Individual Tax Rates 2018

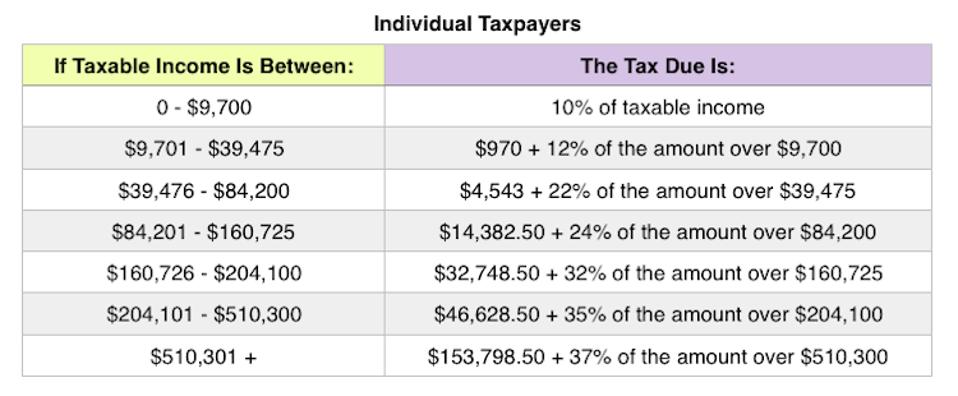

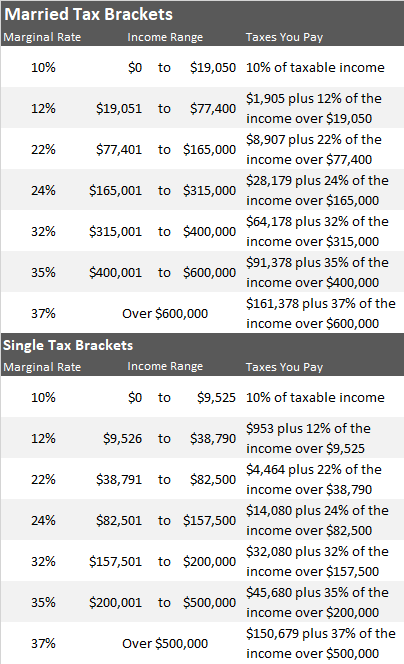

