Importance Of Retirement Planning In Malaysia

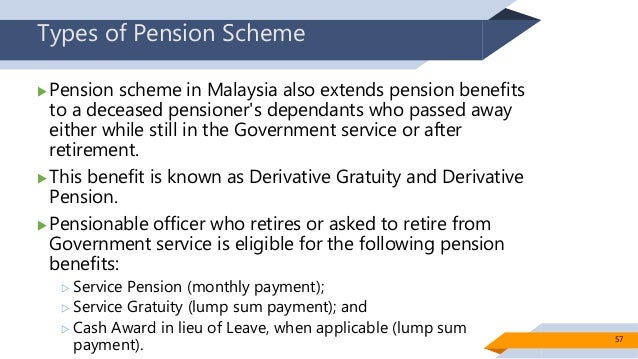

From a government perspective its 60 years old.

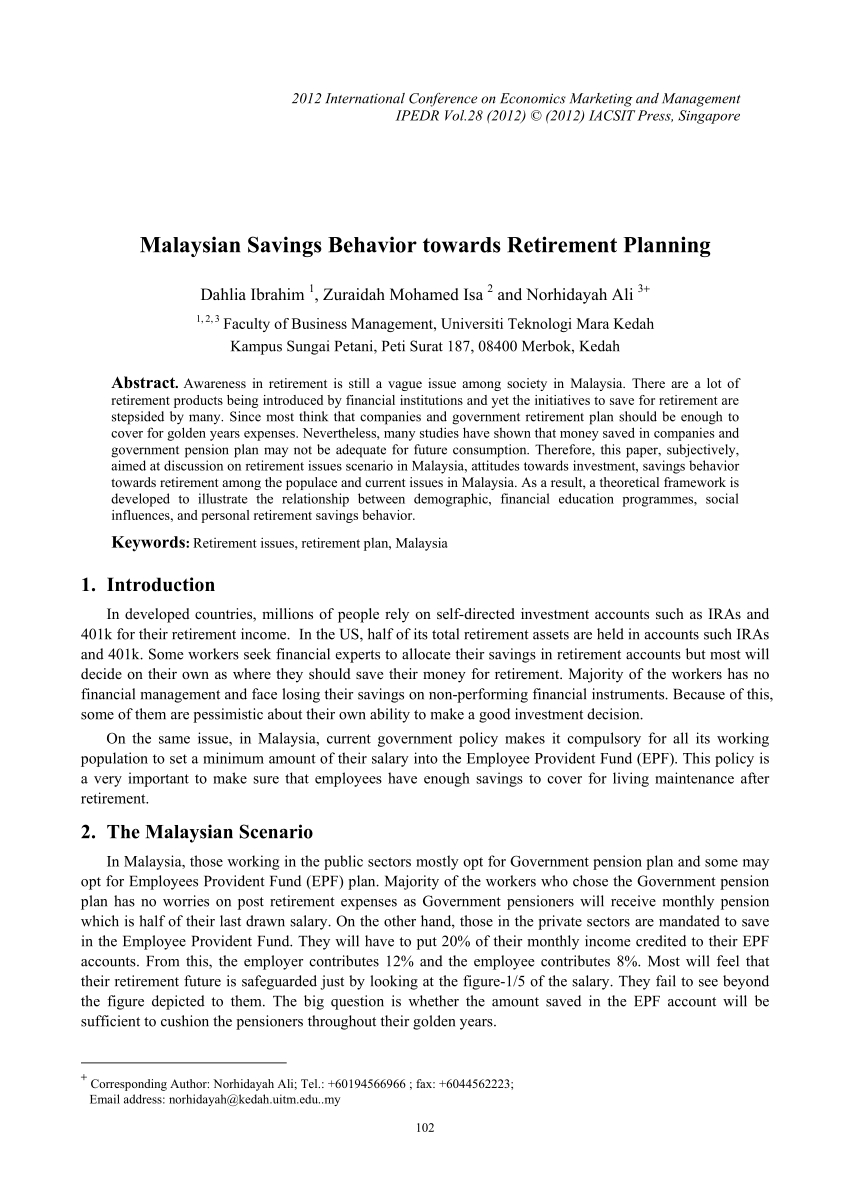

Importance of retirement planning in malaysia. Your retirement can contribute to your family too. Currently the retirement plans available in malaysia such as employee provident fund epf. In essence people are worried about retirement. Retirement is the next great journey in life and can even be broken into three main phases says de alwis.

