Is Dividend Income Taxable In Malaysia

Dividend yield annual dividend current stock price x 100.

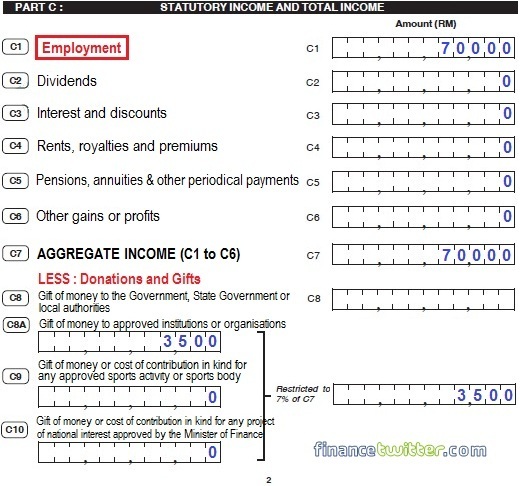

Is dividend income taxable in malaysia. Under section 61a 1 of the income tax act these two types of companies do not pay tax as long as they pay out 90 of their profits for the year as dividends to their shareholders and those shareholders in turn don t have to declare this income for tax purposes. It is not taxable in malaysia except for gains derived from the disposal of real property or on the sale shares in a real property company. On the other hand if the tax payer is in the tax bracket of 27 the tax payer is require to pay 2 additional tax on the gross dividend received. If the tax payer is in the lower tax bracket e g 19 then the tax payer is entitle for a refund of 6.

