Investment Linked Insurance Malaysia

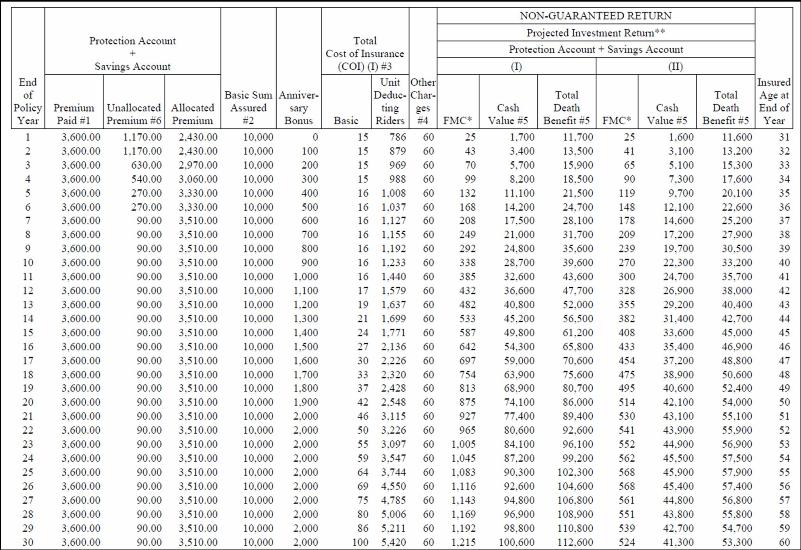

Flexible payment tenures of 5 10 15 or 20 years or until you reach age 100.

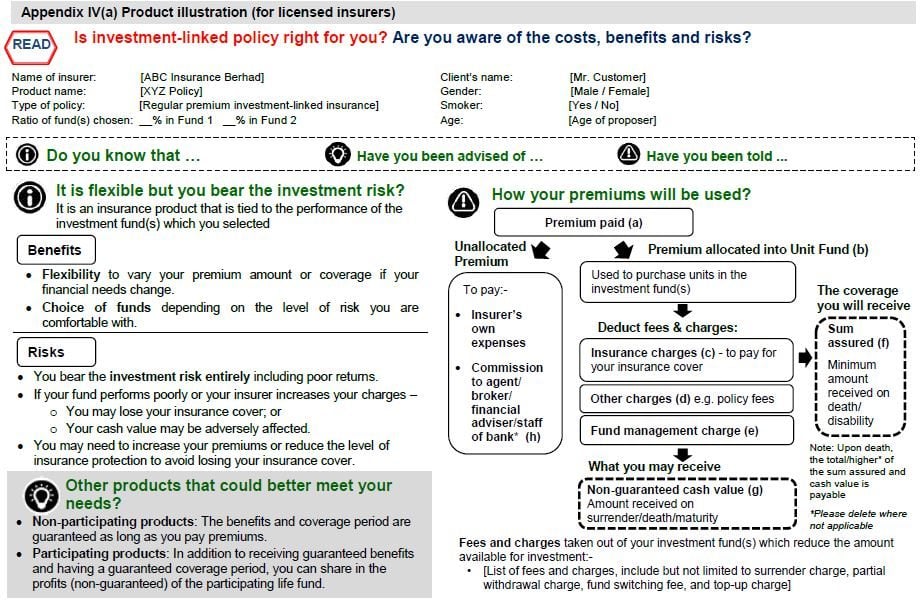

Investment linked insurance malaysia. Regulated by bank negara this policy is essentially for those who are seeking to have their premiums earn some returns while insuring their health. Investment linked vs traditional policy. Investment linked life insurance is paid on death permanent disability or maturity of the policy. The flexibility and availability to control your insurance coverage and investment growth are reasons why an investment linked plan is a popular choice.

