How Unit Trust Works In Malaysia

After several months it was fully subscribed by all the investors.

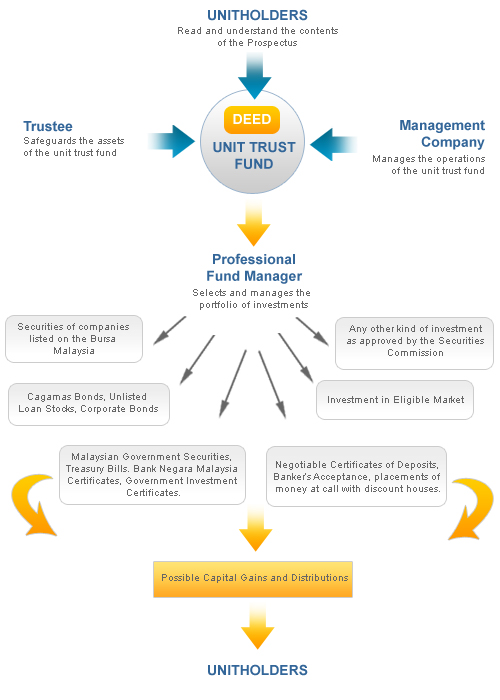

How unit trust works in malaysia. That in a nutshell is how a unit trust works. You are entrusting the job of investing to the fund manager and it is their full time job to try and grow your money as best as they can. Unit trusts can invest in a range of asset classes including stocks bonds and commodities. Unit trusts are managed by professional fund managers and have varying levels of risk and return.

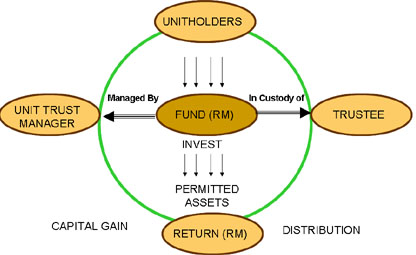

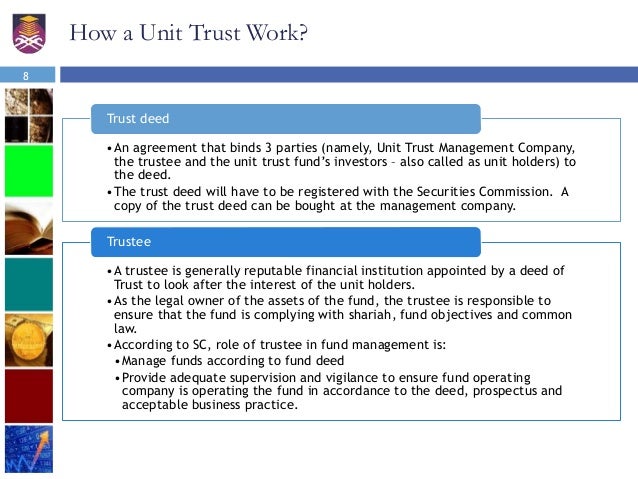

The manager of the funds plan to segregate the investment into 70 on stocks 15 on bonds and the remaining money of 15 to be invested in the money market. A unit trust company issued 300 million units at rm1 0 each. Unit trusts are not protected by perbadanan insurans deposit malaysia pidm. The mechanism of a unit trust fund a unit trust is a form of collective investment scheme regulated by the securities commission sc in malaysia.

An equity unit trust is the most common type of unit trust. Unit trusts pool the resources of investors into one large fund which is then divided into shares or units. How does a unit trust work. What are unit trusts.

Equity unit trust funds are popular in malaysia as they provide investors with exposure to the companies listed on bursa malaysia. The major portion of its assets are generally held in equities or securities of listed companies. A sum of money collected from people interested in investing is broken down into units.