Income Tax Calculator 2019

At the same time you may prefer to have less tax withheld up front so you receive more in your paychecks and get a smaller refund at tax time.

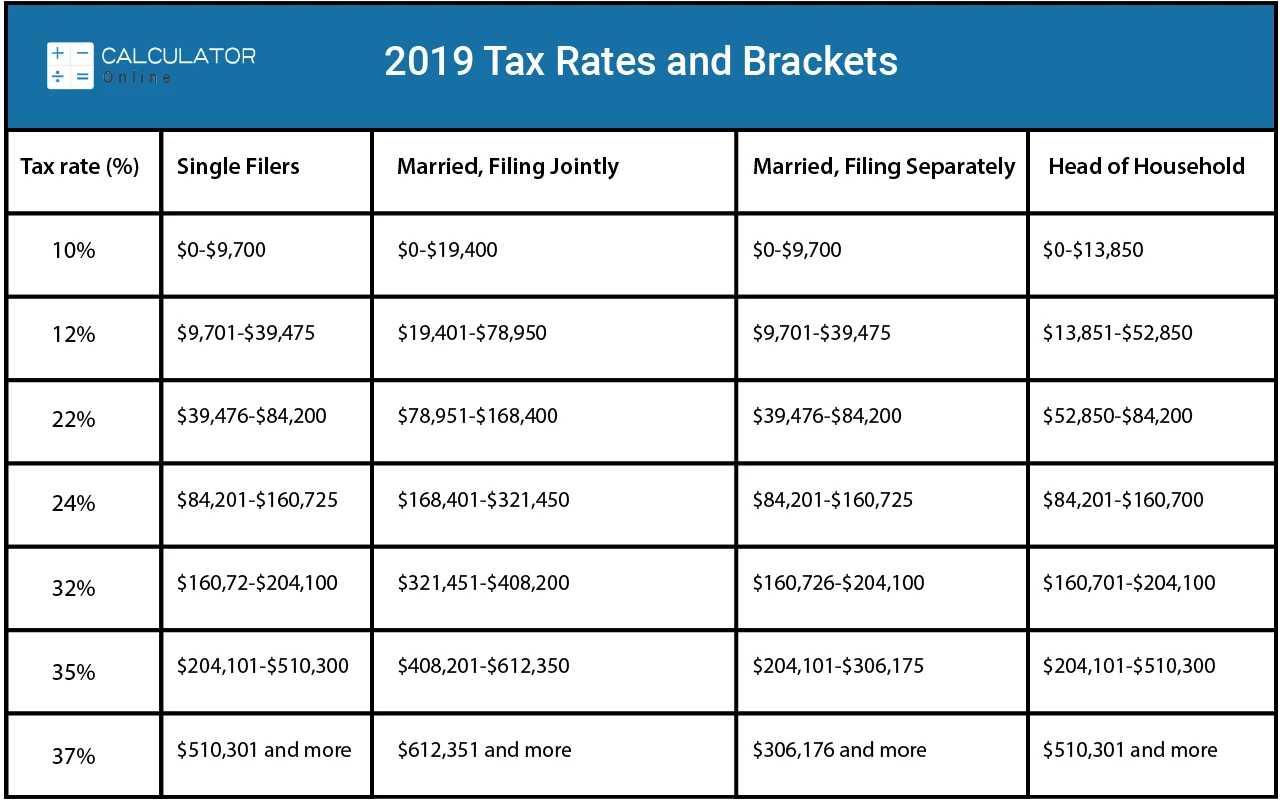

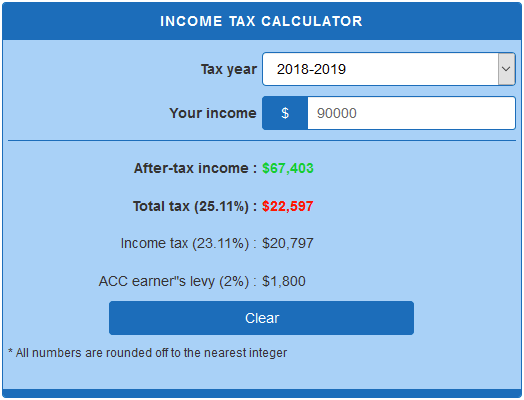

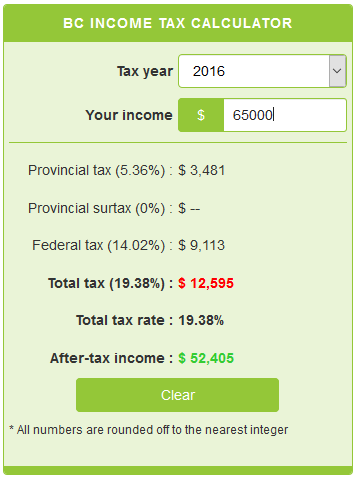

Income tax calculator 2019. Your marginal federal income tax rate remained at 12 00. Income tax calculator 2019 estimate your tax refund quickly estimate your 2019 tax refund amount with taxcaster the convenient tax return calculator that s always up to date on the latest tax laws. Income tax calculator estimate your 2019 tax refund answer a few simple questions about your life income and expenses and our free tax refund estimator will give you an idea of how much you ll get as a refund or owe the irs when you file in 2020. Your marginal federal income tax rate remained at 22 00.

We strive to make the calculator perfectly accurate. This calculator computes federal income taxes state income taxes social security taxes medicare taxes self employment tax capital gains tax and the net investment tax. Your effective federal income tax rate changed from 7 93 to 7 86. It is mainly intended for residents of the u s.

Use this free tax return calculator to estimate how much you ll owe in federal taxes on your 2019 return using your income deductions and credits in just a few steps. The income tax department never asks for your pin numbers passwords or similar access information for credit cards banks or other financial accounts through e mail. And is based on the tax brackets of 2019 and 2020. The income tax calculator estimates the refund or potential owed amount on a federal tax return.

Your federal income taxes changed from 3 174 to 3 147. The provided information does not constitute financial tax or legal advice. Get started filing status. Your federal income taxes changed from 5 818 to 5 693.

Tax calculator estimate your 2019 tax return see how income withholdings deductions and credits impact your 2019 tax refund or balance due amount. This interactive free tax calculator provides accurate insight into how much you may get back this year or what you may owe before you file. When should you use the estimator if you changed your withholding for 2019 the irs reminds you to be sure to recheck your withholding at the start of 2020. Total estimated 2019 tax burden.

Your effective federal income tax rate changed from 10 22 to 10 00.