Income Tax Relief Malaysia

Medical expenses for parents.

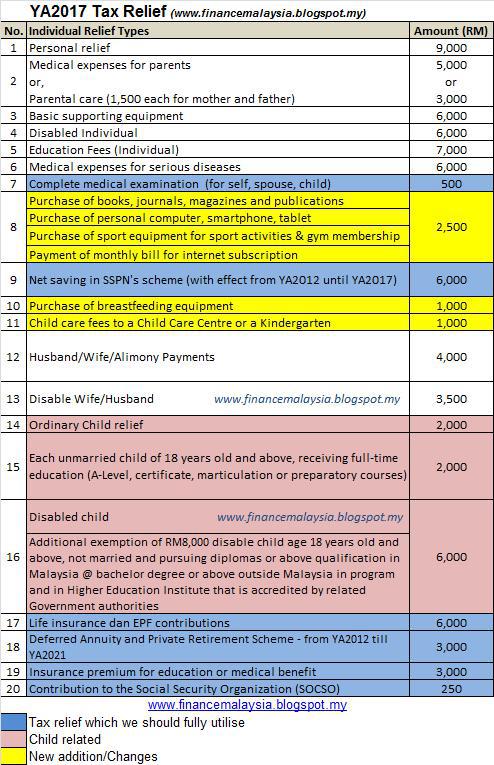

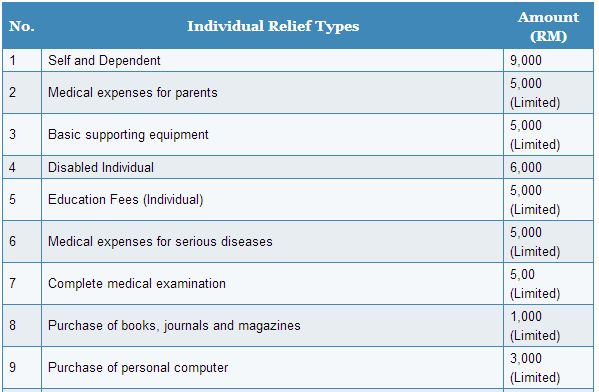

Income tax relief malaysia. A tax rebate directly reduced your amount of tax charged and there are currently four types of tax rebates for income tax malaysia ya 2019. 5 000 limited 3. These are for certain activities that the government encourages to lighten our financial loads. Tax reliefs are set by lhdn where a taxpayer is able to deduct a certain amount for money expended in that assessment year from the total annual income.

How to use investment to claim more malaysian income tax relief 1 section 49 1d of the income tax act ita provides that income tax deduction not exceeding rm3 000 can be claimed by an individual who has a paid premiums for a deferred annuity. According to the full booklet this individual income tax exemption will take effect from 1st july 2020. 1 tax rebate for self if your chargeable income after tax reliefs and deductions does not exceed rm35 000 you will be granted a rebate of rm400 from your tax charged. Amount rm 1.

For income tax malaysia tax reliefs can help reduce your chargeable income and thus your taxes. This relief is applicable for year assessment 2013 and 2015 only. Hence the tax relief is claimable by resident individuals for ya2020 and ya2021. Self and dependent special relief of rm2 000 will be given to tax payers earning on income of up to rm8 000 per month aggregate income of up to rm96 000 annually.

Tax relief for fees paid to child care centres or kindergartens. Tax reliefs are set by lembaga hasil dalam negeri lhdn where a taxpayer is able to deduct a certain amount for cash expended in that assessment year from the total annual income. Meanwhile there is also a special individual income tax relief of up to rm2 500 on the purchase of handphone laptops tablet which takes effect from 1st june 2020. Tax rebate for self if your chargeable income after tax reliefs and deductions does not exceed rm35 000 you will be granted a rebate of rm400 from your tax charged.

The prime minister announced that personal income tax relief in the amount of myr 1 000 on travel expenses incurred from 1 march 2020 to 31 august 2020 is to be extended to 31 december 2021.