Income Tax Submission 2018

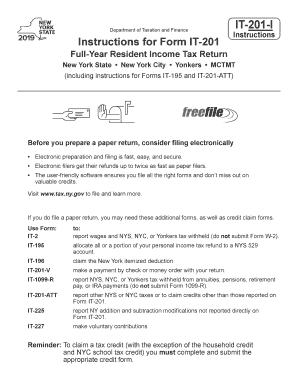

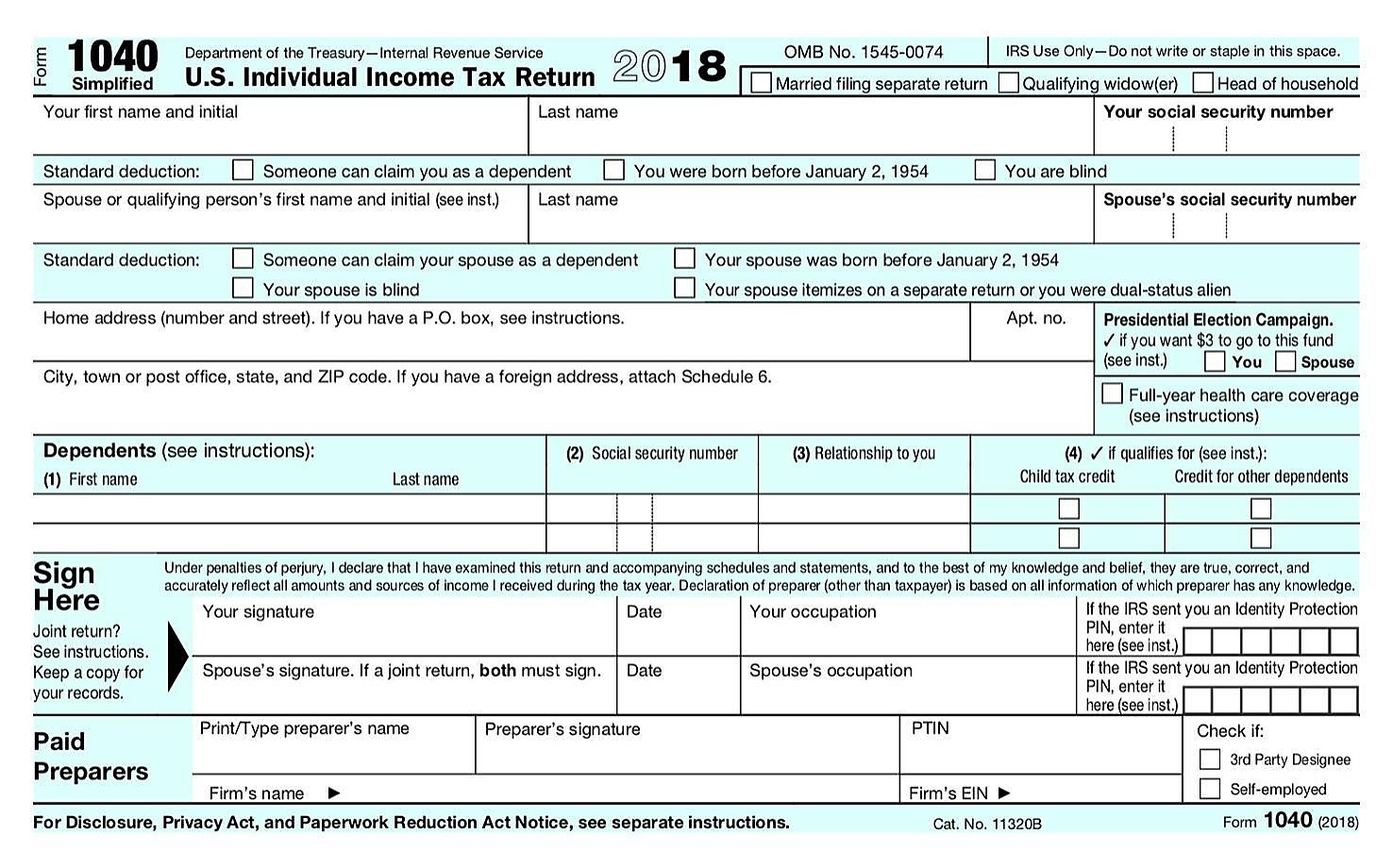

Income tax return form itrf filing programme for the year 2018 grace period for submission of itrf 1 no.

