Income Tax Table 2018

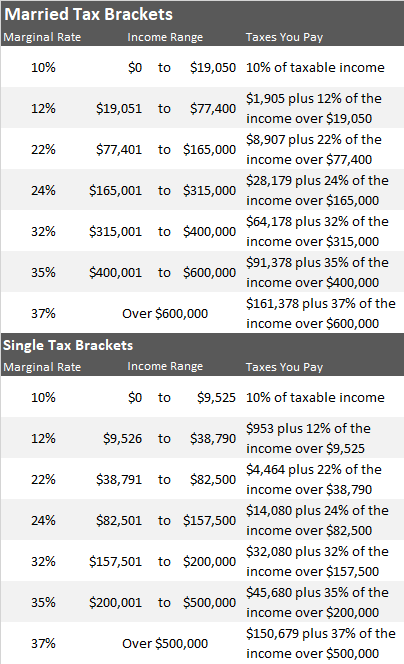

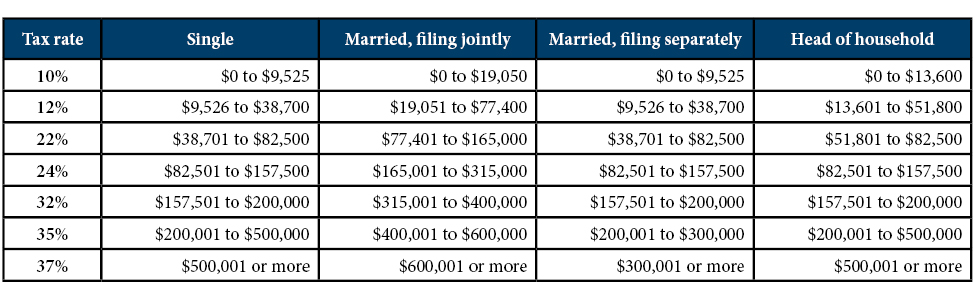

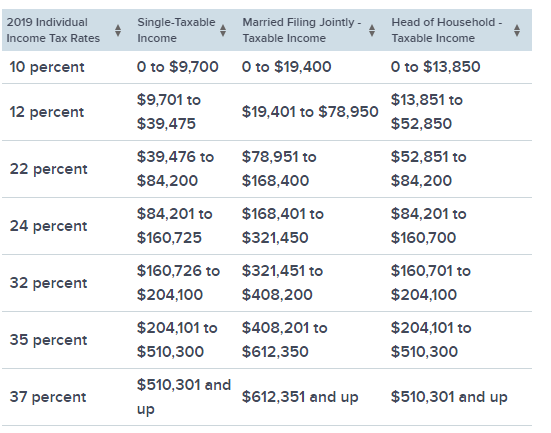

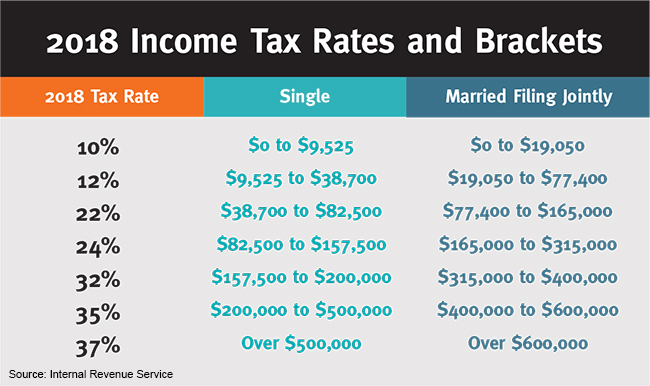

The top marginal income tax rate of 37 percent will hit taxpayers with taxable income of 500 000 and higher for single filers and 600 000 and higher for married couples filing jointly.

Income tax table 2018. Tax tables form 1040 instructions html. 2018 nebraska tax table 3 060 10 060 17 060. If your nebraska taxable income is more than the highest amount in the tax table see instructions at the end of the table. If your taxable income is.

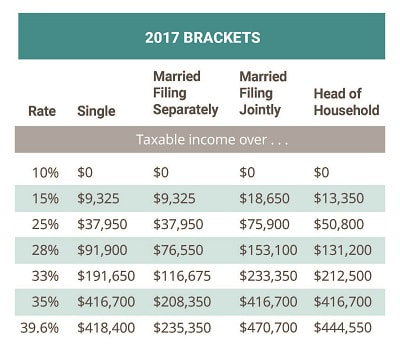

First they find the 25 300 25 350 taxable income line. Topic page for tax table. Over but not over the tax is. In 2018 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows tables 1 and 2.

Brown are filing a joint return. Read down the column labeled if your taxable income is to find the range that includes your taxable income from form 540 line 19. 2018 form 540 tax table to find your tax. 0 9 525 10 of the amount over 0 9 525 38 700 952 50 12 of the amount over 9 525.

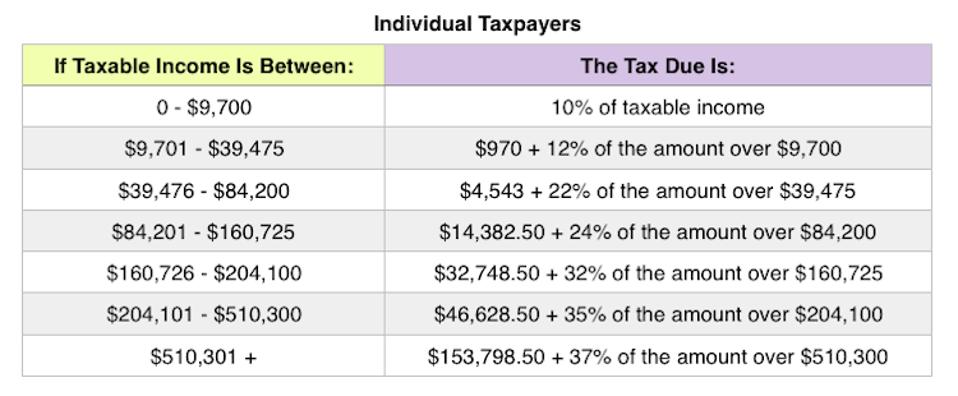

The inland revenue service irs is responsible for publishing the latest tax tables each year rates are typically published in 4 th quarter of the year proceeding the new tax year. 2018 individual tax rate table if your filing status is single. Individual income tax return. Prior year tax tables forms and instructions.

Their taxable income on form 1040 line 10 is 25 300. Over but not over single married filing. Only taxpayers filing paper returns may use the nebraska tax table. This page provides detail of the federal tax tables for 2018 has links to historic federal tax tables which are used within the 2018 federal tax calculator and has supporting links to each set of state tax tables for 2018.

Visit our tax center for more information or make a tax office appointment to speak to one of our tax pros.