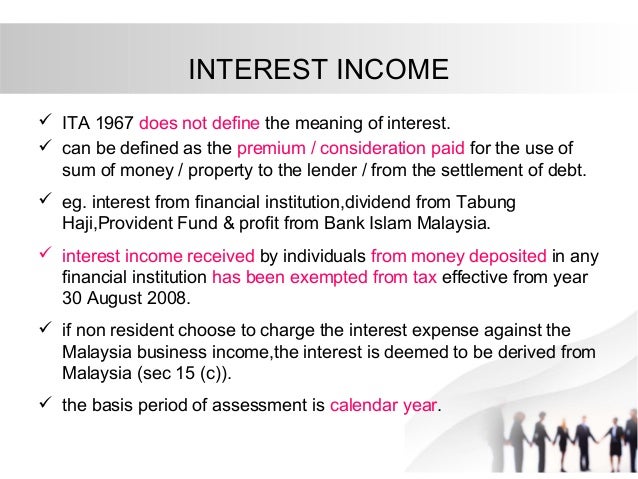

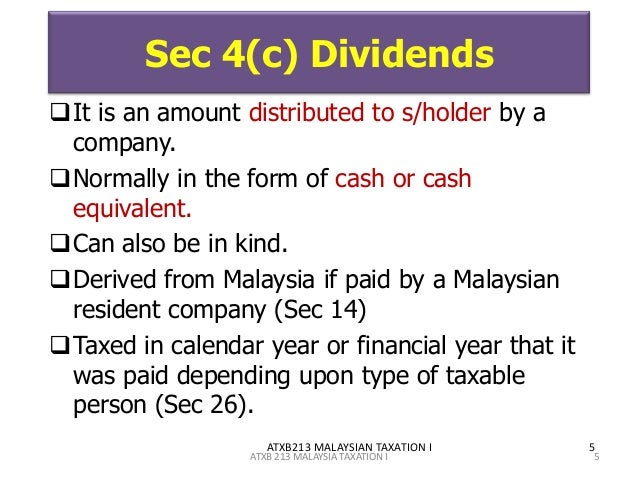

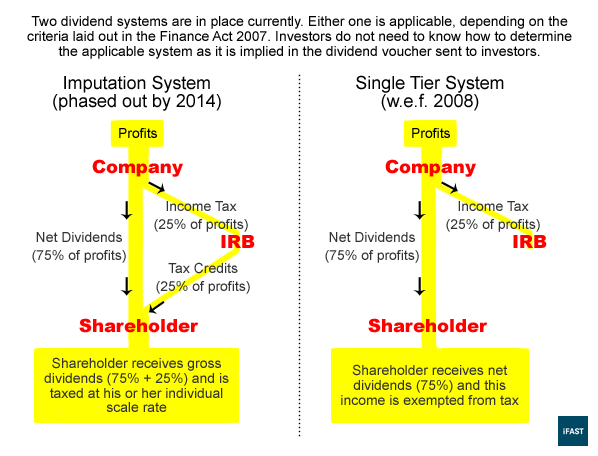

Companies are not required to deduct tax from dividends paid to shareholders and no tax credits will be available for offset against the recipient s tax liability. The chargeability of income is governed by section 3 of the income tax act 1967 ita which states that income shall be charged for tax for each year of assessment ya upon the income of any person accruing in or derived from malaysia or received in malaysia from outside malaysia. 1 3 tax payer is require to declare gross dividend income 100 in the income tax return. However when it is frequent enough inland revenue board irb will treat it as an active income and do require income tax liability.

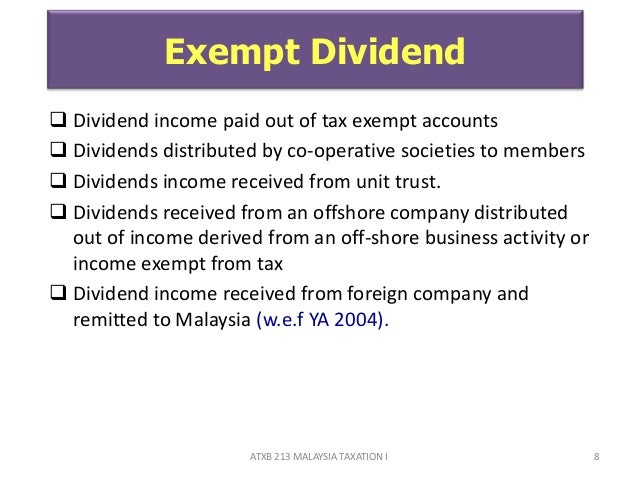

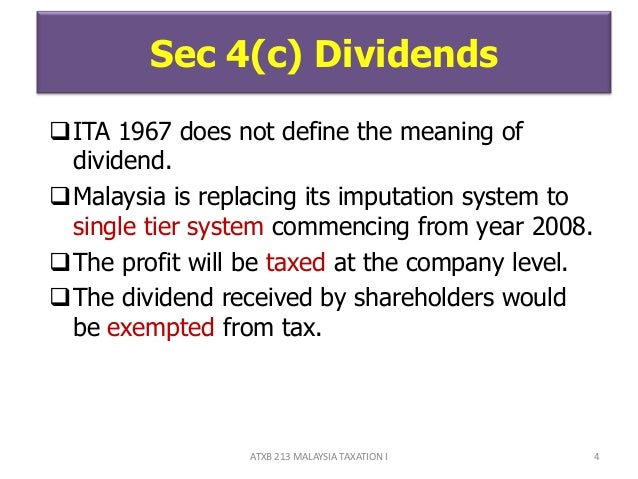

In other words except from the above four type of business all other types of business can enjoy the tax exemption from dividend received from foreign source. The tax exemption is based on the principle that the income is not derived in malaysia. The definition of employment income covers all forms of remuneration including benefits whether in cash or in kind received by an individual for exercising or having an employment in malaysia 14 therefore an employee s income with respect to their employment in malaysia will be subject to malaysian tax regardless of whether it is paid in. Dividend income malaysia is under the single tier tax system.

The taxation of dividends in malaysia is subject to a single tier system and those dividend payments made by companies under this system are not subject to tax. Dividends are exempt in the hands of shareholders. According to this regime the corporate income tax imposed on a company s profits is in the form of a final tax and the distributed dividends are exempt from tax in the hands of the shareholders. Tax benefits are sometimes used encourage certain government objectives.

Companies are not required to deduct tax from dividends paid to shareholders and no tax credits will be available for offset against the recipient s tax liability.

.png)