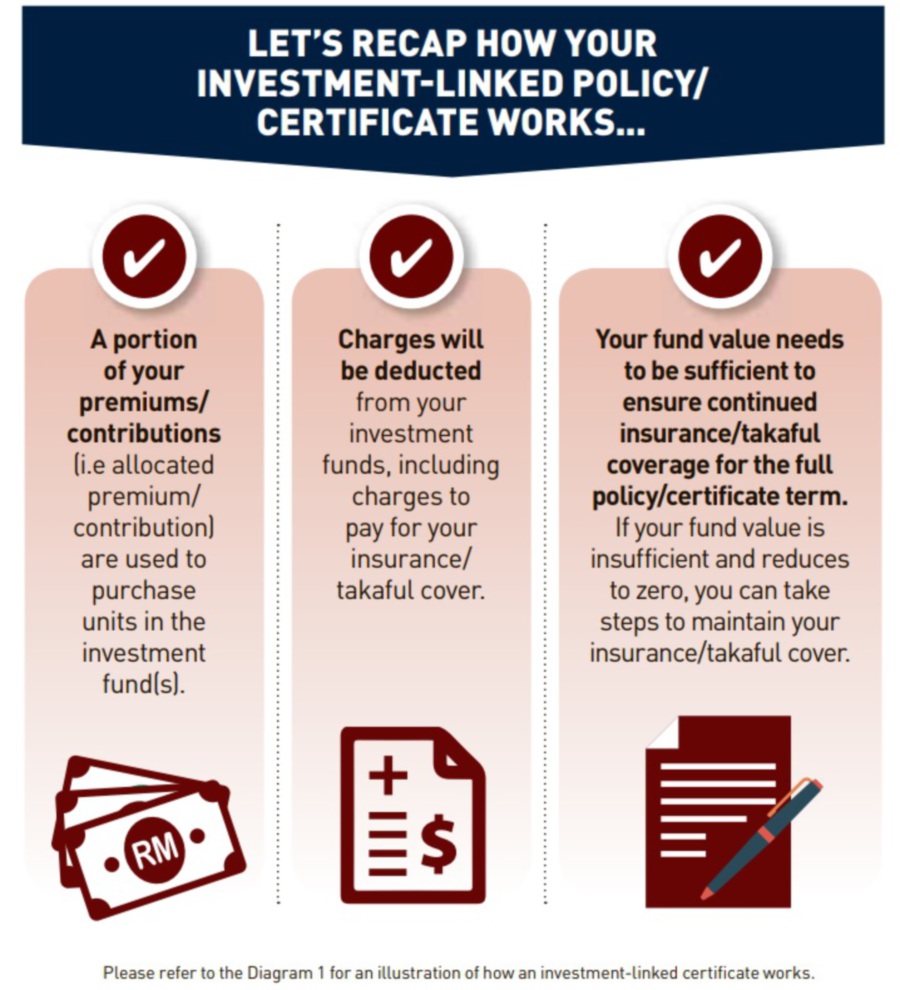

An investment linked plan is a life insurance plan that combines investment and protection. Let s look at some major differences between the 2 type of policies. An investment linked plan is a life insurance plan that combines investment and protection. The aia investment linked insurance in malaysia also has a aia takaful investment linked insurance plan.

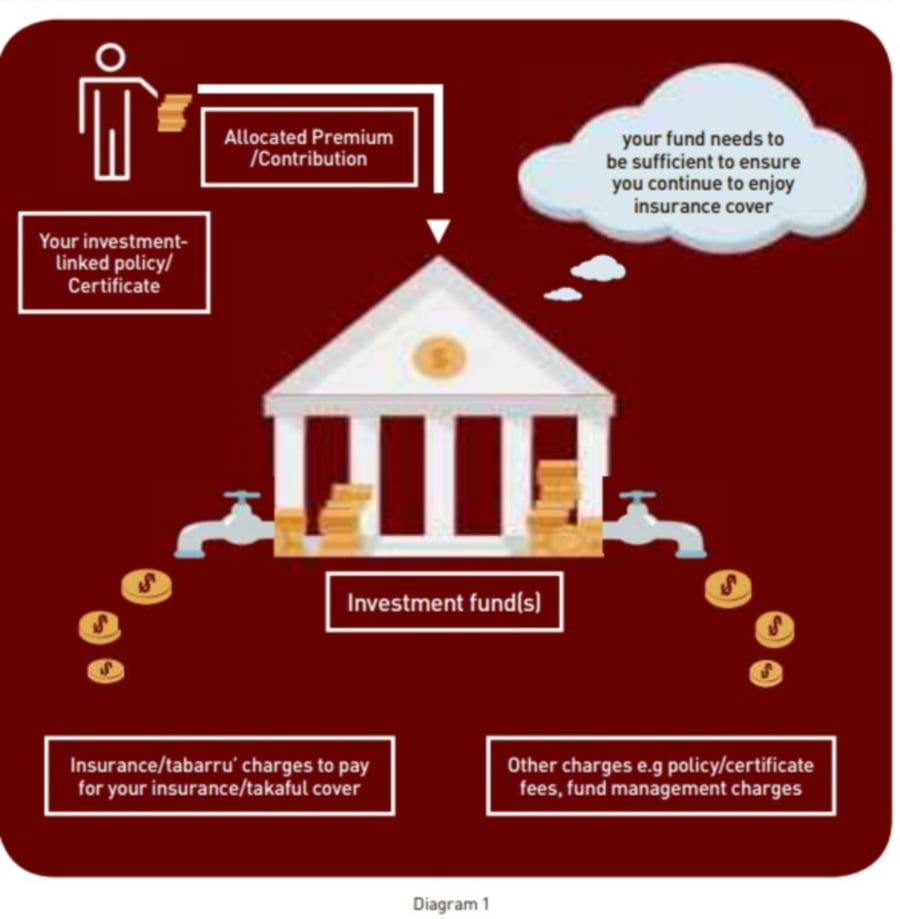

Meanwhile about 70 of medical and health insurance plans in the country are sold together with investment linked products. In other words many malaysians and their families are protected by investment linked products. The premiums that you pay provide you not only with life insurance cover but part of the premiums will also be invested in specific investment funds of your choice. The plan offers a convenient way to increase your sum assured when you want more coverage due to increasing financial and family commitments at different life stages.

