Islamic Finance Industry In Malaysia

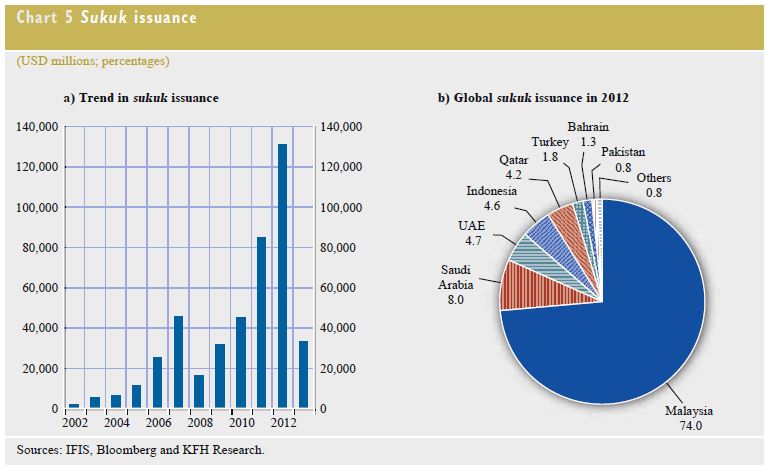

The study proclaimed asia as the largest market for both sukuk and islamic funds.

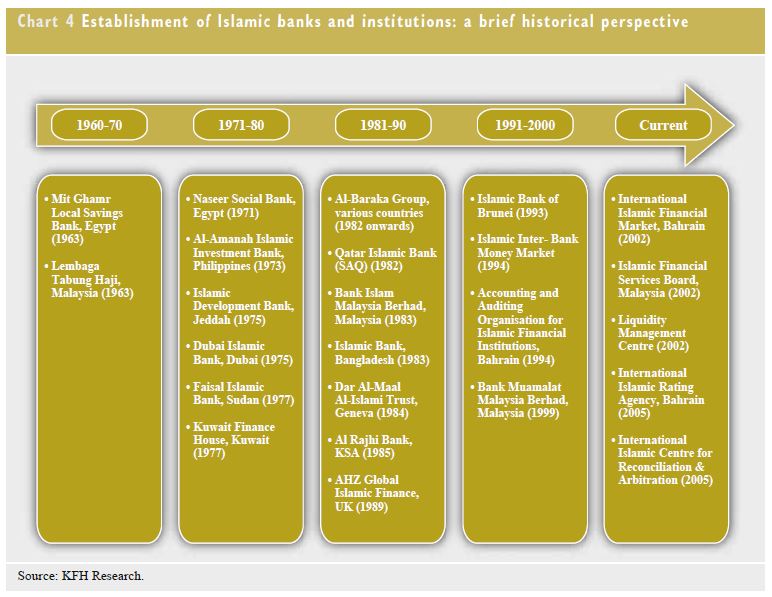

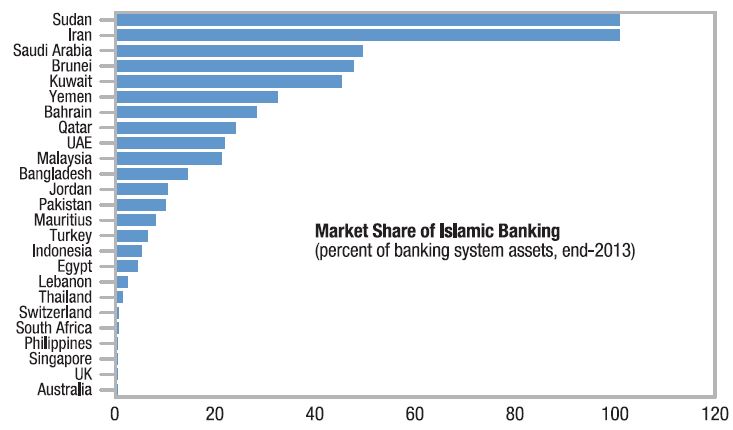

Islamic finance industry in malaysia. The country is the third largest market for global islamic finance products and the world s largest sukuk issuer. Malaysia s islamic finance marketplace with its international business environment is open to the world capitalise on malaysia s expertise innovation and deal flow in islamic finance. Iifm awareness seminar on islamic finance monday 2nd december 2019 gulf convention centre the gulf hotel manama kingdom of bahrain. Fewer still know that the malaysia singapore indonesia corridor is a breeding ground for innovation in the industry.

