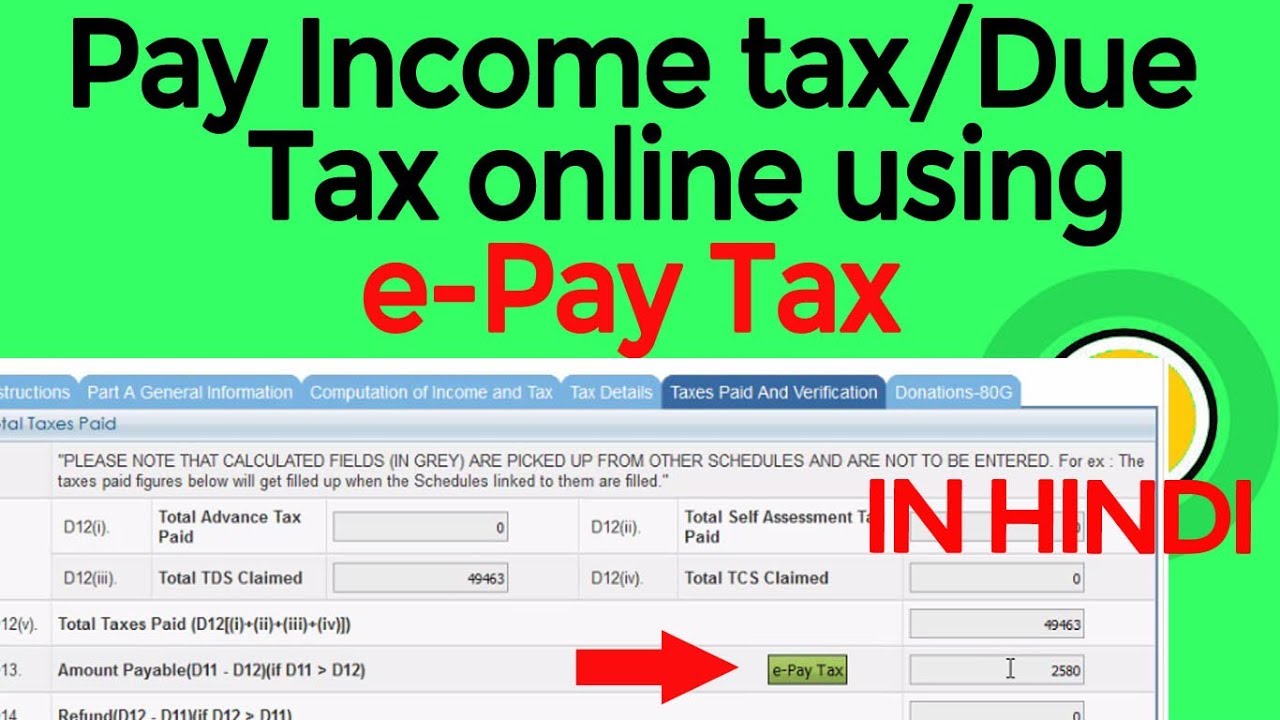

How To Pay Income Tax Online

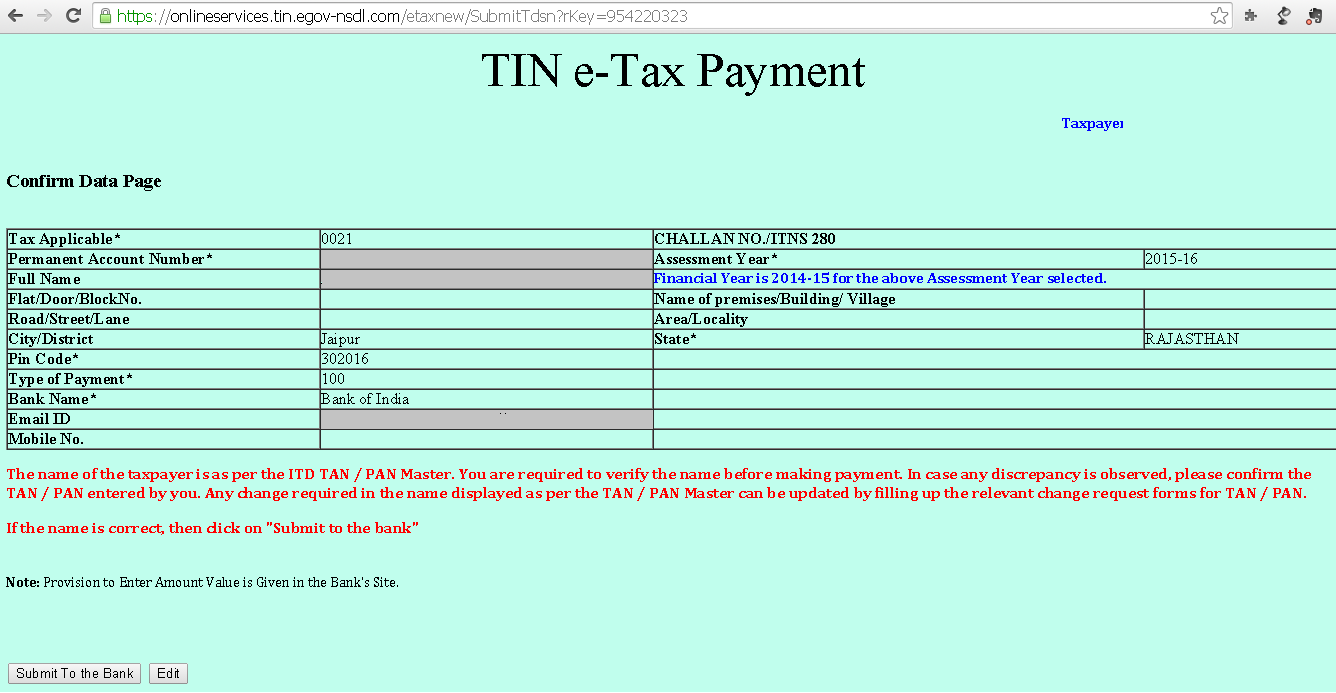

