How To Pay Tax In Malaysia

You re not taxable if you are.

How to pay tax in malaysia. Apart from the spa stamp duty and real property gains tax rpgt all the other costs are very manageable and even rpgt can be kept to a minimum if you wait for 5 years. It ll also apply when the pension is paid due to retirement from. 3 pay income tax via. Non residents filing for income tax can do so using the same method as residents.

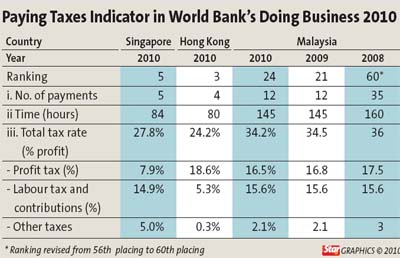

Both individuals and businesses can pay their income taxes. In the table below there are seven methods where six methods are through irb s agents mostly banks throughout the country. You ll still need to pay taxes for income earned in malaysia and will be taxed at a different rate from residents. How to pay income tax in malaysia over the counter at irb malaysia counters.

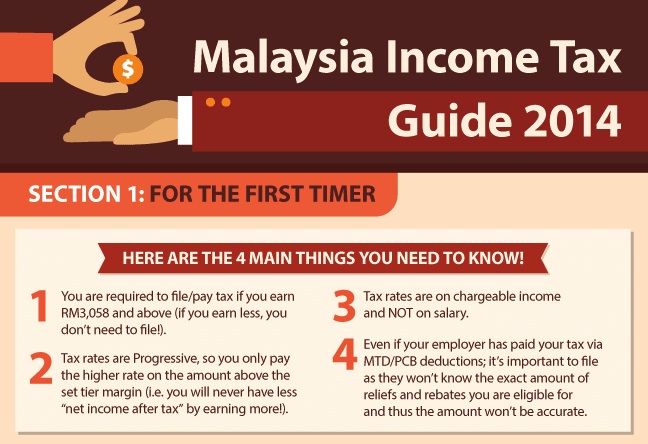

For ease of filing you can use ezhasil to file your taxes online. 2 pay income tax via credit card you can pay your income tax with your credit card through fpx participating bank at. Every individual who is liable to pay tax is required to declare his income to the inland revenue board of malaysia irbm. How to pay income tax in malaysia 1 pay income tax via fpx services the fpx financial process exchange gateway allows you to pay your income tax online.

Remember to factor all these costs in if you re considering if you can afford an investment property. Employed on board a malaysian ship. Firstly pensions paid to people after reaching the age of retirement are exempt from tax under schedule 6 paragraph 30 of the income tax act 1967. Over the counter at banks and pos malaysia outlets.

This option is available for registered businesses only and does not apply. It feels really bad if you still have to pay income tax after retiring but good news malaysians don t pay any tax on that. By far online payment. Property taxes in malaysia are not as bad as one might expect.

The taxpayer is responsible for submitting their completed income tax return form itrf keeping records of supporting documents for auditing purposes for seven years and paying the income tax due. Therefore whether you are a malaysian or a foreign national as long as you reside in malaysia for less than 182 years in a year any income you earn in malaysia is taxable under non resident income tax rates. In malaysia the companies are levied on incomes and the tax rate is settled at 25. Employed in malaysia for less than 60 days.

There are many tax exemptions in malaysia which is why the country is quite attractive from this point of view to foreign investors and here we remind the following. Payment there are many ways to make income tax and real property gain tax rpgt payments to lembaga hasil dalam negeri lhdn or inland revenue board irb after calculating tax assessment. Non residents in malaysia are classified as those staying less than 182 days within malaysia regardless of citizenship or nationality.

/tax-avoidance-vs-evasion-397671-v3-5b71dfc846e0fb0025e54177.png)