Income Tax Calculator Ay 2019 20 Excel Software

Income tax slabs for fy 2019 20 ay 2020 21 download scss calculator 2020.

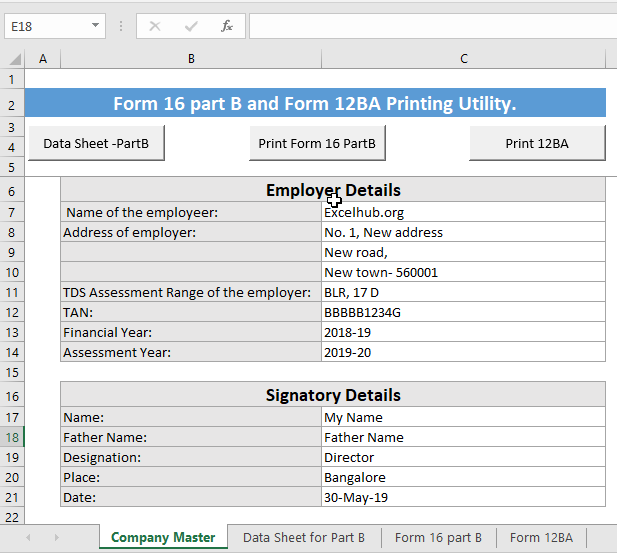

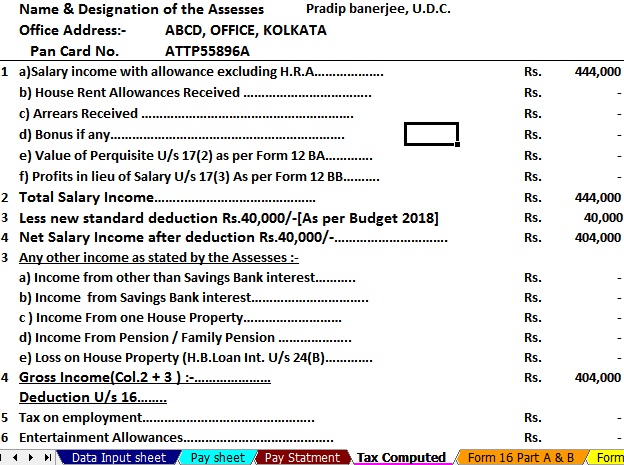

Income tax calculator ay 2019 20 excel software. As per section 89 1 of the income tax act 1961 relief for income tax has been provided when in a financial year an employee receives salary in arrears or advance. This will marginally increase income tax for every tax payer. Govt extends deadlines for filing tax returns for the f y 2019 20 up to 31st december 2020 with automated income tax preparation excel based software all in one for the govt and non govt private employees for f y 2020 21 with new and old tax regime u s 115bac for f y 2020 21. It is simple excel based calculator specially made for salaried people.

