Income Tax 2018 Malaysia

On the first 5 000.

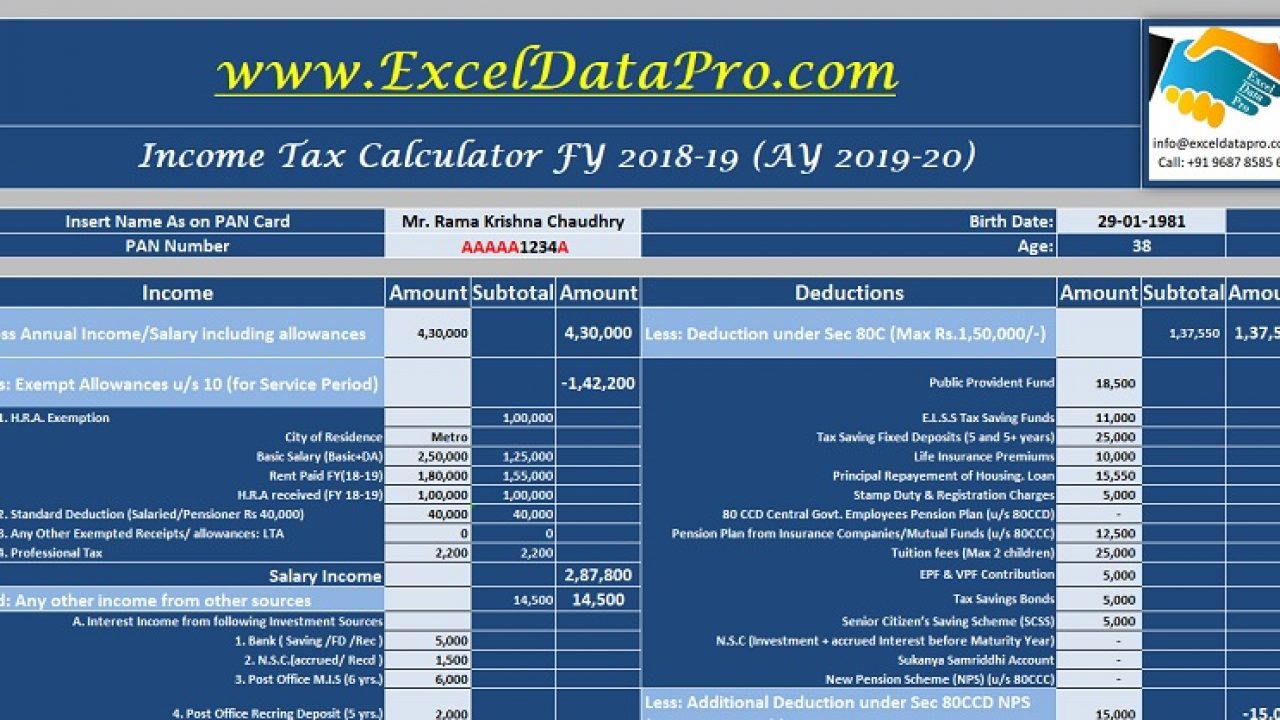

Income tax 2018 malaysia. Answering yes to reasons listed above means that it is compulsory for you to file your income tax in malaysia. What is income tax. If it s anywhere below rm34 0000 rm2 833. Calculations rm rate.

Taxable income myr tax on column 1 myr tax on excess over. Mulai 18 mac 2019 lembaga hasil dalam negeri malaysia lhdnm tidak lagi menerima permohonan untuk sijil taraf orang kena cukai stokc. Income tax malaysia 2018. 33 per month after epf deduction or rm38 202 25 per year rm3 183 52 per month before epf deductions then you will have the option to do away with tax filing.

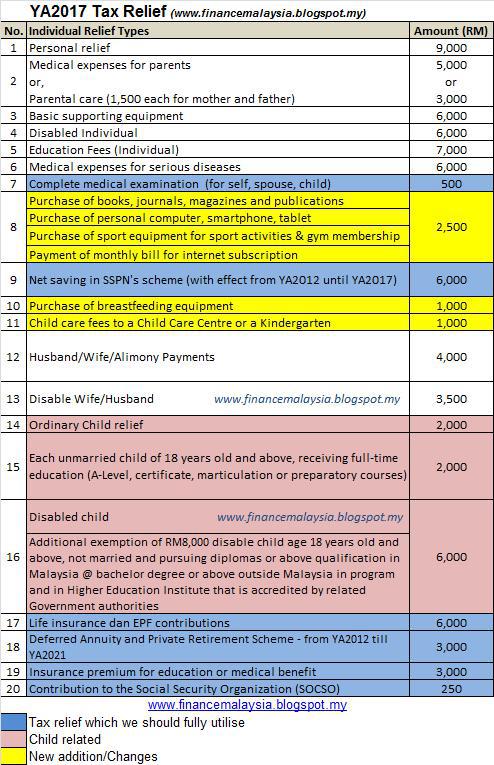

Receiving further education in malaysia in respect of an award of diploma or higher excluding matriculation preparatory courses. Total deposit in year 2018 minus total withdrawal in year 2018 6 000 limited. There are no other local state or provincial. If you re still in the dark here s our complete guide to filing your income taxes in malaysia 2019 for the year of assessment 2018.

Useful reference information for malaysia s income tax 2018 filing deadline for year of assessment 2017 for be is apr 30 2018 manual form and may 15 2018 e filing. The following rates are applicable to resident individual taxpayers for ya 2020. Untuk makluman stokc adalah pengesahan yang dikeluarkan oleh lhdnm ke atas status seseorang yang dikenakan cukai di malaysia. An effective petroleum income tax rate of 25 applies on income from petroleum operations in marginal fields.

Who needs to pay income tax. Any individual earning more than rm34 000 per annum or roughly rm2 833 33 per month after epf deductions has to register a tax file. What are the income tax rates in malaysia in 2017 2018. Malaysia personal income tax rate a graduated scale of rates of tax is applied to chargeable income of resident individual taxpayers starting from 0 on the first rm5 000 to a maximum of 30 on chargeable income exceeding rm2 000 000 with effect from ya 2020.

Income tax is a type of tax that governments impose on individuals and companies on all income generated. Tax rm 0 5 000. No other taxes are imposed on income from petroleum operations. Non resident individuals pay tax at a flat rate of 30 with effect from ya 2020.

Personal income tax rates. Special relief of rm2 000 will be given to tax payers earning on income of up to rm8 000 per month aggregate income of up to. An individual whether tax resident or non resident in malaysia is taxed on any income accruing in or derived from malaysia. Malaysia has a fairly complicated progressive tax system.

There s a lower limit of earnings under which no tax is charged and then a progressively higher tax rate is applied based on how much you earn above that level.