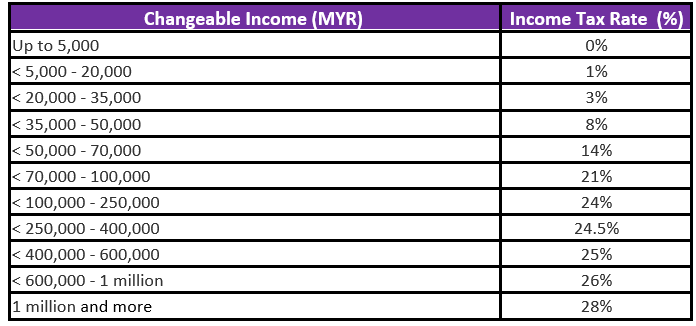

Income Tax Rate 2019 Malaysia

No other taxes are imposed on income from petroleum operations.

Income tax rate 2019 malaysia. Average lending rate bank negara malaysia schedule section 140b restriction on deductibility of interest section 140c income tax act 1967 study group on asian tax administration and research sgatar. How much will you be taxed in 2019. According to lhdn foreigners employed in malaysia must give notice of their chargeability to the non resident branch or nearest lhdn branch within 2 months of their arrival in malaysia. Here are the income tax rates for personal income tax in malaysia for ya 2019.

Petroleum income tax is imposed at the rate of 38 on income from petroleum operations in malaysia. Taxable income myr tax on column 1 myr tax on excess over. Cit rate for year of assessment 2019 2020. An individual whether tax resident or non resident in malaysia is taxed on any income accruing in or derived from malaysia.

The following rates are applicable to resident individual taxpayers for ya 2020. You can file your taxes on ezhasil on the lhdn website. Understanding tax rates and chargeable income. Malaysia residents income tax tables in 2019.

Personal income tax rates. An effective petroleum income tax rate of 25 applies on income from petroleum operations in marginal fields. Here s how you can calculate with the progressive income tax rates in malaysia. Now that you re up to speed on whether you re eligible for taxes and how the tax rates work let s get down to the business of actually filing your taxes.