Income Tax Slab For Ay 2019 20 Calculator Pakistan

Income tax slabs fy 2019 2020.

Income tax slab for ay 2019 20 calculator pakistan. Individual resident aged below 60 years. Income tax calculator pakistan 2014 2015. This income tax calculator pakistan helps you to calculate salary monthly yearly payable income tax according to tax slabs 2020 2021. If it will be collected then all of the poorer classes will be given relief and benefits.

Finally income tax slab rates for salaried class in pakistan 2020 21 has published in the month of june. Where the taxable salary income does not exceed rs. The income tax slabs rates are categorized as below. Salary tax calculator pakistan 2019 please enter all figures on an annual basis where it apply.

This will help and let us to smoother up the flow of our money that also effects on the economy. As per finance bill 2019 presented by government of pakistan in general assembly june 2019 following slabs and income tax rates will be applicable for salaried persons for the year 2019 2020 who meet the following income condition. Find salary tax calculator on. Income tax slabs financial year 2019 20.

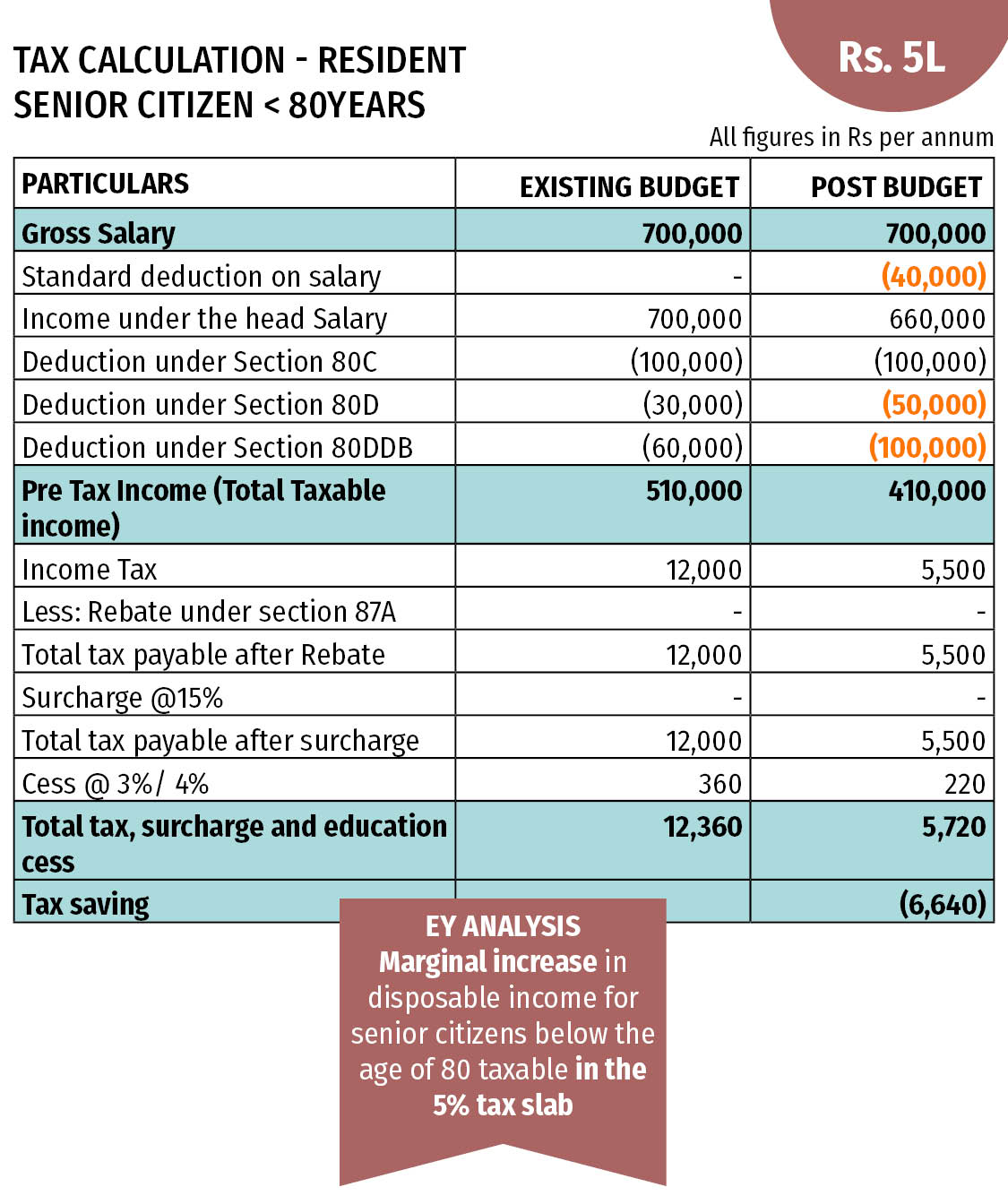

It s worth mentioning here that the former government had given exemption of earnings ceiling around rs1 2 million in rs400 000 per annum. Calculate salary tax 2020 21 last updated. Senior citizen individual resident who is of the age of 60 years or more but below the age of 80 years at any time during the previous year. Paragraph 1a where the income of an individual chargeable under the head salary exceeds fifty per cent 50 of his taxable income the rates of tax to be.

