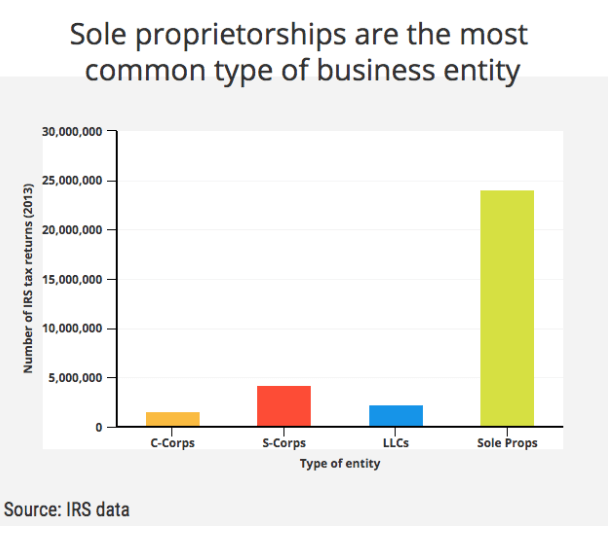

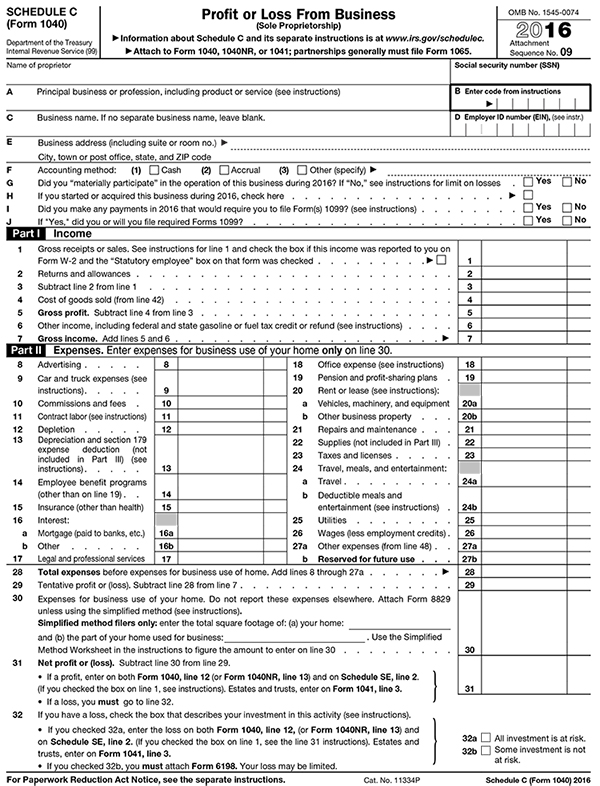

Depending on your nature of business you can register as sole proprietorship partnership limited liability partnership or company. Sole proprietorships are pass through entities. To register as a taxpayer if eligible register file to get a copy of income tax return form from the nearest lhndm branch if the form does not reach on time to complete form b sole proprietor and form p partnership to prepare statement of accounts and other statements such as rental statements and commission statements. Go to an ssm branch near to you pick.

