How To Record Hire Purchase Motor Vehicle

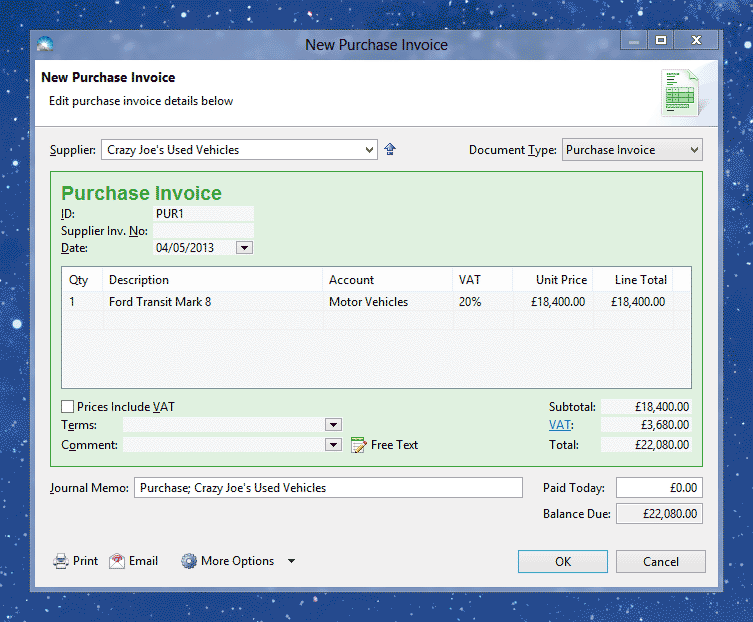

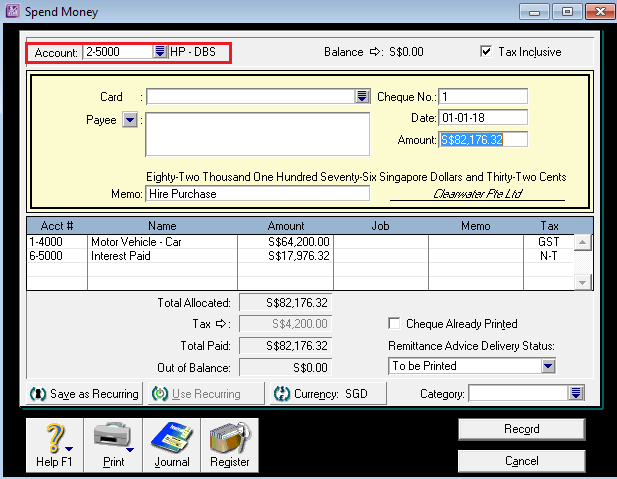

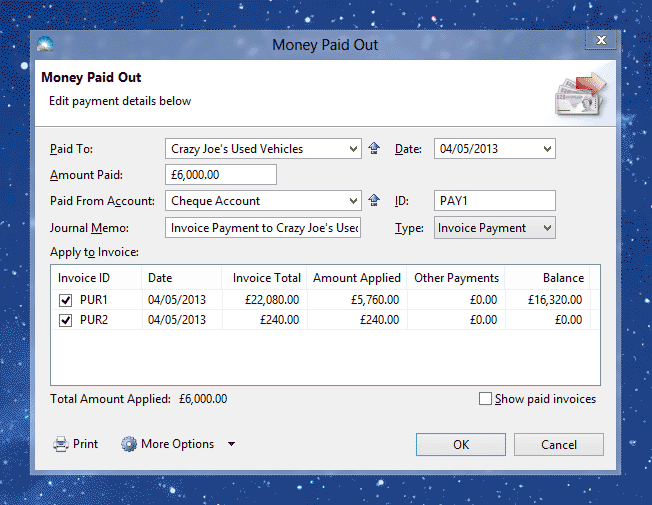

Record the purchase of the new van create a purchase invoice with 22 080 allocated to the motor vehicles account.

