How To File Income Tax Malaysia

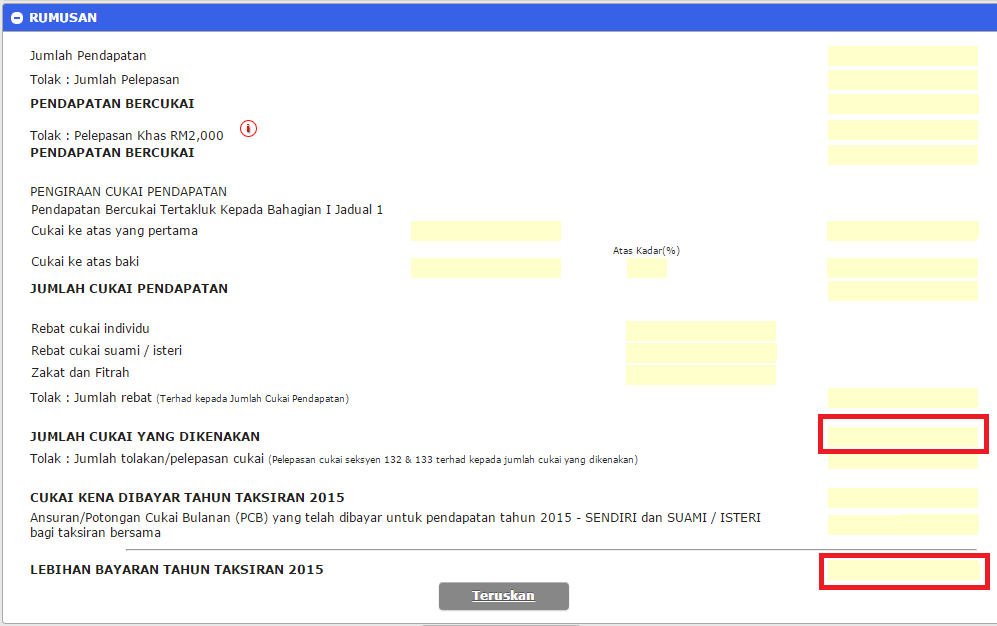

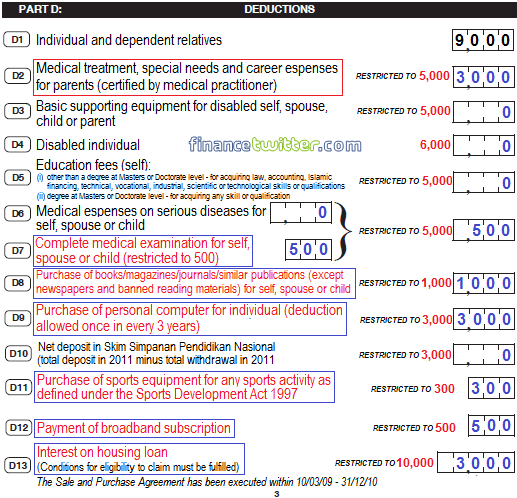

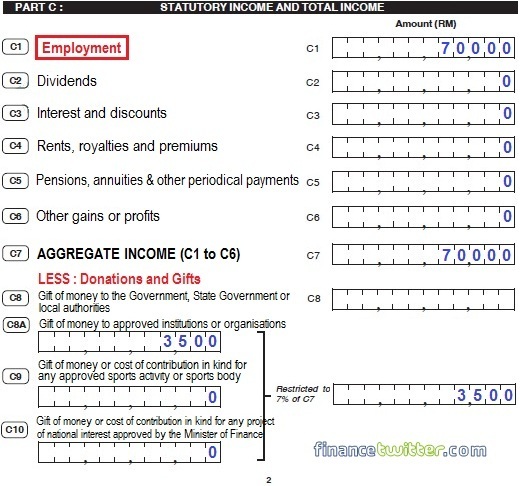

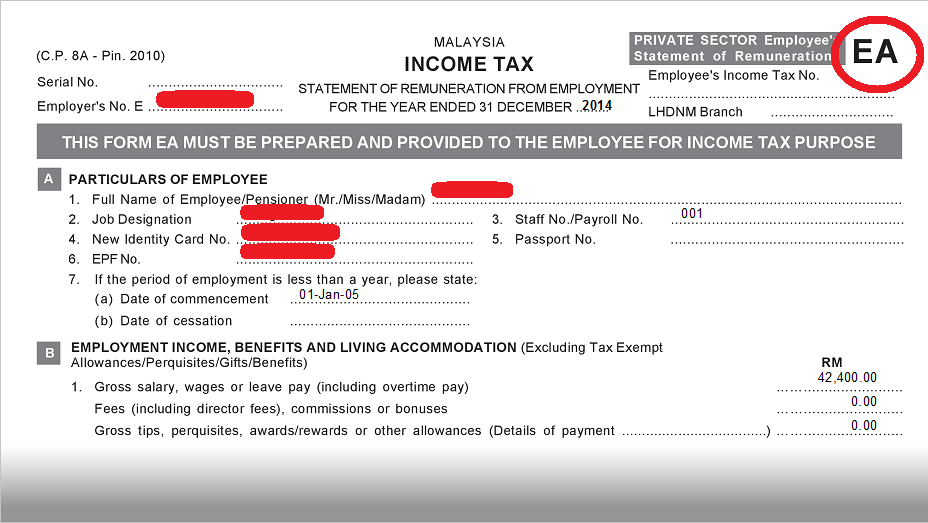

After paying your income taxes monthly for a full year starting on the first day of january and ending on the last day of december of the same year you will need to prepare to file your taxes basically to