Income tax submission 2018. Submission for taxable years beginning within the 2018 and 2019 calendar years all taxpayers that file a florida corporate income franchise tax return including the short form are required to provide additional information to the department. Bayaran cukai keuntungan harta tanah available in malay language only. 10 paying income tax due accordingly may avoiding you from being charged tax increase court action and also stoppage from leaving malaysia. 31st august 2020 is the final date for submission of form b year assessment 2019 and the payment of income tax for individuals who earn business income.

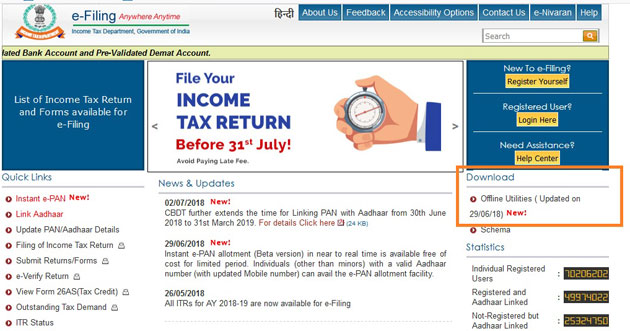

Form due date for submission o f and payment of balance of tax if applicable e filing system or. Irs free file or e file get your tax record and view your account. File income tax get the income tax and benefit package and check the status of your tax refund. Nice initiative by income tax india this website saves lots of time and a great step towards digital and cashless india.

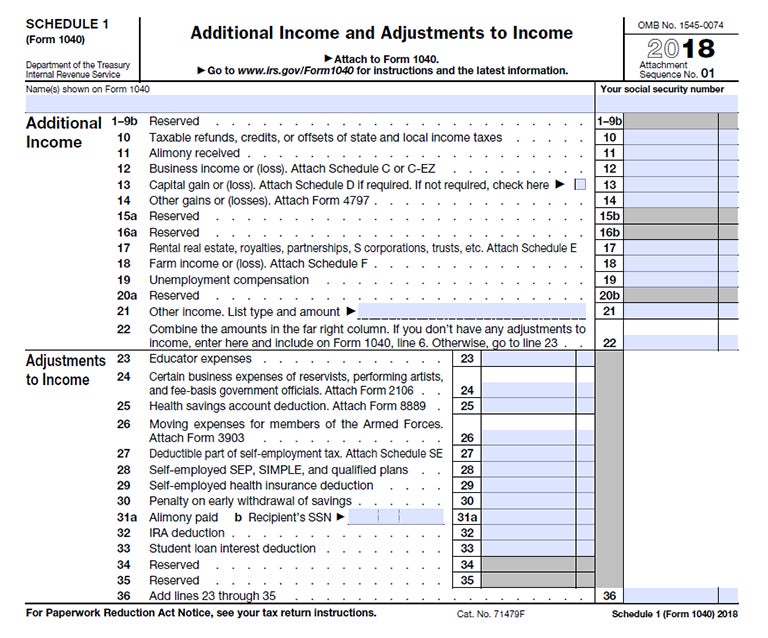

Bringing respite to the income tax filers the central board of direct taxes cbdt had on july 29 extended the deadline for filing income tax returns for fy 2018 19 ay 2019 20 from july 31 2020 to september 30 2020 due to coronavirus covid 19 pandemic. Business or professional income calculate business or professional income get industry codes and report various income types. Section 220 27 florida statutes requires an online submission of additional tax information when a florida corporate income franchise tax return is filed for a taxable year that begins between january 1 2018 and december 31 2019. Businesses and self employed get your employer id number ein find form 941 prepare to file make estimated payments and more.

Procedures for submission of real porperty gains tax form. In support of the president s call to the covid 19 pandemic that social distancing be observed at all times and that we should at most stay indoors and limit movement sars is responding by rapidly enhancing its efforts to further simplify the tax return filing requirements for individual taxpayers and removing the need to travel to our branches in 2020. Most taxpayers will make two separate online submissions e g a calendar year end taxpayer will generally make one submission for taxable year ending december 31 2018 and a second for taxable year ending december 31 2019. Restriction on deductibility of interest section 140c income tax act 1967 study group on asian tax administration and research sgatar commonwealth association of tax administrators cata.

/ScreenShot2020-04-03at11.52.59AM-9d0f626d45704b75a451679182d740ef.png)

:max_bytes(150000):strip_icc()/1040-Page1-e7bbe01bc7824e54a552dfab83fff0b6.jpg)

/ScreenShot2020-04-03at11.52.59AM-9d0f626d45704b75a451679182d740ef.png)

:max_bytes(150000):strip_icc()/ScreenShot2020-01-29at2.02.36PM-684e12df977744fa8f7e2c37999d5118.png)