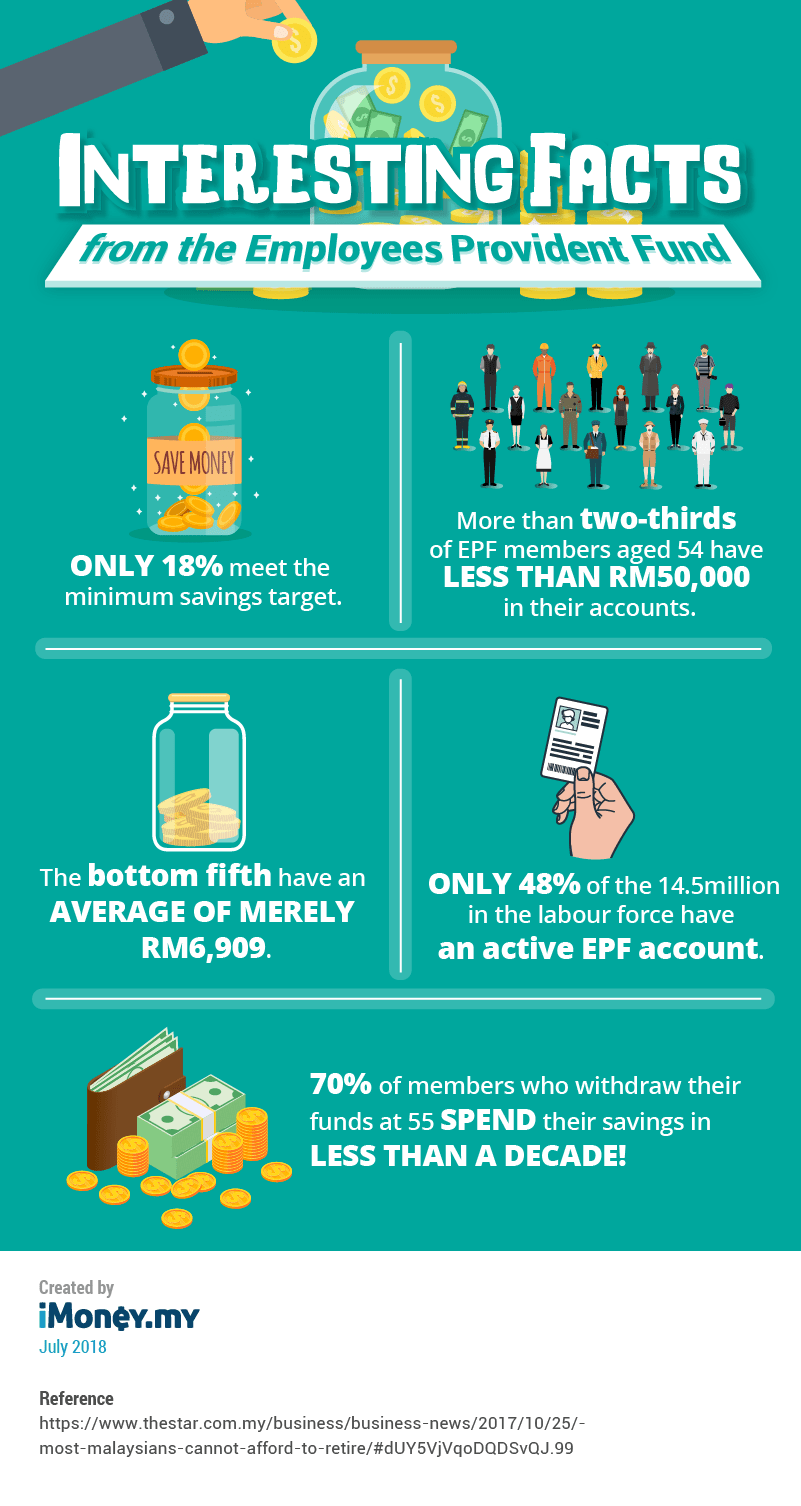

This is measured by the cpi consumer price index indicator from department of statistics of malaysia. Best retirement plan malaysia. Last year the employees provident fund epf raised the minimum savings target to rm228 000 by the age of 55. 4 important questions in retirement planning.

