How To Reduce Company Tax Payable In Malaysia

/tax-avoidance-vs-evasion-397671-v3-5b71dfc846e0fb0025e54177.png)

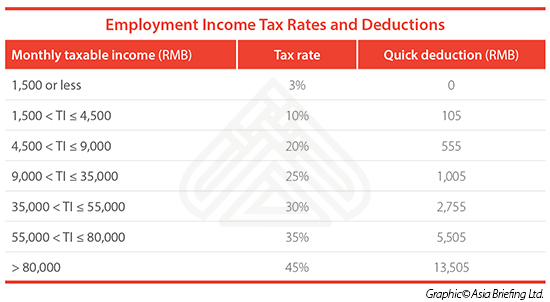

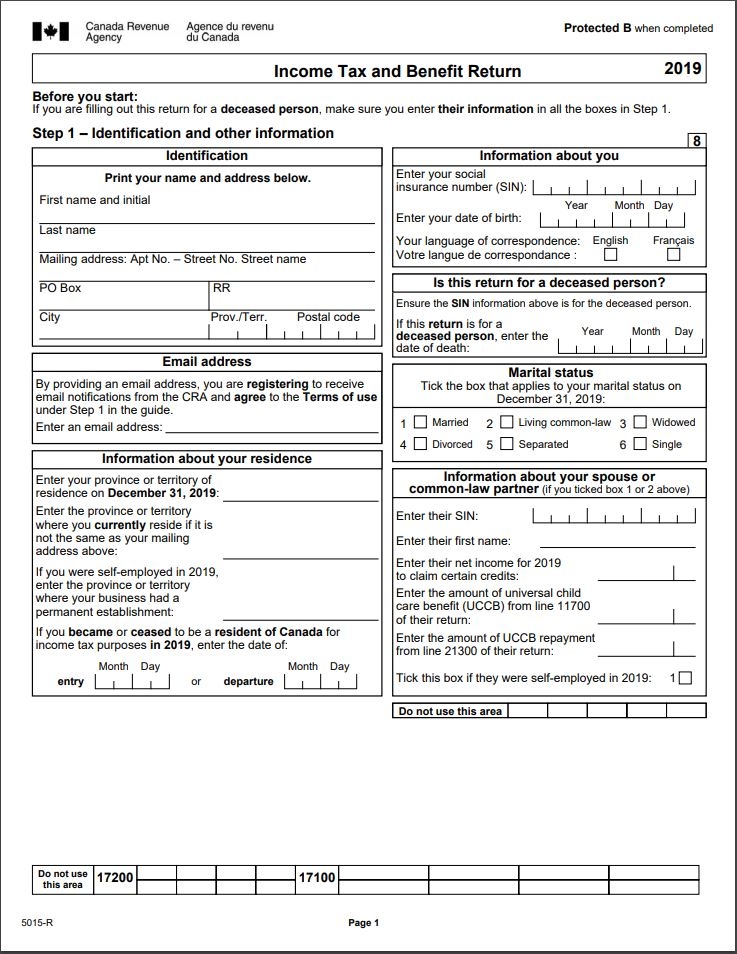

A comparison has to be made between the monthly tax deduction mtd deducted and the actual tax payable.

