How To Register Income Tax

Ntn or registration number for aop and company is the 7 digits ntn received after e enrollment.

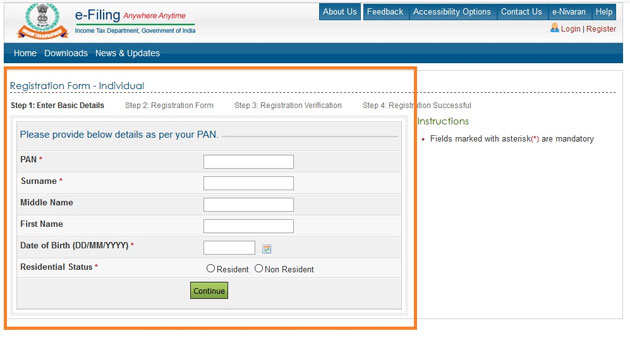

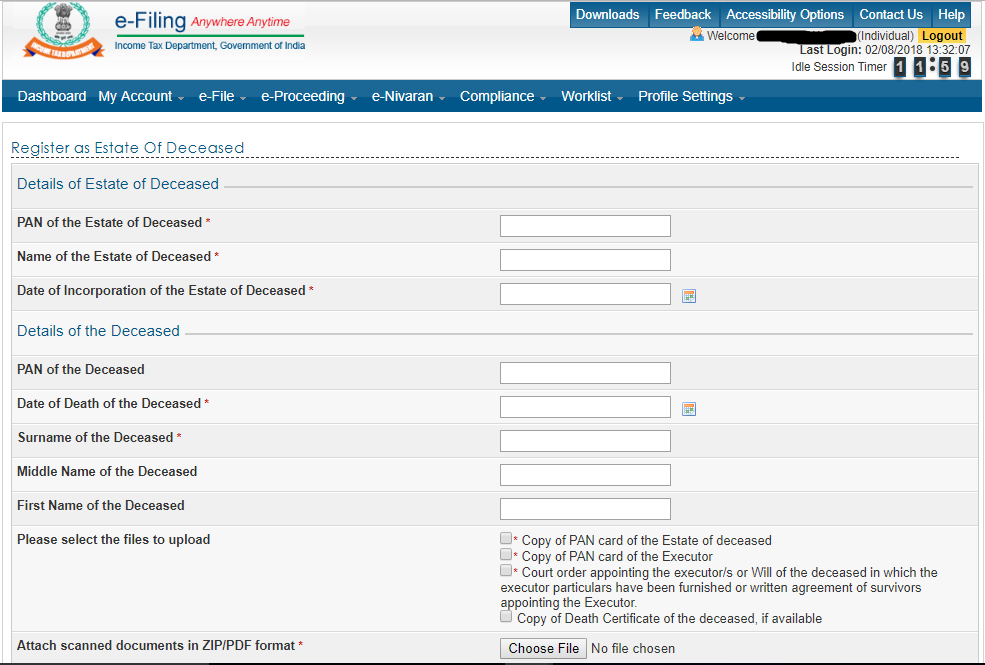

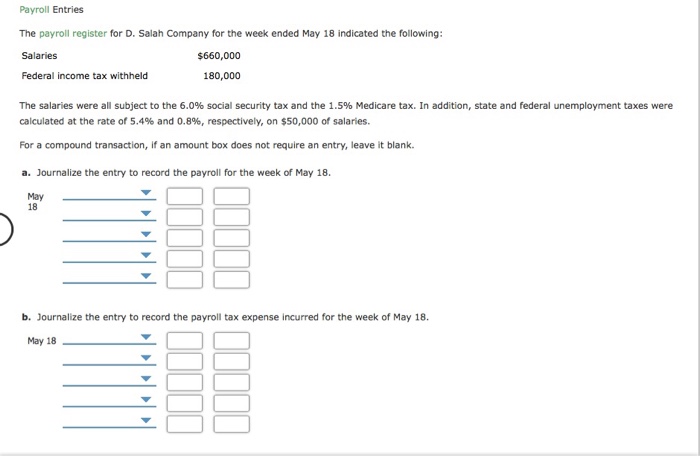

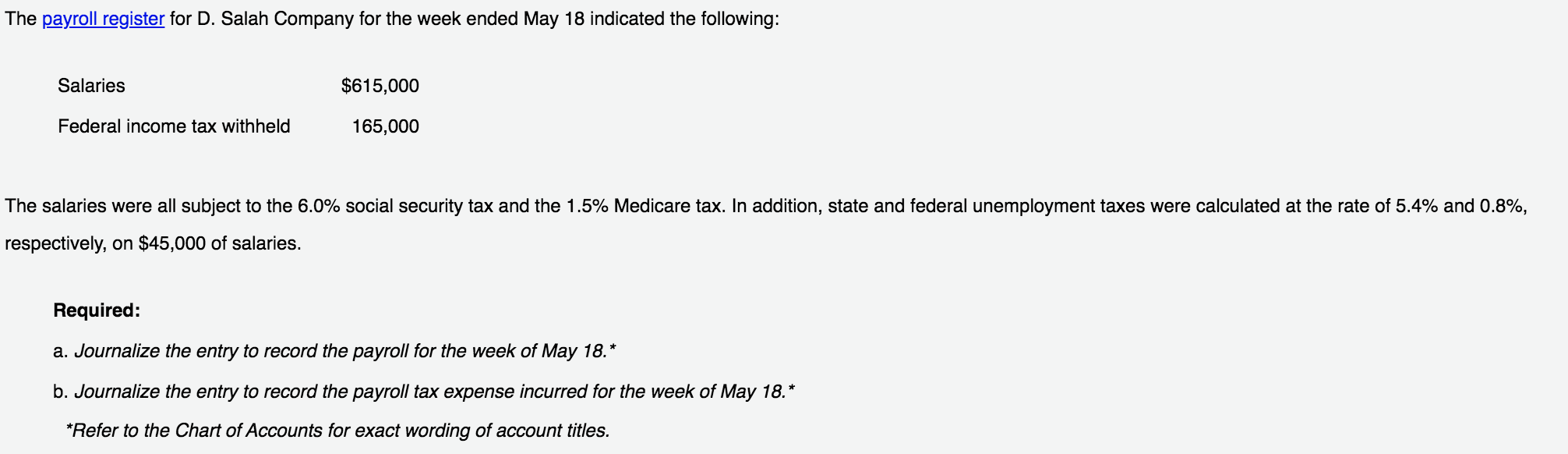

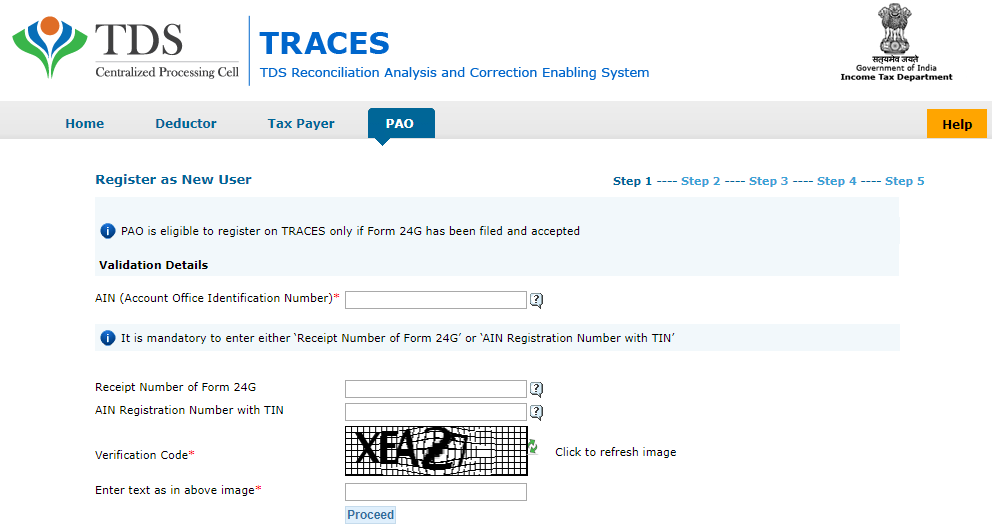

How to register income tax. Follow the steps below to register yourself. Individual who has business income. If you are not yet registered you would only be required to visit a sars branch to register for the first time. Click continue provide pan of the huf name of.

After you register we mail you a personal identification number pin you use to activate your account. Who are required to register income tax file. C valid current address. Register online through e daftar visit the official inland revenue board of malaysia website.

