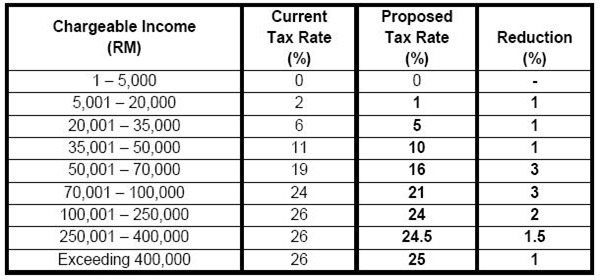

Income Tax Malaysia Rate

Here are the income tax rates for personal income tax in malaysia for ya 2019.

Income tax malaysia rate. However if you claimed rm13 500 in tax deductions and tax reliefs your chargeable income would reduce to rm34 500. The personal income tax rate in malaysia stands at 30 percent. With effect from ya 2020 a non resident individual is taxed at a flat rate of 30 on total taxable income. Calculations rm rate.

Based on this amount the income tax to pay the government is rm1 640 at a rate of 8. Other rates are applicable to special classes of income eg interest or royalties. Tax rm 0 5 000. A graduated scale of rates of tax is applied to chargeable income of resident individual taxpayers starting from 0 on the first rm5 000 to a maximum of 30 on chargeable income exceeding rm2 000 000 with effect from ya 2020.

Non resident individuals pay tax at a flat rate of 30 with effect from ya 2020. On the first 5 000. The gross amount of interest royalty and special income paid by the payer to a nr payee are subject to the respective withholding tax rates of 15 10 and 10 or any other rate as prescribed under the double taxation agreement between malaysia and the country where the nr payee is a tax resident.