Income Tax Rate In Pakistan 2018 19 Pdf

10 00 000 30 30 surcharge.

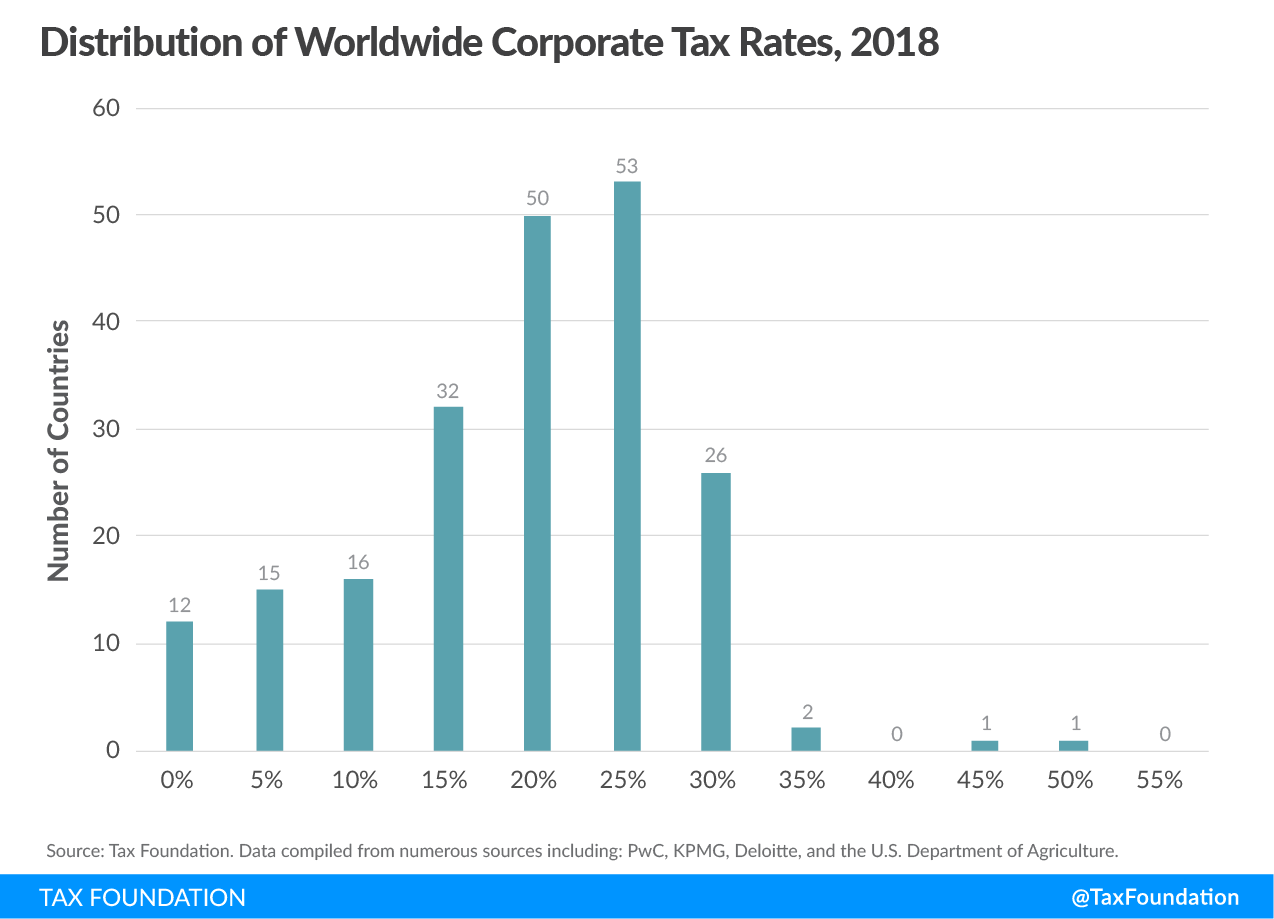

Income tax rate in pakistan 2018 19 pdf. A non resident individual is taxed only on pakistan source income including income received or deemed to be received in pakistan or deemed to accrue or arise in pakistan. It is upto date and covers latest finance supplementary amendment bill 2018 passed by government of pakistan in september 2018. The finance act has reduced the tax rate for small company which will gradually be decreased by 1 from tax year 2019 to tax year 2023. 5 00 000 5 5 rs.

