Income Tax Rate 2016 Malaysia

Malaysia taxation and investment 2016 updated november 2016 contents 1 0 investment climate 1 1 business environment 1 2 currency 1 3 banking and financing 1 4 foreign investment 1 5 tax incentives 1 6 exchange controls 2 0 setting up a business 2 1 principal forms of business entity 2 2 regulation of business.

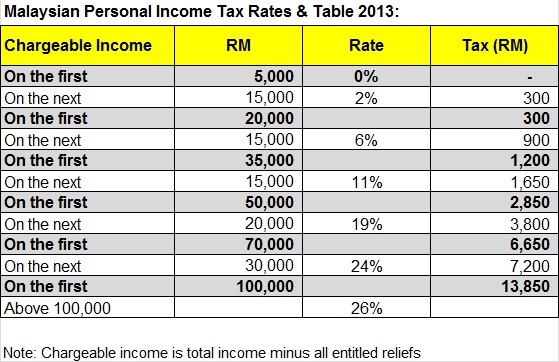

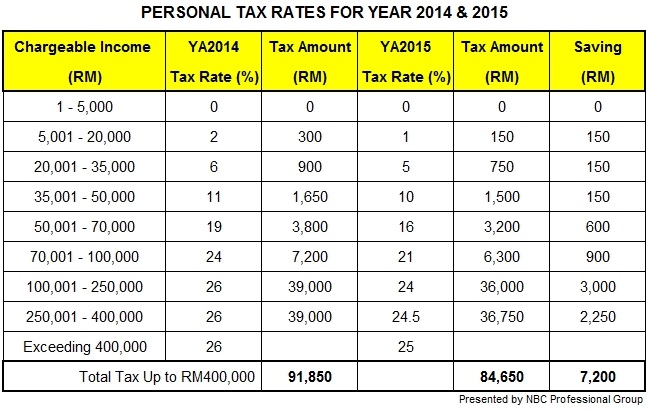

Income tax rate 2016 malaysia. What is income tax return. Tax relief for year of assessment 2019 tax filed in 2020 chapter 5. However there are some exceptions to the matter. A graduated scale of rates of tax is applied to chargeable income of resident individual taxpayers starting from 0 on the first rm5 000 to a maximum of 30 on chargeable income exceeding rm2 000 000 with effect from ya 2020.

Jadual average lending rate bank negara malaysia seksyen 140b sekatan ke atas kebolehpotongan faedah seksyen 140c akta cukai pendapatan 1967 edisi bahasa inggeris sahaja study group on asian tax administration and research sgatar. Malaysia income tax e filing guide. Tax rm 0 5 000. Malaysia personal income tax rate.

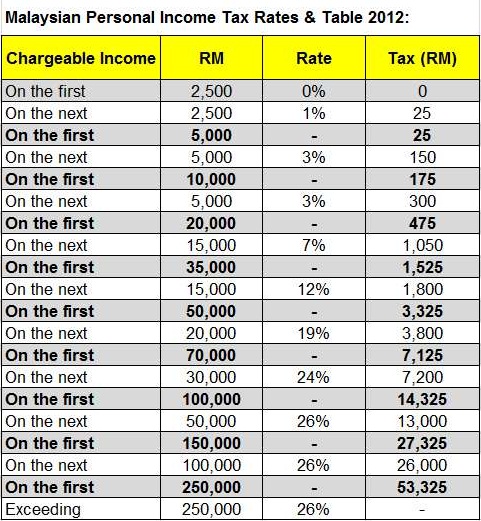

Non resident individuals pay tax at a flat rate of 30 with effect from ya 2020. An effective petroleum income tax rate of 25 applies on income from petroleum operations in marginal fields. Calculations rm rate. On the first 2 500.

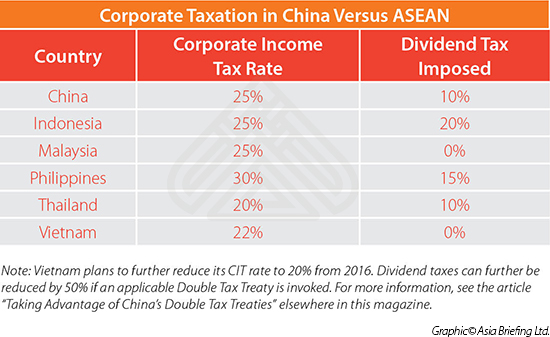

How to pay income. 1 for non residents of malaysia people who have been living in the country for less than 182 days per year the tax rate has been set at 25 on all the income that has been earned in malaysia regardless of your citizenship or nationality. On first rm600 000 chargeable income 17 on subsequent chargeable income 24 resident company with paid up capital above rm2 5 million at the beginning of the basis period 24 non resident company branch 24. Other rates are applicable to special classes of income eg interest or royalties.

Income tax rates resident companies are taxed at the rate of 25 reduced to 24 w e f ya 2016 while those with paid up capital of rm2 5 million or less are taxed at the following scale rates. Petroleum income tax is imposed at the rate of 38 on income from petroleum operations in malaysia. For chargeable income in excess of myr 500 000 the corporate income tax rate is 25. Assessment year 2016 2017.

Tax rates for year of assessment 2019 tax filed in 2020 chapter 6. Leasing income from moveable property derived by a permanent establishment in malaysia is taxed against a rate of 25 whereas a non resident corporation with no malaysian permanent establishment is taxed against a rate of 10. No other taxes are imposed on income from petroleum operations.