How To Submit Form E

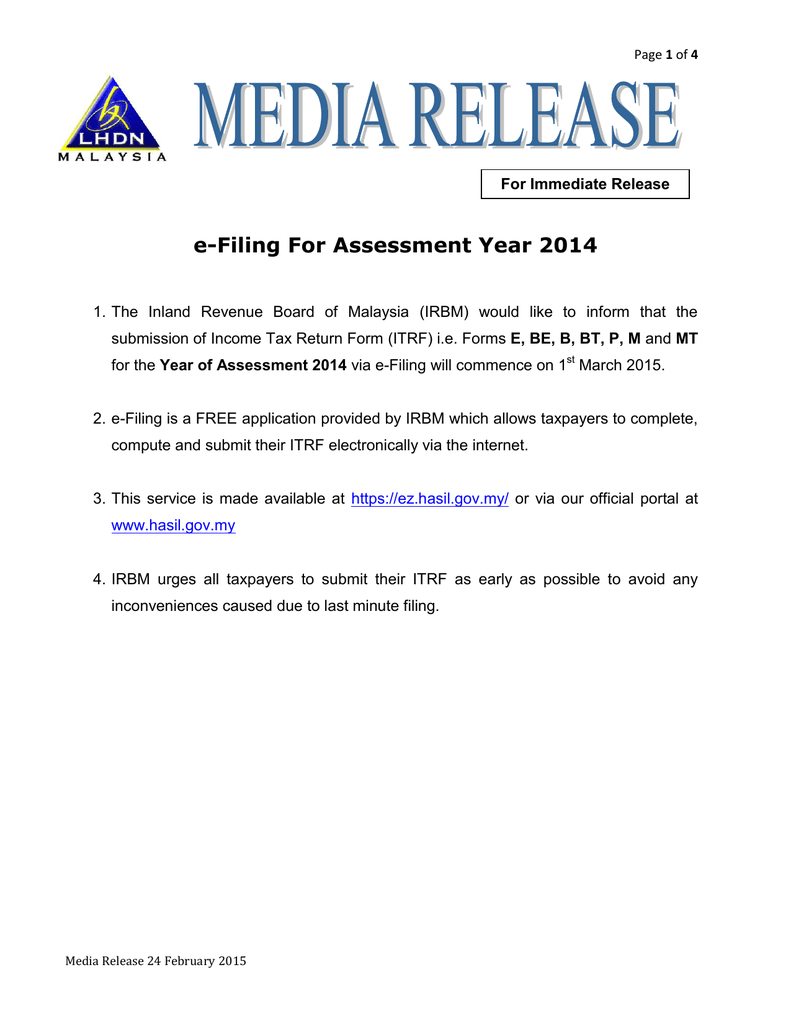

Kindly note that minimum fine of rm200 will be imposed by irb for failure to prepare and submit the form e and cp8d to irb as well as prepare and deliver form ea to the employees.

