Interest Rate For Car Loans With Bad Credit

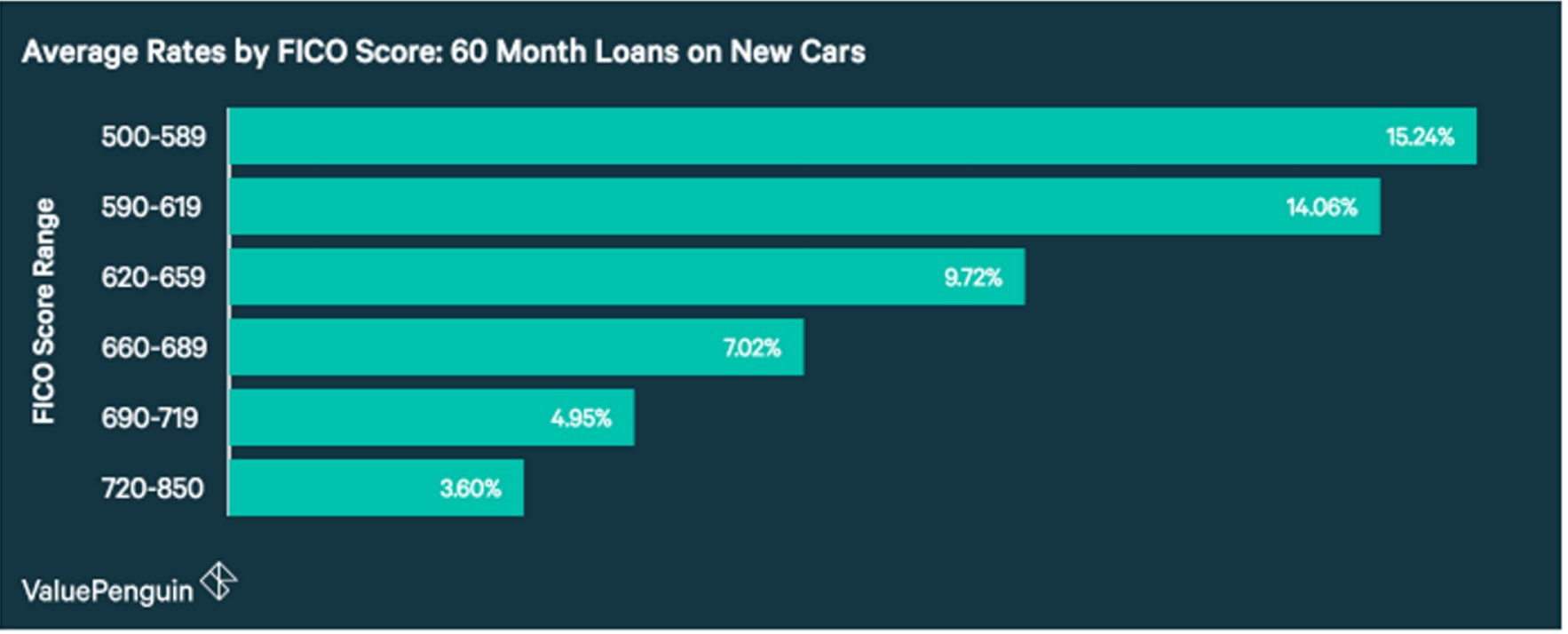

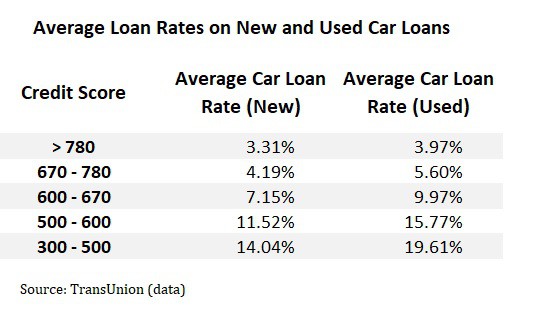

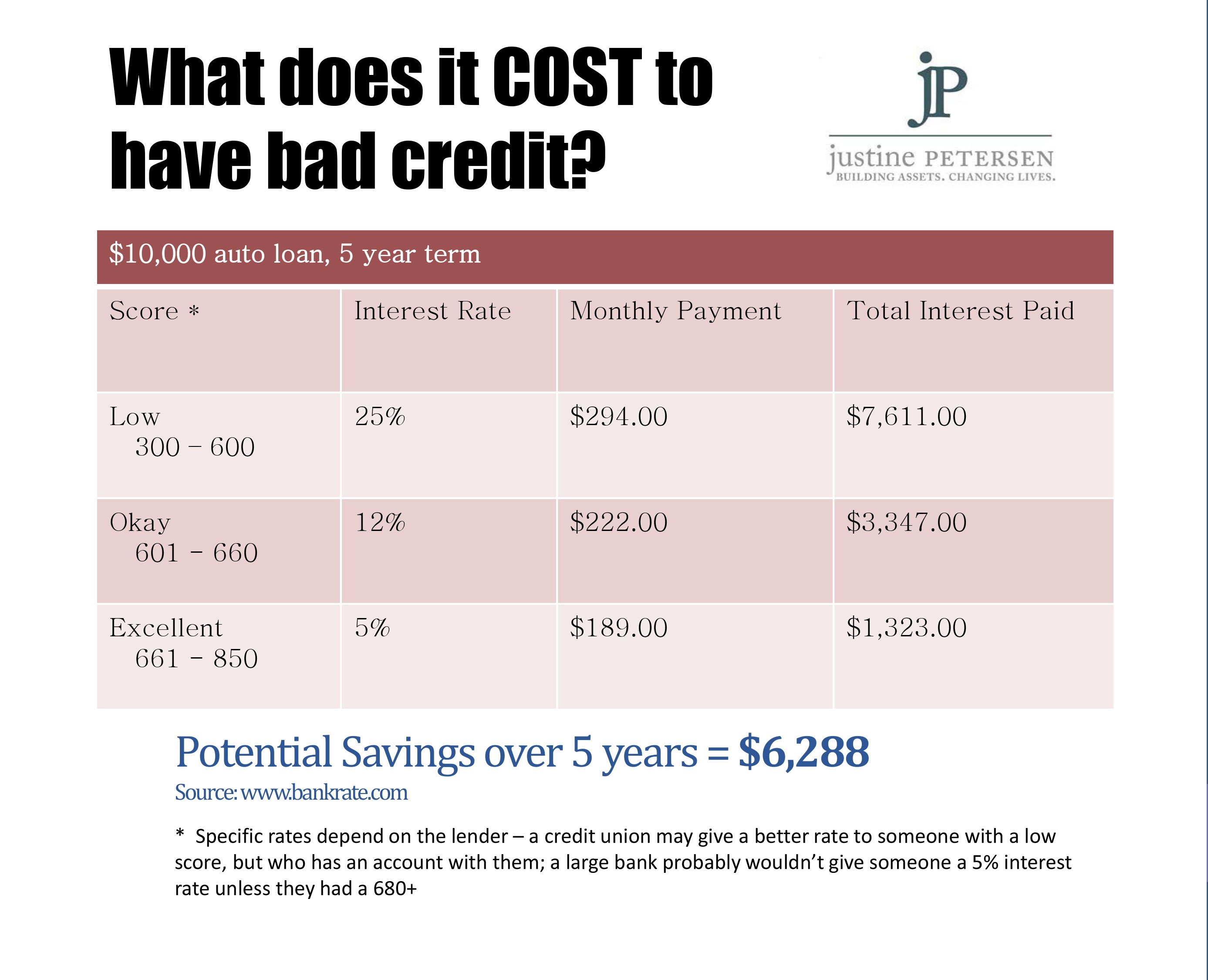

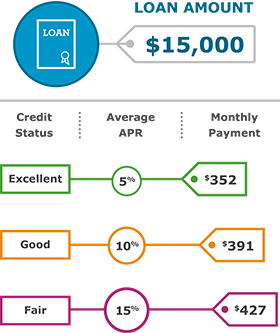

Generally speaking the higher your credit score is the lower the interest rate you can qualify for.

Interest rate for car loans with bad credit. Moreover some subprime auto loans can charge as much as 15 apr or even higher which could mean paying nearly 2 500 over the cost of your vehicle just in interest fees. The opposite goes for borrowers with lower credit scores. If you are able to boost your credit score before applying for a loan you could save thousands of dollars in interest over the life of the loan. Best low interest rate auto loans for bad credit 1.

The average interest rate for a car loan is higher if you have bad credit than if you have a good credit score. Aprs vary by lender but start at 5 99 and go up to 35 99. Though not specifically a lender bad credit loans is a company that connects you with a network of lenders based on your needs and creditworthiness. You can borrow as little as 500 or up to a maximum of 5 000 with terms ranging from 3 to 36 months.

This is because lenders charge higher interest rates to borrowers with poor credit. A credit score isn t the only factor that influences your interest. Before financing a vehicle you should look up the average interest rates you can expect based on your credit score. The interest rate for someone with bad credit varies from 6 5 all the way up to 12 9 or more on average.

Car loan interest rates are primarily based on your credit score.

/pros-and-cons-of-refinancing-a-car-loan-1a117a027ee14bd583fd1abdef935b9d.gif)