Income Tax Malaysia Table

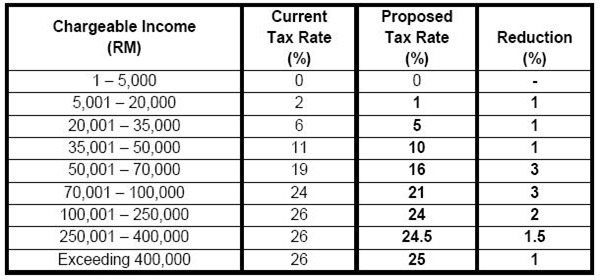

A graduated scale of rates of tax is applied to chargeable income of resident individual taxpayers starting from 0 on the first rm5 000 to a maximum of 30 on chargeable income exceeding rm2 000 000 with effect from ya 2020.

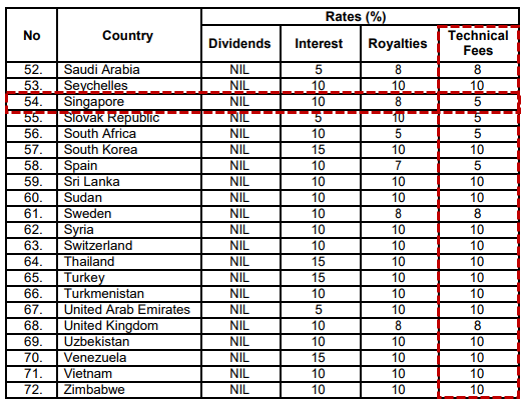

Income tax malaysia table. Other rates are applicable to special classes of income eg interest or royalties. Ibu pejabat lembaga hasil dalam negeri malaysia menara hasil persiaran rimba permai cyber 8 63000 cyberjaya selangor. Tax offences and penalties in malaysia. The personal income tax rates for 2018 2019 have been restructured and are different from previous year s rates.

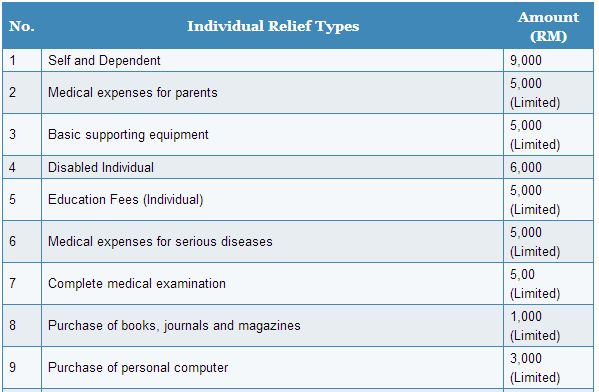

Below are the individual personal income tax rates for the year of assessment 2019 provided by the the inland revenue board irb lembaga hasil dalam negeri lhdn malaysia. However if you claimed rm13 500 in tax deductions and tax reliefs your chargeable income would reduce to rm34 500. For employees who receive wages salary exceeding rm5 000 the employee s contribution of 11 remains while the employer s contribution is 12. Based on this amount the income tax to pay the government is rm1 640 at a rate of 8.

About simple pcb calculator pcb calculator made easy. Non resident individuals pay tax at a flat rate of 30 with effect from ya 2020. What is income tax return. Calculations rm rate tax rm 0 5 000.

On the first 5 000 next 15 000. Simple pcb calculator is a monthly tax deduction calculator to calculate income tax required by lhdn malaysia. The following rates are applicable to resident individual taxpayers for ya 2020. How to file your taxes manually in malaysia.

Malaysia personal income tax rate. Income tax rates 2020 malaysia. As the clock ticks for personal income tax deadline in malaysia 2018 like gainfully employed malaysians you may have started visiting the lhdn malaysia website to do your e filing as both a proactive and precautionary measure. Taxable income myr tax on column 1 myr tax on excess over.

The acronym is popularly known for monthly tax deduction among many malaysians. On the first 20 000 next 15 000. An individual whether tax resident or non resident in malaysia is taxed on any income accruing in or derived from malaysia. Malaysia income tax e filing guide.

This guide is for assessment year 2017 please visit our updated income tax guide for assessment year 2019. Personal income tax rates. Here are the income tax rates for personal income tax in malaysia for ya 2019. How to file income tax as a foreigner in malaysia.

For employees who receive wages salary of rm5 000 and below the portion of employee s contribution is 11 of their monthly salary while the employer contributes 13. Pcb stands for potongan cukai berjadual in malaysia national language. How to pay income tax in malaysia. 205 tarikh kemaskini.