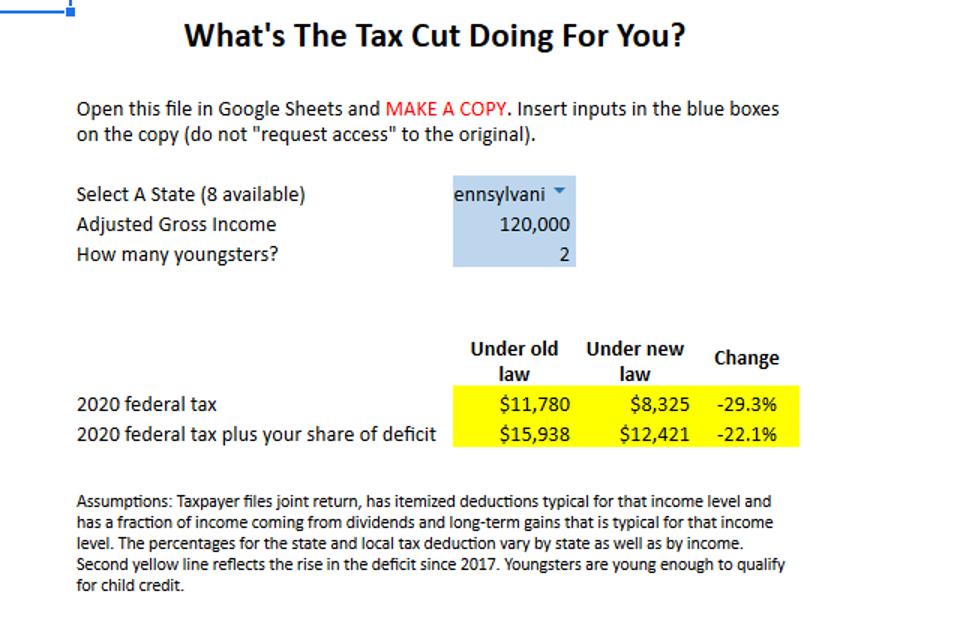

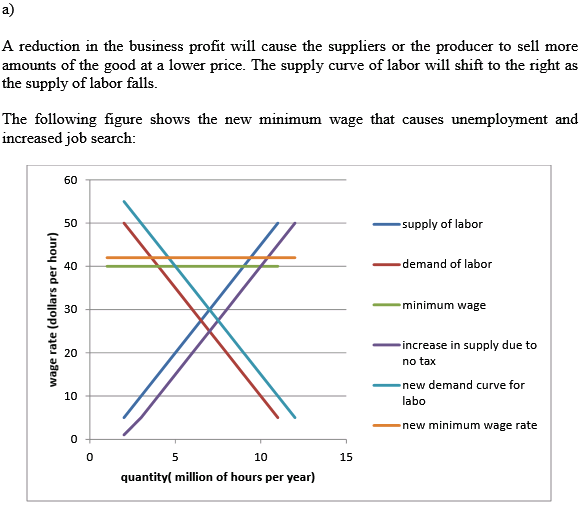

How to reduce company tax payable in malaysia. The company can submit the cp 204a to revise the estimate of tax payable in the sixth or and ninth month of the basis period. Change remuneration to reimbursement claims if you re a salaried employee fixed allowances given by your employer such as mobile subsidies and parking fees are taxable as they are considered part of your employment income. Your total deductions are subtracted from your taxable income in. I n my book we will explore how taxation notably income tax and real property gains tax rpgt affects each area of real estate investment in malaysia.

