Income Tax Malaysia 2018

Akta cukai pendapatan 1967.

Income tax malaysia 2018. Any individual earning more than rm34 000 per annum or roughly rm2 833 33 per month after epf deductions has to register a tax file. 10 paying income tax due accordingly may avoiding you from being charged tax increase court action and also stoppage from leaving malaysia. Lanjutan daripada itu pengeluaran stokc juga akan diberhentikan. In order to promote affordable accommodation to the needful the malaysian government through budget 2018 offered a tax exemption of 50 on statutory income of rental received by malaysian citizens.

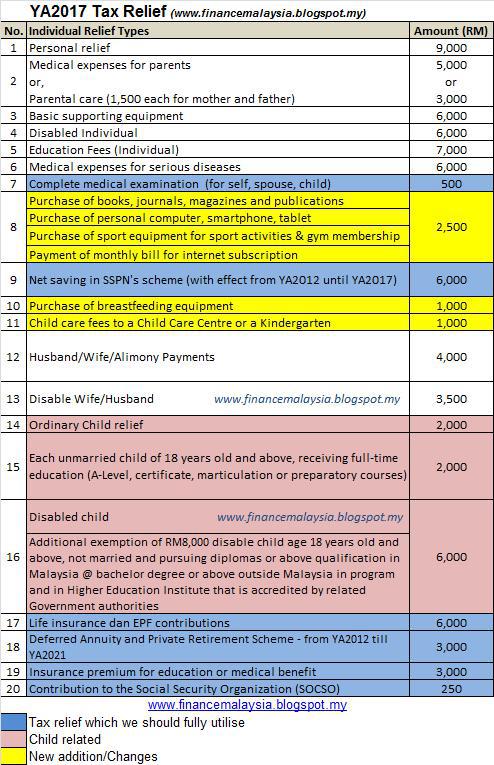

Mulai 18 mac 2019 lembaga hasil dalam negeri malaysia lhdnm tidak lagi menerima permohonan untuk sijil taraf orang kena cukai stokc. 31st august 2020 is the final date for submission of form b year assessment 2019 and the payment of income tax for individuals who earn business income. For year of assessment 2018 the rates for lower brackets earners have been decreased from 5 to 3 10 to 8 and 16 to 14 for the year of assessment 2018. Lembaga hasil dalam negeri malaysia inland revenue board of malaysia.

Total deposit in year 2018 minus total withdrawal in year 2018 6 000 limited. Calculations rm rate. On the first 5 000. Income tax is a type of tax that governments impose on individuals and companies on all income generated.

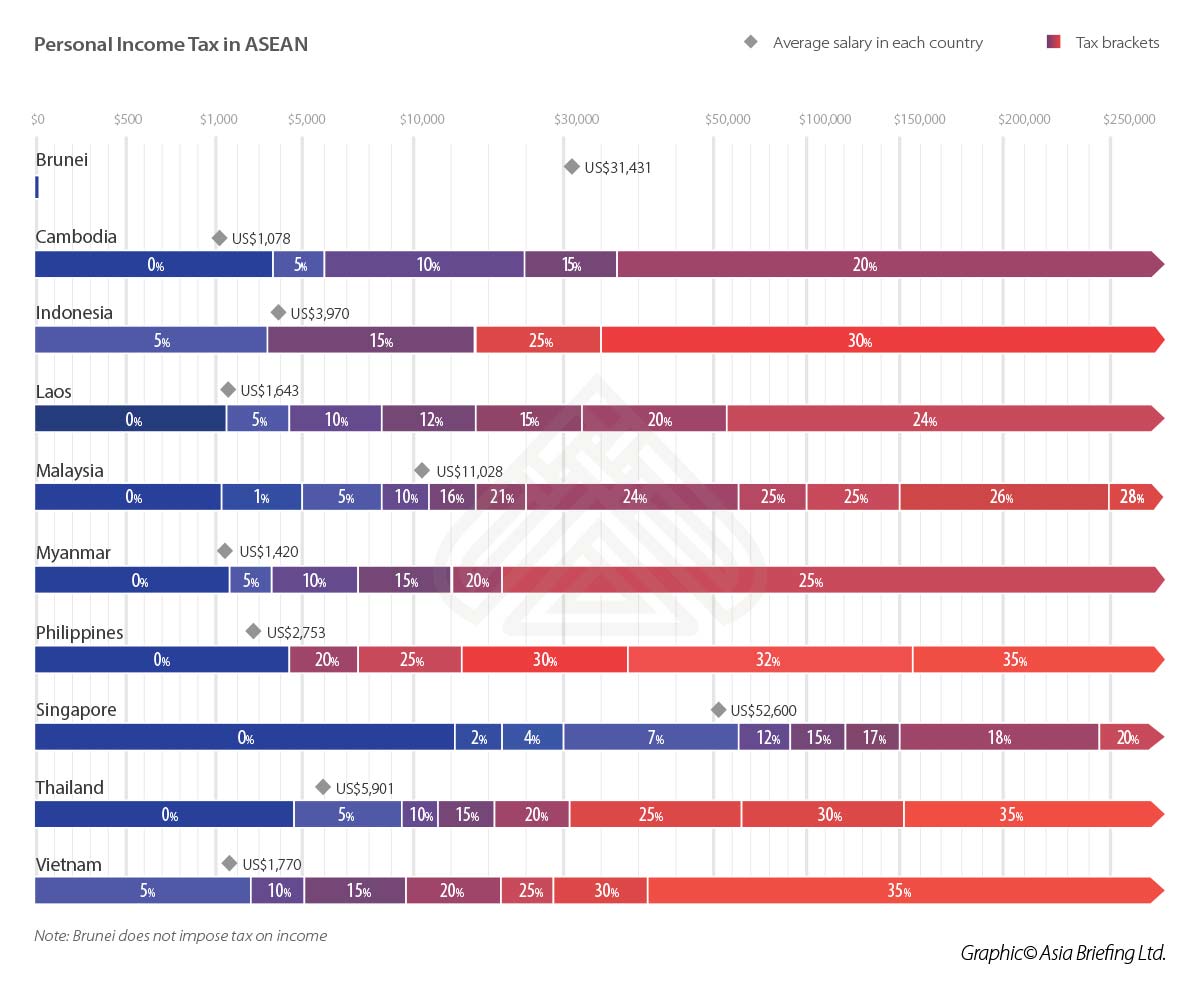

The standard corporate tax rate is 24 while the rate for resident and malaysian incorporated small and medium sized companies smes i e. Companies capitalized at myr 2 5 million or less and that are not part of a group containing a company exceeding this capitalization threshold is 18 on the first myr 500 000 with the balance taxed at the 24 rate. Useful reference information for malaysia s income tax 2018 filing deadline for year of assessment 2017 for be is apr 30 2018 manual form and may 15 2018 e filing. Tax rm 0 5 000.

What is income tax. Who needs to pay income tax. Receiving further education in malaysia in respect of an award of diploma or higher excluding matriculation preparatory courses. These new rates will apply for those who have accumulated their income from january 2018 to december 2018 and are filing their taxes from march april 2019.

E filing bermula 1 mac 2018 close. If you re still in the dark here s our complete guide to filing your income taxes in malaysia 2019 for the year of assessment 2018. Income tax malaysia 2018.