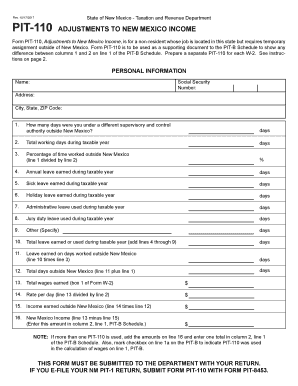

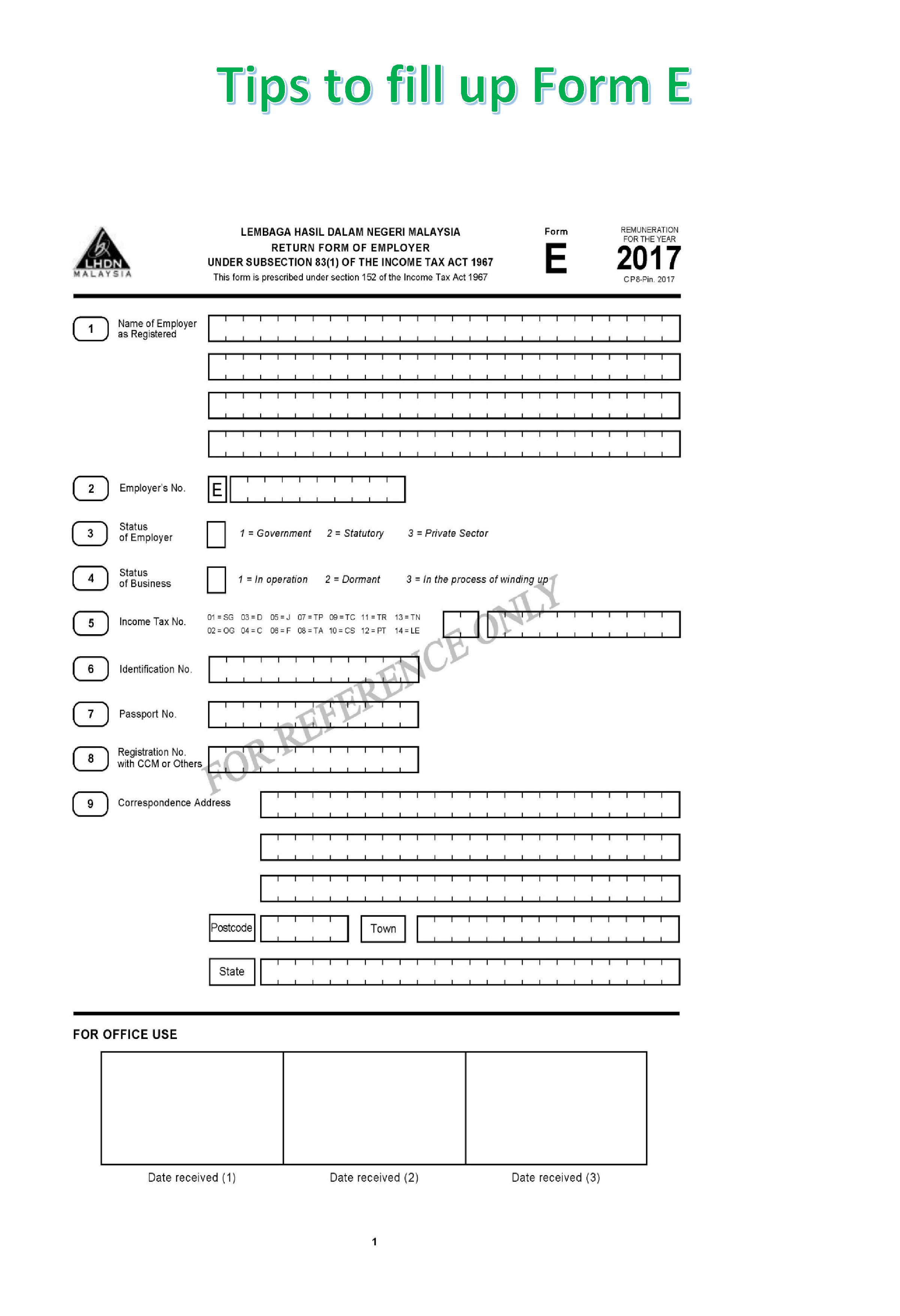

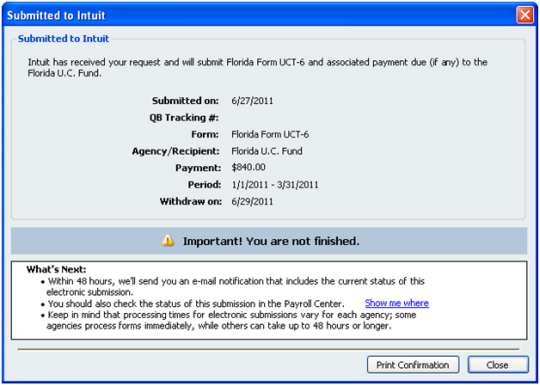

How to submit form e. Go to payroll info. Failure to do so will result in the irb taking legal action against the company s director. Scroll down to year end tax and select the correct tax year. However to encourage employers to furnish form e via e filing irbm will extend the due date until 30 april 2017.

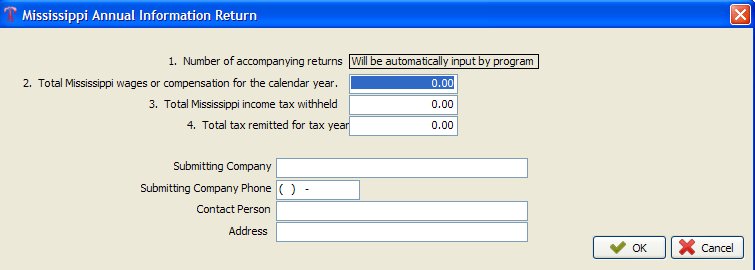

Therefore the information of employee s income on a form e must be consistent with the information stated on an employee s ea form. What if you fail to submit borang e and cp8d. Form e field by the employer is in fact where the irb can do a cross check on whether an employee is reporting his income correctly. Lastly select generate txt file under form e.

Scan and attach form 8453 emp employment tax declaration for an irs e file return. I want a tax professional to file for me. Go to company information. Use the authorized irs e file provider locator service to find a tax professional who can submit the forms for you.

