How To Get A Small Business Startup Loan Malaysia

Banks require a sound business plan and must be persuaded by the viability of your business before they come to an agreement to lend you money.

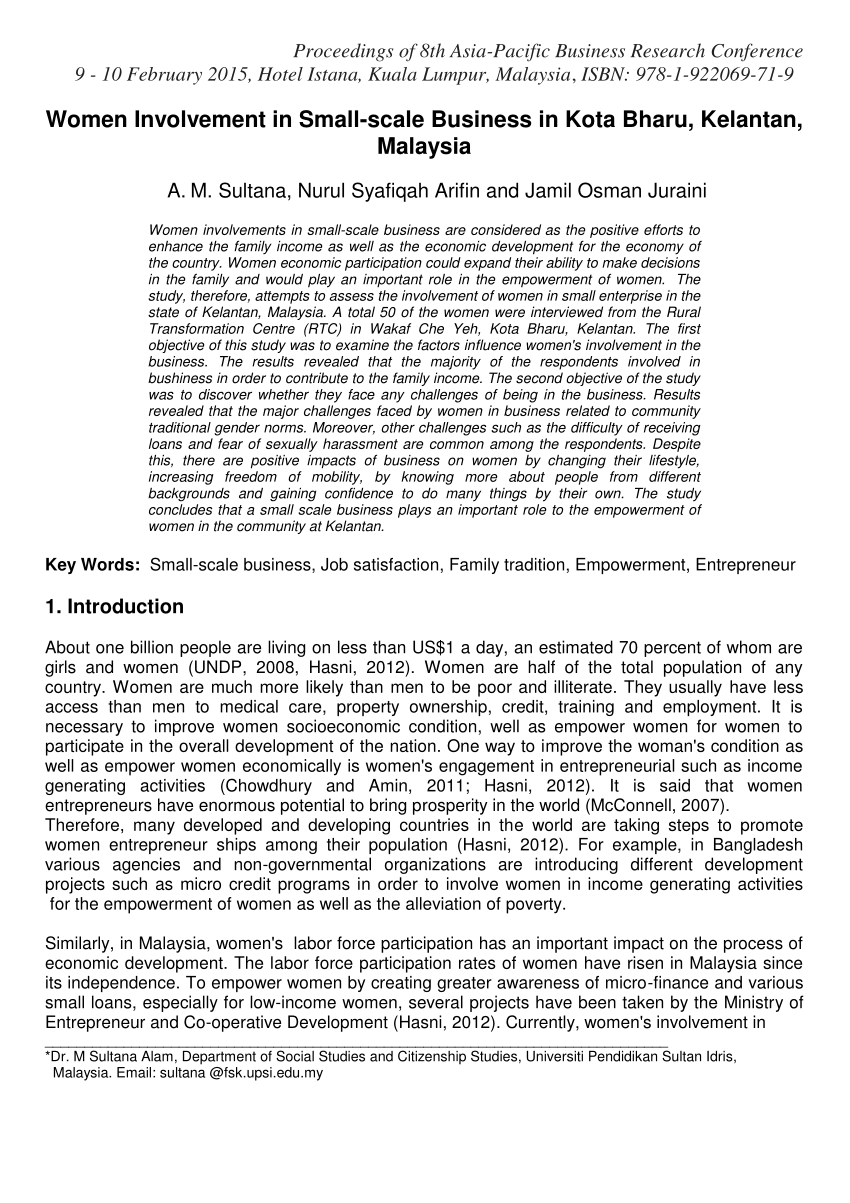

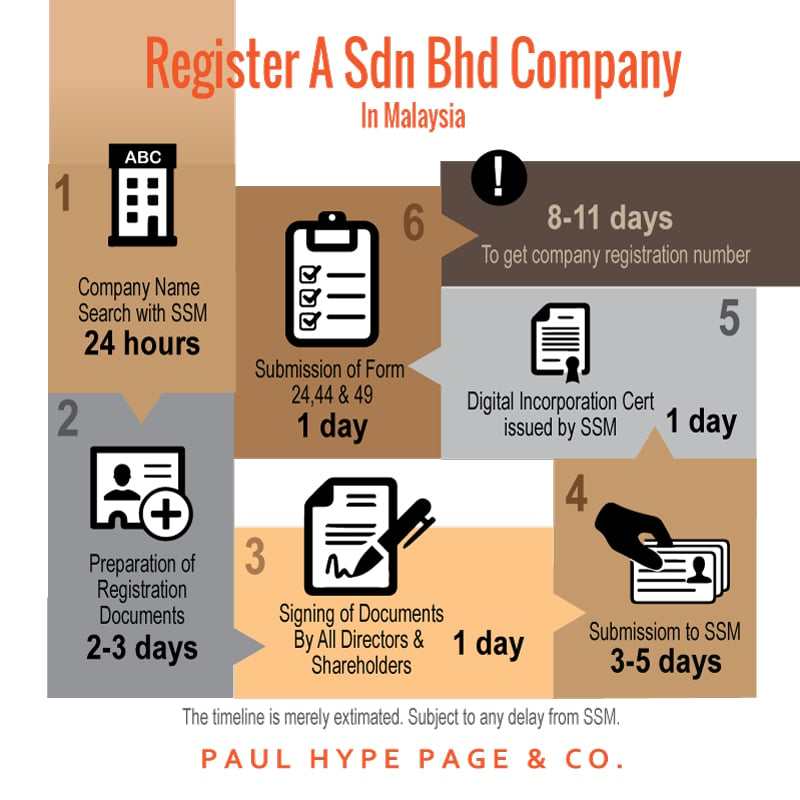

How to get a small business startup loan malaysia. Bank loans banks lend money to existing businesses but there may be some difficulties for a start up. Although not all startup grants have the same application method you would usually have to go through the individual government organisations that provide those grants you are looking for. Now that a business wants to approach and apply for bank loans for startup business malaysia they need concrete business plan. Short of capital to start a small business.

