Is Allowance Taxable In Malaysia

Tax exemption are items which are completely removed from your taxable income unlike tax reliefs which are deductions upon your taxable income.

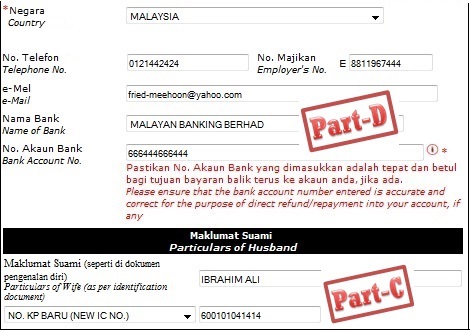

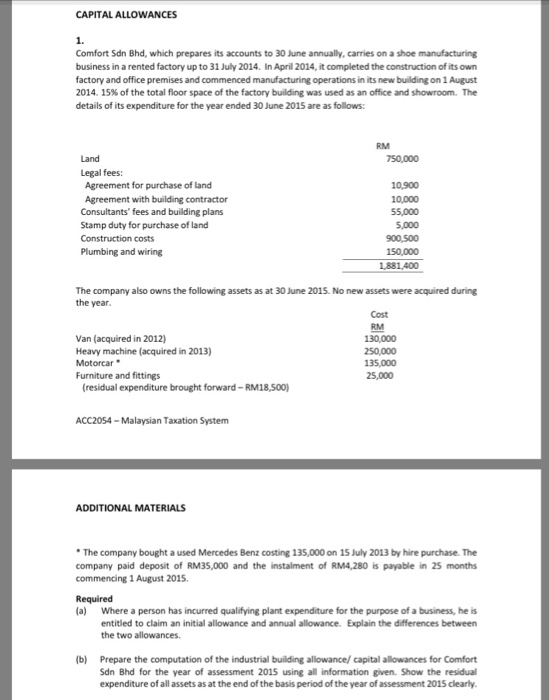

Is allowance taxable in malaysia. Income remitted from outside malaysia. The exemption is limited to rm2 000 per month for each residential home rented out and the residential home must be rented under a legal tenancy agreement. Box 10192 50706 kuala lumpur malaysia tel. For income tax filed in malaysia we are entitled to certain tax exemptions that can reduce our overall chargeable income.

Fortunately taxpayers in malaysia are not taxed on our total income as certain portions of our income are tax exempted. Individual taxes on personal income. In malaysia employees are allowed to claim tax exemptions for the benefits perquisites below unless the employee has shareholding or voting power in the company. Tax exemptions either reduce or entirely eliminate your obligation to pay tax.

Tax exemptions are a personal allowance or specific monetary exemption which may be claimed by an individual to reduce taxable income. Here are the 14 tax exempt allowances gifts benefits perquisites. You are required to pay taxes for your income arising from any rent received but there is a 50 tax exemption in this category for malaysian resident individuals. For example perquisites which cover things like parking medical and transport allowances and benefits in kind such as cars personal drivers accommodation and so on are taxable under law but the government has provided some tax exemptions for them.

03 21731288 this publication is a quick reference guide outlining malaysian tax information which is based on taxation laws and current practice.

.jpg)