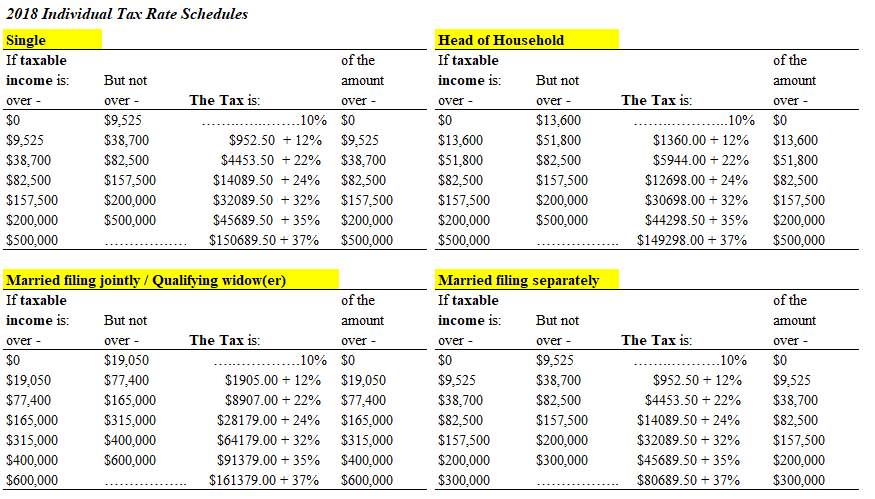

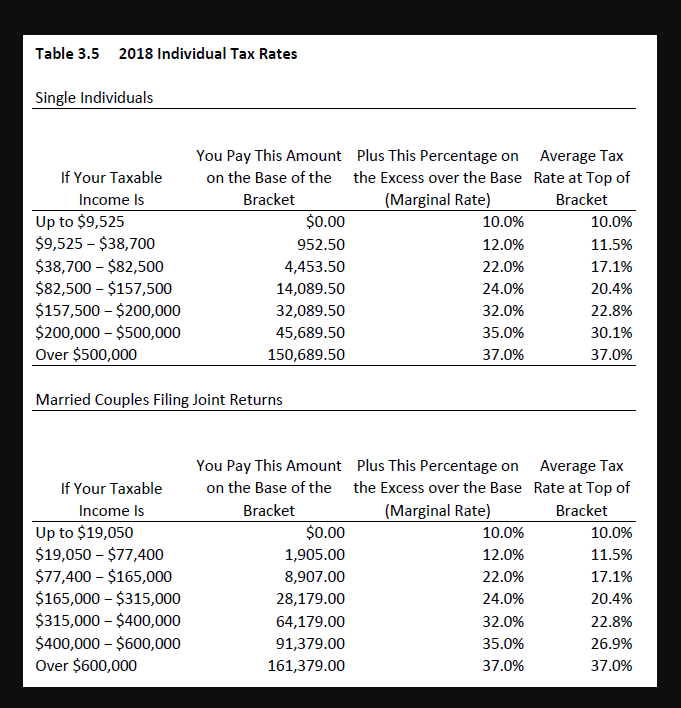

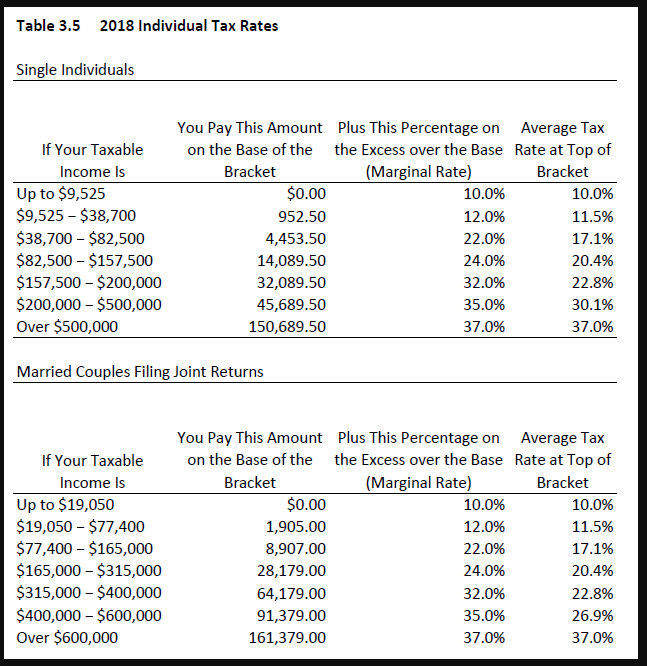

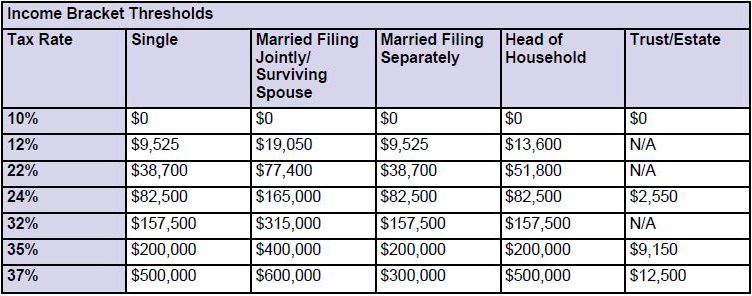

