Income Tax Percentage Malaysia

For example let s say your annual taxable income is rm48 000.

Income tax percentage malaysia. A qualified knowledge worker in a specified area currently only iskandar malaysia is taxed at the concessionary rate of 15 on chargeable income from employment with a designated company engaged in a qualified activity e g. Deputy communications and multimedia minister zahidi zainul abidin has shared that the malaysian government is planning to introduce a new service tax for online shopping. However if you claimed rm13 500 in tax deductions and tax reliefs your chargeable income would reduce to rm34 500. As reported by harian metro and malaysiakini the proposed rate is about 0 02.

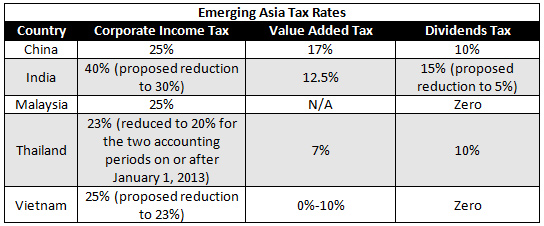

Non resident individuals pay tax at a flat rate of 30 with effect from ya 2020. Average lending rate bank negara malaysia schedule section 140b restriction on deductibility of interest section 140c income tax act 1967 study group on asian tax administration and research sgatar. Green technology educational services healthcare services creative industries financial advisory and consulting services logistics services tourism. The gross amount of interest royalty and special income paid by the payer to a nr payee are subject to the respective withholding tax rates of 15 10 and 10 or any other rate as prescribed under the double taxation agreement between malaysia and the country where the nr payee is a tax resident.

Personal income tax rate in malaysia averaged 27 29 percent from 2004 until 2020 reaching an all time high of 30 percent in 2020 and a record low of 25 percent in 2015. The personal income tax rate in malaysia stands at 30 percent.