Income Tax Number Malaysia Format

The deadline for filing your income tax returns form in malaysia varies according to what type of form you are filing.

Income tax number malaysia format. This may in some cases result in a refund. Sg 10234567090 or og 25845632021 for individual itn the end number can be either 0 or 1 which indicates the husband or wife. You can do the registration either on line or at the nearest branch of the malaysian inland revenue board irbm lembaga hasil dalam negeri malaysia. This will help ensure that residents with financial accounts in other countries are complying with their domestic tax laws and act as a deterrent to tax evasion.

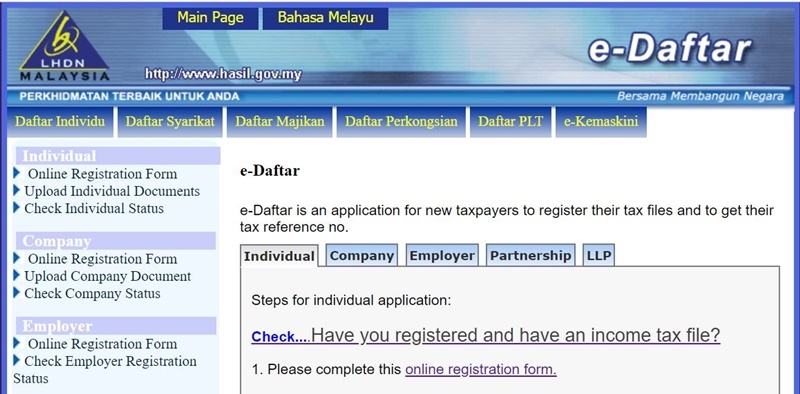

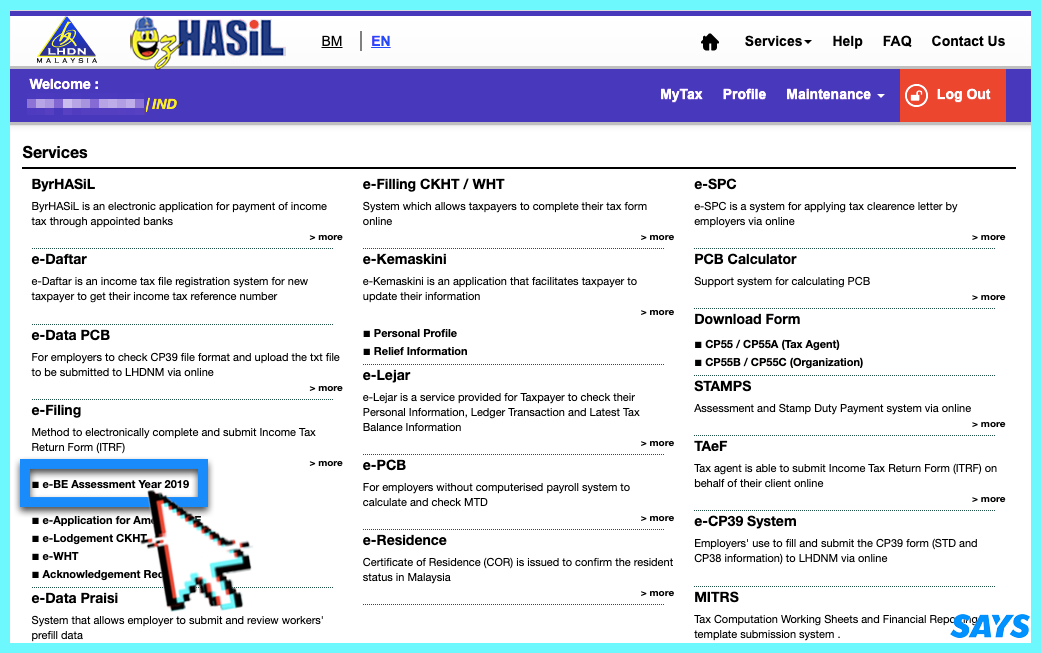

Malaysia has committed to exchange the crs information from 2018 and would also be receiving financial account information on malaysian residents from other countries tax authorities. Pengenalan kod keselamatan sila masukkan e mel dan nombor telefon yang berdaftar dengan lhdnm untuk memaparkan nombor cukai pendapatan dan cawangan. For the be form resident individuals who do not carry on business the deadline for filing income tax in malaysia is 30 april 2020 for manual filing and 15 may 2020 via e filing. Click link to e daftar.

Sg 12345678901 tax reference types. A company is regarded as a tax resident in malaysia if its management and control are exercised in malaysia. Lembaga hasil dalam negeri malaysia classifies each tax number by tax type. Corporate tax rates in malaysia most companies which are tax residents in malaysia are taxed on an annual basis at a rate of 24.

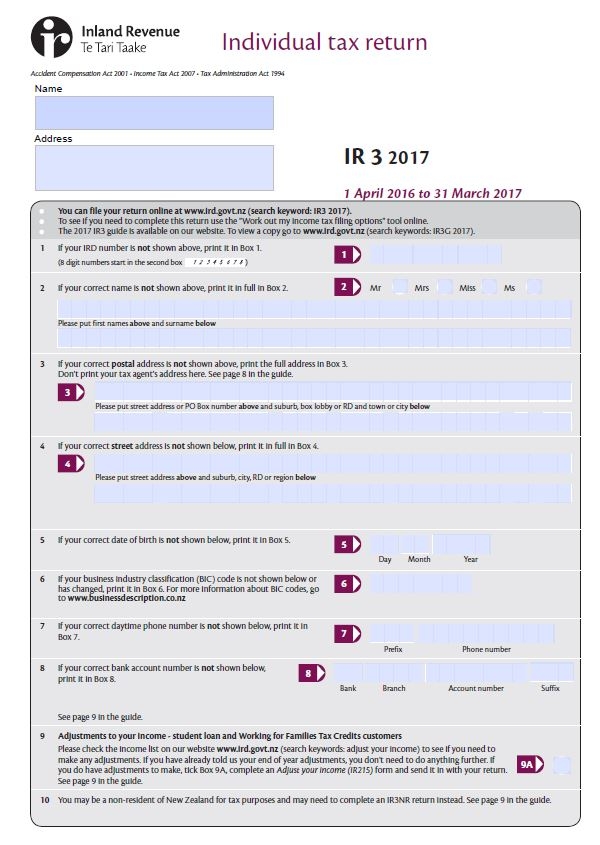

During tax season you need to submit your income tax return itr12 so sars can reconcile expenses for the year of assessment. Ssns are tax identification numbers for individuals and the social security administration ssa issues them in the format of xxx xx xxxx. Employer tax id numbers are also nine digits long but. Your income tax number consists of a tax reference type of 1 or 2 letter code followed by a 10 or 11 digit tax reference number.

When will you get the income tax reference no. Make sure that your have your id number on hand when you make the call. Contact 03 8913 3800. Tax tips from sars.

Check your application status. Type of file number 2 alphabets characters sg or og space income tax number maximum 11 numeric characters example. Foreign tax credit is restricted to the amount of malaysian tax payable on the foreign income. Please used the given application number to check your application status.

This is the responsible agency operated by the ministry of finance malaysia. Within 3 working days after completing an online application. Registering for a malaysian tax number is not very complicated. Tax season runs from july to november every year.

The inland revenue board of malaysia malay. Semakan nombor cukai pendapatan individu lembaga hasil dalam negeri malaysia.