Income Tax E Filing Website To Link Your Pan And Aadhaar

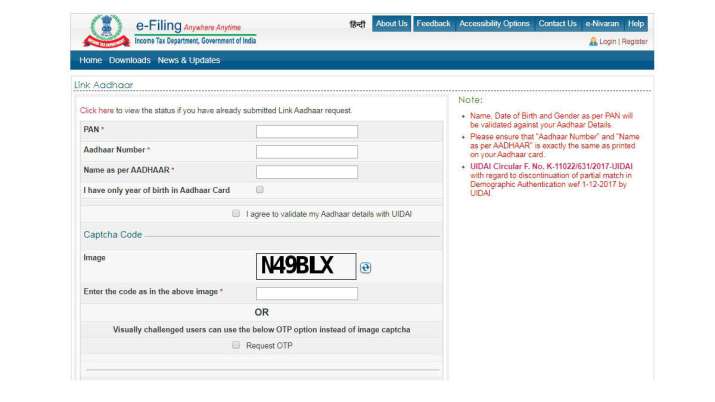

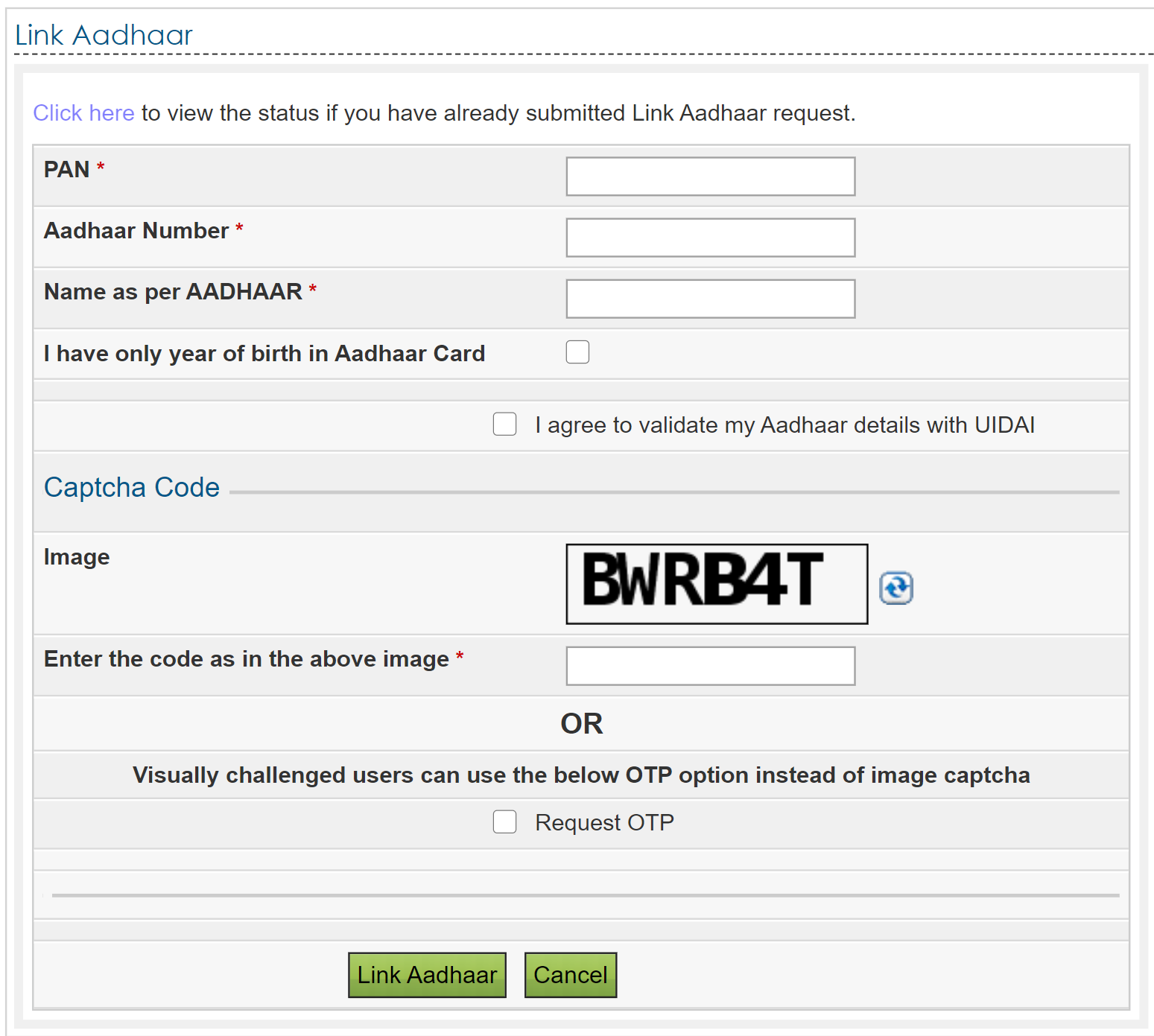

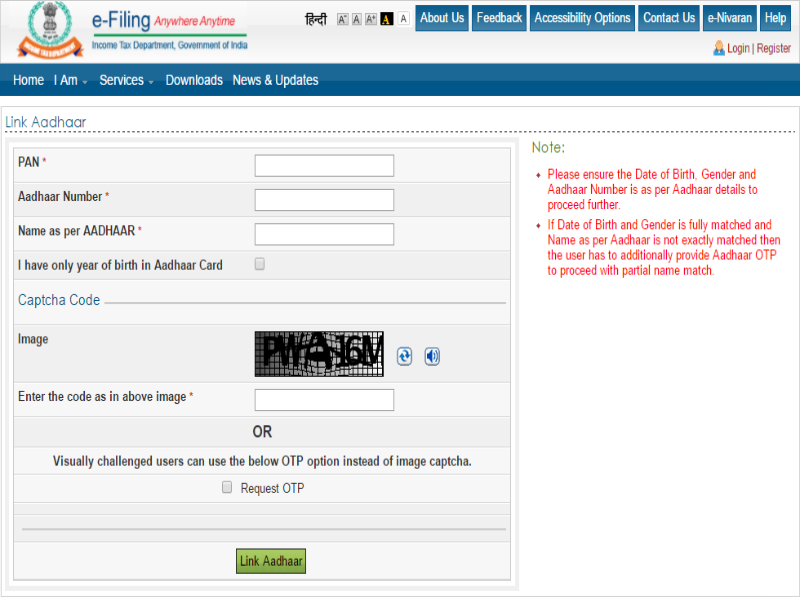

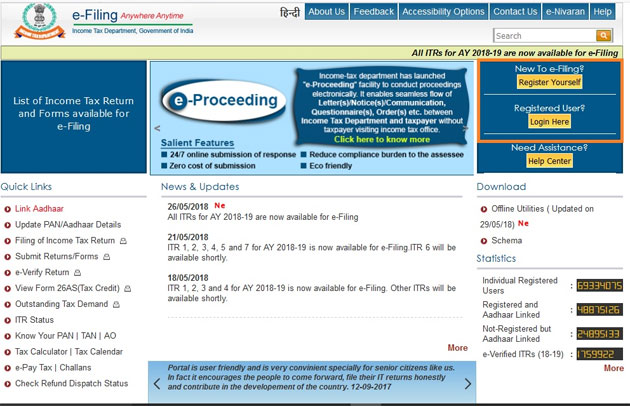

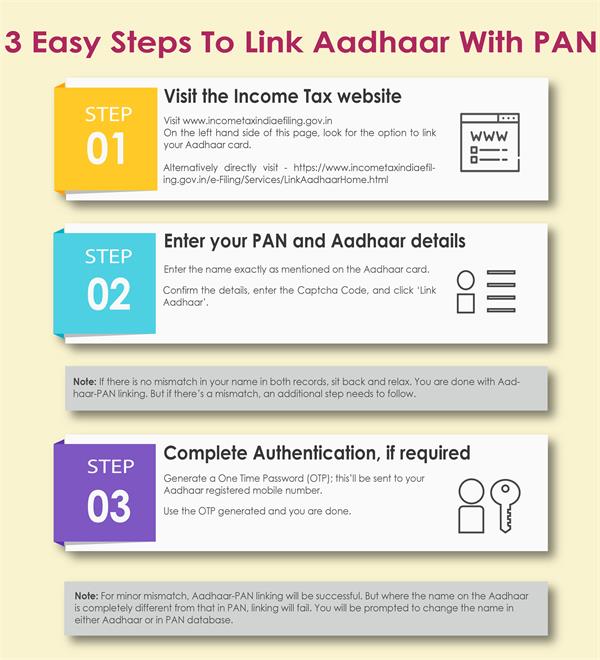

For the purpose of e filing income tax returns an individual has to follow the below steps to link aadhaar with pan.