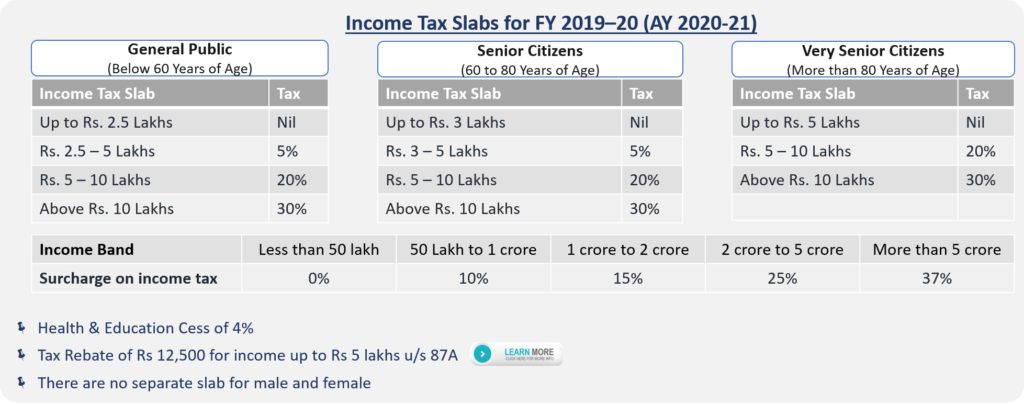

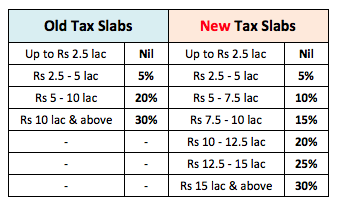

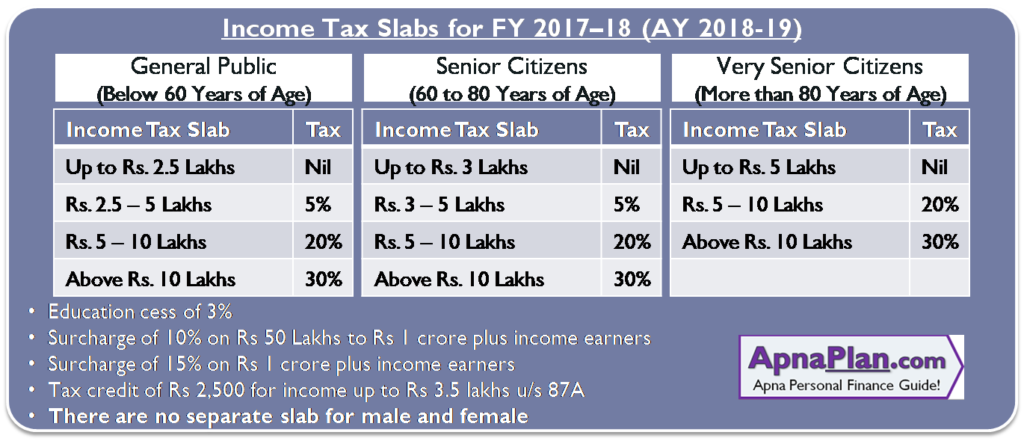

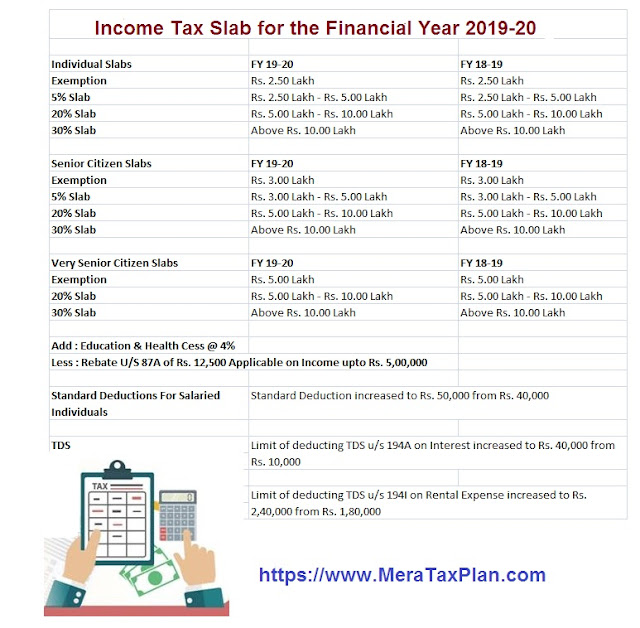

No change in income tax slabs 2. 1 additional health cess taking total cess on income tax to 4 2 education cess 1 higher education cess continues. Income tax slabs remain unchanged as per previous year. Highlights of changes in fy 2019 20 in income tax return form.