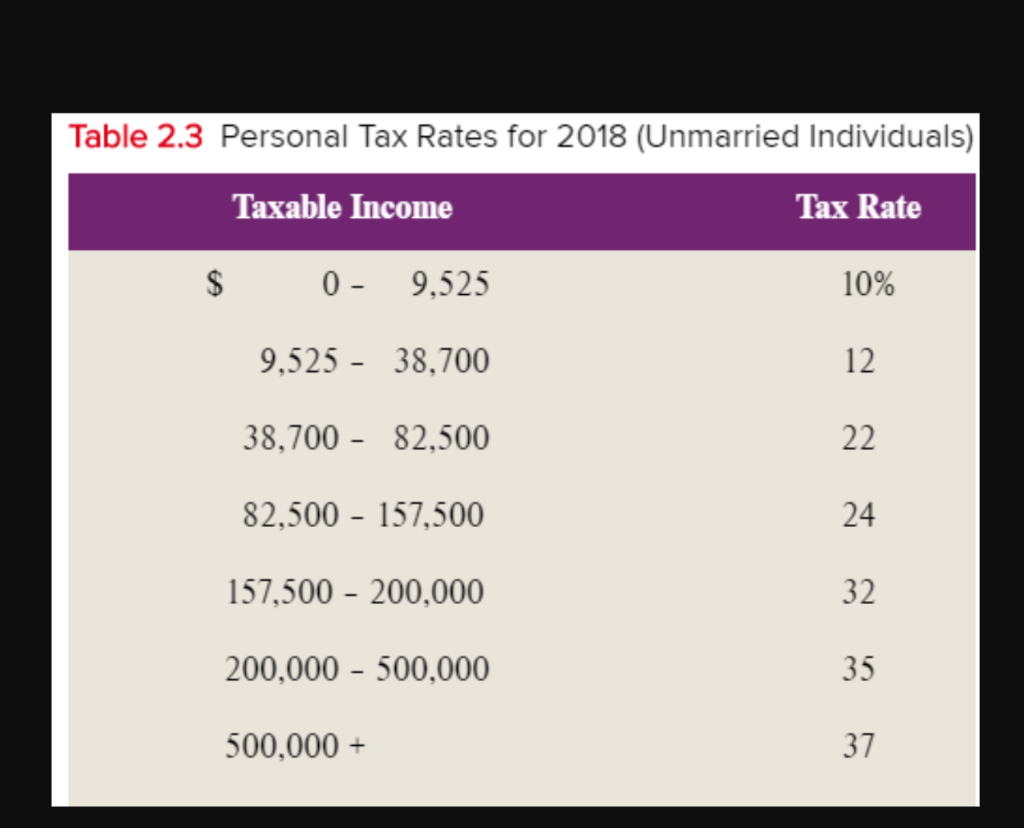

2018 individual income tax brackets the federal income tax has 7 rates.