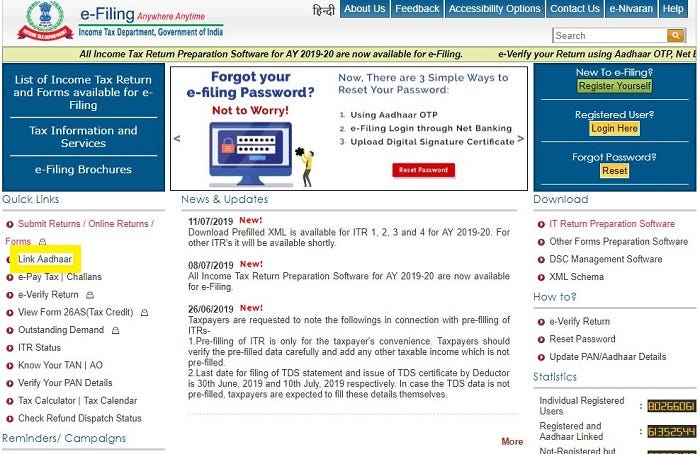

Income tax e filing website to link your pan and aadhaar. Adrlnk space your pan space your aadhaar space y note. Step 2 click on link aadhaar under the quick links section. In order to do this. In 2013 income tax department issued letters to 12 19 832 non filers who had done high value transactions.