As a startup you may find borrowing opportunities at the sme bank a subsidiary of bank pembangunan malaysia berhard. How to get a small business startup loan malaysia small business loan with bad credit report. What is the general method for applying for startup grants in malaysia. While most banks offer small business loans they grant these based on your credit.

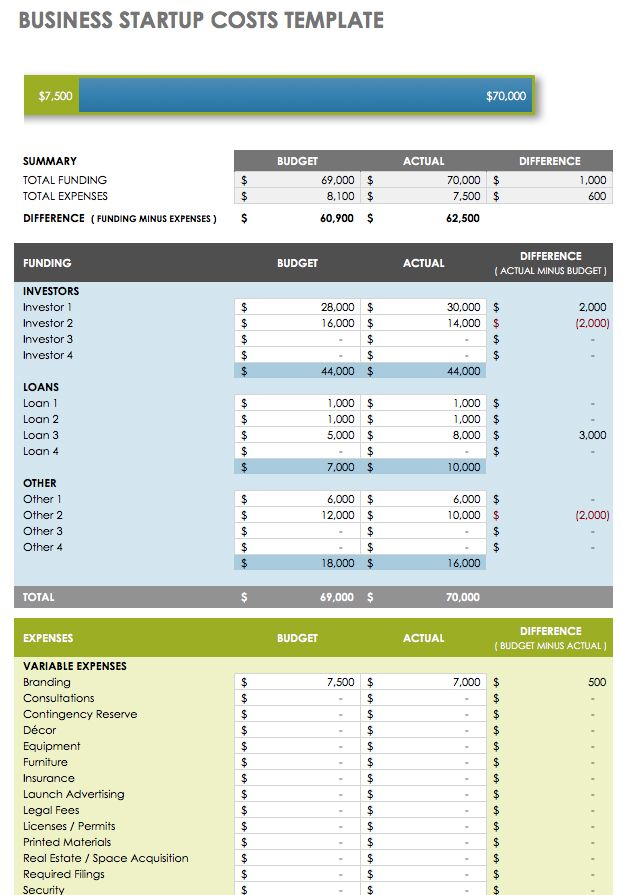

Business credit cards can be a great alternative to a small business startup loan and can help you get off on the right foot separating business and personal finances and establishing business credit. Monthly repayment rm 8891 67. The sme bank makes loans to innovative small and medium size enterprises in all phases of growth with the sme start up programme designed for new businesses that are ready to launch their products and services including those with insufficient collateral or history to qualify for standard bank loans. Read more apply now.

Start up loan sme loan short term loans invoice factoring and term loans. Interest rate 6 7 p a. In need of cash for business expansion. This is due to banks do not have any track record for start up businesses.

The startup ceo founder would have to give them a call before visiting them to ask for requirements. Borrowing rm 100000 over 1 years. These business owners might have financial concerns or they may simply need some additional capital so they start asking for. Apply business loan to fund for your working capital and get your money within 5 working days through fast and simple rhb sme financing online.

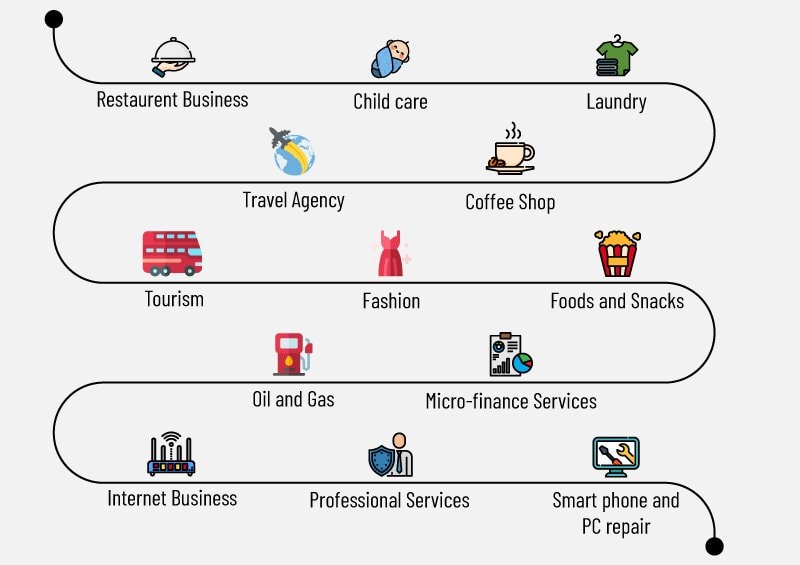

Think about what kind of business you want it to be will it be a corporation a sole proprietorship a non profit or a partnership venture. To qualify you for a business credit card issuers will generally look at your personal credit scores and combined income personal and business. The several types of loans to choose from include. The financial institution will assess their plan judge its potential and return on investment before extending the loan to borrower.

With the boost in business chances numerous small companies have actually likewise opened their doors to loan providers. Determine which lending institution is best suited to provide you with finance when looking for business finance it is advisable to have several options you can choose from.

/signing-agreement-1086308604-429c7b4130bb4c9a8bcb3408aeb8c44a.jpg)

:max_bytes(150000):strip_icc()/credit-report-form-on-a-desk-with-other-paperwork--643148934-38a18d28bed64f329e2f80c890e8dd11.jpg)