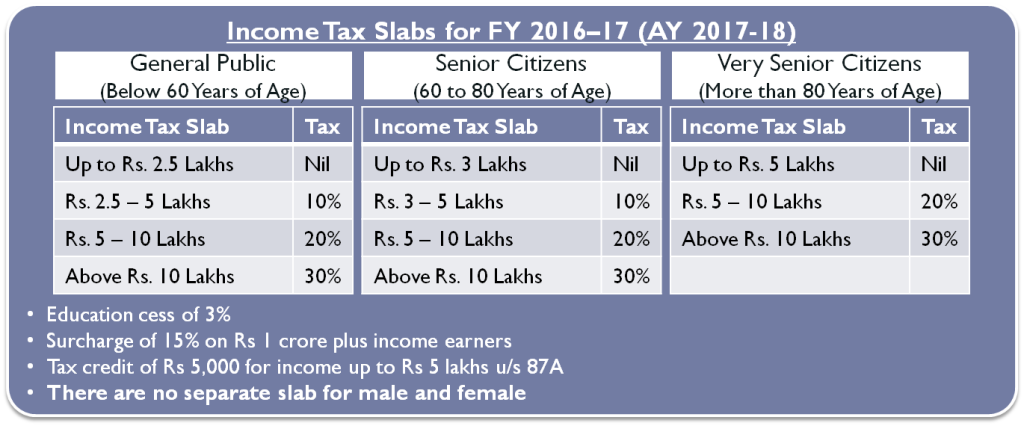

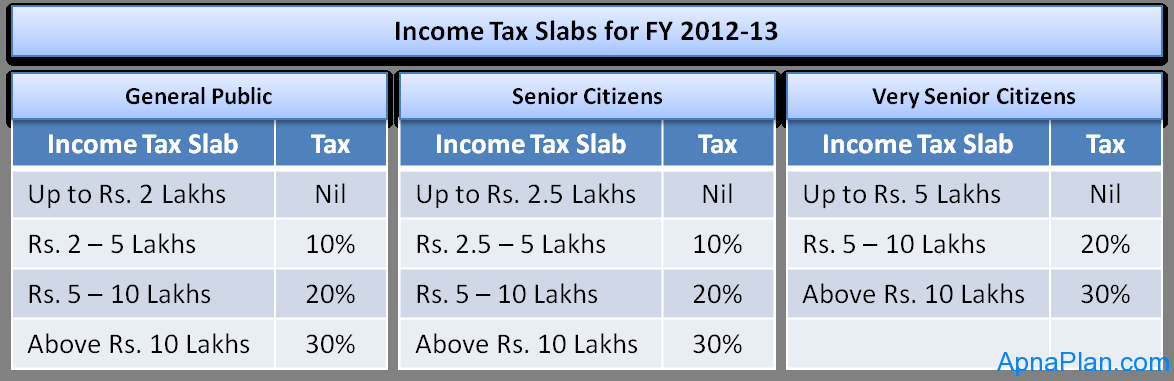

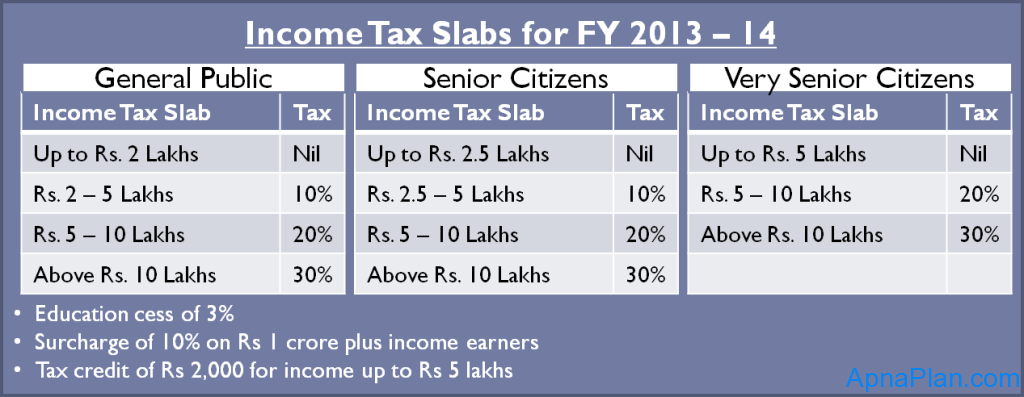

Taxes on personal income and business profits are major revenue sources for most industrialized nations. Article contains income tax slab rates for financial year 2019 20 assessment year 2020 21 for individuals resident or non resident senior citizens 60 years old or more but less than 80 years old only residents and super senior citizens 80 years old or more only residents with rates of applicable surcharge and education cess rate. The government will take some tax measures of about rs 150 billion. Income tax slabs as per federal budget 2019 2020 presented by government of pakistan following slabs and income tax rates will be applicable for salaried persons for the year 2019 2020.

Income tax slabs for fy 2019 20. Here are the new income tax slabs for fy 2019 20 posted 1 year ago by haamiz ahmed the federal government has just announced the budget for the year 2019 2020 with several tax adjustments. Income tax calculator pakistan 2018 2019. Salary income tax calculator pakistan 2019 2020.

Fbr income tax slabs for salaried persons 2020 21. Check out our terms conditions. 600 000 the rate of income tax is 0.

.jpg)

.jpg)