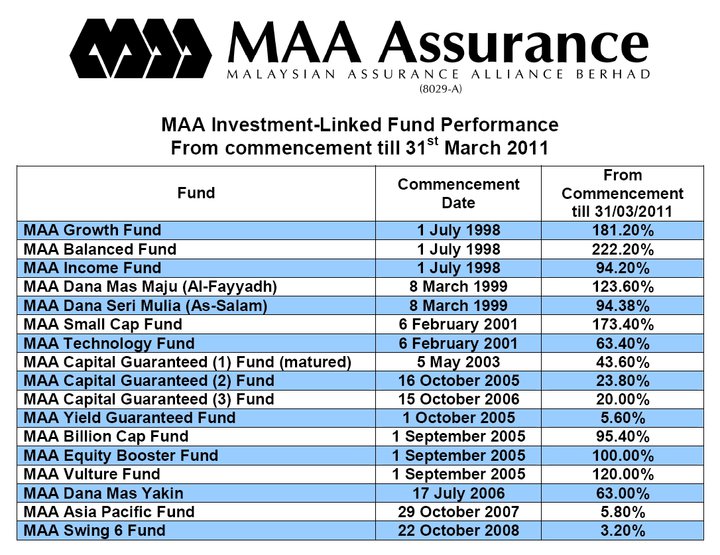

Smart invest growth is an investment linked insurance plan designed to do just that by enhancing your protection and financial safety net. Before year 2000 there are only traditional life insurance policy available to the market. The investment linked plan offers first time and veteran investors a platform to invest and receive protection at the same time. Since then some insurance companies in malaysia had come up with many investment linked insurance products.

