How To Submit Form E Online

:max_bytes(150000):strip_icc()/Form-w4-e54ebb209cbc48b48541a54b07e2d5c2.jpg)

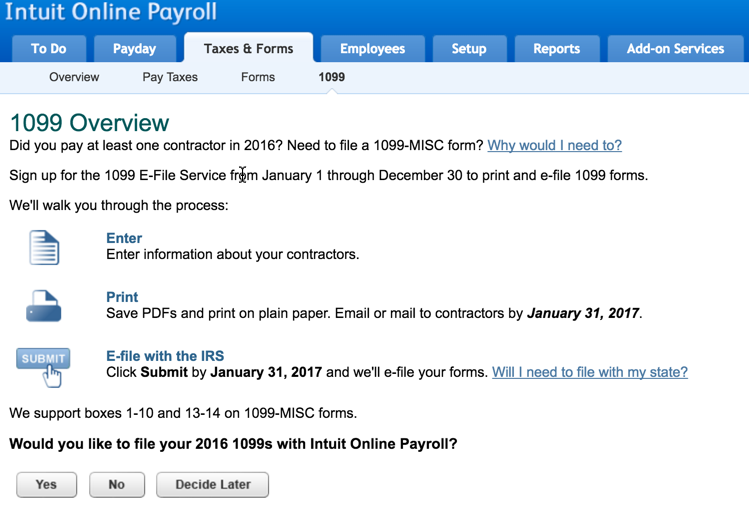

Submitting your application online provides you with several benefits.