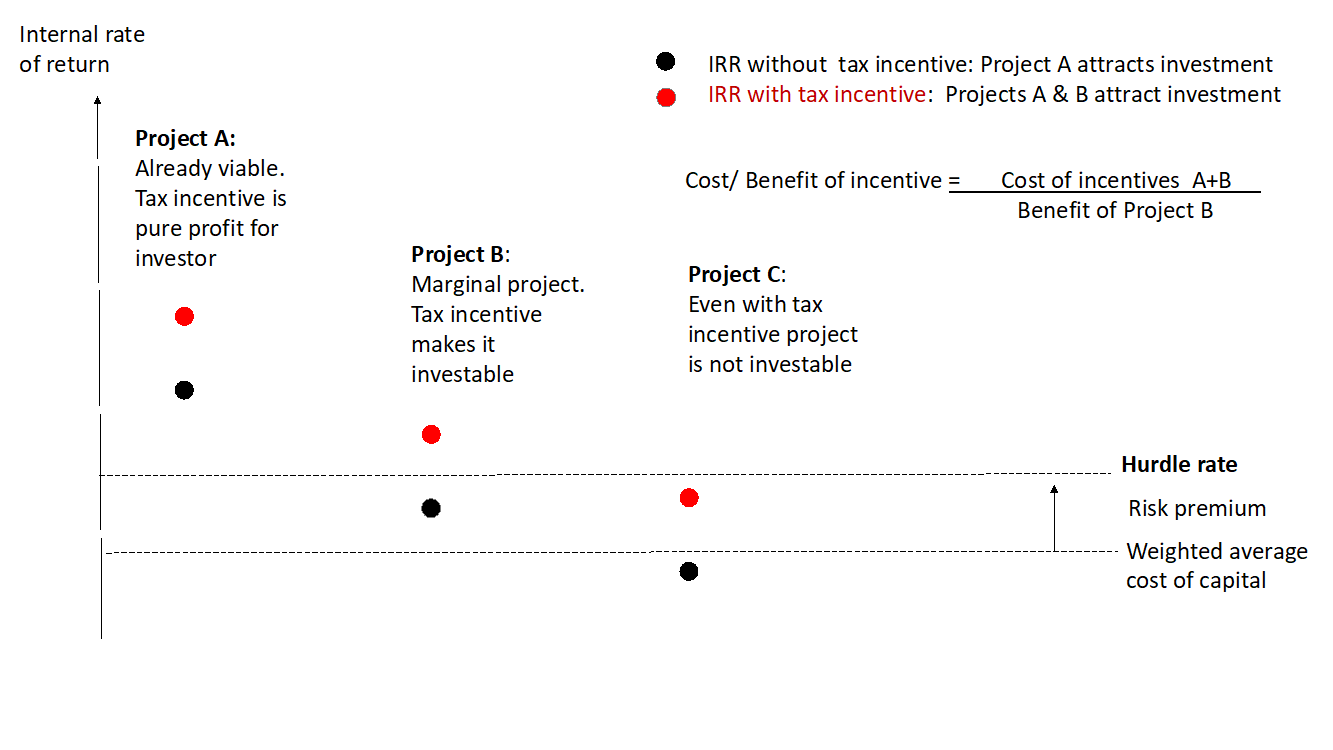

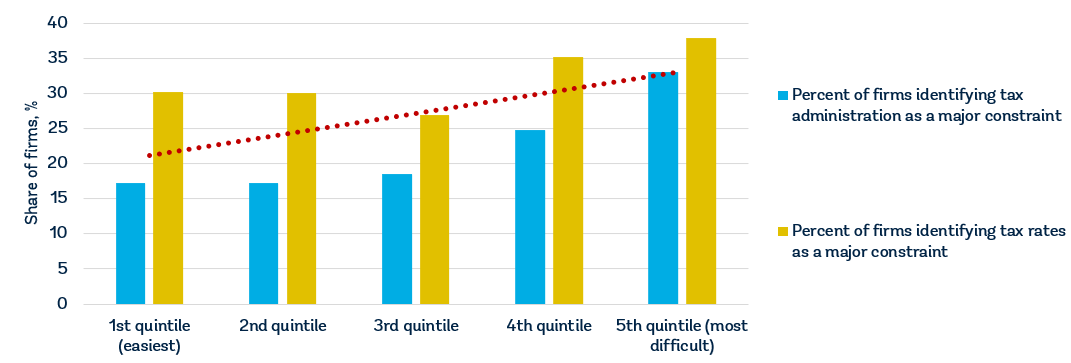

That s a difference of rm1 055 in taxes. Lower corporate income tax. Apply for specific industry tax incentive such as msc status. Tax deductions reduce your taxable income.

Failure to submit or pay income tax on time may results in heavy tax penalty. Tips for income tax saving. The tax payable is deducted from the monthly remuneration of the individual according to the mtd schedule or mtd computerised calculation method issued by irbm. Estimate your tax payable amount accurately to avoid the penalty on underestimation of tax payable under the income tax act.

However if you claimed rm13 500 in tax deductions and tax reliefs your chargeable income would reduce to rm34 500. For instance a manufacturing company with a pioneer status tax incentive pays an effective tax at the rate of 7 2 as only 30 of its profits are subject to tax. If your business has a chargeable income of less than rm500 000 your company will be taxed at a specific rate. This would enable you to drop down a tax bracket lower your tax rate to 3 and reduce the amount of taxes you are required to pay from rm1 640 to rm585.

If your company has a taxable income of less than 500 000 malaysian ringgit then your business with being taxed at a 19 percent rate versus the usual 25 percent. Some of the major tax incentives available in malaysia are the pioneer status ps investment tax allowance ita and reinvestment allowance ra. Check out these 6 smart tax moves that malaysians can make to maximise the opportunities offered by tax laws and to reduce tax liability. 2 submit and pay income tax on time.

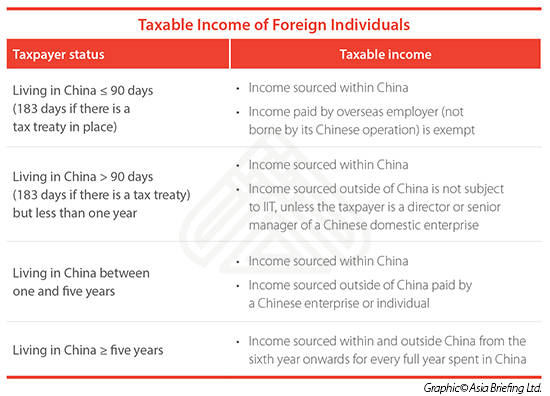

Balance of tax payment. As the law currently stands in malaysia taxation can account for up to 26 of the income earned by any taxpayer and that includes property investors. Light will be shed on the.

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)