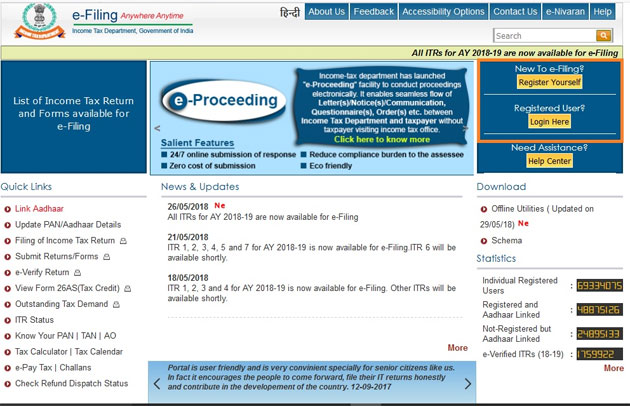

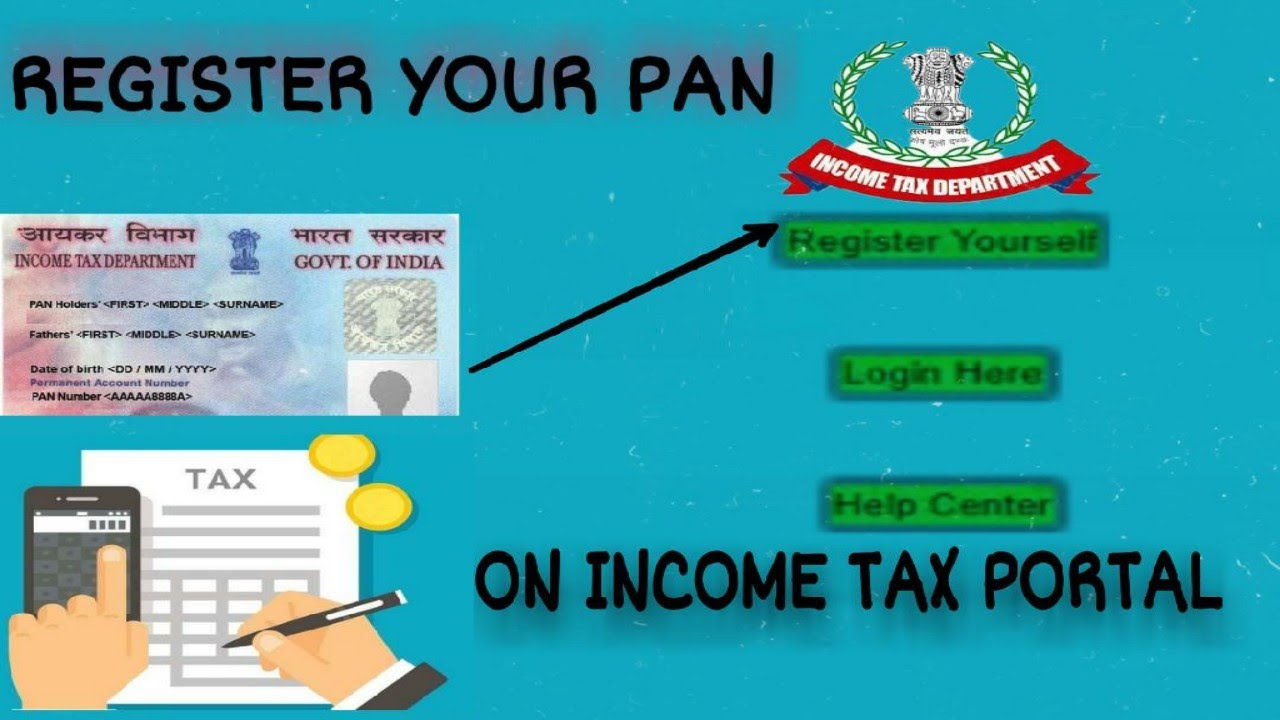

Click on register yourself. We mail the pin to the address associated to the tax professional id you provided during registration. An application via internet for the registration of income tax file for individuals companies employer partnership and limited liability partnership llp. The first step of filing your income tax return is to register yourself with federal board of revenue fbr.