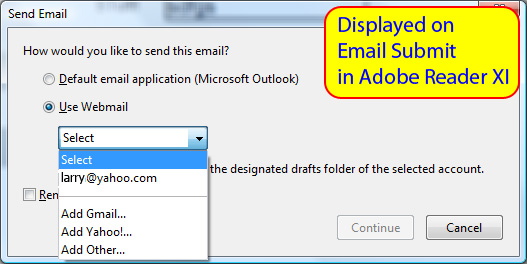

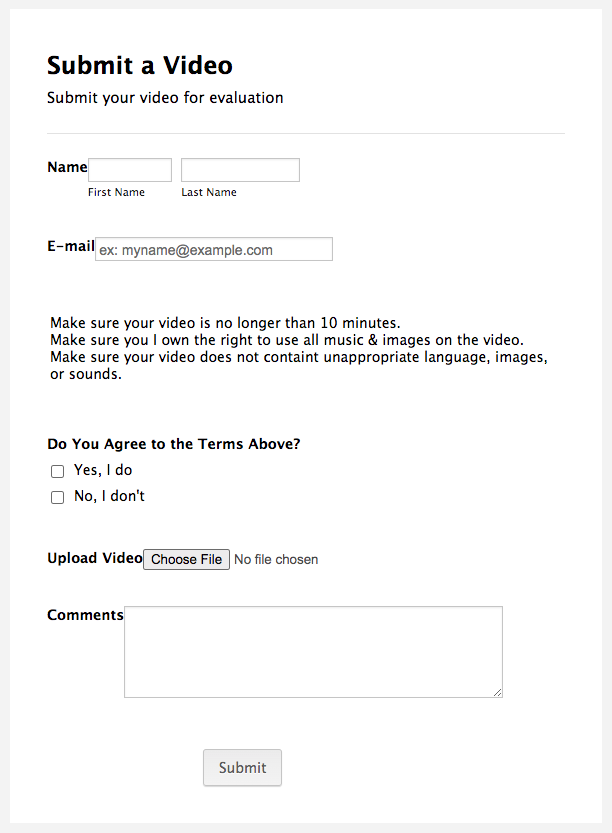

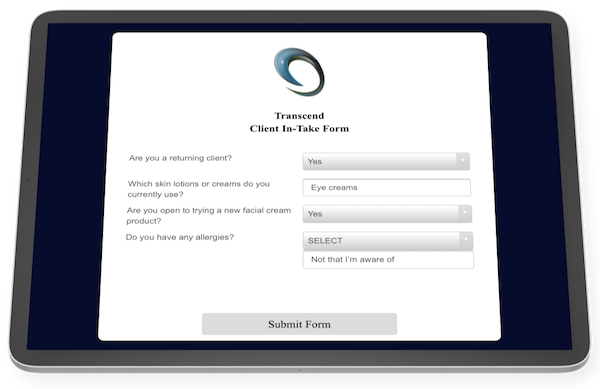

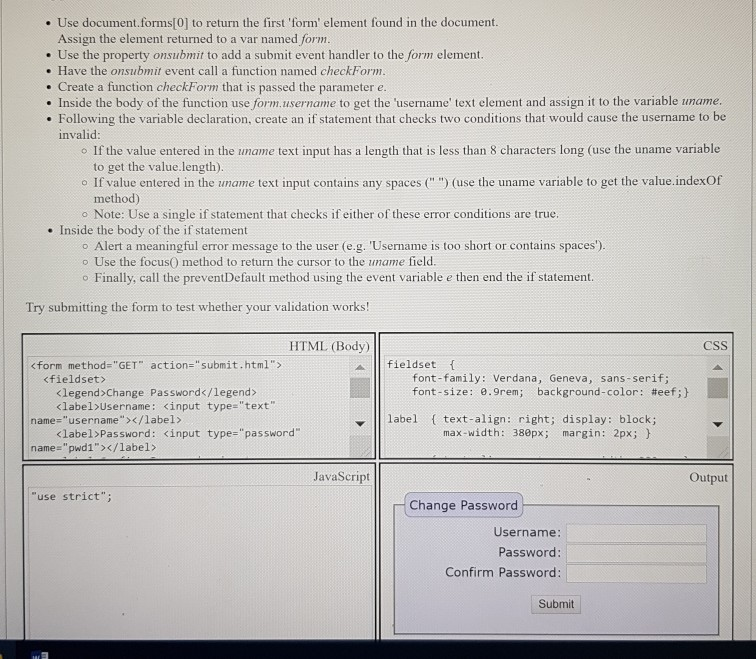

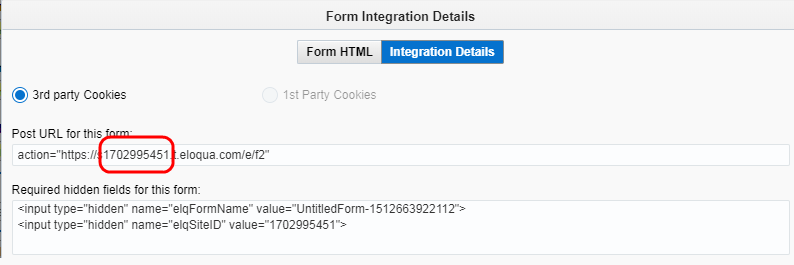

However we encourage e filing for anyone required to file form 2290 who wants to receive quick delivery of their watermarked schedule 1 with e file you ll receive it almost immediately after we accept your e filed form 2290. Unlike form e employers do not need to submit ea form to irb. Employers other than companies have the option to submit form e via e filing or manually paper form. The input type submit defines a button for submitting the form data to a form handler.

You must e file your form 2290 heavy highway vehicle use tax return if you are filing for 25 or more vehicles. The form handler is typically a file on the server with a script for processing input data. How do i submit form e. Submit form e to lhdn via e filing.

/how-and-when-to-file-form-941-for-payroll-taxes-398365_FINAL-3e897153189040e99df9b89437493b7b.png)

:max_bytes(150000):strip_icc()/w2-9ca13523f4d74e958b821aab63af2e60.png)