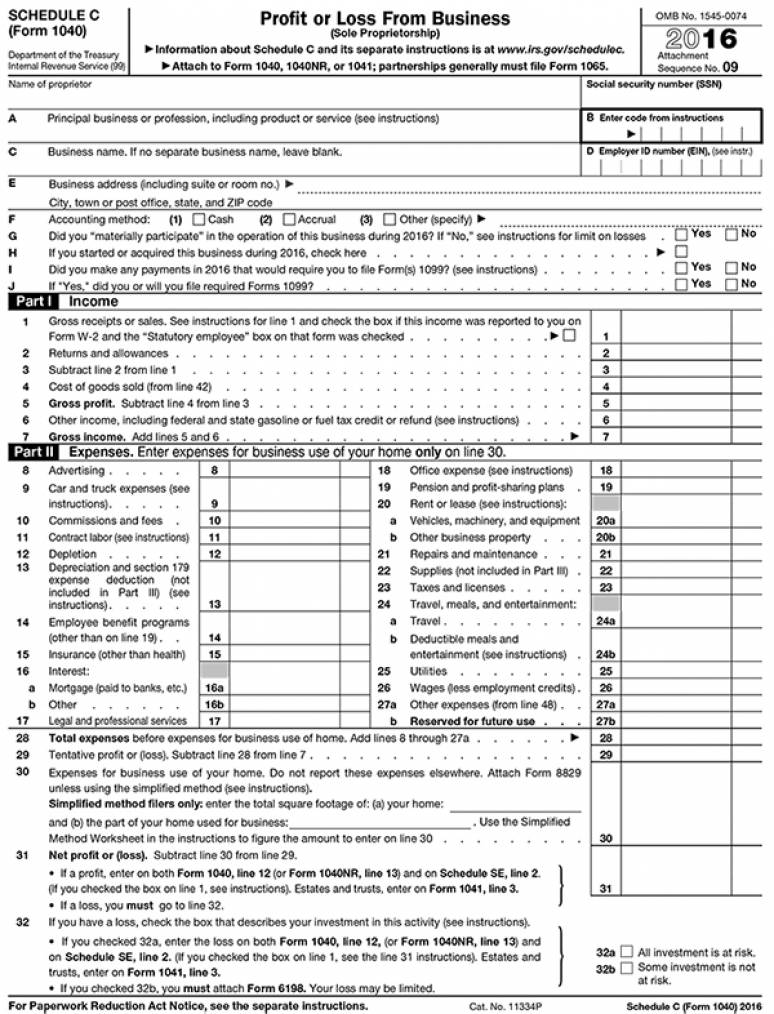

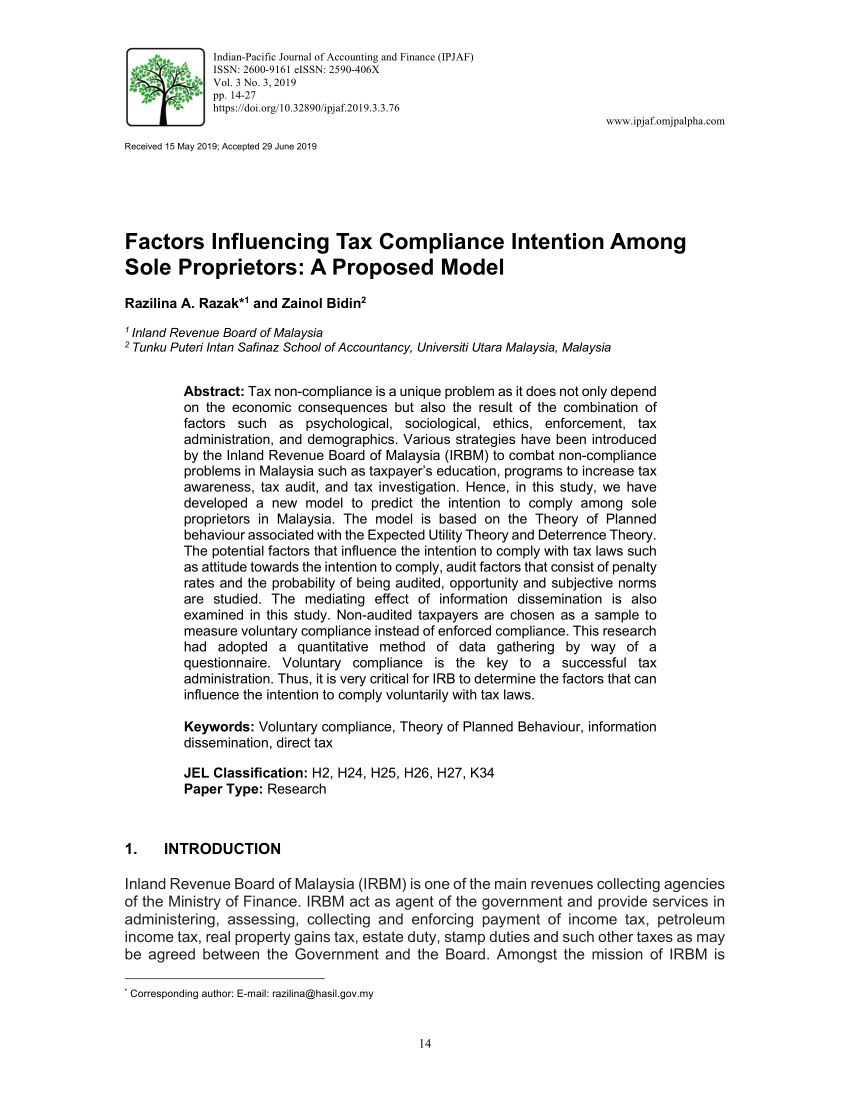

You ll also need to submit copies of your llp certificate from step 1 and stamped llp agreement. Sole proprietorship registration is the most common and simplest legal business structure option in malaysia. Sole proprietorships in malaysia are charged the income tax on a gradual scale applied to individual income from 2 to 26. A sole trader is represented by the natural person who will carry business operations in his or her own name.

You can stamp your llp agreement at any lhdn branch. A sole proprietorship is a business wholly owned by a single individual using personal name as. Register a sole proprietorship in malaysia a sole proprietorship must be registered with the companies commission malaysia the main institution where companies file for registration.