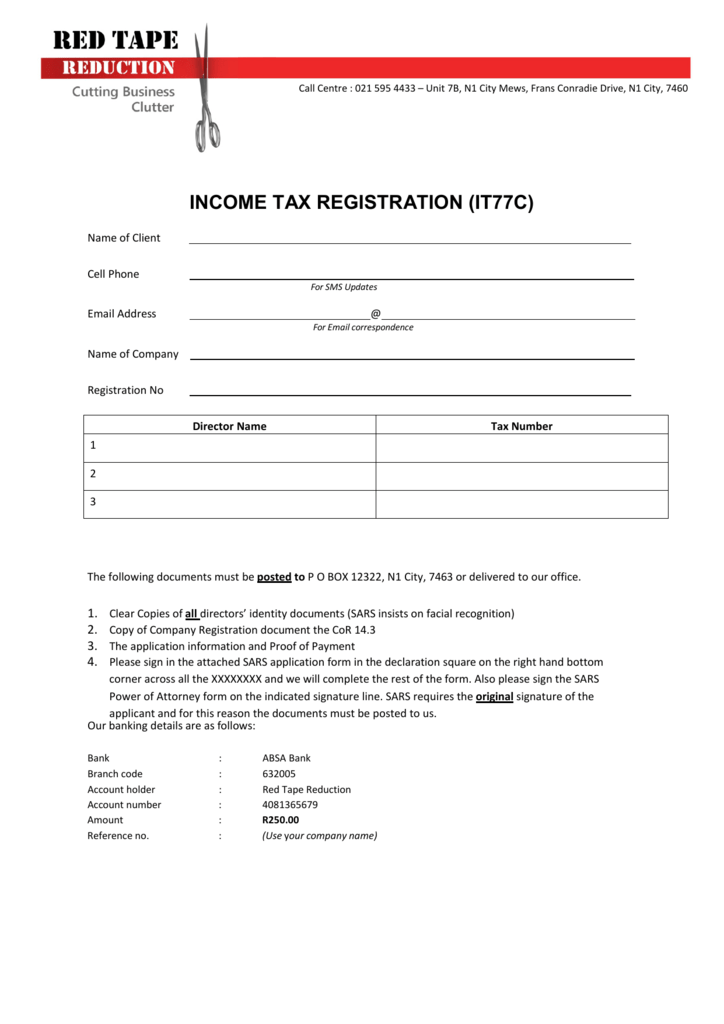

Please upload your application together with the following document. You must register for income tax if you earn a taxable income which is above the tax threshold see above you must register as a taxpayer with sars. Obtaining an income tax number if you do not hold but require an income tax number you should. For example if you register for myftb using your ptin we mail your pin to the address provided to the irs when you renewed or registered for your ptin.