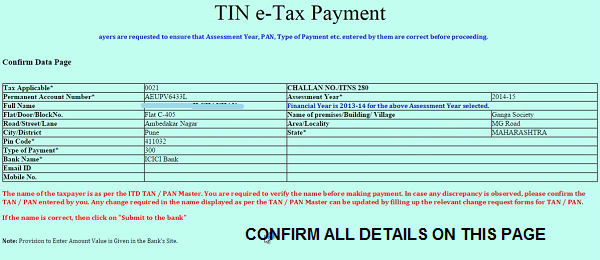

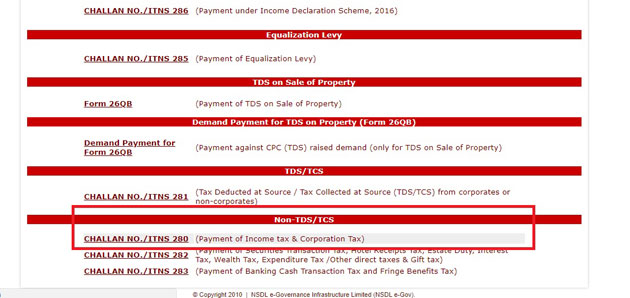

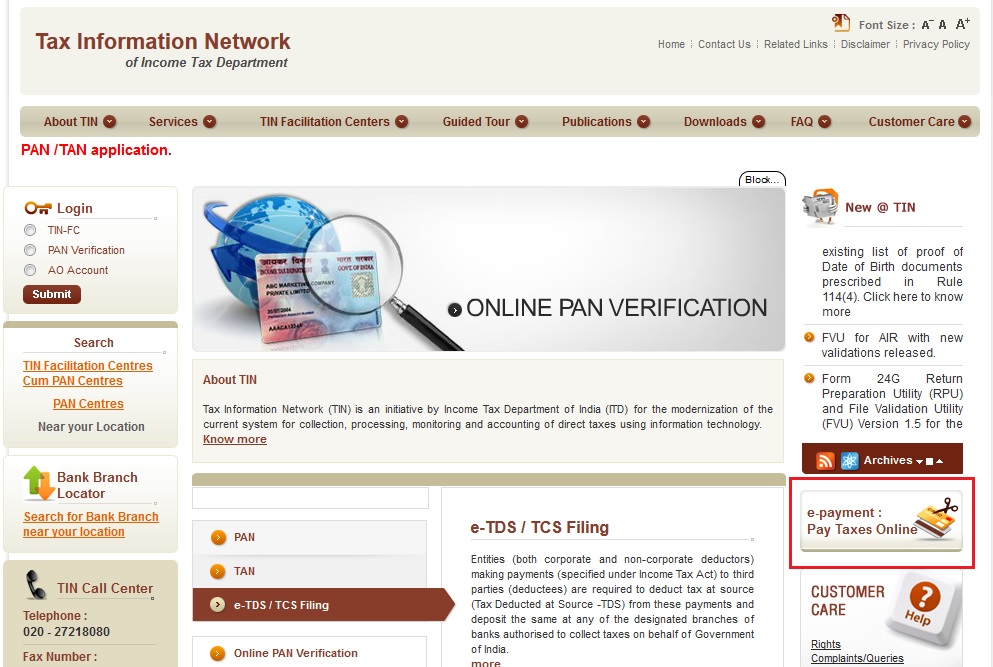

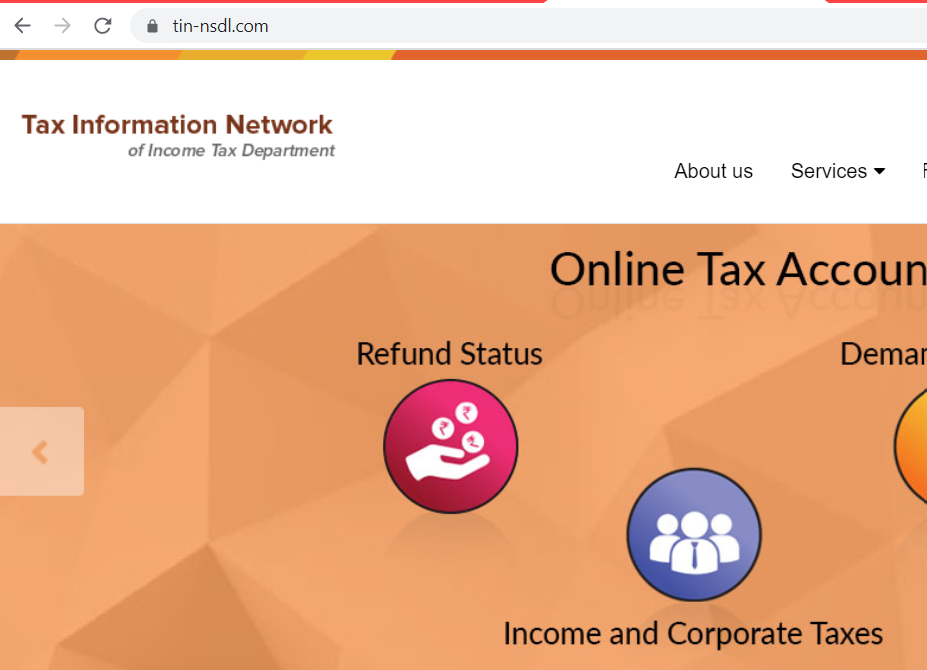

Choose your payment processor.

