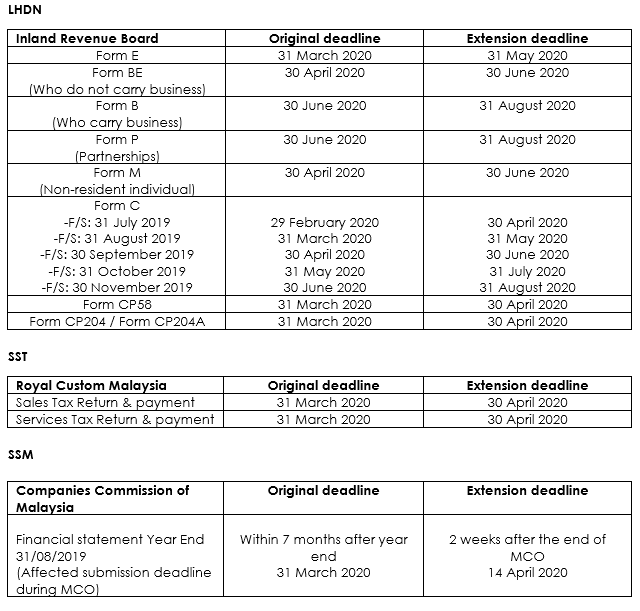

Income Tax Due Date 2020 Malaysia

Extension of two months for filing malaysia income tax 2020.

Income tax due date 2020 malaysia. Individuals partnerships form be resident individuals who do not carry on business ya 2019 30 april 2020 30 june 2020 form b resident individuals who carry on business. The extended deadline is oct. Employers form e employers ya 2019 31 march 2020 31 may 2020 b. C corporation income tax returns irs form 1120.

Tax returns are due april 15 most years but 2020 has hardly been a normal year. The due date for submission of the reit s rf form tr for year of assessment 2020 is 31 december 2020. Taxpayers who have problems with income tax issues especially on filling and submitting bncp forms can call the hasil care line at 03 8911 1000 or 603 8911 1100. The inland revenue board irb has announced an extension of two months from the regular deadline for income tax filings amid the movement restriction order imposed by the government.

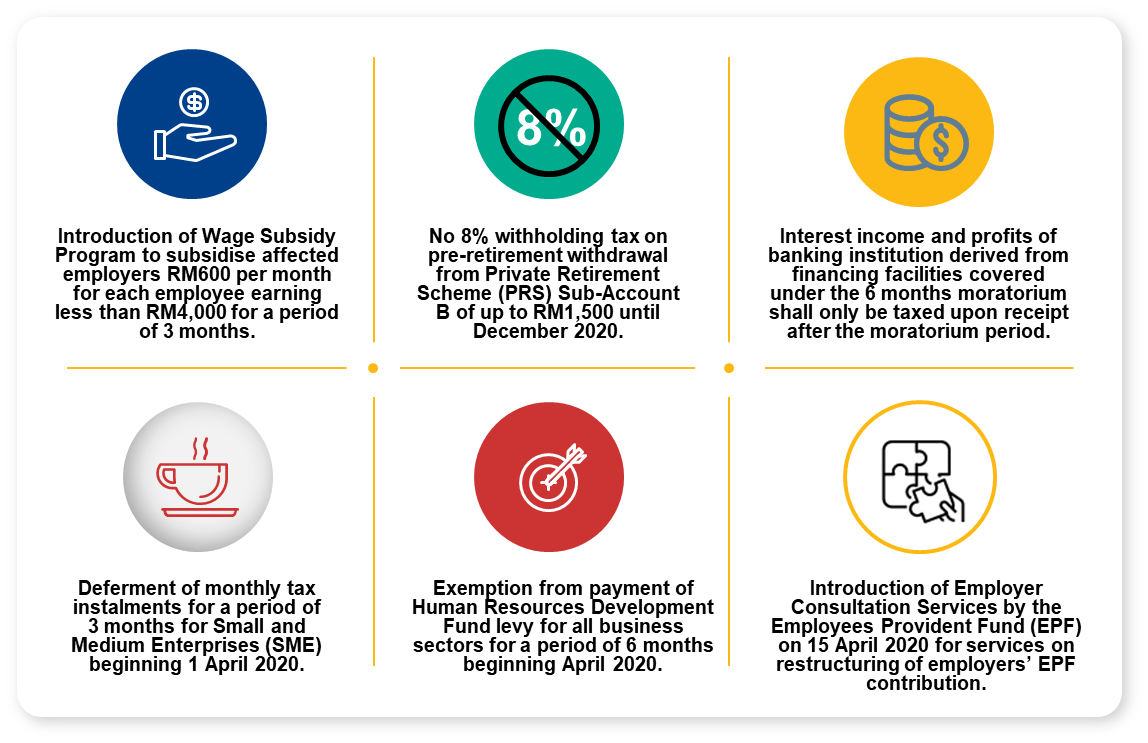

These are due july 15 2020 for c corporations that operate on a calendar year. March 17 2020 11 47 pm. Meanwhile for the b form resident individuals who carry on business the deadline is 15 july for e filing and 30 june for manual filing. The government has announced an extension of two months for filing income tax from the original deadline in consideration of the movement restriction order mro that has been enforced during the covid 19 pandemic.

The malaysian inland revenue board mirb has set out a new timetable for certain personal tax filing and employer compliance obligations including due date extensions in light of the covid 19 crisis. March 18 2020 11 52 am 08. According to lembaga hasil dalam negeri lhdn the move is meant to facilitate the submission of tax returns affected by the national movement control order which starts today. A a.

The irs moved the big april 15 tax filing deadline to july 15 but that will be here before you know it. Thus the new deadline for filing your income tax returns in malaysia via e filing is 30 june 2020 for resident individuals who do not carry on a business and 30 august 2020 for resident individuals who carry on a business. Grace period is given until 6 january 2021. The new deadline for filing income tax returns in malaysia is now 30 june 2020 for resident individuals who do not carry.

For 2020 it s july 15. For the be form resident individuals who do not carry on business the deadline for filing income tax in malaysia is 30 april 2020 for manual filing and 15 may 2020 via e filing. Also the mirb has closed all its office premises until 14 april 2020 but is providing some limited services. Requesting a federal income tax return extension automatically extends this date as well until oct.

Form type taxpayer year of assessment deadline extended deadline by e filing a. The deadline for filing income tax return forms in malaysia has been extended by two months.