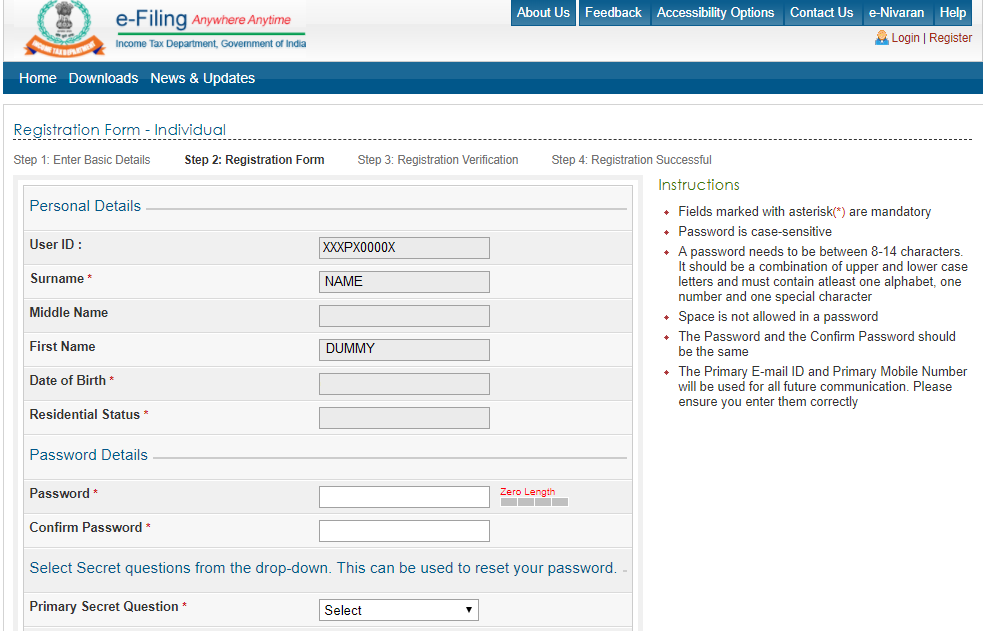

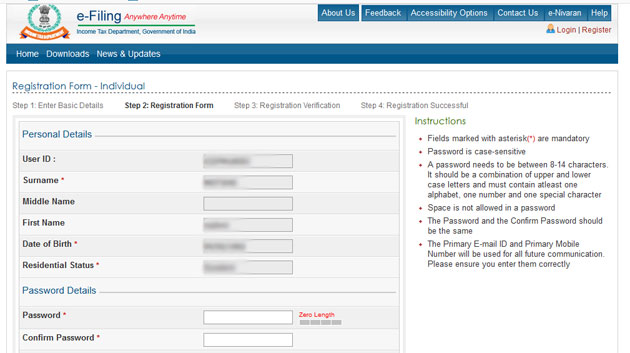

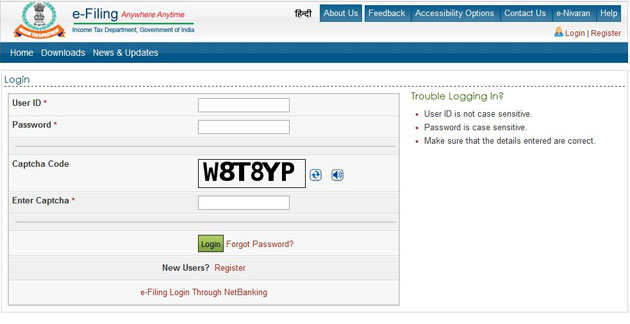

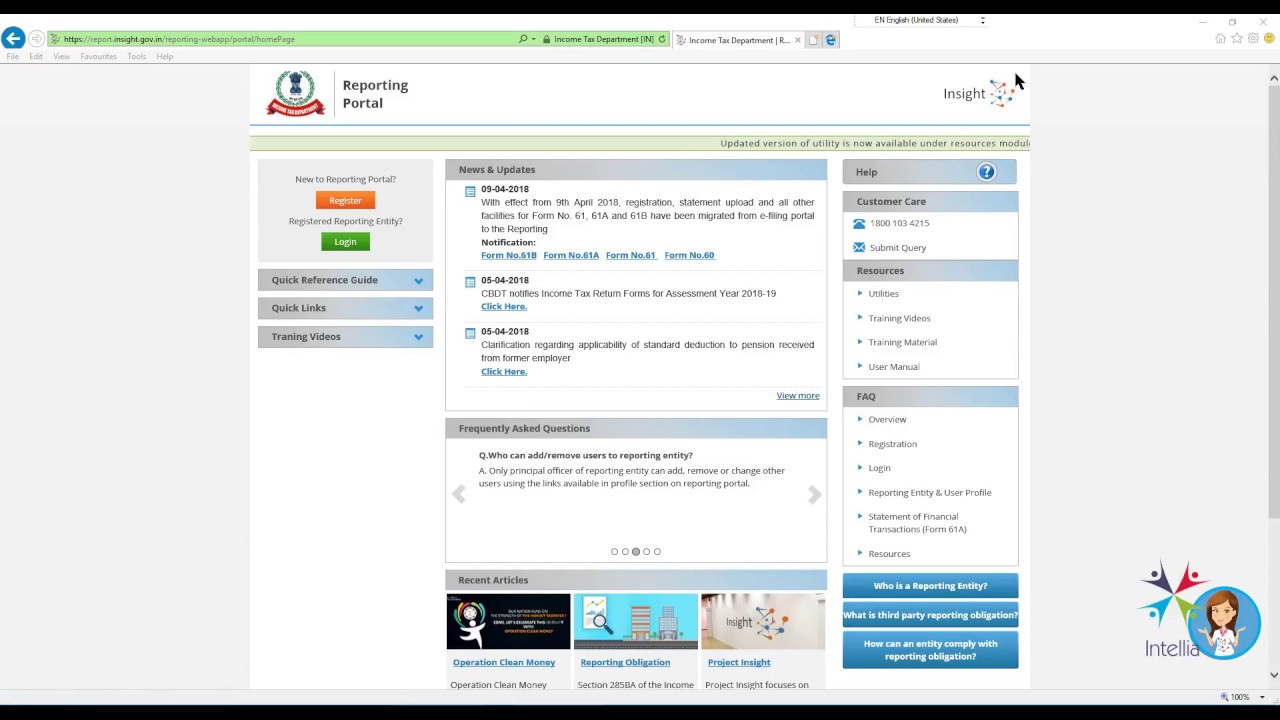

Individual who has income which is liable to tax. Visit the e filing portal www incometaxindiaefiling gov in click register yourself button located at right side of the home page. For income tax registration individual can register online through iris portal. In case of individuals 13 digits computerized national identity card cnic will be used as ntn or registration number.

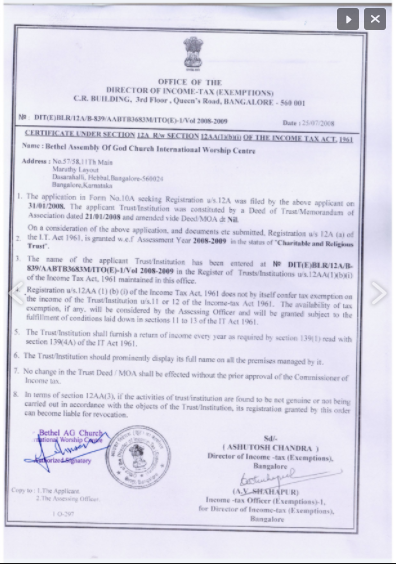

Perform the following steps to register as a huf user. Check the application status using the application no. Employee who is subject to monthly tax deduction mtd. E enrollment with fbr provides you with a national tax number ntn or registration number and password.

Please complete this online registration form. How to register yourself on income tax e filing website. Select the user type as hindu undivided family huf. B valid mobile number.

Register for income tax.