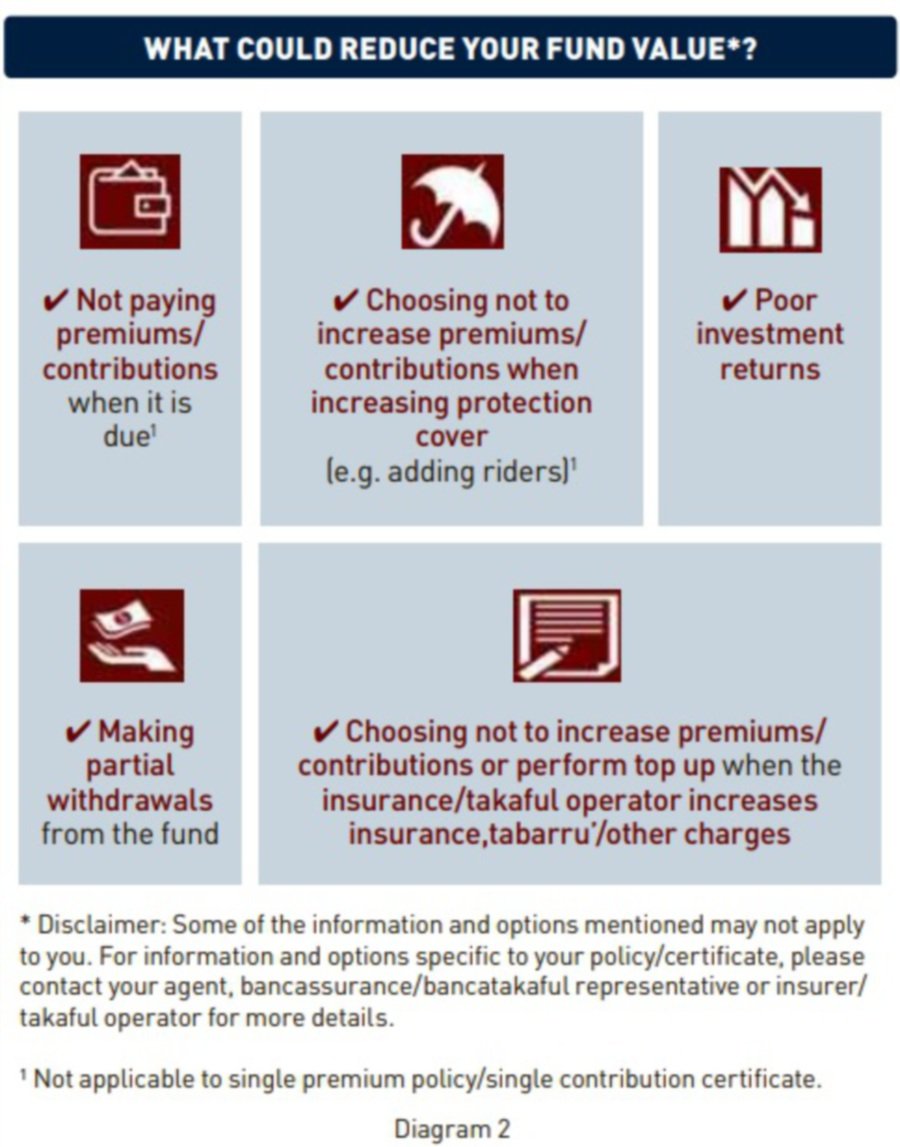

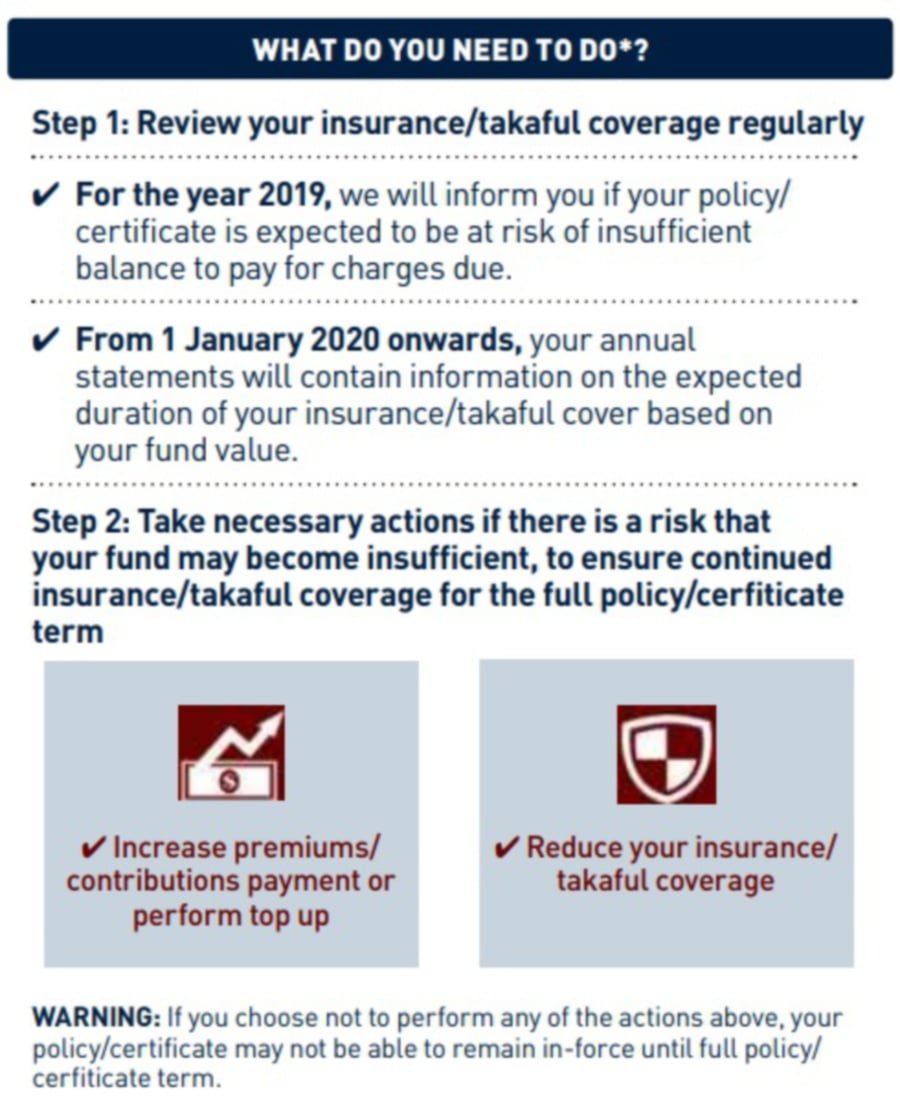

It even has a surrender value where you get back a portion of your savings if you intend to terminate the insurance policy. If you have or are planning to purchase an investment linked product ilp insurance policy then you should take note of the new regulations by bank negara that will come into effect from 1 july 2019. The investment linked plan ilp is an insurance plan that combines the benefit of investment and protection. Kuala lumpur june 24 bank negara s new requirements for investment linked product ilp insurance policies come into effect on 1 july 2019.

What is investment linked life insurance. The investment linked plan that secures the lifestyle of your family.