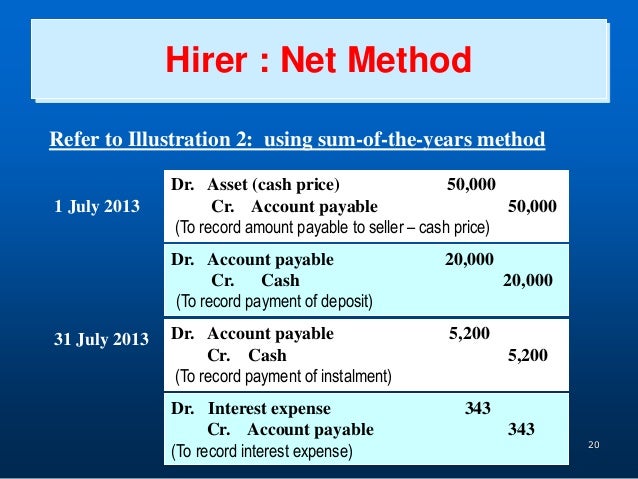

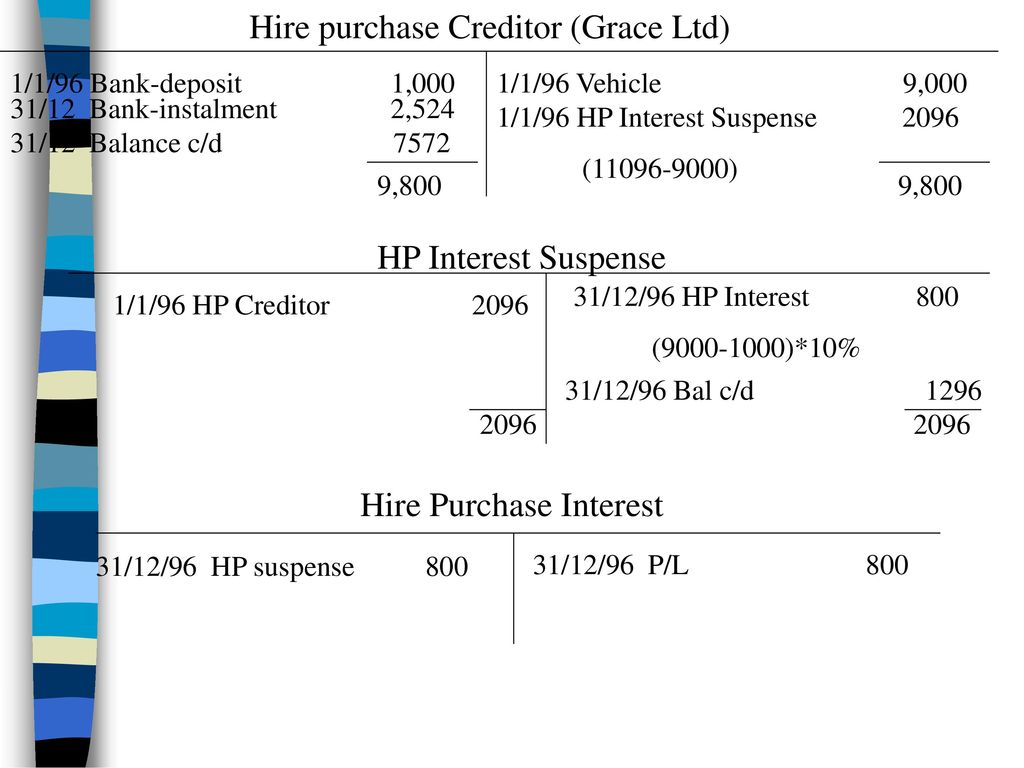

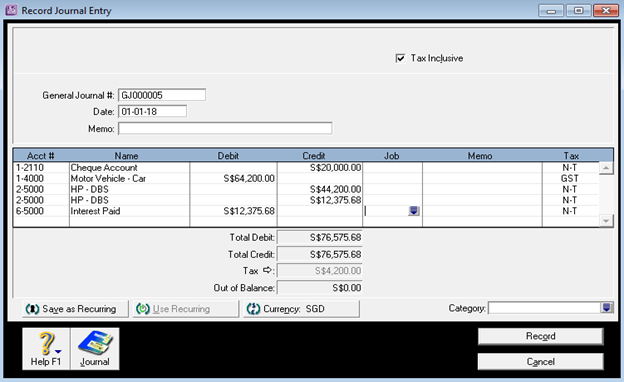

How to record hire purchase motor vehicle. August 26 2018 financial accounting example. Interest in suspense ltl. The van cost 50 000 and your business paid cash for the van. You record the bill into quickbooks with the accounts under the expense tab as.