report to the lhdn that you have paid your taxes for that year and to submit receipts that you can claim for tax relief or tax exemption if applicable.

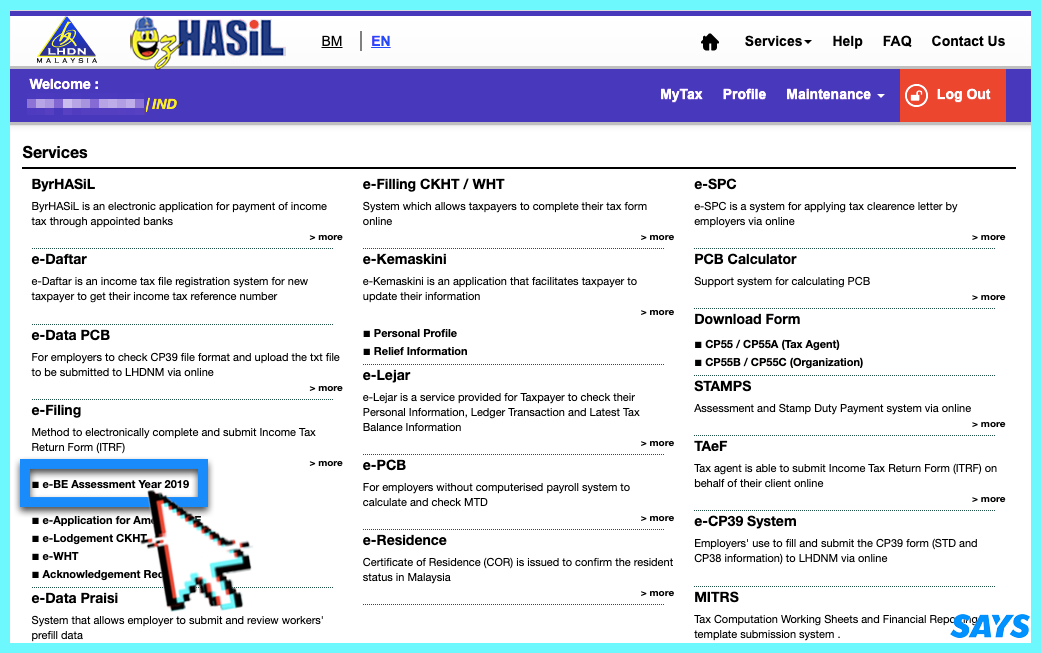

How to file income tax malaysia. Who needs to pay income tax. Register at the nearest irbm inland revenue board of. Go to e filing website. When you arrive at irb s official website look for ezhasil and click on it.