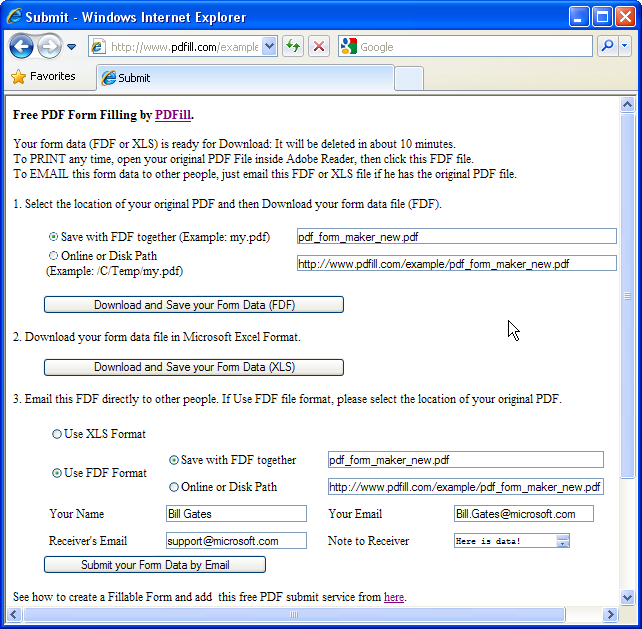

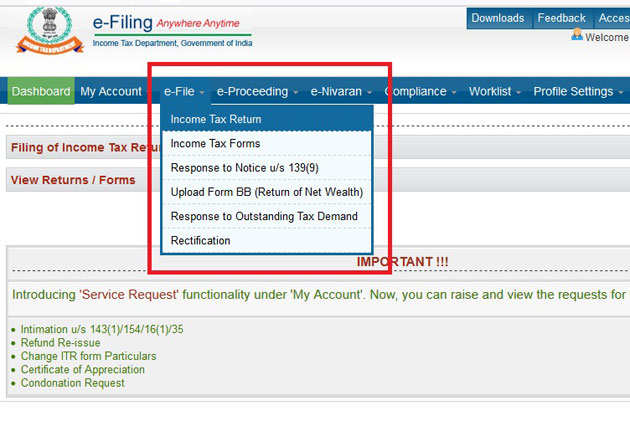

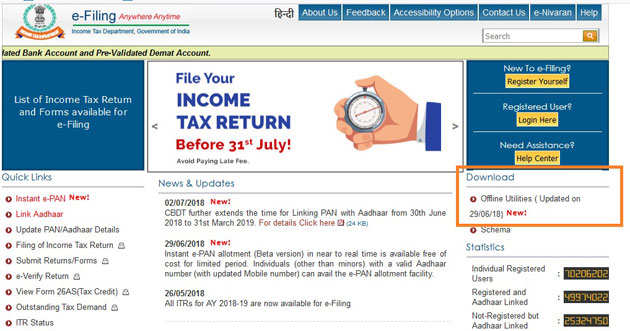

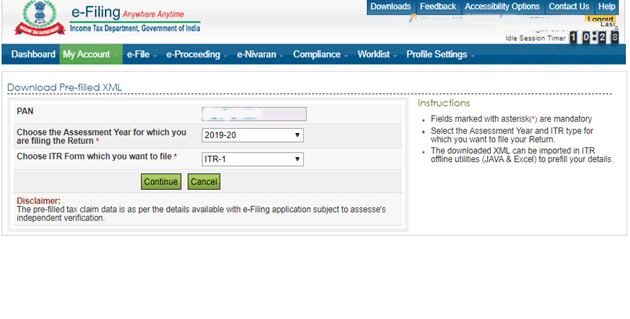

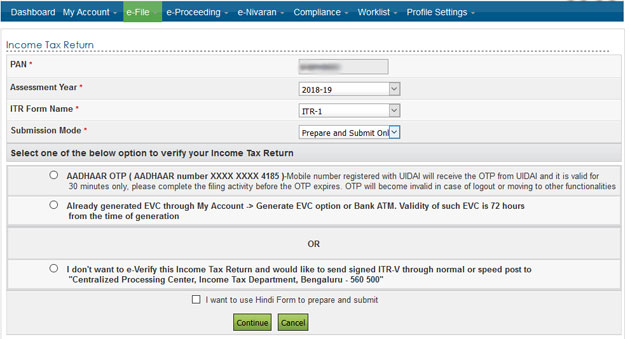

How to submit form e online. Mandatory e filing staring next year. It is time to start preparing the form e return form of employer remuneration for the last calendar year. Get helpful instructions and tips from uscis as you complete your form using our secure online filing system avoid common mistakes and pay your fees online. Therefore the information of employee s income on a form e must be consistent with the information stated on an employee s ea form.

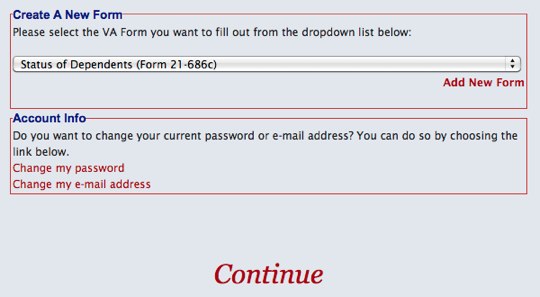

Lastly select generate txt file under form e. If you will be submitting forms as or on behalf of a federal firearms licensee ffl or to import defense. Basically its a form of declaration report to inform the irb on the number of employees and the list of employee s income details and must be submitted by 31st march of each calendar year. If you are submitting form 6 for your personal use no additional registration steps are necessary.

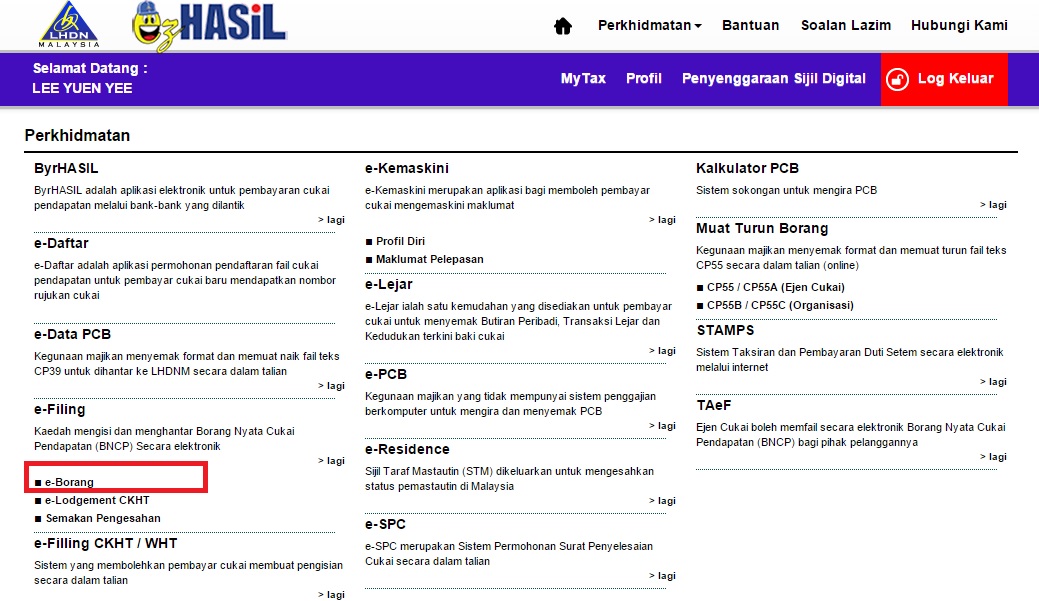

Form e borang e is a form required to be fill and submit to inland revenue board of malaysia ibrm by an employer. Form e field by the employer is in fact where the irb can do a cross check on whether an employee is reporting his income correctly. Go to payroll info. Go to company information.

Employer s responsibilities if you have an employee during last year it is mandatory to submit form e borang e to lhdn inland revenue board irb by upcoming 31 march. These are just a few of the many benefits filing online offers. This is a one time registration process and you must apply at least 45 days before you plan to file electronically. Dear reader reminder for prepare form e.

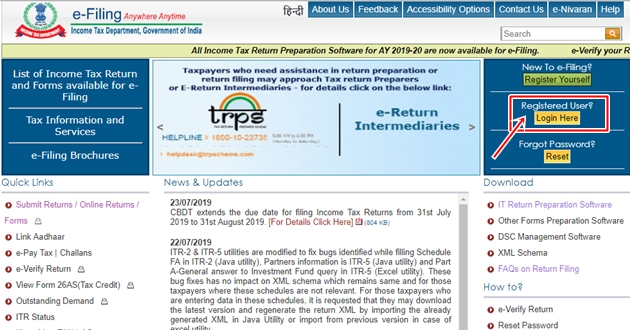

Form 5300 11 annual firearms manufacturing and exportation report under 18 u s c chapter 44 firearms additional registration steps. Employers may still submit form e manually to irb this year for year of assessment 2015 submission. Tax professionals who plan to file forms 990 990 ez 990 pf or 1120 pol electronically must submit a new or revised electronic irs e file application using the electronic e services application.

/w2-9ca13523f4d74e958b821aab63af2e60.png)