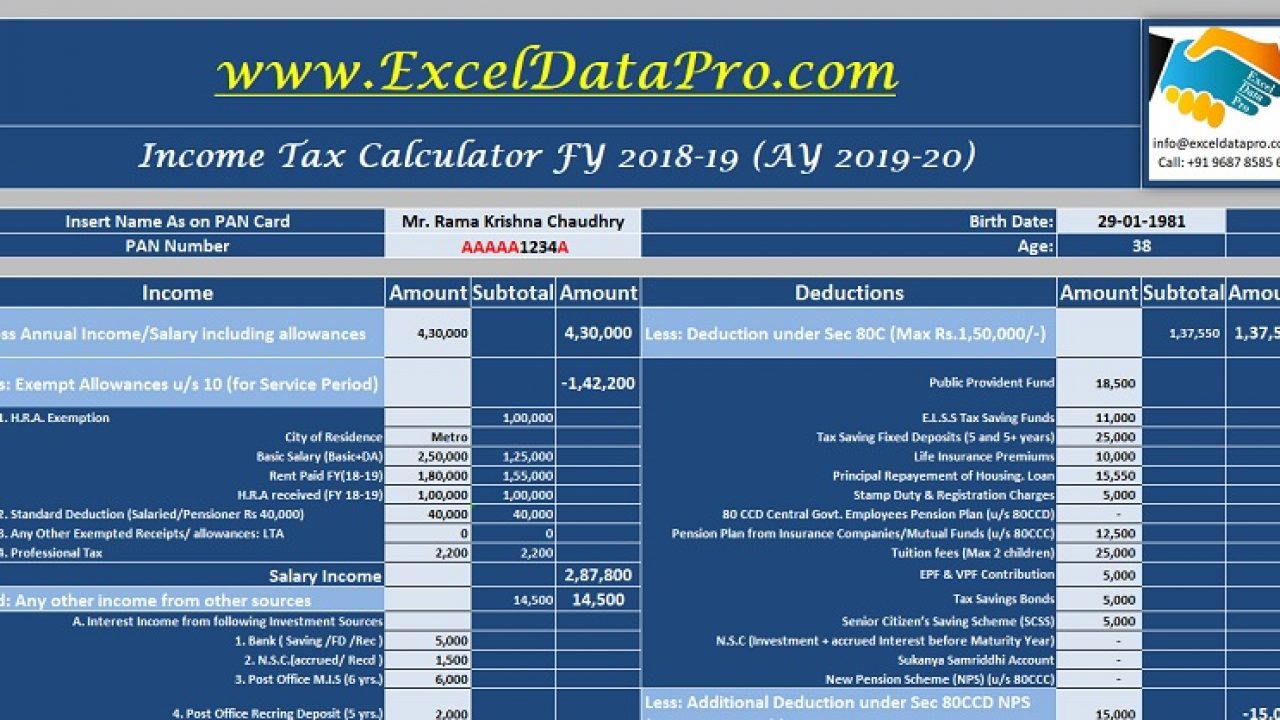

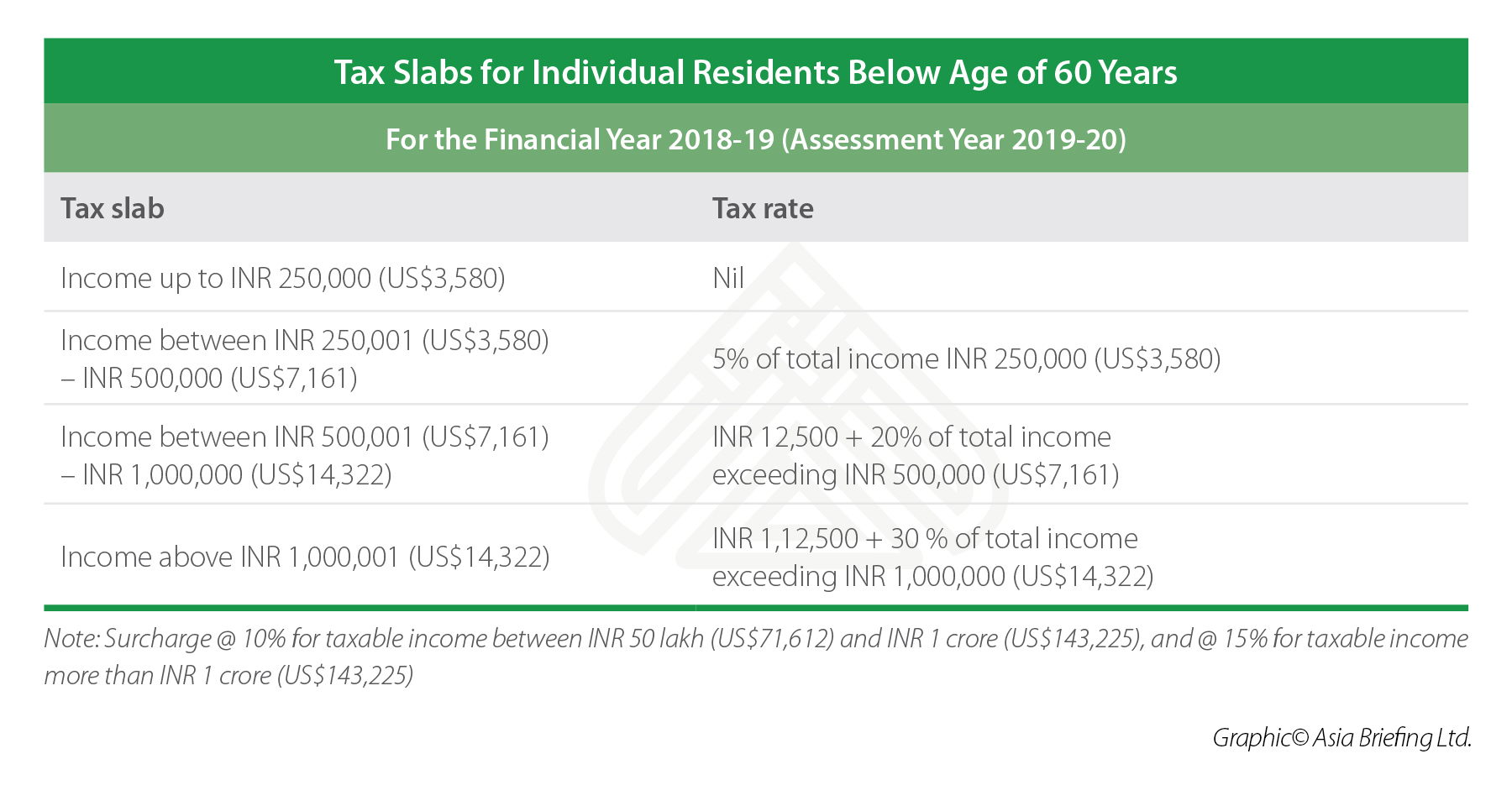

Prior to looking at income tax calculator let s take a look at income tax slab for fy 2018 19 and recent changes made in income tax during budget 2018. Also read bulk data income tax calculator for multiple employees for financial year 2019 20 assessment year 2020 21 and bulk tds calculation salary in excel don t forget to check income tax calculator for ay 2020. Using this calculator you can calculate your income tax liability for fy 2018 19 ay 2019 20. This excel based income tax calculator can be used for computing income tax on income from salary pension gifts fixed deposit and bank interest house rent and capital gains short and long term gains.

Standard deduction enhanced for salaried persons from 40 000 to 50 000 in fy 2019 20. The excel based income tax calculator can be used for computing income tax on income from salary pension gifts fixed deposit and bank interest house rent and capital gains short and long term gains. It is simple excel based calculator specially made for the salaried people. 2021 22 without exemptions deductions.

Standard deduction of rs 40 000 to salaried and pensioners. You can use this calculator for calculating your tax liability for fy 2019 20 ay 2020 21. Excel based income tax calculator for fy 2019 20 ay 2020 21 3. New scheme income tax rates for the financial year 2020 21 assessment year.

Excel form 10e salary arrears relief calculator ay 2020 21 for claiming rebate under section 89 1 of income tax act 1961 download. It software 2018 19 prepared by kss prasad kss prasad income tax software 2019 2020 financial year 2020 21 assessment year income tax calculation software 2019 2020 financial year 2019 2020 fy 2018 19 assessment year ay 2019 20 it is ms excel sheet for guessing the it for ap ts teachers for 2019 2020 financial year as well as 2020 2021. To help them here is simple income tax calculator for the financial year 2019 20. Changes in income tax rules.