For the be form resident individuals who do not carry on business the deadline for filing income tax in malaysia is 30 april 2020 for manual filing and 15 may 2020 via e filing. Go to e filing website. How to file income tax in malaysia using e filing 1. Individual who has business income.

Employee who is subject to monthly tax deduction mtd. Income tax deadline extended until 30 june 2020 in lieu with the movement control order period from 18 to 31 march 2020 due to covid 19 pandemic irb has extended the income tax deadline for this year. In malaysia income tax is compulsory by law and the income tax you pay differ based on your total taxable income for the year. Existing e filing users proceed to next step.

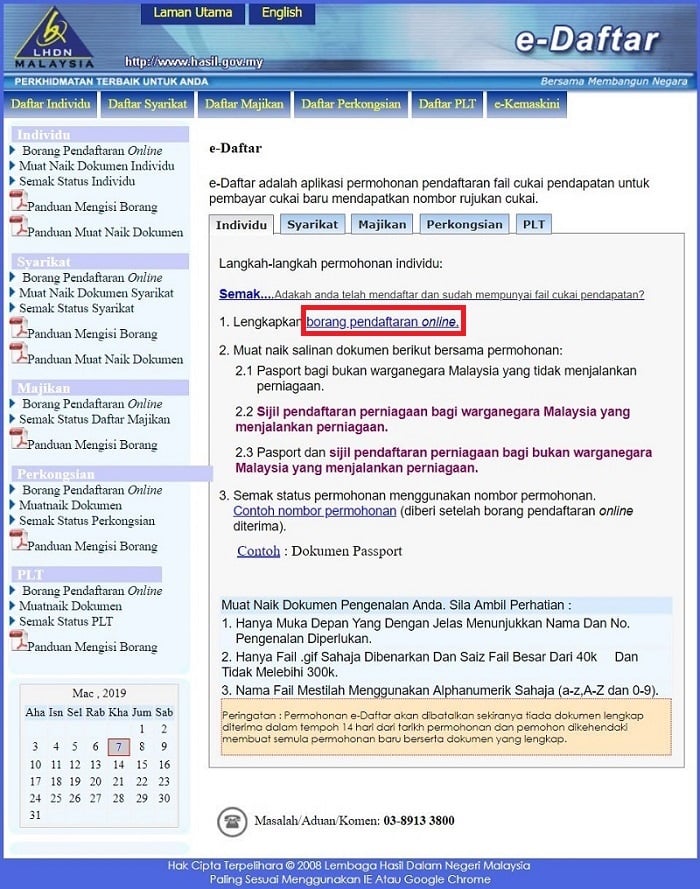

Login to e filing. If you have never. An application via internet for the registration of income tax file for individuals companies employer partnership and limited liability partnership llp. Malaysia income tax e filing guide 1.

Register at the nearest. Who are required to register income tax file. Individual who has income which is liable to tax. The deadline for filing your income tax returns form in malaysia varies according to what type of form you are filing.

Next key in your mykad identification number without the dashes and your password. Login to e filing website. Once you have gotten your pin here are the steps on how to file income tax in malaysia. A first timer s easy guide to filing taxes 2019 register at lhdn if you are newly taxable you must register an income tax reference number.

Yes you can still file your income tax manually in malaysia. If you ve just entered the workforce and have absolutely no idea how all this works here s a handy guide on how to file your taxes for the first time. Any individual earning more than rm34 000 per annum or roughly rm2 833 33 per month after epf deductions has to register a tax file.