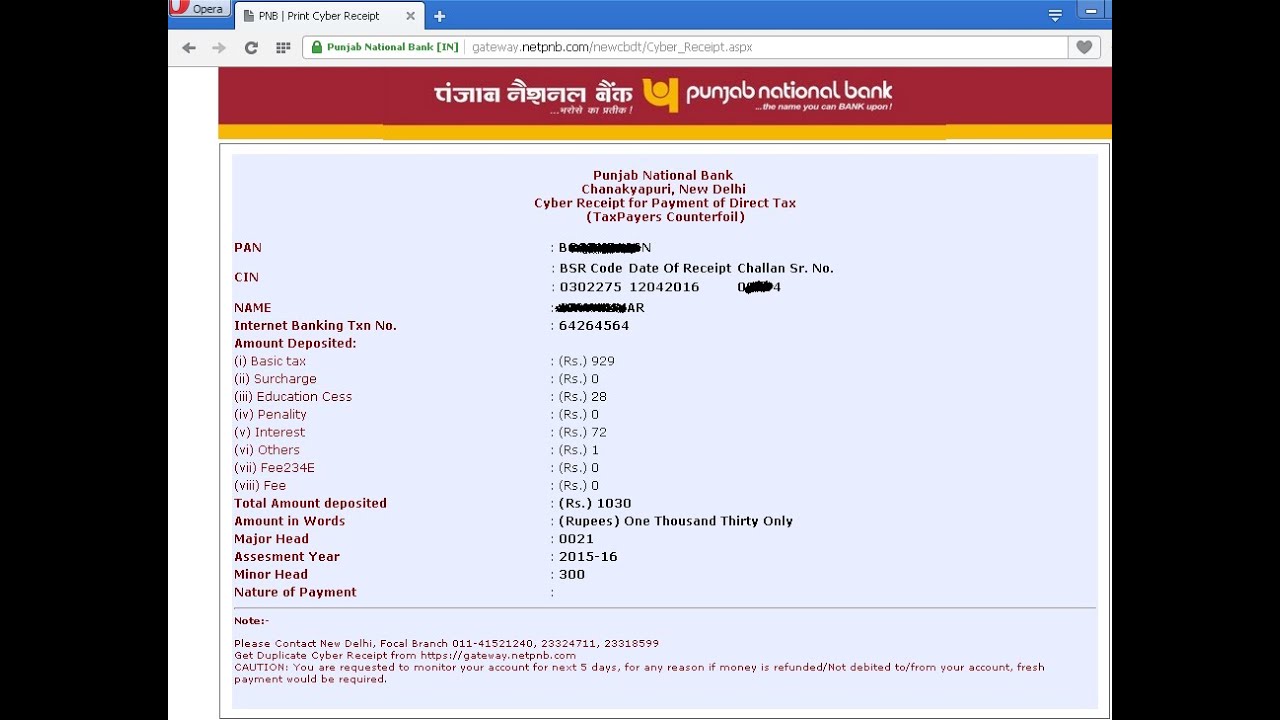

How to pay income tax online. Direct pay internal revenue service. Pay your balance as soon as possible the deadline to pay 2019 income taxes was july 15. Taxpayers receive instant confirmation once they ve made a payment. Pay your taxes by debit or credit card online by phone or with a mobile device.

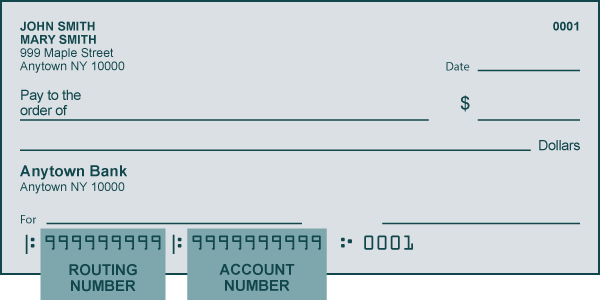

Pay your balance as soon as possible. Use direct pay to securely pay form 1040 series estimated or other individual taxes directly from your checking or savings account at no cost. Pay using your bank account when you e file your return. Visit irs gov paywithcash for instructions.

The deadline to pay 2019 income taxes was july 15. You can make a cash payment at a participating retail partner. Taxpayers can pay tax bills directly from a checking or savings account free with irs direct pay. Pay directly from a checking or savings account for free.

Pay your taxes by debit or credit card. Meet your tax obligation in monthly installments by applying for a payment plan including installment agreement find out if you qualify for an offer in compromise a way to settle your tax debt for less than the full amount. You can check your balance or view payment options. With direct pay taxpayers can schedule payments up to 30 days in advance.

Request that we temporarily delay collection until your.

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/19661272/Screen_Shot_2020_01_31_at_9.43.13_AM.png)