Individual Tax Rate 2018 Malaysia

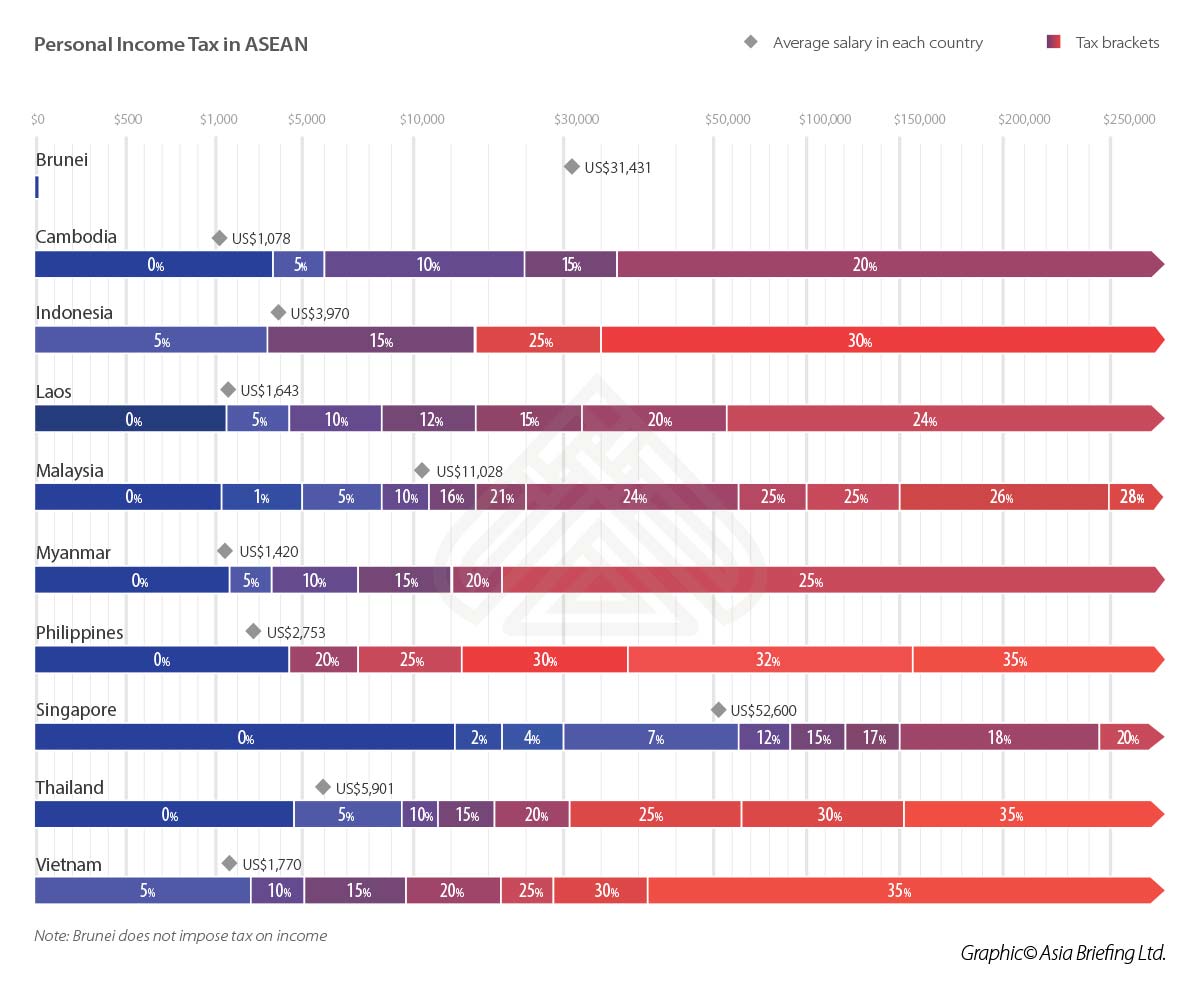

Non resident individuals pay tax at a flat rate of 30 with effect from ya 2020.

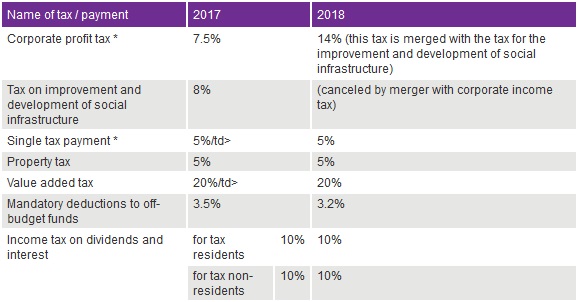

Individual tax rate 2018 malaysia. With effect from ya 2020 a non resident individual is taxed at a flat rate of 30 on total taxable income. In 2018 some individual tax rates have been slashed 2 for three slabs chargeable income bands 20 001 35000 35001 50 000 50 001 70 000 will now be taxed 3 8 14 respectively. Income taxes in malaysia for non residents. A qualified knowledge worker in a specified area currently only iskandar malaysia is taxed at the concessionary rate of 15 on chargeable income from employment with a designated company engaged in a qualified activity e g.

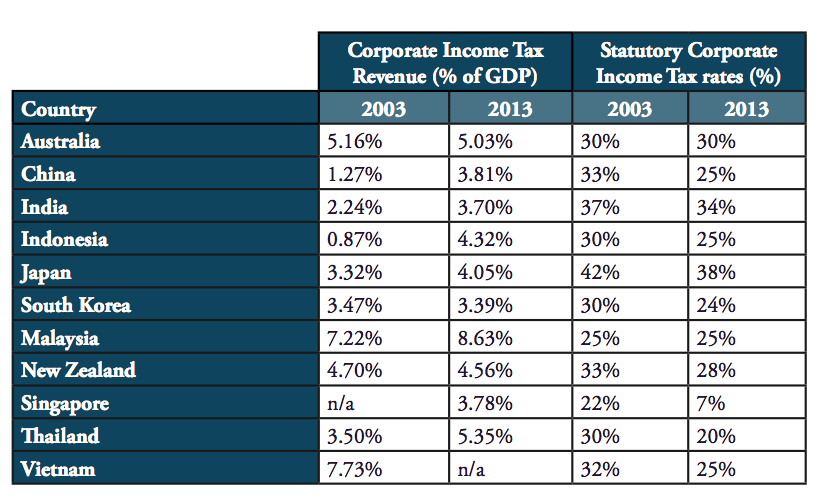

Calculations rm rate. Malaysia personal income tax rate. A graduated scale of rates of tax is applied to chargeable income of resident individual taxpayers starting from 0 on the first rm5 000 to a maximum of 30 on chargeable income exceeding rm2 000 000 with effect from ya 2020. Other rates are applicable to special classes of income eg interest or royalties.

Green technology educational services. Tax rm 0 5 000. This would enable you to drop down a tax bracket lower your tax rate to 3 and reduce the amount of taxes you are required to pay from rm1 640 to rm585. These new rates will apply for those who have accumulated their income from january 2018 to december 2018 and are filing their taxes from march april 2019.

Personal income tax in malaysia is charged at a progressive rate between 0 28.