Income Tax Statement Malaysia

Lanjutan daripada itu pengeluaran stokc juga akan diberhentikan.

Income tax statement malaysia. You ll still need to pay taxes for income earned in malaysia and will be taxed at a different rate from residents. Untuk makluman stokc adalah pengesahan yang dikeluarkan oleh lhdnm ke atas status seseorang yang dikenakan cukai di malaysia. Based on this amount the income tax to pay the government is rm1 640 at a rate of 8.

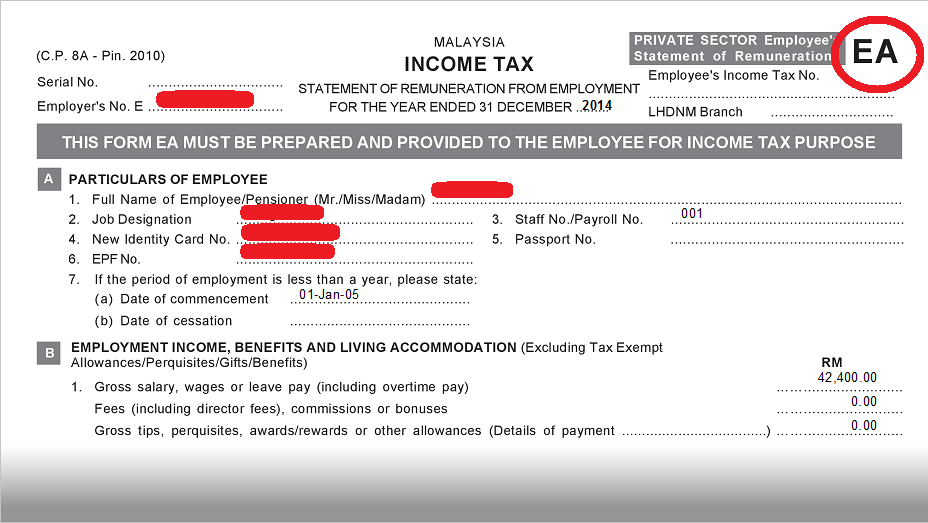

A general view of the inland revenue board s office in kuala lumpur january 8 2020. Yearly remuneration statement ea ec form refer to section 83 1a income tax act 1967 with effect from year of assessment 2009 every employer shall for each year prepare and render to his employee statement of remuneration of that employee on or before the last day of february in the year immediately following the first mentioned year. Picture by yusot mat isa. E connect great eastern life malaysia.

Great eastern e connect is a secured customer portal that allows easy access to your policy details and statements update contact details and pay premium online. Personal income tax rates. If you have never filed your taxes before on e filing income tax malaysia 2019 go to http edaftar hasil gov my where you can apply online for the registration of income tax file for individuals and companies. Income taxes in malaysia for non residents you are regarded as a non resident under malaysian tax law if you stay in malaysia for less than 182 days in a year regardless whether you are malaysian or not.

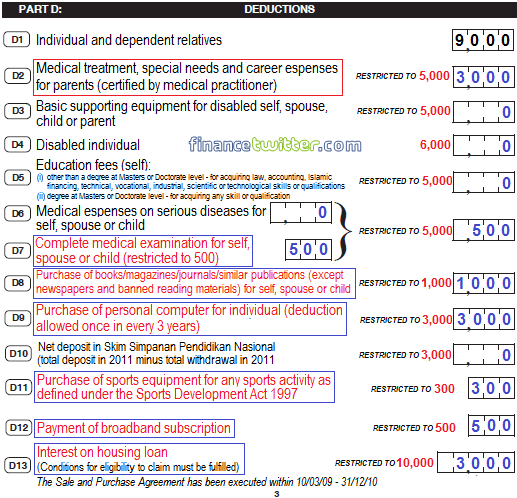

In 2018 i started to have rental income rm 40 000 before deduct renovation agency cost loan interest. Capital statement is the most common investigation method used by the inland revenue board in detecting income of an individual taxpayer. Here are the income tax rates for personal income tax in malaysia for ya 2019. However if you claimed rm13 500 in tax deductions and tax reliefs your chargeable income would reduce to rm34 500.

For example let s say your annual taxable income is rm48 000. Click on borang pendapatan online in the first step of e daftar and then you will have to fill up the form for registration. In malaysia capital statement is applied to individuals who include directors of companies and the self employed to ascertain their actual income received.

The irb in a statement today said the incentives provided under the income tax act 1967 were for the ministry of health s covid 19 fund involving donations of cash and items. A qualified knowledge worker in a specified area currently only iskandar malaysia is taxed at the concessionary rate of 15 on chargeable income from employment with a designated company engaged in a qualified activity e g. With effect from ya 2020 a non resident individual is taxed at a flat rate of 30 on total taxable income. I am malaysia working and file income tax return in singapore.