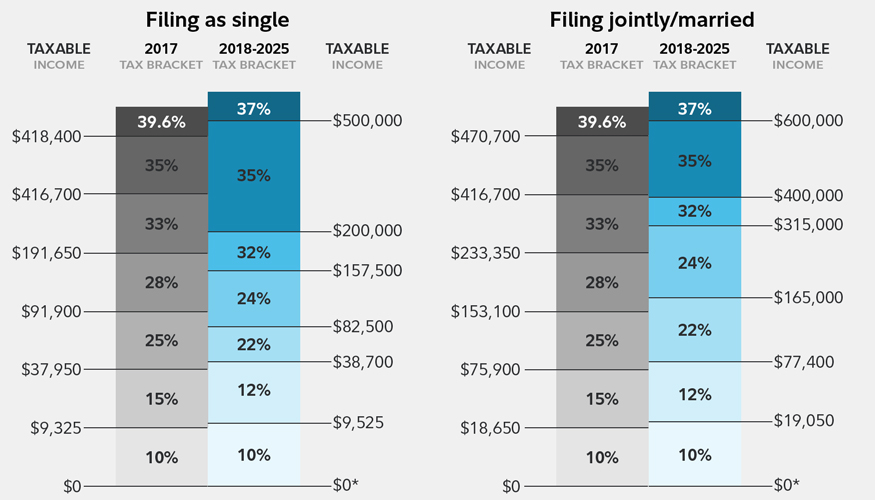

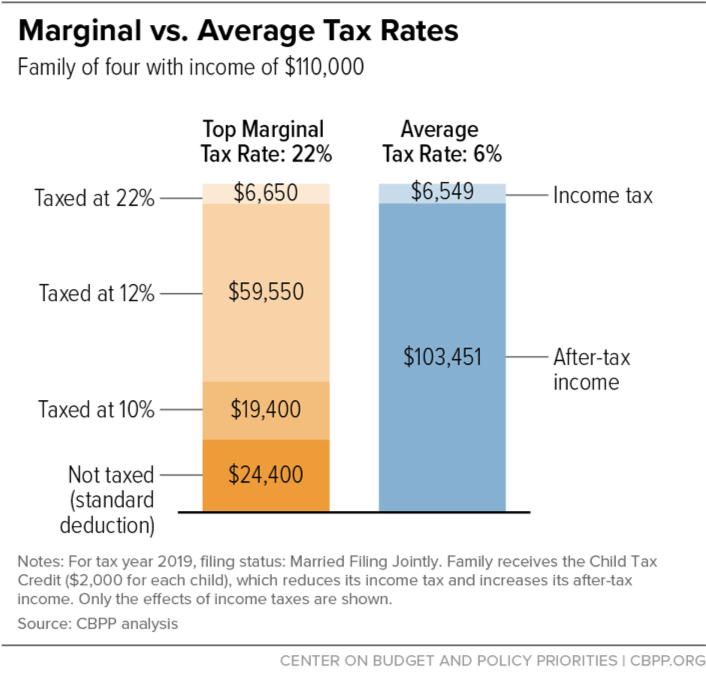

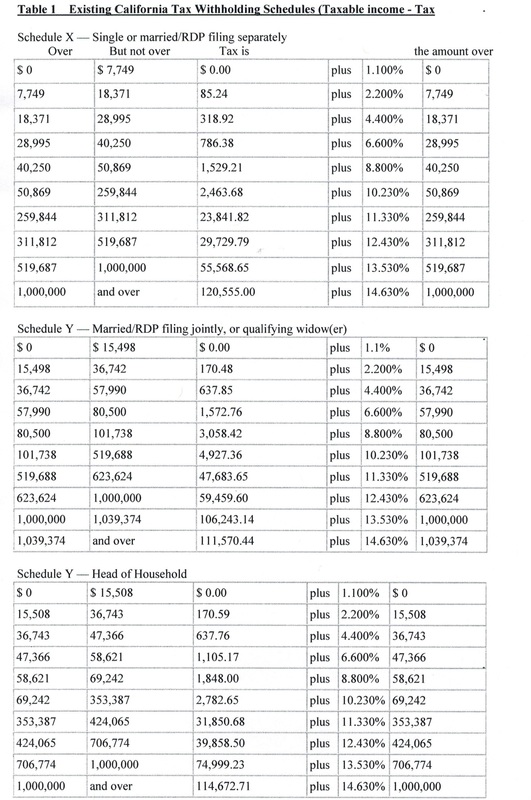

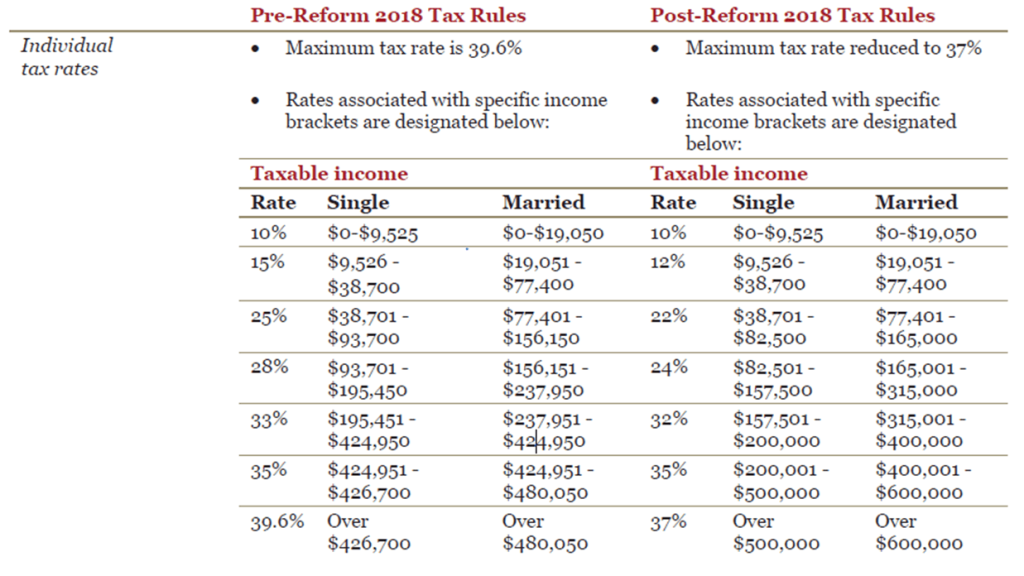

Individual tax rates 2018. The bottom rate remains at 10 but it covers twice the amount of income compared to the previous brackets. The top marginal income tax rate of 37 percent will hit taxpayers with taxable income of 500 000 and higher for single filers and 600 000 and higher for married couples filing jointly. 2021 tax year 1 march 2020 28 february 2021. 2018 irs tax brackets and tax rates for individuals and business.

2018 standard deduction and exemptions. Calculations rm rate tax rm 0 5 000. 01 jul 2020 qc 16218. 2018 tax year 1 march 2017 28 february 2018.

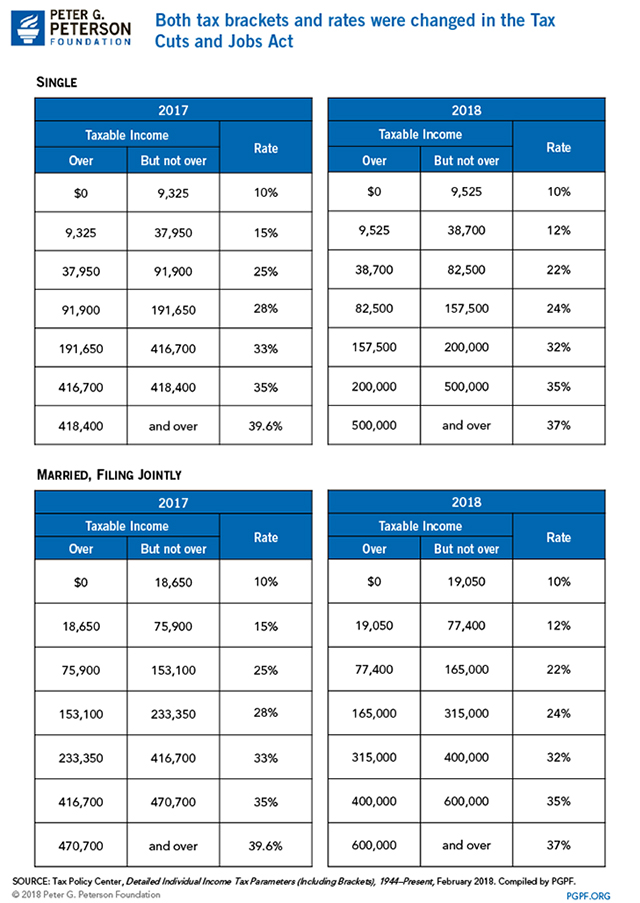

The top rate will fall from 39 6 to 37. 10 12 22 24 32 35 and 37. If you need help applying this information to your personal situation phone us on 13 28 61. 2018 individual tax rate table if your filing status is single.

These rates show the amount of tax payable in every dollar for each income bracket for individual taxpayers. These tax rates are new and come from the tax jobs and cuts act of 2017 which was signed into law by president trump on december 22 2017. Over but not over the tax is. On the first 2 500.

Video tax tips on atotv external link. Visit our tax center for more information or make a tax office appointment to speak to one of our tax pros. The tax cuts and jobs act of 2017 otherwise knows as tax reform reduced the amount of tax brackets for individuals and lowered the rates. Tax rates 2017 2018 year residents the 2018 financial year starts on 1 july 2017 and ends on 30 june 2018.

The financial year for tax purposes for individuals starts on 1st july and ends on 30 june of the following year. 0 9 525 10 of the amount over 0 9 525 38 700 952 50 12 of the amount over 9 525. The 2017 budget made no changes to the personal income tax scale for. In 2018 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows tables 1 and 2.

Individual income tax rates for prior years. Tax reform reduced the corporate tax rates to one flat rate. On the first 5 000 next 15 000. The tax cuts and jobs act that went into effect on jan.

Rates of tax for individuals.