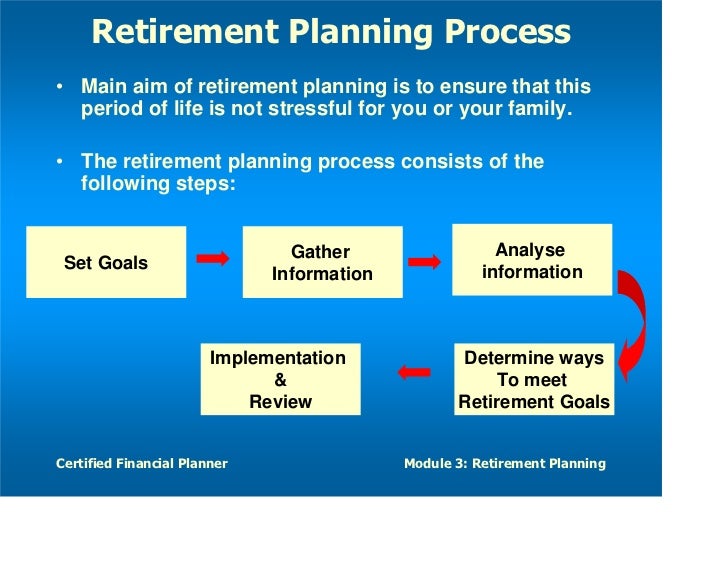

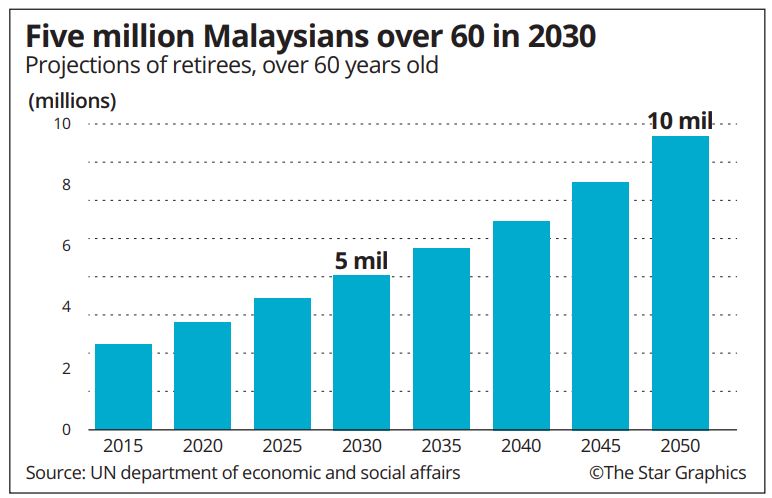

We often go on an autopilot cruise mode through adulthood taking things on as they come whether it s buying a house raising a child or planning for the next holiday. According to him malaysians sorely need a wake up call to understand that retirement is a whole life chapter that needs careful planning and consideration. The importance of retirement planning is a call in malaysia due to fast ageing population in the country. Miscalculations in terms of your retirement fund can be caused by common misconceptions such as these.

This means a monthly retirement income of the only rm950 per month assuming a life expectancy of 75 years old. So is your retirement fund sufficient. Manage the inflation risk and outlive your retirement nest egg inflation in malaysia averages between 2 to 3 per year. 1 retire in malaysia.

Most companies in malaysia have this as the retirement age you can opt for. With all the talk revolving around the epf withdrawal age lately the topic of the best retirement plan in malaysia seems to be on the tip of everybody s tongue. The deputy governor of bank negara malaysia bnm abdul rasheed ghaffour advocated that financial literacy has become a key life skill especially since only about 40 of malaysians are ready for retirement. Retirement planning is rarely the top of mind topic for many people except perhaps for financial planners.

We take 3 as conservative estimate for computation for living costs in retirement planning. Proper retirement planning is necessary in the event you need to cover any long term care that you may require later in your life. I set 55 years old as my retirement age. You want to get as many years to retirement as possible so start early and built this bridge.

Retirement is an expensive state of affairs but it doesn t have to be a cause for concern if you ve already begun saving for it. However with the rising cost of living and a longer lifespan for malaysians coupled with increasing inflation planning for our golden years aka retirement is a more. Parents influence on retirement planning in malaysia article pdf available in family and consumer sciences research journal 45 3 315 325 march 2017 with 841 reads how we measure reads.