Income Tax Return Filing Due Date For Ay 2019 20 Penalty

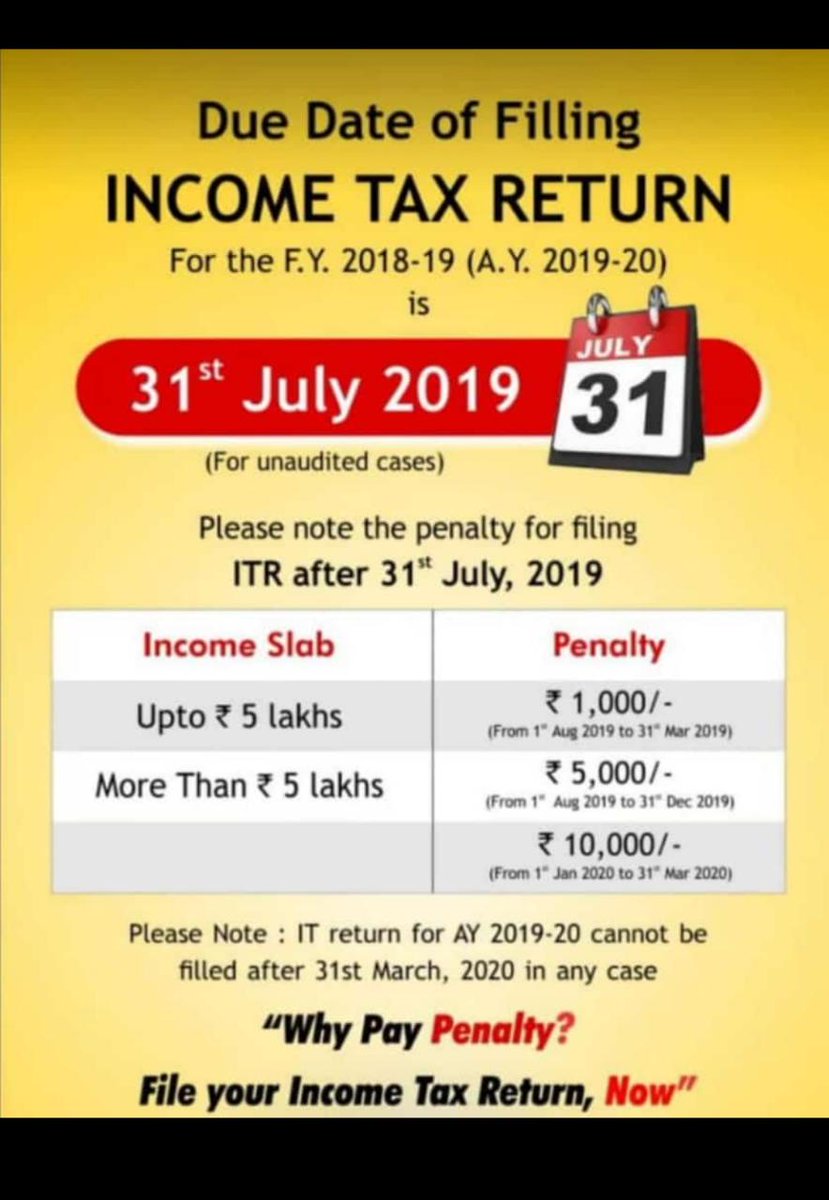

The fee penalty will be as follows.

Income tax return filing due date for ay 2019 20 penalty. The due date for income tax return for the fy 2019 20 ay 2020 21 was also extended. The it department said in a tweet in view of the constraints due to the covid 19 pandemic and to further ease compliances for taxpayers the central board of direct taxes cbdt extends the due date for filing of income tax returns for fy 2018 19 ay 2019 20 from july 31 to september 30 2020. While you can file belated itr till march next year it will attract fine. Let us understand these in detail below.

Penalty for late filing of income tax return for ay 2020 21. The last date to file your itr for the fy 2020 21 is extended to 30 november 2020. Earlier in march the date was extended to june 30 from march 31 and in june till july 31. Click here to read update from income tax department.

Also to note that the penalty is applicable even if the taxpayer files the returns before 31st march while there is no option to file the returns after 31st march 2020. As announced by the government via a press conference due date for all income tax return for fy 2019 20 will be extended from july 31 2020 and october 31 2020 to november 30 2020 and tax audit from september 30 2020 to 31st october 2020 atmanirbhar economic package. Express photo by praveen khanna representational income tax return itr filing 2019 20 last date. Moreover in a normal year the due date of filing itr is july 31 of the assessment year ay so the interest on tax payable if any would not be much on the date of filing itr if the return is.

Not filing your itr on time can lead to a penalty but there are also other consequences and inconveniences attached to the delay. July 31 2019 is the last day for filing income tax return itr for the assessment year 2019 20 the financial year 2018 19. The extended due date for itr is 30 sept 2020 for fy 2018 19 ay 2019 20. But this year ay 2020 21 due to the covid 19 pandemic the due date of filing return has been extended up to november 30 2020 from july 31 2020.

Itr deadline extended to nov 30 2020 for fy 2019 20. The due date of filing income tax returns for financial year 2018 19 assessment year 2019 20 is 31 07 2019 further extended to 31 08 2019 for taxpayers not liable to audit. Cbdt has extended the last date for filing itr by individual body of individuals boi hindu undivided family huf and association of persons aop for ay 2019 2020. The taxpayer has to file the late filing of tax returns for a y.