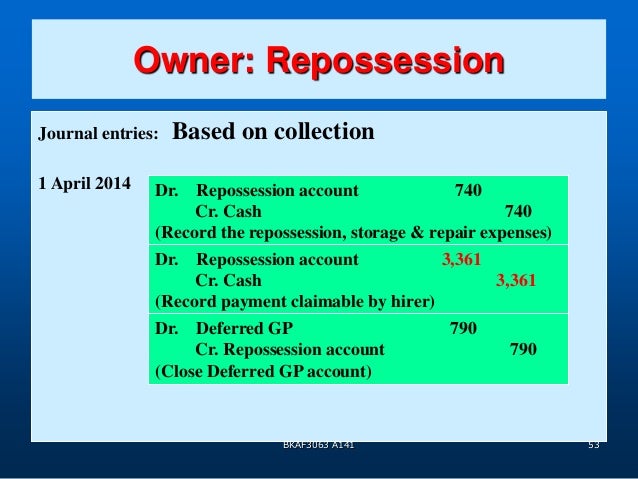

This will need to be recorded as an asset so that. 15 000 with 7 gst code row2. How to record hire purchase motor vehicle. This post considers an example of a vehicle purchase to show how to record the entries and the impact on the financial statements.

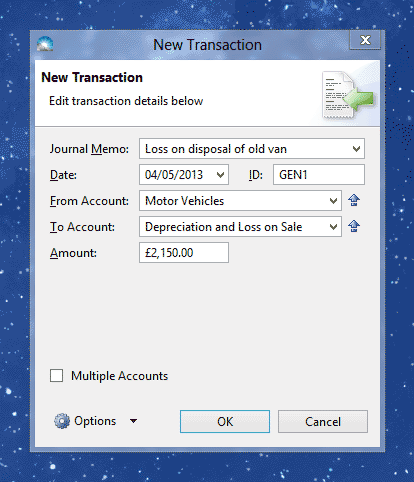

Example of a new vehicle purchase. You cannot use such an approach for hire purchase agreements. You ll have to make asset purchase accounting entries for as long as the loan is outstanding. There are two unusual issues related to vat on this purchase that you should consider.

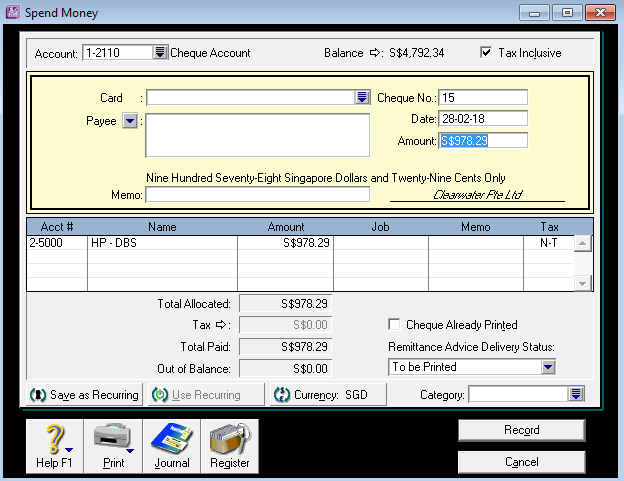

When you pay you debit that account and credit cash. The initial journal entry for the purchase of a fixed asset on credit is just step one in dealing with the new motor vehicle in accounting. You record each month s interest in interest expense. 1 create a asset account for the cost of the vehicle with gca account when recorder it only lists the non gst figure in the asset total.

Let s assume that your business purchases a new van on january 1. Motor vehicle abc xxxx cost rm 238 446 00 insurance rm 7 842 35 loan from bank rm 200 000 loan from director rm. The gst component goes int your gst account. Cost of office equipment fa.

If i have a loan i create a liabilities account for the loan amount.