Such links are provided only for the convenience of the client and e filing portal does not control or endorse such websites and is not responsible for their contents. You may be one of them. In 2014 income tax department has identified additional 22 09 464 non filers who have done high value transactions. Step 1 go to the income tax portal for e filing.

This is to inform that by clicking on the hyper link you will be leaving e filing portal and entering website operated by other parties. Tax payers will be filing the income tax return itr for the fy 2019 20 ay 2020 21. With income tax filing deadline nearing in some time you must make sure that your pan card is linked with your aadhaar card. If you are not registered with the e filing portal use the register.

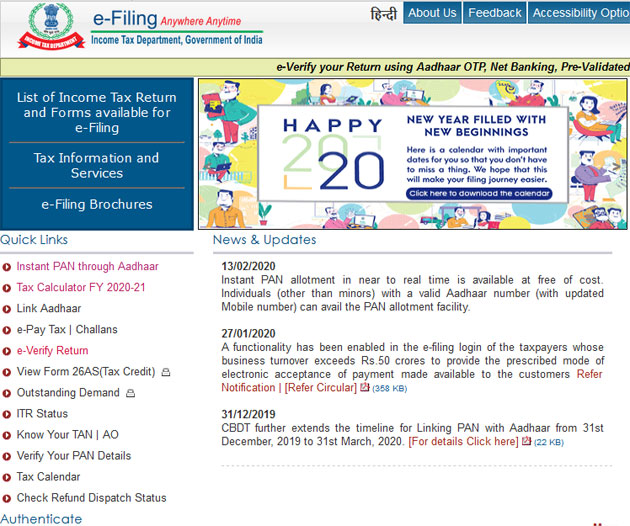

The notification issued by the central board of direct taxes cbdt dated march 31 2019 said that with effect from april 1 2019 it is mandatory to quote your aadhaar number while filing itr as required. Step 1 go to https incometaxindiaefiling gov in and select link aadhaar option under services. With the supreme court s verdict it is now mandatory to link aadhaar card with permanent account number pan card to file and process income tax returns itr to apply for a new pan card and to avail several subsidies from both the state and the central governments this stands the same in the cases of bank transactions of and above rs. Step 3 the individual will be directed to the link aadhaar page.

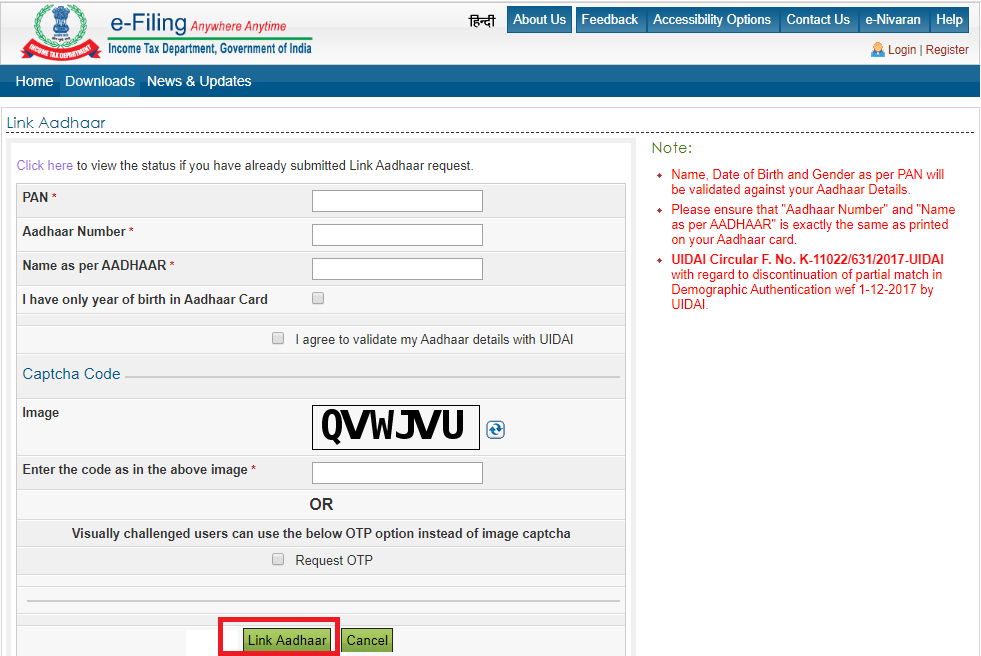

Click the login to e filing account button to pay any due tax intimated by the ao or cpc. Step 2 enter pan aadhaar number name as per aadhaar exactly as printed in your aadhaar card. Click the continue to nsdl website button to pay advance tax or self assessment tax. The system will direct you to the tax information network website maintained by nsdl for the payment of taxes.

This is the easiest way for linking your aadhaar card with pan card. Continue to nsdl website. Without logging in income tax e filling portal. If you have already linked your pan with aadhaar click here to check its status.

Click here to know four ways to link your pan with aadhaar. The government has made quoting of aadhaar mandatory for filing income tax returns itrs as well as obtaining a new pan. An aadhaar card number can be linked with a pan card number online through the income tax department s e filing portal incometaxindiaefiling gov in according to the taxman.