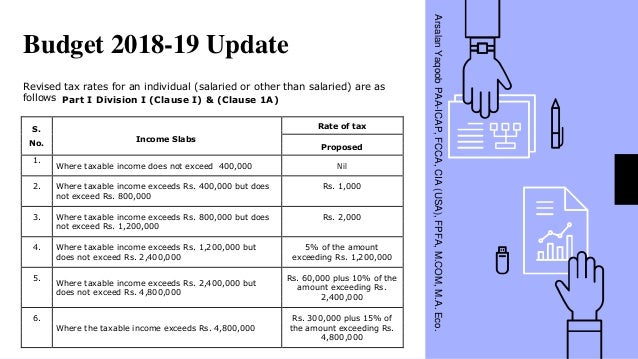

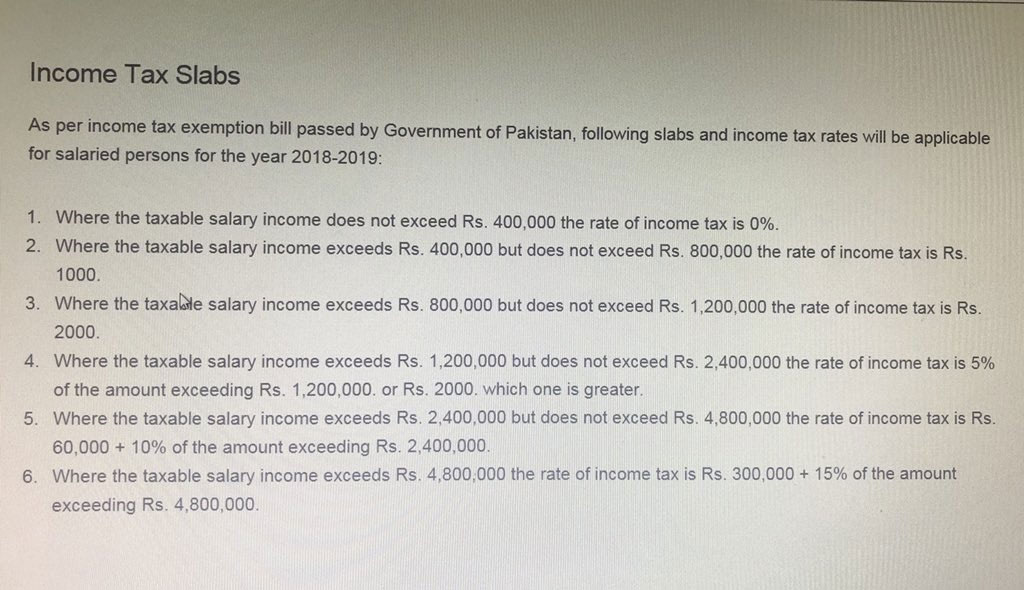

As per federal budget 2019 2020 presented by government of pakistan following slabs and income tax rates will be applicable for salaried persons for the year 2019 2020. Updated fbr income tax rates 2018 19 for salaried persons in pakistan abdul hadi 02 05 2018 the federal government employees along with defense employees in the recent budget 2018 19 have got a lot of benefits in which one of the most prominent was relief in tax on salary. As per income tax exemption bill passed by government of pakistan following slabs and income tax rates will be applicable for salaried persons for the year 2018 2019. Tax rates for salaried individuals where salary income exceeds 50 of taxable income taxable income rate of tax on taxable income 0 to rs.

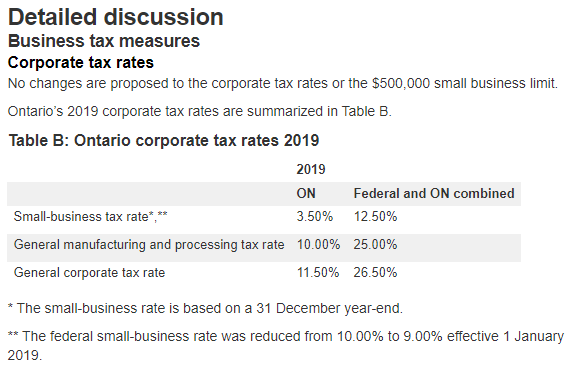

Pakistan budget digest 2018 19 income tax rationalization of withholding tax rates for non filers for sales supplies the rate of tax for non filers has been increased from 7 to 8 in the case of companies and from 7 75 to 9 in the case of persons not being companies. The finance bill proposed to extend the super tax to tax year 2020 with gradual decreased in rate by 1. Super tax division iia part i of first schedule. Personal income tax rates the following tax rates apply where income of the individual from salary exceeds 75 of taxable income.

Updated up to june 30 2020. From tax year 2023 onwards the rate shall be 20. It calculates income tax for salaried and non salaried business persons. Where the taxable salary income does not exceed rs.

600 000 the rate of income tax is 0. Withholding tax rates applicable withholding tax rates. Surcharge is levied on the amount of income tax at following rates if total income of. 2 50 000 rs.

10 00 000 20 20 above rs. For contracts the rate of tax for non filers. Net income range rate of income tax assessment year 2021 22 assessment year 2020 21 up to rs. Where the taxable salary income does not exceed rs.