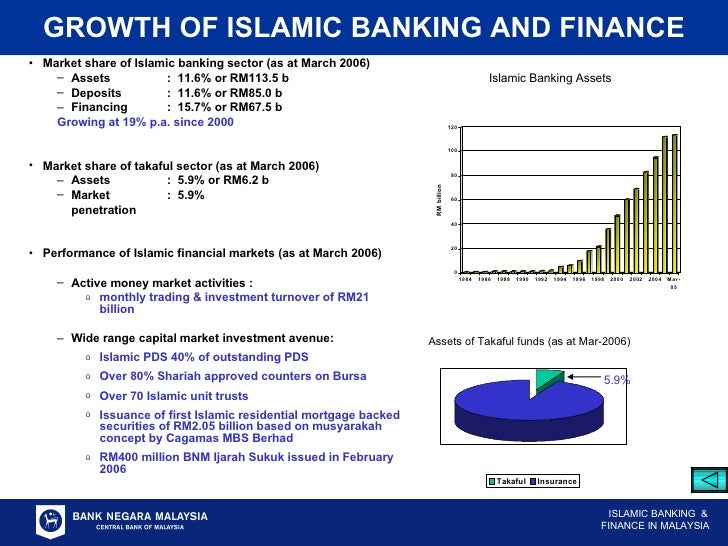

But when it comes to the tech side of islamic fintech the picture is not quite so clear cut. According to ram ratings malaysia was the top sukuk issuer with us 13 9 bil ringgit equivalent or 35 1 of the us 39 5 bil ringgit equivalent sukuk issued. Malaysia was named a leader in islamic finance producing 26 of the world s shariah compliant financial assets by the end of 2017 amounting to us 528 7 billion rm2 05 trillion. Follow all updates and access malaysia specific islamic finance information and data here.

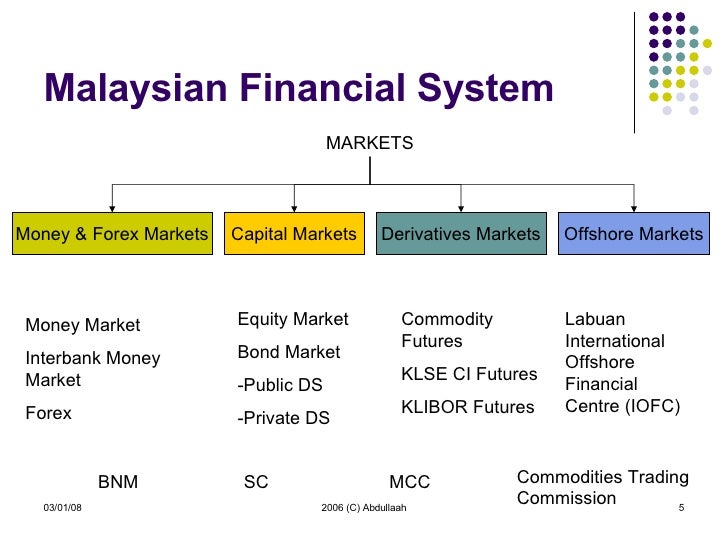

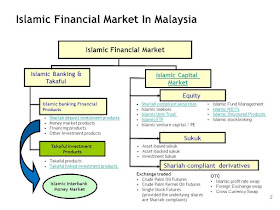

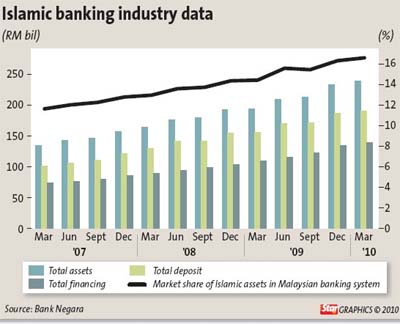

With the introduction of value based intermediation vbi by bank negara malaysia bnm in 2017 the association of islamic banking and financial institutions malaysia aibim is confident the central bank s target for the local islamic banking industry to have 40 market share in total banking assets by 2020 is achievable. Few non muslims even know about the islamic financial industry. The islamic finance industry in malaysia is characterised by having comprehensive market components ranging from islamic banking takaful islamic money market and islamic capital market. Kuala lumpur sept 25.

Industry opportunities in islamic finance in malaysia thursday 3rd october 2019 universiti malaysia sabah labuan campus. Islamic finance is set to keep expanding in 2020 and beyond as the gulf cooperation council gcc countries and malaysia help drive growth in shariah compliant financial products though the coronavirus outbreak may disrupt sukuk issuance moody s investors service said in a report. Malaysia is the leading international centre for islamic finance.